Tuesday Talk: Walking It Back, Moving Forward

There will be a lot of talk, some of which is shared here, about the current banking crisis. What is important at this juncture is that the government has stepped in to walk it back.

The Federal Reserve Bank of San Francisco, (whose board prior to last week, included Greg Becker, ex-CEO of Silicon Valley Bank) will no doubt be taken to task by Fed Chair Jerome Powell and one can expect that Senator Elizabeth Warren will call more than one bank exec to Washington to testify. The end result hopefully will be to put back the teeth taken out of the Dodd-Frank act during the Trump Administration, and maybe some of those responsible will face trial, but for the meantime the public has been told that the mess is to be paid for by the banking industry's insurance fund and not taxpayer money. Perhaps, but if those insurance premiums rise because of hefty payouts, bank customers will no doubt bear that burden. All a reminder that the Seven Deadly Sins are always lurking about and come out to strike when least expected.

The overall market was fairly calm yesterday after Friday's turbulence. The S&P 500 closed at 3,856, down 6 points, the Dow closed at 31,819, down 91 points and the Nasdaq Composite closed at 11,189, up 50 points.

Chart: The New York Times

Still, it was not a good day for financial sector equities with all of Monday's top losers coming from the sector. First Republic Bank (FRC) down 61.8%, was the biggest loser, followed by Comerica (CMA), down 27.7%, and Cleveland based KeyCorp (KEY), down 27.3%.

Chart: The New York Times

In current trading S&P 500 market futures are trading up 20 points, Dow market futures are trading up 140 points and Nasdaq 100 market futures are trading up 57 points.

First thing up for today is the BLS release of February CPI data at 8:30 am, Eastern. Predictions are that inflation may have cooled, ever so slightly last month.

The Staff at Bespoke Investment Group observes that lower readings are not typically the norm for this time of the year in Don’t Forget About CPI.

"With all the worry about the potential for bank runs, you may have forgotten that there’s a CPI report tomorrow morning. After January data came in higher than investors had hoped, consensus forecasts for Tuesday’s February CPI are calling for a 0.4% m/m increase on both a headline and core basis. Based on recent trends, while the bias towards higher-than-expected readings hasn’t been as extreme as it was just a few months ago, lower-than-expected headline readings have been hard to come by over the last year with just three in the last 12 months."

"In terms of seasonality, history isn’t really on the side of those who are looking for a lower-than-expected report tomorrow. Going back to 1999, headline CPI reports released in March have been lower than expected just two times which is easily the lowest of any month. In total, of the 24 CPI reports released in March since 1999, 10 have been higher than expected, 12 have been inline, and two have missed forecasts. Will tomorrow be the third time the charm?"

Contributor Patrick Munnelly succinctly surveys the state of concern in his Daily Market Outlook.

"Asian markets remain rattled by the ongoing concerns stateside regarding the potential for contagion risk amongst regional US banks, investors fled the sector en masse in a shoot-first ask-questions-later type trade, US regulators FDIC have confirmed that all bank deposits will be secured via the Bank Term Funding Program... Asian investors hammered the Nikkei banking stocks overnight with the banking index slumping more than 7% posting its largest losses in the past six months.

Investor focus now shifts to US inflation data due later today...FOMC Chair Powell remarked overnight that a full and transparent investigation into the cause of the (banking) crisis must be undertaken, suggesting this risk wasn't on their radar. Inflation data is expected to confirm a steady rise in consumer prices, as US home rental prices remain stubbornly elevated, coupled with an uptick in goods prices predominantly driven by the ongoing rise in used car prices, net-net, markets expect core `CPI ex-food and energy to print a 0.4% handle for the third consecutive month, this would mean the core CPI will have gained an annualized 5.5% in February versus a 5.6% level in January, representing the lowest levels seen in the last 12 months. The conundrum for the Fed is clear which do they feel is the biggest threat to economic stability, has the banking crisis been addressed if so the committee should remain on its set course and continue to raise rates, or is the market turmoil sufficient for the long-awaited Fed pause to materialize, the argument is that the Fed usually embarks on a rate cycle until ‘something breaks’ SBV (SIVB) & Signature (SBNY) being the prime candidates for confirming a break, hence, most major investment banks now believe that the Fed will be forced to pause at the March meeting delivering one of the biggest turnarounds in recent financial history given just a week ago markets were heavily pricing a 50bps rise and 6%+ terminal rate, it appears that a week is a long time in economics and not just politics!"

TalkMarkets contributor Tyler Durden writes that Nomura Securities strategist Aichi Amemiya believes that the Fed will not only pause hiking rates, but will lower rates at its March meeting and give up QT altogether in Nomura Calls For Rate Cut At Next FOMC Meeting, End Of QT. It is a lengthy article and good read, below are some of the salient bits:

"In the past year, Japanese bank Nomura has had a penchant for making several headline-grabbing outlier predictions about the Fed...Quickly realizing that he needed to make a stark impression with yet another super outlier call - after Goldman broke the seal last night when it said it expects an FOMC pause in March - Nomura's Amemiya decided he has to do what he has done so many times before and quickly published the most controversial Fed forecast yet, going from +50bps to -25bps at the next FOMC meeting, thus becoming the first on Wall Street to call for a cut to Fed rates at the next FOMC meeting.

So why a rate cut when merely calling for a pause seems controversial enough (JPM's Michael Feroli is still calling for 25bps hike)? Well, as Amemiya explains in his note, while the Fed launched several bailout policy actions (all discussed here) which were "significantly more aggressive than Nomura had expected. Regulators expanded the scope of the emergency measures to protect the depositors of Signature Bank, which had amounted to much less than SVB."

We think this suggested the strong intention of the Regulators to prevent a similar episode with other banks and contain contagion. In addition, the Fed’s new lending facility will likely mitigate the risk of small banks selling holding assets and incurring capital losses.

Nomura admits judging by the market’s reaction, "financial markets seem to view these policy actions as insufficient, as stock prices for the US financial sector continue to decline as of this writing."

One market concern, according to Nomura (and ZH), is that "a deposit flight might not slow anytime soon for a number of reasons."

Despite the FDIC’s protection of all depositors of SVB and Signature Bank, corporate depositors are still concerned about a loss, even temporarily, of access to their deposits from the bank(s) going under conservatorship, even if they are made whole later.

Second, ironically, the sensitivity of individual depositors to deposit rates might have increased due to the FDIC’s announcement of making all Silicon Valley Banks’ depositors whole. We could see a significant outflow from commercial banks, which may compel banks to liquidate their loan portfolios unless banks raise their deposit rates substantially.

Third, on banks’ securities investment, unrealized capital losses in the banks’ held-to-maturity portfolio might not become an imminent issue because of the Fed’s new BTFP. However, if the Fed keeps the policy rate “higher for longer”, banks would be averse to liquidating securities holdings for which selling would realize losses in securities any time soon.

Putting it all together, Nomura now expects the Fed "to cut rates in 25bp increments in the March FOMC meeting in comparison to where we had previously expected a 50bp rate hike since 24 February, well before Chair Powell’s testimony last week."

The bank adds that "although a 25bp rate cut seems unlikely to be a panacea for financial institutions, if the Fed shows expected continued rate cuts in the Summary of Economic Projections (“dots”), markets could quickly price in further rate cuts. This could somewhat reduce the risk of further bank runs, as well as reduce unrealized capital losses."

There's more: the Nomura strategist also expects the Fed to stop quantitative tightening. Also echoing out observation that small banks are now reserve constrained..."

Whew, that's a lot to ingest, let alone digest, but there is more in the full article.

Moving forward:

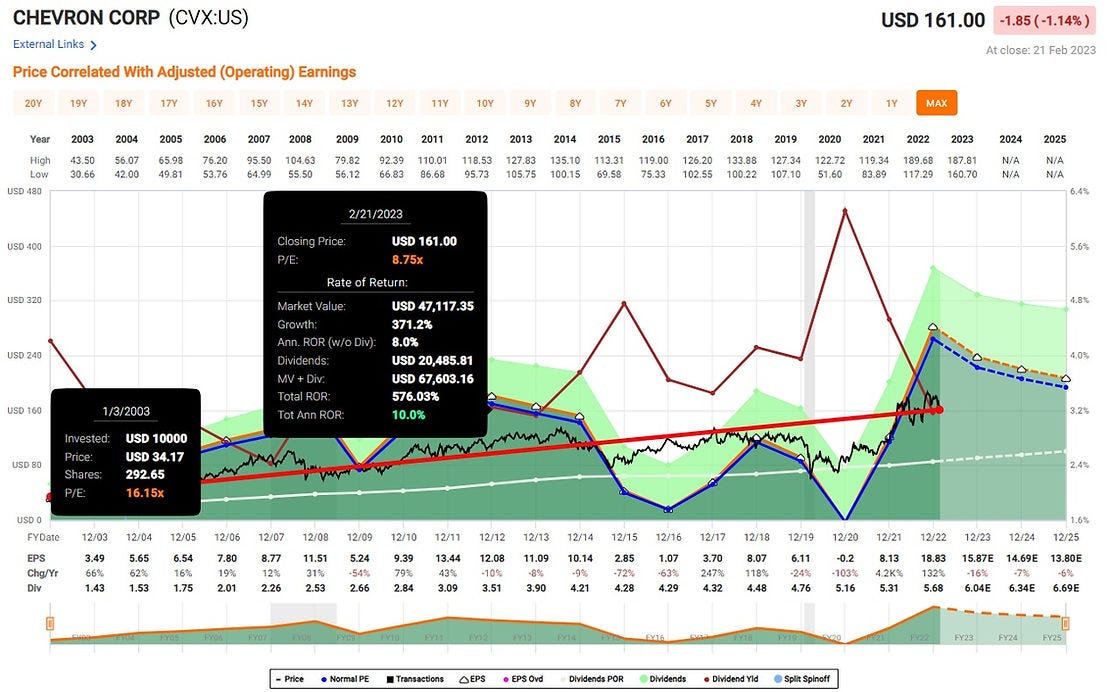

Contributor ARTInvest shares the following to the Department of Where to Invest: Top 3 Warren Buffett Dividend Stocks.

Image via ARTInvest

"1. Bank of America (BAC)

2. Chevron (CVX)

3. Coca-Cola (KO)

KO has a 60 years record of dividend-paying and increasing! The current yield is again at its 4-year average with a recent increase of 4.5%, so the current yield is 3.08%.

The payout ratio is right at the border at 70%. In the last 7 years, it was always around 70–80%, which is a little bit scary, but I’m pretty sure they know what they are doing for the dividend champion status.

KO is issuing shares which gives me concerns. There is a 0.16% increase year over year.

Dividend growth stays the same over the years, always around 4–5%."

Read the article for Artenie Alexandru's full take on the above three stock picks. At a minimum it will be a distraction from the headlines.

As always, caveat emptor.

Have a good one.

More By This Author:

Thoughts For Thursday: Somewhere In Between

Tuesday Talk: Waiting For Jerome