Apple Q3 Preview: Can The Earnings Streak Continue?

Image Source: Unsplash

Now that we’re in the heart of earnings season, investors are more than eager for their favorite companies to pull the curtain back and unveil their quarterly results. Market participants will finally get a clearer idea of how companies have sailed the rough economic waters we’ve found ourselves in.

One of the most beloved stocks out there is Apple (AAPL - Free Report) . Up more than 750%, shares of the tech titan have undoubtedly been one of the best places for investors to park their cash over the last decade. The share performance doesn’t even compare with the S&P 500.

Image Source: Zacks Investment Research

Apple's slated to release quarterly results on July 28th after the trading session.

The quarterly report will be watched like a hawk and will have widespread market effects. So, how does the tech titan shape up heading into the quarterly release? Let’s take a closer look.

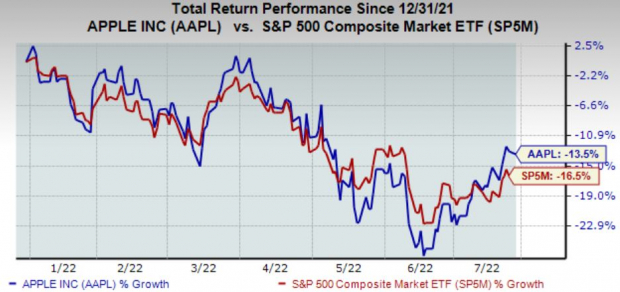

Share Performance & Valuation

Year-to-date, Apple shares have displayed a much higher level of valuable defense than the general market, declining just 13.5% vs. the S&P 500’s 16.5% decline.

Image Source: Zacks Investment Research

In fact, Apple shares have been much stronger than the general market for some time now, increasing nearly 4% over the last year, while the S&P 500 has lost almost 10% in value.

Image Source: Zacks Investment Research

The relatively strong share performance is undoubtedly a major positive – buyers have defended Apple shares at a high level.

Apple’s forward earnings multiple resides on the higher side at 25.3X but is nowhere near highs of 41.5X in 2020. In addition, shares trade at a 42% premium relative to the S&P 500.

Apple has a Style Score of a C for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have had mixed estimate revisions for the quarter to be reported over the last 60 days, with two upwards revisions and two downwards revisions. The Zacks Consensus EPS Estimate for the quarter resides at $1.13, reflecting a disheartening 13% decrease in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

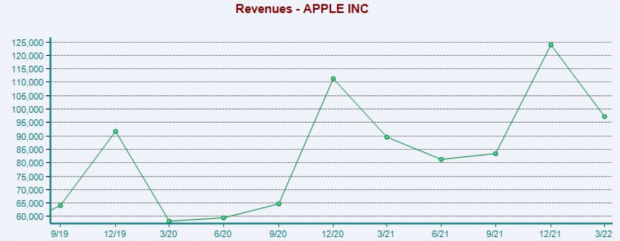

However, the top-line looks to expand marginally – the $81.9 billion quarterly revenue estimate pencils in a slight 0.5% uptick year-over-year. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Quarterly Performance & Market Reactions

Apple is known for consistently reporting strong quarterly results, which is precisely what it’s done. Over the company’s previous 20 quarters, the tech titan has exceeded the Zacks Consensus EPS Estimate a jaw-dropping 19 times. Just in its latest quarter, Apple posted a robust 6.3% bottom-line beat.

Top-line results have been just as stellar; Apple has recorded nine top-line beats over its last ten quarters.

In addition, the market has reacted well to the company’s quarterly releases as of late – over its last three quarterly reports, shares have moved upwards each time.

Bottom Line

Apple shares have held up relatively well year-to-date, undoubtedly a development that any investor can celebrate. The company’s quarterly report will be a significant point of interest, and for easily understandable reasons – Apple has been of the most stellar investments over the last decade.

The tech titan has consistently reported top and bottom-line results above expectations, and the market has reacted well to the company’s quarterly releases as of late. However, earnings are forecasted to drop notably, but revenue is expected to see a marginal increase.

Heading into the quarterly report, Apple is a Zacks Rank #3 (Hold) with an Earnings ESP Score of 0.9%.

More By This Author:

Pfizer Q2 Preview: Quarterly Estimates Display Robust Growth

Airline Stock Roundup: United, American & Alaska Airlines' Q2 Earnings, Delta In Focus

Shopify Q2 Preview: Can Shares Find New Life?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more