GDP Nowcasts

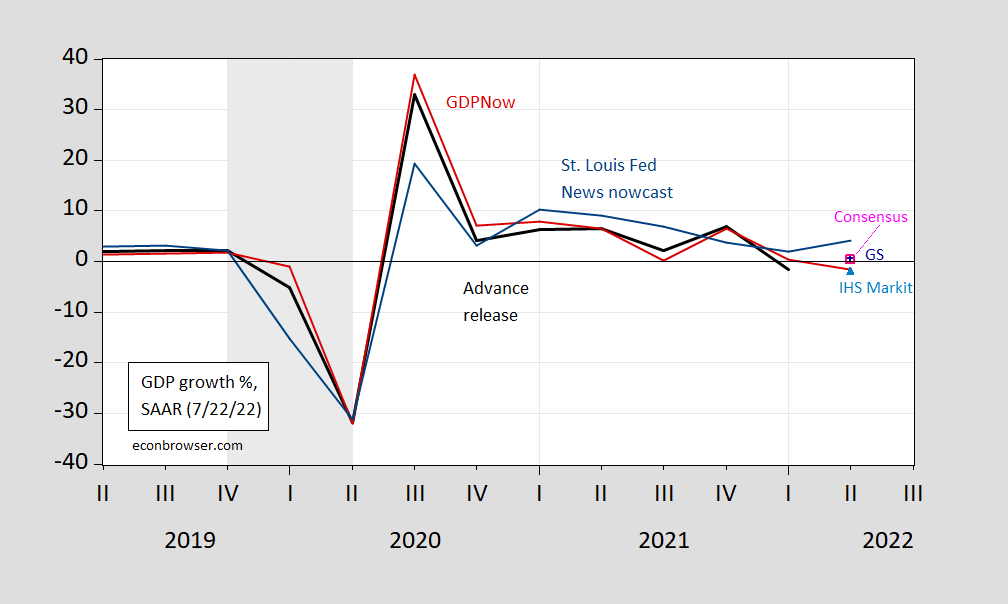

GDPNow at -1.6%, St. Louis Fed News index at +4%, IHS-Markit at -2.0%, and Goldman Sachs at 0.5%. Bloomberg consensus at +0.4% (all q/q SAAR).

Figure 1: Actual advance GDP growth rate (black), Atlanta Fed GDPNow (red line), St. Louis Fed News index (teal line), IHS Markit (sky blue triangle), Goldman Sachs (blue +), Bloomberg consensus (pink open square), all in %, NBER defined peak-to-trough recession dates shaded gray. SAAR. Source: BEA via ALFRED, Atlanta Fed, St. Louis Fed via FRED, IHS-Markit, Goldman Sachs, Bloomberg, and NBER.

Over this three year sample (clearly an unrepresentative one, given the pandemic’s impact), GDPNow is upwardly biased, while the St. Louis Fed news based nowcast is downwardly biased, by 0.8 and 0.9 ppts respectively. On the other hand, the RMSFE of the former is about 2 ppts, that of the latter 5.9 ppts. If you drop 2020Q1-Q3, then GDPNow is less downwardly biased than the St. Louis index, while the RMSFE is smaller (1.5 vs. 2.5 ppts).

That being said, recall these nowcasts are aimed at estimating the advance release. The 7/28 release for 2022Q2 is an advance release, with many components of GDP estimated. The estimates will be revised, sometimes significantly, particularly in the annual benchmark (this year taking place in September instead of July), and in the five year comprehensive revisions (see discussion in this post). A positive reading can then eventually change to negative, and vice versa.

More By This Author:

If We End Up Talking about the Global Recession of 2023, What/Who Will We Blame?

Tracking the Russian Economy: Are Sanctions Working?

Inflation, Gasoline, Recession

Disclosure: None.