Tuesday Talk: In The Waiting Place

Currently the stock market seems reminiscent of "The Waiting Place" in the iconic Dr. Seuss book, "Oh, The Places You'll Go", a place where not much seems to happen, but everything does.

Yesterday, the markets at first seemed as though they would spring back from Friday's smackdown by stretching upwards in fits and starts but shortly after midday the major indices turned lower to close down or unchanged. The S&P 500 closed down 17 points at 4,402, the Dow Jones Industrial Average closed down 172 points at 34,566 and the Nasdaq Composite closed down less than a point at 13,791.

Chart: The New York Times

However, in early morning trading market futures appear to be responding to news that Russia is "pulling back some troops", as well as a statement from Russian Foreign Minister Lavrov that diplomacy "is far from exhausted"; S&P futures are trading up 62 points, Dow futures are trading up 351 points and Nasdaq 100 futures are trading up 275 points.

Be that as it may TM contributor Diego Colman notes, S&P 500 Subdued On Russia-Ukraine Crisis, Double-Top Pattern Creates Bearish Bias.

"The Russia-Ukraine crisis is likely to weigh on sentiment in the near term, exacerbating volatility and capping upside speculation. Rising bond yields will be another headwind for risk assets that could prevent a meaningful recovery in the equity space. On this front, the Treasury curve shifted upwards during the session after St. Louis Fed President James Bullard doubled down on his hawkish views, stating that interest rate hikes need to be front-loaded to curb inflation."

"Focusing on the S&P 500, it appears that a bearish double top formation is currently in play following last Friday's drop below 4,450, the pattern’s neckline. If price holds below this area over the next few days, selling interest is likely to accelerate, paving the way for a move towards support at 4,300."

Contributor Rupert Watts in his article S&P 500 Dividend Aristocrats: Defensive Attributes, Growing Dividends, And Competitive Yields, suggests the S&P 500 Dividend Artistocrats index as a safe place to be in times of uncertainty and inflation.

"Market participants contemplating how to position themselves for the path ahead should not overlook dividend growth strategies such as the S&P 500 Dividend Aristocrats®. To be included in this index, companies must be members of the S&P 500 and have increased dividends for at least 25 consecutive years."

Watts' article contains historical data and charts showing how "dividends paid by current constituents of the S&P 500 Dividend Aristocrats have grown on average by 10.6% a year over the last 25 years compared with ~2.25% per year for inflation."

See the full article for more details.

As to be expected inflation is a hot topic among several TalkMarkets contributors.

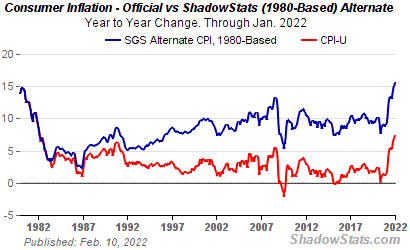

In a piece entitled Price Inflation Rates Shoot Above The 1980 Peak, Mike Gleason wants readers to drop the whole idea of transitory inflation.

"Americans get fed a lot of BS when it comes to price inflation. Prices in the U.S. are rising faster than they were in the late 1970s when gasoline shortages triggered an economic crisis...Most Americans would be surprised to know if price inflation was calculated using the same methodology the Bureau of Labor Statistics used during the 1980 peak, inflation would officially be worse now than it was then." Gleason provides an accompanying chart, shown below:

"Today’s mounting inflation crisis is very different from the one forty years ago. Fed bankers have nowhere near the leeway to hike interest rates and bring surging prices back under control. The equity markets cannot stomach rates above the low single digits."

Mish Shedlock updates readers noting, James Bullard Says Fed Credibility Is On The Line, Repeats Faster Rate Hike Message.

"...James Bullard stressed the needs to ‘front-load’ rate hikes to combat inflation.

Bullard Statements

- We have the hot CPI report. Not so much that report alone, but the last four reports taken in tandem have indicated inflation is broadening and possibly accelerating.

- I am just one person but I would like to see 100 basis points on the policy rate by July 1.

- "I do think we need to front-load more of our planned removal of accommodation than we would have previously. We’ve been surprised to the upside on inflation.

- This is a lot of inflation in the US economy. 7.5% on the headline CPI. These are numbers Alan Greenspan never saw and haven't occurred in 40 years.

- Our credibility is on the line and we do have to react to data.

- My position is a good one and I will try to convince my colleagues it's a good one.

- Inflation is much higher than we would have expected six months ago, nine months ago, and certainly twelve months ago.We've been surprised to the upside.

- I think the inflation we are seeing is very bad for low and moderate-income households. Real wages are declining. People are unhappy. Consumer confidence is declining. This is not a good situation."

Contributor Christophe Barraud writes in Why Is The Federal Reserve Under Pressure To Act Quickly And Strongly Against Inflation? that "Facing political and inflationary pressures, the Federal Reserve is expected to tighten its policy soon by raising rates for the first time since December 2018."

Barraud's article runs through all the issues concerning current inflation woes in a thorough and detailed manner, replete with supporting graphs. A look at the full article is merited. Below is some of what he has say:

"In January, the consumer price index (CPI) climbed 7.5% YoY (fastest since February 1982 and up from 7% in December), according to Labor Department data released Thursday. Excluding the volatile food and energy components, core prices increased 6% YoY (fastest since August 1982 and up from 5.5% prior). Both measures came above expectations (7.3%e and 5.9%e respectively) but the real surprises came from MoM measures. A few days before the release of CPI figures, the White House said that “individuals should focus on the month-over-month increase, rather than the annual jump, considering what we’ve seen over the last year.” Reality is that CPI rose 0.645% MoM in January (above average consensus of 0.44%), implying an annualized rate slightly above 8.0%. In other words, the recent dynamic is stronger than the YoY trend."

"According to several surveys, inflation has become a primary concern for households. As an example, the University of Michigan’s sentiment index dropped to 61.7, the lowest since October 2011 and down from 67.2 in January according to data released Friday."

"In a context where the labor market is probably tighter than indicated by the unemployment rate (at 4.0% in January 2022), there are more and more signs that a wage-price spiral is gaining traction with low-income families asking for higher salaries. The January employment report highlighted that, in the private sector, wages growth of “production and non-supervisory employees” increased by 6.9% YoY (fastest since April 2020 and well above the headline of 5.7% for all employees)."

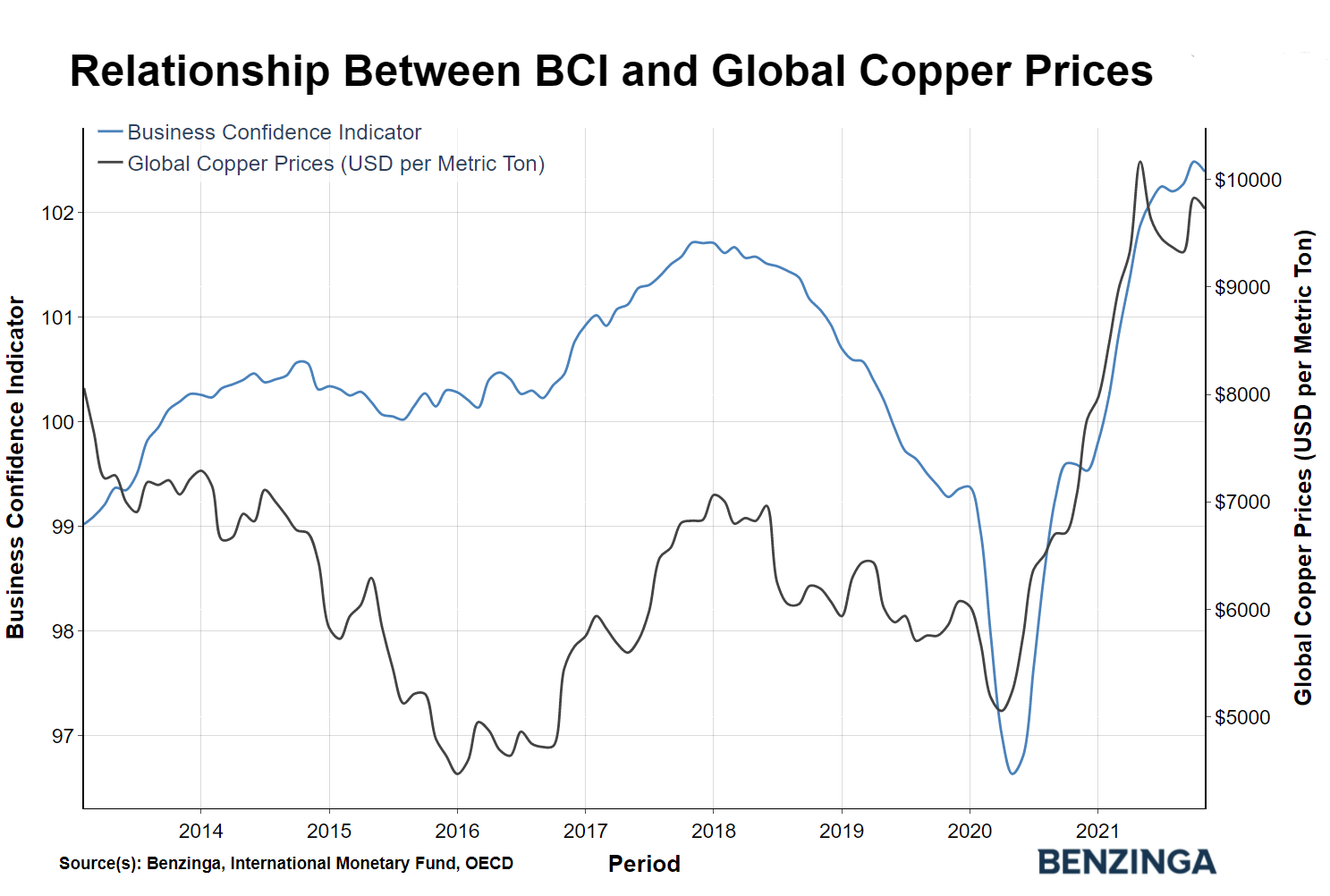

Turning again to the S&P, contributor Wayne Duggan explains Why Copper Is One Of The Best Macroeconomic Indicators.

"Copper prices are one useful, under-the-radar indicator for investors to use as a gauge of U.S. economic health. Despite downward pressure on stock prices so far in 2022, copper prices have held up relatively well, a trend that has been reflected in the strength of underlying U.S. economic numbers. In the past year, the SPDR S&P 500 ETF Trust SPY has generated a 16.9% total return, while the United States Copper Index Fund CPER has returned 21.7%. Year-to-date in 2022, the SPY fund is down 5.8%, but the CPER fund has drifted higher by 0.5%."

"Copper prices are benefitting from both underlying economic demand and elevated inflation rates, which serve as a tailwind for commodity prices. However, the Federal Reserve plans to curb inflation in coming months, and rising interest rates could eventually weigh on economic growth and copper demand."

Contributor Tim Knight shines the volatility spotlight on pharma stocks in Moderna Medicine.

"A wipeout of nearly 75% in just six months. I’m sure the insiders dumped at just the right time and left the retail bagholders wondering what just happened with their “investment.” MRNA."

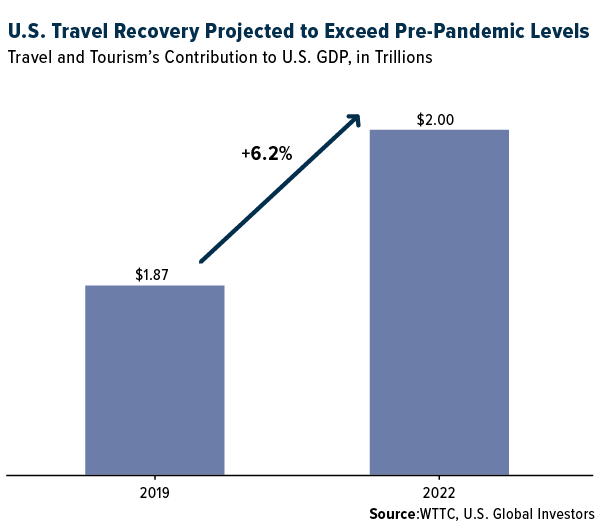

To close on a more optimistic note TalkMarkets contributor Frank Holmes advises Get Ready For A Major Travel And Tourism Recovery This Year, New Study Says.

"Travel and tourism in the U.S. will outpace pre-pandemic levels this year, with the sector projected to generate $2 trillion, or 6% more than it did in 2019. That’s according to new economic modeling by the World Travel & Tourism Council (WTTC), working with Oxford Economics."

"On a global level, the industry is forecast to contribute $8.6 trillion in economic activity this year, according to the WTTC, which would be only 6.4% below the $9.2 trillion generated in 2019...Airline business confidence is improving, according to a January survey conducted by the International Air Transport Association (IATA), with nearly every airline CFO (96%) reporting that passenger demand increased in the fourth quarter of 2021...The market also appears to see an end to the most restrictive travel mandates and border closures sooner rather than later."

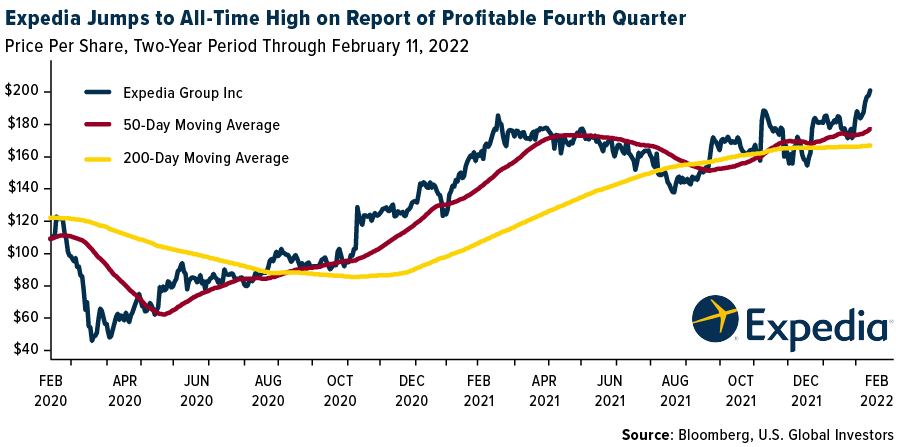

Holmes' article includes several stock picks to go along with this sunny forecast, including Expedia Group (EXPE).

Caveat Emptor.

I'll be back on Thursday, in the meantime have a good one and pray for peace.