Pfizer Q2 Preview: Quarterly Estimates Display Robust Growth

Image: Bigstock

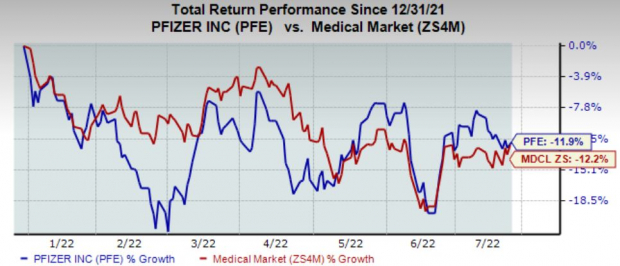

The Zacks – Medical Sector has held up relatively well year-to-date, decreasing approximately 12% in value vs. the S&P 500’s retracement of 15%. Over the last month, the sector has posted a 6% return.

One company residing in the sector, Pfizer (PFE - Free Report), is slated to release quarterly results before the opening bell on July 28. Pfizer is a multinational pharmaceutical and biotechnology corporation headquartered in New York City, well-known for its COVID-19 vaccine. PFE is currently a Zacks Rank #3 (Hold) with an overall VGM score of an A.

How does the pharmaceutical titan shape up heading into its quarterly release? Let’s take a closer look to find out.

Share Performance & Valuation

Year-to-date, Pfizer shares have struggled, declining close to 12% in value, but slightly outperforming its Zacks Sector.

Image Source: Zacks Investment Research

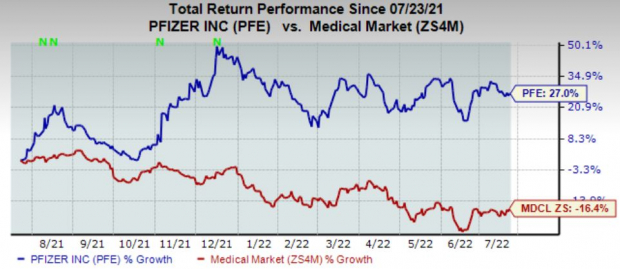

However, upon widening the timeframe to encompass the last year of share performance, we can see that Pfizer shares have returned a double-digit 27%.

Image Source: Zacks Investment Research

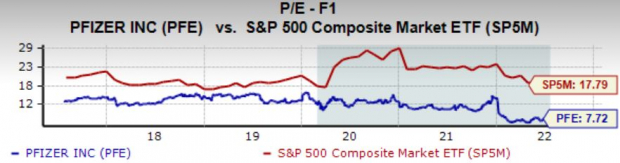

Pfizer sports rock-solid valuation levels, further displayed by its Style Score of an A for Value. Its 7.7X forward earnings multiple is nowhere near its five-year median of 12.8X and represents a steep 57% discount relative to the general market.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have had mixed estimate revisions over the last 60 days, with two upwards revisions and two downwards revisions. However, the $1.84 Zacks Consensus EPS Estimate reflects a sizable 71% uptick in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

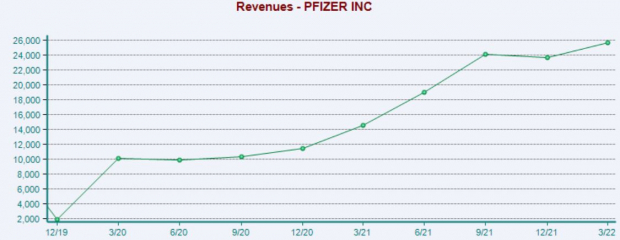

In addition, the top-line is also in incredible shape – the $28.5 billion quarterly revenue estimate pencils in a substantial 50% uptick in sales from the year-ago quarter. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Quarterly Performance & Market Reactions

Pfizer regularly reports bottom-line results above expectations; over the company’s previous ten quarters, it’s recorded seven EPS beats. However, in its latest quarter, PFE recorded a slight 2.4% bottom-line miss.

Quarterly sales results have left much to be desired, with the company exceeding quarterly revenue estimates in just four of its previous eight quarters. As of late, the market has reacted well to the company’s quarterly results; over its previous four EPS beats, shares have moved upwards three times following the report.

Bottom Line

Pfizer looks poised to record double-digit top and bottom-line growth. In addition, the company carries attractive valuation levels and has primarily reported bottom-line results above expectations. Heading into the quarterly release, Pfizer carries an Earnings ESP Score of -1.6%.

More By This Author:

Airline Stock Roundup: UAL, ALK & AAL's Q2 Earnings, DAL In FocusShopify Q2 Preview: Can Shares Find New Life?

Microsoft to Report Q4 Earnings: What's in the Cards?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more