Tracking The Russian Economy: Are Sanctions Working?

It depends on what you mean by “working”, even if Russian GDP (as reported) hasn’t collapsed yet in the reported statistics yet, the worst is likely yet to come. And some effects won’t be easily measurable.

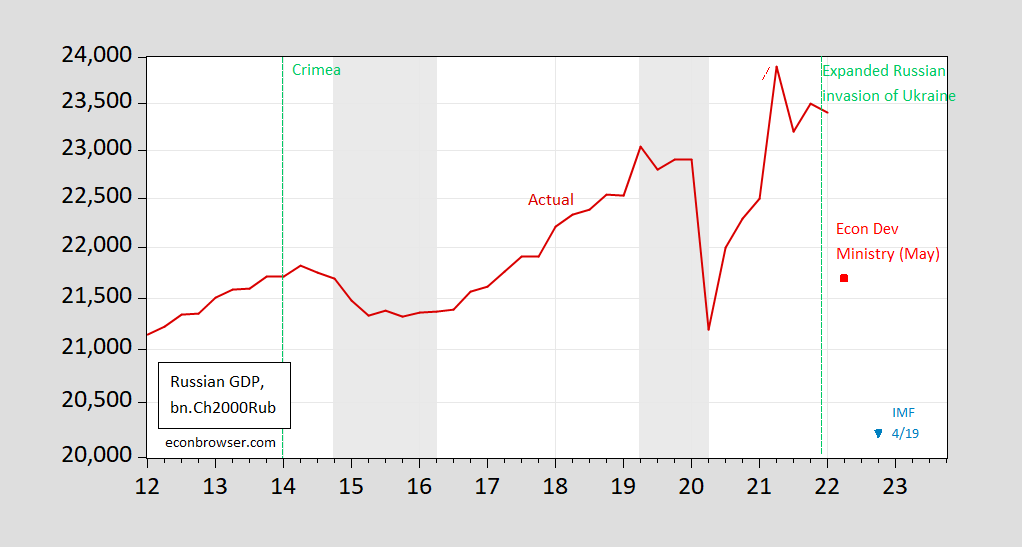

First, consider what’s happened to GDP:

Figure 1: Russian GDP in billions Ch.2000Rubles (red), IMF April WEO forecast (blue triangle), Economic Development Ministry May GDP (light red square), all on a log scale. Levels for 2019Q3 onward calculated using growth rates. Economic Development Ministry estimate as cited by BOFIT. ECRI defined peak-to-trough recession dates shaded gray. Source: OECD via FRED, IMF, BOFIT (July 8, 2022), ECRI, and author’s calculations.

Some observers have noted that Russian GDP y/y has not collapsed in Q1 (the latest reported data). Note that 3.5% y/y reading is exactly that — year-on-year growth, which encompasses about one month of the post-sanctions period (the expanded invasion of Ukraine started on February 24th, so only March is in the Q1 post-sanctions data). We don’t have Q/Q growth rates reported by Rosstat, but if I iterate on previously reported quarterly GDP data, then we can infer the path of GDP shown in Figure 1. That implies a -1.7% decline on an annualized basis — pretty big considering only one month of the quarter reflects the sanctions environment.

Are we on the path toward the IMF’s estimate in the April World Economic Outlook? BOFIT cites a May GDP y/y reduction of 4%, which if I assume May represents Q2, and we work off of 2021Q2, shows up as the red square in Figure 1. It does look like a big GDP drop is still in the cards, perhaps not as big as S&P’s March forecast, though.

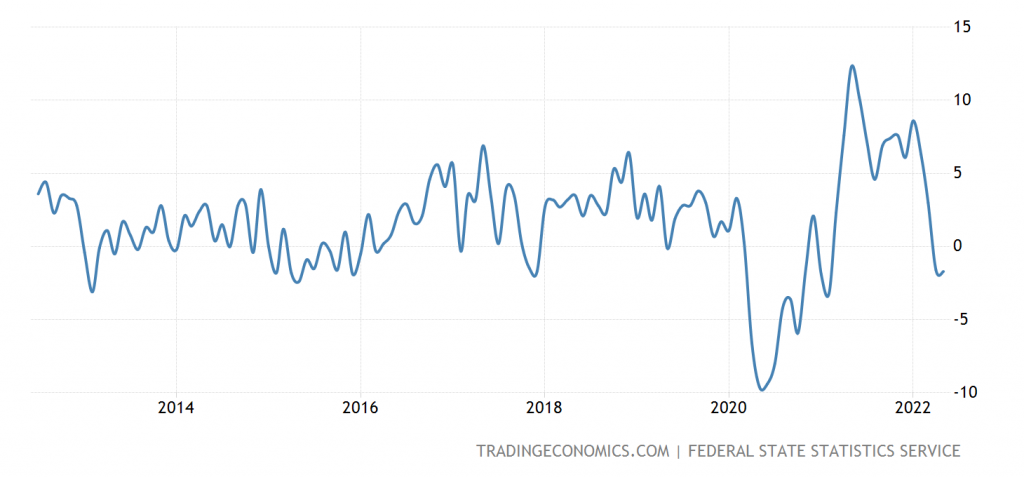

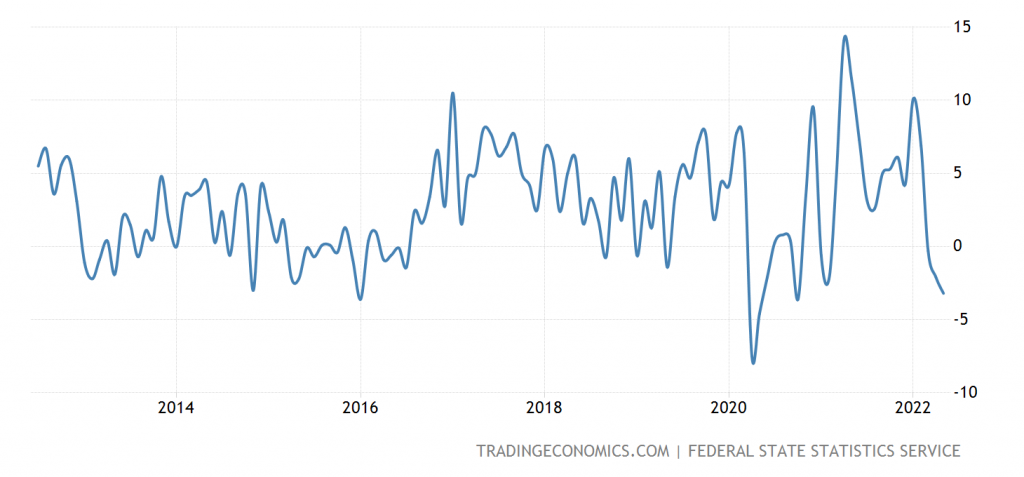

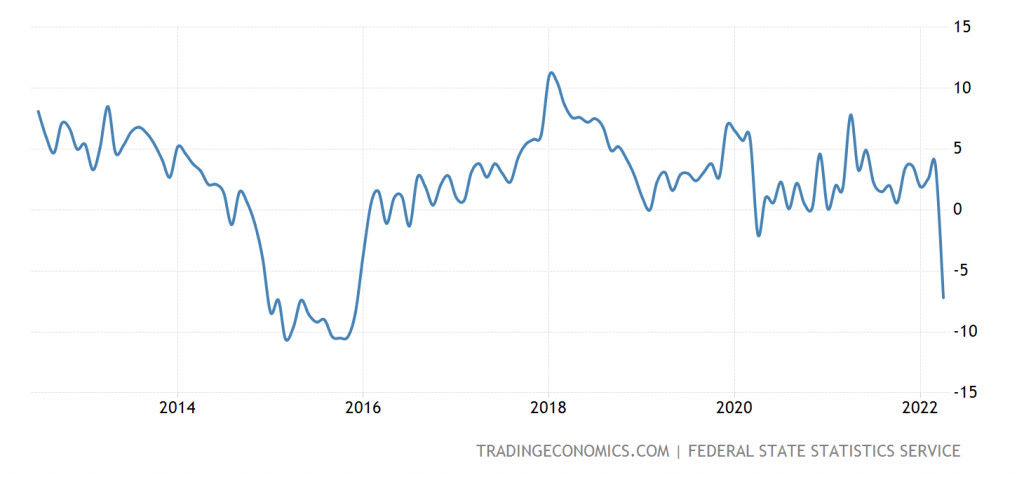

Other aggregate measures show the impact more forcefully. Industrial production and manufacturing production down, y/y.

Figure 2: Industrial Production, year-on-year growth rate%. Source: Tradingeconomics.com.

Figure 3: Manufacturing Production, year-on-year growth rate%. Source: Tradingeconomics.com.

In its July 8th Weekly Monitor on Russia (an indispensable resource on this topic), the Bank of Finland’s Institute for Emerging Economies (BOFIT) noted:

Russia’s Center for Macroeconomic Analysis and Short-Term Forecasting (CMASF) finds a larger contraction in Russian industrial output in recent months when military production is excluded. CMASF estimates industrial output fell by 4 % in May. Russia’s lower-house Duma this week approved a law amendment that allows the government to impose special measures on firms to fulfil military needs. Firms can be compelled, for example, to manufacture goods for the military, repair military equipment or provide the military with transport.

So, one needs to look behind the numbers to get a better feeling for the state of the Russian economy.

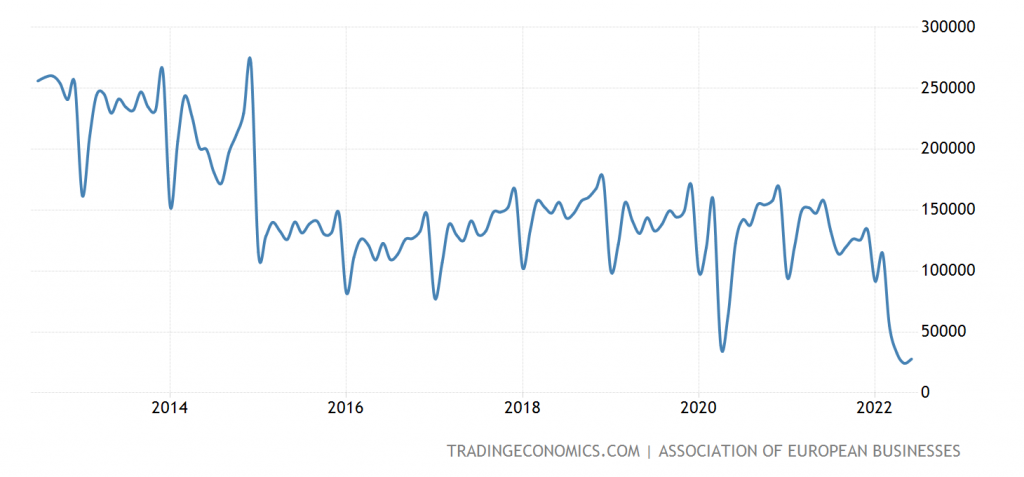

New car registrations/sales down very substantially.

Figure 4: New car registrations. Source: Tradingeconomics.com.

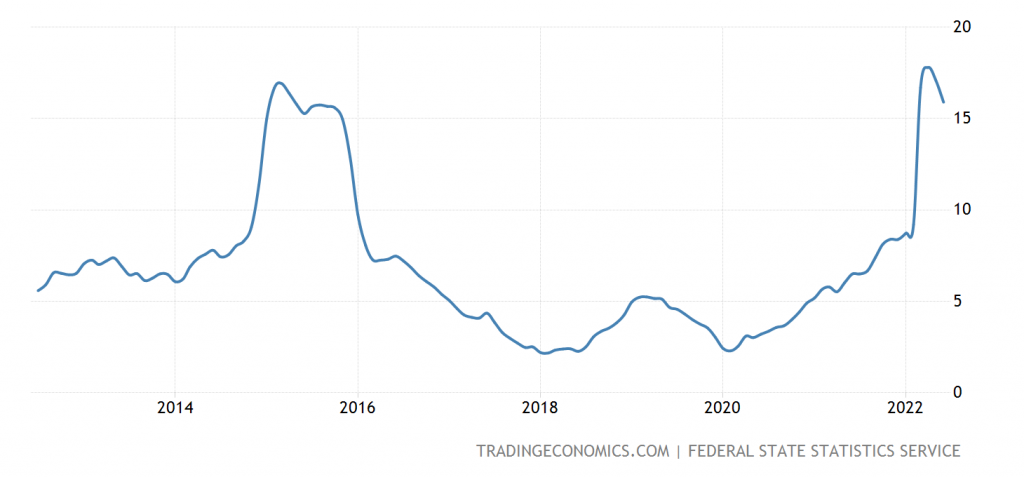

Wage growth (y/y) negative even as measured inflation (y/y) is way up.

Figure 5: Wage growth, year-on-year growth rate, %. Source: Tradingeconomics.com.

Figure 6: CPI inflation, year-on-year growth rate, %. Source: Tradingeconomics.com.

The combination of these last two figures is to imply a large real wage drop.

While the ruble has recovered to pre-sanctions levels, it has done so with incredibly stringent exchange controls, so much so that it is not appropriate to consider the current rate a “market rate”. Imports are down, although exactly how much down is hard to say since the government has clamped a cone of silence on the trade data (see Starostina/Carnegie Endowment). Here’s the Kiel Institute’s numbers:

Figure 7: Import growth, month-on-month, %. Source:Kiel Institute, as of July 20, 2022.

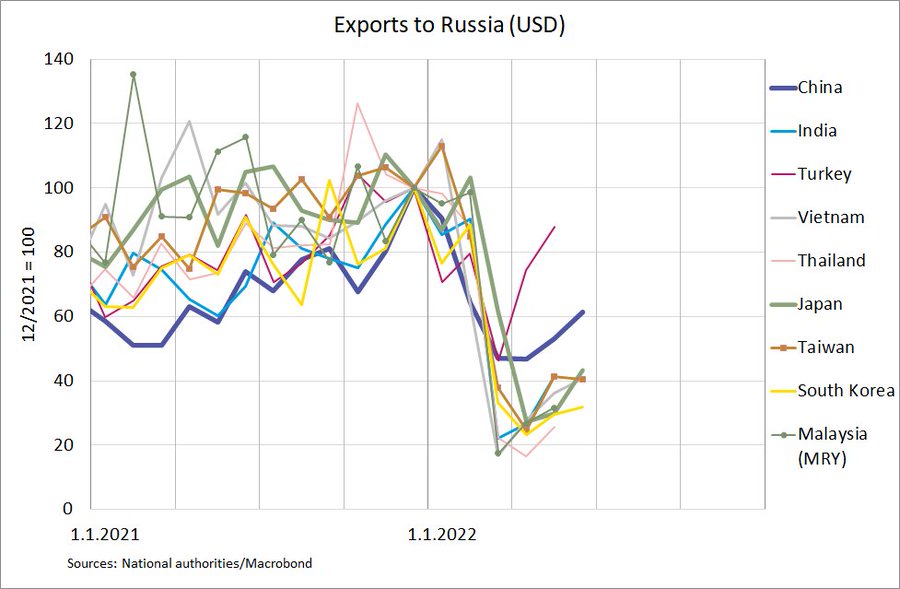

One can infer what’s happening by looking at what exports to Russia look like:

Figure 8: Exports to Russia, in USD, 2021M12=100. Source: Macrobond via Iikka Korhonen.

See also Chorzempa/Peterson IIE on differential impact on imports from sanctioning and non-sanctioning countries.

The government does seem to be pressed in budgetary terms, insofar as revenue growth is not keeping pace with inflation, as discussed by BOFIT (July 21st).

In June, the nominal income of the federal budget was only one and a half percent more than a year earlier. The drop in income is really big in real terms, as the increase in consumer prices and industrial producer prices from a year ago was 14% on average in June. [google translation from Finnish].

Despite this, the budget remains in (slight) surplus; but that need not remain the case.

In some ways, the impact on the Russian economy will not be reflected very much in these macroeconomic indicators. Rather (in my own opinion), they will have a profound medium to long term impact on the economy, and the ability for the Russian military to project its power abroad. That is through the impact of trade/high-tech sanctions. As discussed in this Breugel article, the export sanctions applied to Russia are constraining production now (and almost assuredly impacting military production, of high tech munitions, aircraft, even tanks).

Targeted sanctions on specific technologies, financial sanctions and ‘self-sanctioning’ by private companies are effectively decoupling Russia from supplies of high-tech goods. The combination of technological and financial sanctions, public pressure and reputational risk, and the collapse of the Russian economy has made the decision to leave the Russian market easy for companies, and not just those from NATO-allied countries.

Russia has tried to resist technological sanctions by import substitution, but without success. High-tech products are developed using inputs from many countries, but few of them can function without inputs from the European Union or the United States. As a result, a single economy cannot replicate the capabilities of the global network.

In some high-tech goods industries, the effect of sanctions is already being felt. In the long term, sanctions will also severely affect Russia’s growth outlook and ensure that waging war means Russia will cease to be a modern economy. Highly skilled Russians are already leaving, reinforcing the effect of the sanctions.

Of course, how debilitating high-tech export restrictions will be on the development of Russian military equipment is up for debate (see Rand, 2021, e.g.), so no guarantees.

More By This Author:

Inflation, Gasoline, RecessionOne Year CPI Inflation Expectations as of Mid-July

Inflation In June

Disclosure: None.