Tuesday Talk: Fireworks And Rollercoasters - The Day After

In addition to those experienced over the 4th of July weekend as part and parcel of Independence Day celebrations, the market also provides its own fireworks and rollercoaster rides.

Image: Pixabay

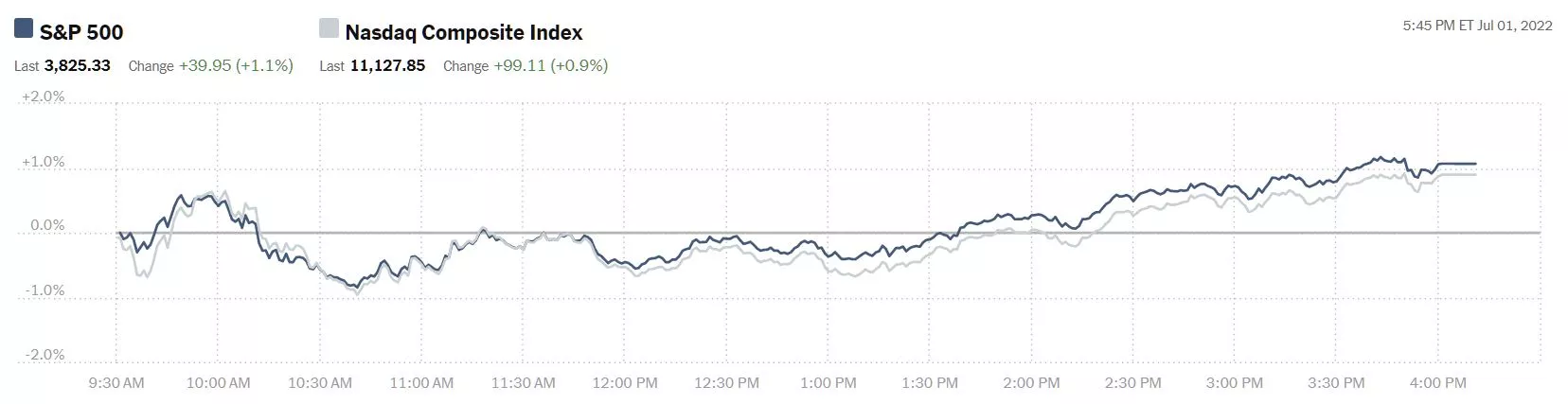

Friday the market provided fireworks in the form of a run-up to the holiday rally. The S&P 500 closed up 40 points at 3,825, the Dow closed up 322 points at 31,097 and the Nasdaq Composite closed at 11,128 up 99 points, which all makes for a good looking chart.

Chart: The New York Times

Which brings us to today, Tuesday morning, July 5 and the rollercoaster. Currently market futures are trading down. S&P 500 market futures are down 19 points, Dow market futures are down 133 points and Nasdaq 100 futures are down 75 points. Buckle-up! ![]()

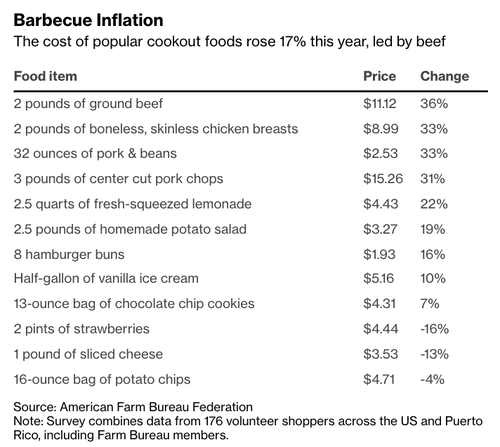

First on the block is TalkMarkets contributor Tyler Durden who charts consumer price inflation by the year to year change in the cost of our holiday barbeques in White House Quiet As BBQ Inflation Roils Americans On July 4.

"A new survey from the American Farm Bureau Federation shows the average cost for a cookout this weekend to feed about ten people will cost on average $70 -- that's up 17% or $10 compared to a year ago. Bloomberg breaks down barbecue inflation and finds ground beef prices are up a staggering 36% from a year ago, chicken up 33%, pork and beans +33%, pork cops +31%, lemonade +22%, and so forth."

Eat more strawberries.

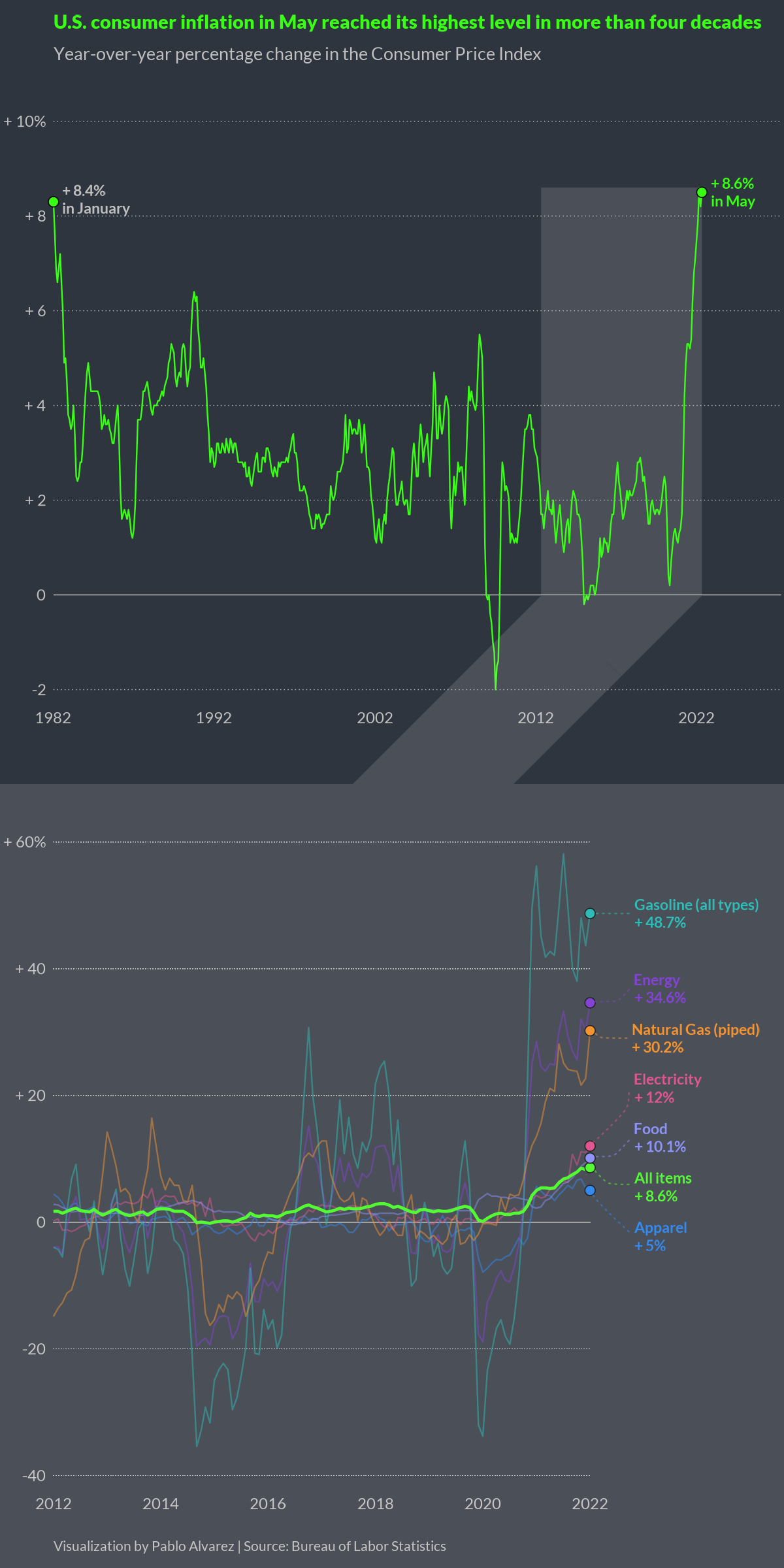

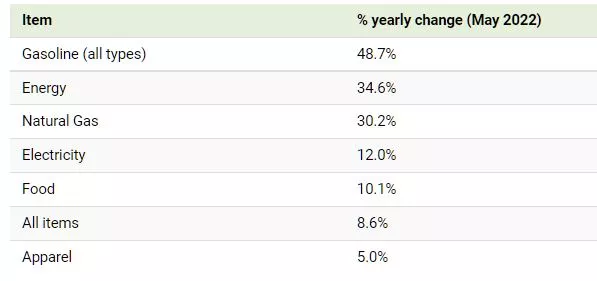

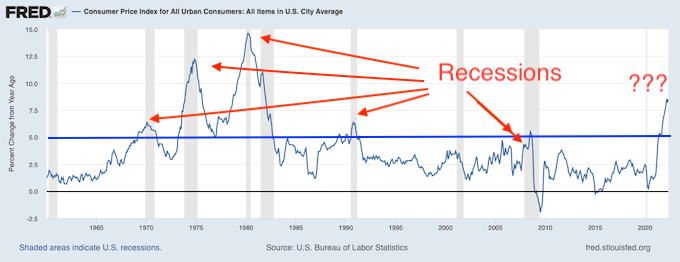

Contributors Pablo Alvarez and Carmen Ang give us a more detailed look at inflation in Charted: Four Decades Of U.S. Inflation.

"In May 2022, the annual rate of U.S. inflation grew to 8.6%—the highest it’s been in four decades, according to the Bureau of Labor Statistics. The visualization below shows U.S. inflation levels since 1982 and highlights a few product categories that have seen the biggest year-over-year increases."

"Perhaps unsurprisingly, energy sources have seen the biggest year-over-year climb. Gasoline has seen one of the biggest spikes, up 48.7% since May 2021."

"Rather than adjust their spending habits, Americans have been relying on their savings to cope with price hikes. A recent survey of over 2,000 Americans showed that 67% of respondents have used some of their savings to deal with price increases, and 23% have made a substantial dent in their nest eggs."

Economist and TM contributor Daniel Lacalle takes central bankers to task in his op-ed If Central Banks Do Not Tackle Inflation, Deflation Will Come From A Crisis. Here is some of what he has to say:

"Most market participants have been surprised by the last six months. The total return of the US Treasury Index was the worst since 1788 according to Deutsche Bank. Stocks closed June with one of the largest corrections since 2008. Bonds and equities are falling in unison, driven by rate hikes and normalization of monetary policy.

However, there is no such real normalization. The balance sheet of the main central banks has barely moved and remains at all-time highs according to Bloomberg. The ECB continues to ignore the highest inflation rate in the eurozone since the early 90s by keeping negative rates. The Federal Reserve rate hikes have been more aggressive, but it is still injecting billions of dollars in the reverse repo market and monetary aggregates remain excessive."

"Central banks seem to fear markets. However, it is better to create a correction in bonds, equities, and risky assets after years of all-time highs than to lead the world to a crisis created by the destruction of purchasing power of salaries and deposits.

Policymakers should be very concerned about the so-called “prudent” normalization because the expansion was far from prudent. The pace at which they bloated their balance sheets and cut rates is what they should have been worried about, not the normalization."

"Inflation can be addressed by properly reducing central bank balance sheets, raising rates, and cutting deficit spending. If policy makers send the private sector to a crisis due to inaction, the crisis will be far worse than 2008. It is still time. End the perverse incentives of excessive monetary action. It may still create another leg down in markets, but they will eventually recover. The destruction of businesses and families’ disposable income is far more challenging to restore."

You can find more hindsight and contradictions in the full article.

TalkMarkets contributor Ilya Spivak raises a flag about the flagging euro with the headline, Euro May Be About To Drop Below Parity Against The US Dollar.

"Managing ‘fragmentation’ – that is, diverging lending rates across Eurozone states – now seems like it will necessarily keep ECB tightening modest relative to global peers. That puts the single currency at an acute disadvantage, suggesting the downtrend is due to resume."

"EUR/USD chart positioning is at a pivotal juncture in the meantime. Looking at the monthly chart, prices are sitting on support at the bottom of a range that has capped downside progress since March 2015. Breaking below this barrier may set the stage for the next big leg in the structural decline from the peak above 1.60 in 2008.

A monthly close below 1.0340 would look like confirmation of a breach, with the next move after that seems set to bring the exchange rate below the closely watched parity level. Long-term Fibonacci extensions approximate next steps, with noteworthy inflection points seen at 0.9707 (50%) and 0.9034 (61.8%).

On the topside, immediate resistance levels come in at 1.0885 and 1.1239. A rebound that brings prices through these barriers is likely to put the multi-year congestion zone capped at 1.1727 back into focus. Still, further above that is trend-defining support-turned-resistance running up into 1.2538."

So far the U.S. seems to be winning the race to reaching peak inflation first, what is good for one, is not good for the other.

Contributor Graham Summers writes that the U.S. economy is in recession and that we shouldn't allow ourselves to be hoodwinked yet a second time by the Fed when quite simply, The Government’s Own Data Tells Us An Economic Collapse Is Underway.

"The big lie of 2021 was that inflation was non-existent or “transitory.” We all know how that turned out. Inflation is at a 40-year high, gas is over $5 a gallon, and Americans have never spent more of their incomes on gas and food.

Now the Fed is back with another big lie. It’s the big lie of 2022: that the U.S. won’t enter a recession. For most Americans, the economy has been in recession for months."

"The National Bureau of Economic Research (NBER) released a trove of data with its highly massaged GDP results. And BOY did it have some worrying stuff in it. Most worrying of all was the following:

Real Disposable Personal Income collapsed an incredible 12% in the first quarter of 2022. Even more incredibly, it has fallen in THREE of the last four quarters.

Unfortunately, it’s even worse than that. Look at the below table. Yes, you are reading that correctly, the collapse in Real Disposable Personal Incomes is larger than that which occurred during the 2008 recession.

This is why inflation is so devastating… because it destroys Americans’ pocketbooks. It’s also why every time inflation rises above 5%, a recession hits.

Remember, 75% of GDP is consumer spending. But if consumers have to cut back on their disposable spending because the basic cost of living (gas, food, etc.) is through the roof… you get a recession."

Any questions?

Which brings us back to what will happen this week. TM contributor Michael Kramer has his take on the start of the trading week with 9 Monster Stock Market Predictions – Week Of July 5.

Read the full article for all nine of Kramer's predictions. Below are a few of his takes on the market in general:

"S&P 500 (SPX)

The S&P 500 finished on a high note Friday but could not erase the week’s loss finishing lower by 2.2%. The rally that came late on Friday had much more to do with the long weekend and the decay of implied volatility than anything else.

The index closed below resistance at 3,830 despite attempting to break above on several occasions in the final 20 minutes of the day. For this rally to have any legs the week of July 5, the S&P 500 will need to gap above 3,830 on Tuesday morning."

"The most significant headwind will come on Wednesday afternoon when the FOMC minutes for the June meeting are released at 2 PM ET. The markets have tended to react negatively to the Fed minutes all year, and this Wednesday’s release may prove not to be all that different."

Whew. I don't know how many cups of coffee you needed to get through all that, but I need another.

See you on Thursday.

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: Which Way Through Uncertainty?

Thoughts For Thursday: Flat And Frazzled