Top 3 Warren Buffett Dividend Stocks

„Risks come from not knowing what you are doing.” — Warren Buffett

Today let's focus on three of Buffet’s favorite stocks.

We will use well-known methods for dividend investing.

He is also outstanding about quotes; I will leave some of his quotes here in this Article.

“Read it, save it, let it sink, and use it in your life and your financial life!”

Before I begin to research the stocks, I want to give you my quick personal opinion, and let’s see what my opinion will be after the research!

BAC, KO, and CVX will be the three stocks for today’s article.

BAC isn’t in my portfolio, but I think it is at fair value or undervalued. (Quantitative Analysis in Finance)

On the other hand, KO is in my portfolio, and with the recent dividend increase, I think KO is in the buy category but not with a reasonable margin of safety.

CVX is in my portfolio, but I didn’t buy from it in the last 1–2 years because I think it is overvalued, at least in dividend investing.

„Predicting rain doesn’t count. Building arks does.”

1. Bank of America (BAC)

„Early in 2011, it looked like Buffett might have been done with Bank of America (BAC) stock for good. With BAC facing pressures from the 2011 debt-ceiling crisis and lingering pressures from the recent financial crash and recession, Buffett proposed a deal to BoA that would provide the struggling financial giant with an injection of new capital.

Berkshire bought $5 billion worth of preferred stock and received stock warrants allowing the holding company to purchase 700 million shares of the banking giant’s common stock at $7.14 per share.” — http://www.fool.com

12 years later, as of this day, investors made an 8.8% Total Annual Return which is a decent number.

The P/E ratio went down to 10.66, so this is also a checkmark! Excellent recovery after the Housing crisis! Price is under the orange line right now and is in the Good Margin of Safety category! — FastGraphs

(Click on image to enlarge)

„Time is the friend of the wonderful company and the enemy of the mediocre.”

The company has been paying out dividends for over 23 years but increasing only for over 10 years. The dividend yield is 2.55%. (Calculating the Dividend Yield)

The payout ratio is remarkable; it was always between 5–30%! So there is a large room for dividend growth! And there is good dividend growth; lastly, it was 10.26%, and before, it was consistently above 10%.

Share buybacks can be a silent killer. If the company does not buy back shares but dilutes them, your investments are worth less over time. It is like a slice of cake; your slice will be smaller if the company dilutes its shareholders.

BAC is doing a good job here, and they have been buying back shares over the years. — SeekingAlpha

Estimated earnings growth for the next two years is 9.34%; analysts are about 50% right about their estimates.

„Only when the tide goes out do you discover who’s been swimming naked!”

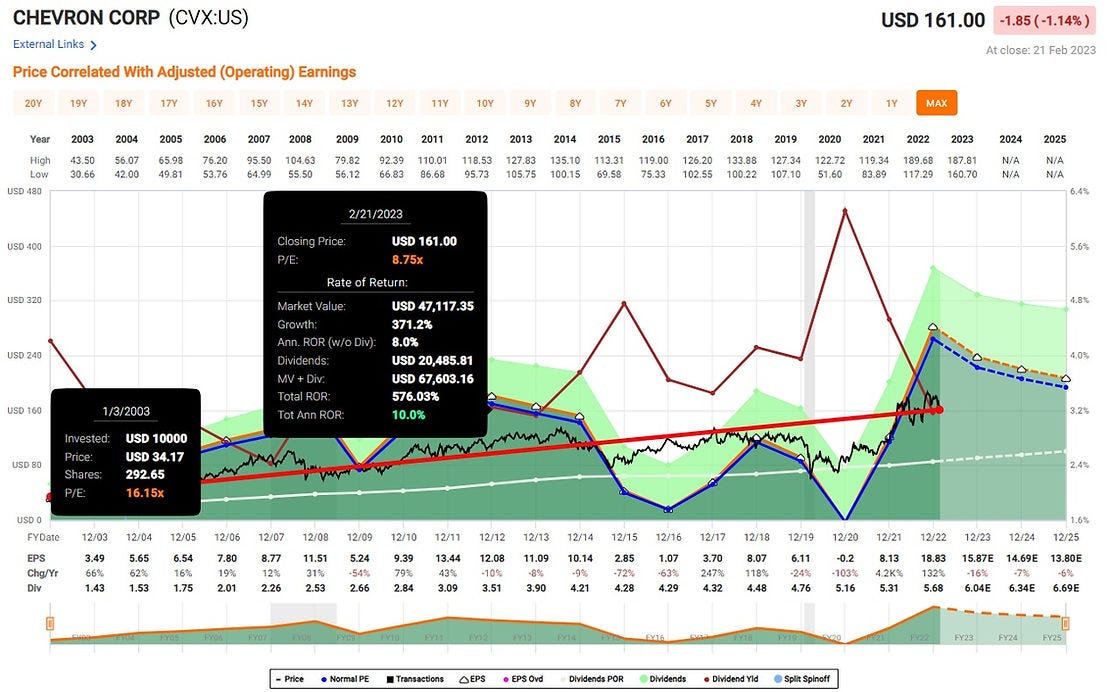

2. Chevron (CVX)

„Berkshire Hathaway initiated a position in Chevron (CVX) stock in 2020 and poured billions of dollars in additional investment into the stock in 2022. That proved to be a great move.

While falling gas prices caused Chevron’s share price to dip around 5% year to date in 2023 and lag the Dow’s roughly 3% gain across the stretch, the energy company has still been crushing the index since the beginning of last year.

Even with the valuation dip in 2023, Chevron stands as Berkshire’s third-largest holding, accounting for roughly 9.8% of the company’s equity portfolio.” — Motleyfool.

As I said above, I have holdings in Chevron, and back then, I was lucky to buy at an excellent price in July 2020. But right now…

I am a dividend investor, and that’s why today’s price isn’t that attractive for me.

Although we are in the margin of safety category, compared with earnings, the price went up so quickly and so much that you can see on the chart that earnings will fall in the next two years.

The total annual Return on our investment was 10% in the last 20 years, and the P/E ratio has also gone down for good. — FastGraphs

(Click on image to enlarge)

Chevron is among the best in the dividend king category, with 36 years of paying and increasing records. Because of the price jump, we haven’t seen this low dividend yield since 2017! The 3.75% isn’t that remarkable, in my opinion.

The payout ratio stays almost always under 40%!

„Energy giant Chevron announced a $75 billion stock buyback program and a dividend hike at the end of January. The company said in a press release the buyback program would become effective on April 1, with no set expiration date.” — CNBC.

The company has outperformed the S&P500 on the dividend side and is almost established on the Capital deprecation.

„Wall Street is the only place people ride to in a Rolls Royce to get advice from those who take the subway.”

3. Coca-Cola (KO)

„Coca-Cola also has one of the best dividend growth streaks of any publicly traded company. At 60 years of consecutive annual payout growth, the company is a decade past the 50-year marker needed to join the illustrious ranks of the Dividend Kings. Only nine public companies have longer dividend growth track records, and Buffett and other shareholders will very likely be treated by the other dividend increase that the company just published recently.” — Motleyfool.

Coca-Cola is a classic dividend stock! It was my first purchase back at the time. I said to the personal financial „expert” who wanted to sell me life insurance that,

„Look at Coke; if the share price stays the same over the years, but I get my 3% dividend yield, I will do better in the long run after taxes and fees than with your life insurance, where I will see some growth after the first 10 years but in the meantime, I have to pay around 2 months of savings every year for your fees!”

I still hold myself to this argument about what I told him back then. And it is still valid and works for me!

In the last 20 years, KO has given its investors a not-too-good but safe 6.7% total annual return!

The P/E ratio surprisingly almost stayed the same, and only a little bit went down.

There isn’t a reasonable margin of safety in the price right now; there hasn’t been one since 2008, but according to ZacksRating and the Dividend Radar list, KO is at its Fair Value! — FastGraphs

Like you just read above, KO has a 60 years record of dividend-paying and increasing! The current yield is again at its 4-year average with a recent increase of 4.5%, so the current yield is 3.08%.

The payout ratio is right at the border at 70%. In the last 7 years, it was always around 70–80%, which is a little bit scary, but I’m pretty sure they know what they are doing for the dividend champion status.

KO is issuing shares which gives me concerns. There is a 0.16% increase year over year.

Dividend growth stays the same over the years, always around 4–5%.

„It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

“The 21 analysts offering 12-month price forecasts for Coca-Cola have a median target of 68.00, with a high estimate of 77.00 and a low estimate of 62.00. The median estimate represents a +13.70% increase from the last price of 59.81.” — CNN

Closing thoughts

Well, I swear I didn’t look at the charts and overall ratios about the three stocks, but I was partly right. CVX’s price jumped so high that I would wait another year or two to see if this is something temporary or if this will stay for a long-time. KO is a safe choice if you want to buy the same BAC with a reasonable margin of safety.

None of these three will make you rich 5 years from now, but will they be a good safe place for your money with some return and hedging against inflation? Definitely, yes!

„Our favorite holding period is forever.” — Warren Buffett

More By This Author:

Discover The Warren Buffett Way Of Investing In Distressed Assets And Reaping Rich Rewards

Disclaimer: Nothing presented in the current article shall be treated as investment advice. All the articles and stock analyses shall be considered for informational purposes only. Make ...

more