Thoughts For Thursday: Flat And Frazzled

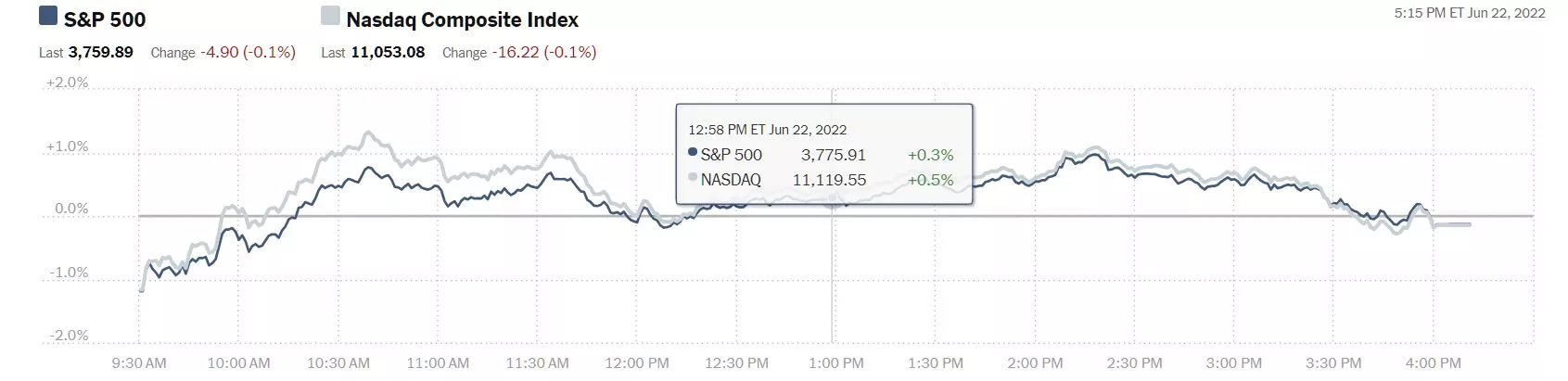

After a steep hike-up on Tuesday and a churner of a down and up for most of the trading session on Wednesday, the market ended the day flat and frazzled.

The S&P 500 closed at 3,760, down 5 points, the Dow closed at 30,483, down 47 points and the Nasdaq Composite closed at 11,053, down 16 points.

Chart: The New York Times

A granular view of yesterday's most actives shows no major changes other than big tobacco giant Altria, which lost 9% on word that the FDA may instruct the company to pull their Juul vaping products from the market.

Chart: The New York Times

Morning market futures at the moment are maintaining the flat and frazzled mood; S&P Market futures are trading up 8 points, Dow market futures are trading down 1 point, and Nasdaq 100 futures are trading up 66 points.

TalkMarkets contributor Michael Kramer notes that Stocks Finish Flat On June 22 As Financial Conditions Tighten Further.

"It was a volatile day, with the market dropping sharply to open and rallying sharply, only to close flat. There was a strong sell-off at the open, with the S&P 500 falling to around 3,720 and rebounding nearly 80 points to 3,800. But in the end, it closed at approximately 3,760.

Maybe it was due to Powell’s testimony; I’m not sure. He had nothing new to say, which may have been reason enough to rally.

I don’t think anything changed today, so I will stick with my view that the S&P 500 retraces to under 3,700 in the next couple of sessions."

There is some talk on the street and in the press that commodities have/are peaked/peaking. Kramer's thoughts on Exxon-Mobil and Freeport Mining echo that thinking.

Exxon (XOM)

Today, I wrote up a story about Exxon and a potential move lower in the stock. A bearish megaphone has formed, which could see the stock fall first to around $83, but I think there is potential for $70.

Freeport (FCX)

Copper prices have been dropping, and today Freeport also fell by nearly 8%. It is a big spot for Freeport on the chart, with the stock hovering around technical support at $30. Where copper goes, Freeport will follow. But if Freeport drops below $30, there is a long way for this to fall, potentially to as low as $26.

Contributor Mish Shedlock writes Unleaded Gasoline Futures Suggest The Price At The Pump May Have Peaked.

"Unleaded Gas Futures

- Peak Price $4.276 on June 9

- June 22 Price $3.824

- Decline $0.452

The futures price has fallen about 45 cents."

In the rest of the article Shedlock puts his spin on the current spat between President Biden and the CEO's of Big Oil regarding oil and gas production and prices at the pump.

Contributor Diego Colman's anticipation of what the market will do next is decidedly bearish in his article, S&P 500 Falls On Recession Angst Following Powell’s Testimony, Bear Market Lives On.

"When it was all said and done, the S&P 500 dropped 0.13% to 3,759 in a volatile session marked by the Federal Reserve chairman’s Semiannual Monetary Policy Report to Congress.

At his Senate hearing, Jay Powell offered some positive comments on the current health of the economy, but there was by no means a "dovish pivot"; instead, he maintained a very hawkish posture in the face of four-decade high CPI readings. The Fed chief warned that the risks of inflation becoming entrenched have increased, but sought to assuage concerns by stressing that the central bank has the resolve to restore price stability, a sign that policymakers will do what is necessary to tame stubbornly elevated inflationary pressures.

Despite Powell's remarks, US Treasury rates fell sharply, with the 2-year and 10-year yield retreating about 15 bp to 3.05% and 3.15% respectively. The recent drop in oil prices, coupled with growing recession fears, has traders speculating that the FOMC may fold sometime in 2023 and reverse course to avoid a deep downturn. The shift in expectations can be seen in the Fed funds futures curve, which now implies a terminal rate of 3.58% in May next year, down from 4.15% a week ago, a 57 bp reversal in less than 10 days."

"The S&P 500 plunged violently last week and established a new 2022 low, but failed to conclusively break below cluster support spanning from 3,700 to 3,665. If this floor holds in the near term, buyers may be emboldened to jump back in, but to have confidence that the worst is over, the index must rise above resistance at 3,810 and reclaim the psychological 4,000 level. On the other hand, if sellers retake control of the market and push prices below 3,700/3,665, all bets are off. Under this scenario, bearish momentum could accelerate, setting the stage for a drop towards the 3,500 area, a key support created by the 50% Fibonacci retracement of the 2020/2022 rally."

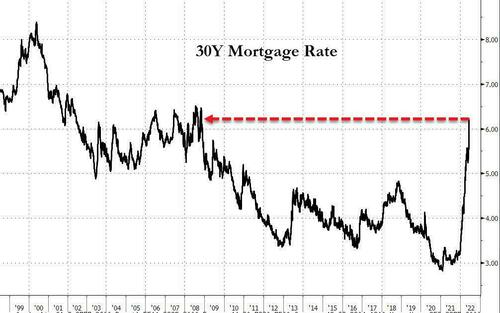

The fall-out from the sharp increase in mortgage rates continues, as two TM contributors report:

Tyler Durden reports JPMorgan Fires Hundreds Of Mortgage Bankers As Housing Market Breaks.

"Today we got the clearest sign that the banks agree when out of the blue - or rather out of the "hurricane" - JPMorgan (JPM) announced it was cutting over a thousand home-lending employees and reassigning hundreds more after soaring interest rates dried up mortgage demand.

Jamie Dimon pulled off his best Jean-Baptiste Emmanuel Zorg impression when the bank decided that more than 1,000 workers will be affected by the slowdown in housing, with roughly half fired and the other half moved to other (less paying) divisions within the bank..."

"It's not just JPM: Wells Fargo (WFC), recently the biggest mortgage lender among US banks (nobody knows anymore what Wells really does anymore with all the rampant crime and corruption at the bank), has also been laying off and reassigning employees in its home-lending division, Bloomberg also reported. And earlier this month, real-estate giants such as Compass and Redfin also announced plans to trim their workforces amid the cooling US housing market. Compass said in a regulatory filing that it will cut about 10% of its workforce, or about 450 employees, while Redfin plans to layoff about 6%, amounting to roughly 470 workers."

The Staff at Schiff Gold opine that More Air Hisses Out Of The Housing Bubble.

"As interest rates rise, the air continues to hiss out of the housing bubble.

Existing home sales tumbled to a two-year low in May. Sales fell to a seasonally adjusted 5.41 million units, according to the latest data from the National Association of Realtors. It was a 3.4% drop, bringing existing home sales to the lowest level since June 2020. May was the tenth consecutive month of year-over-year declines.

Year on year, sales of existing homes have tumbled by 8.6%.

According to the National Association of Realtors, “Further sales declines should be expected in the upcoming months given housing affordability challenges from the sharp rise in mortgage rates this year.”

While we may not see the kind of crash we saw in 2008, a housing market bust will reverberate through the economy as rising housing prices squeeze Americans already struggling to make ends meet.

We expect the housing bubble to continue to deflate as we move through 2022. Just how fast the air comes out and the impact on the broader economy remains to be seen."

See the full article for more gory details.

Talking crypto, TalkMarkets contributor Kevin Beckman in an "In the Spotlight" piece says Bitcoin Could Fall Further In Indecisive Trade. Below are some of the highlights from his article.

"Bitcoin (BITCOMP) has been oscillating around the $20,000 figure these days after a brief plunge to late-2020 lows in the $17,600 area over the weekend. Despite the selling pressure has eased, the largest cryptocurrency by market capitalization looks set for deeper losses as recovery attempts look too modest and indecisive for the time being."

"...market participants expect BTC to drop further beyond the $20,000 level, with a $13,000 key support area coming into the market focus, as digital assets tend to follow dynamics in traditional financial markets this year."

"...the wider crypto space is unlikely to get rid of its volatility any time soon, especially as traditional markets remain shaky as well. On the other hand, the potential selling pressure could ease somehow eventually should signals of seller exhaustion emerge over the coming weeks.

In the immediate term, BTCUSD needs to hold above $20,000 on a daily closing basis in order to avoid another plunge. However, the path of least resistance remains to the downside so far."

Ending today's column on the bullish side of the market is contributor Tracey Ryniec, who posits that The Golden Era Of Value Investing Is Back.

From Ryniec's article:

"In a now-infamous 1974 interview with Forbes Magazine, (Warren) Buffett could barely contain his giddiness.

Forbes asked how he felt about the market opportunities after the big sell-off and he replied “Like an oversexed guy in a harem. This is the time to start investing.”

Image: Pixabay

"3 Signs the Golden Era is Returning

Buffett may have been giddy over the buying opportunities in stocks in 1974, but it turned out that the rest of the decade was a golden era for value investors too.

There are 3 signs that US stocks could be returning to another golden era for value investors in this decade.

1) P/E Ratios are Dropping

After topping out above 20 in 2021, the S&P 500 is now trading at 16.2x. That’s still well above the single digit P/Es of the late 1970s.

But forward earnings for individual industries have plunged into the single digits. For example, the companies that are drilling and producing oil and natural gas are trading at just 4.65x forward earnings as an industry. That’s dirt cheap.

2) Dividend Yields are Rising

Along with cheap valuations usually comes rising dividend yields. The dividend aristocrats, those companies that have raised their dividend payouts for over 20 years, get cheaper than ever in a stock market sell-off. So not only are they raising their dividend but the yield rises as the stock gets cheaper.

It was easy to get juicy dividends in the 1970s as those valuations dropped – and we see a similar opportunity today.

3) Dollar Cost Averaging Works

In Berkshire Hathaway’s 1978 letter to shareholders, Warren Buffett discussed their strategy of adding to their stock positions in their insurance portfolio as the bear market continued to rage on.

“We are not concerned with whether the market quickly revalues upward securities that we believe are selling at bargain prices. In fact, we prefer just the opposite since, in most years, we expect to have funds available to be net buyers of securities,” Buffett wrote.

Dollar-cost averaging works for value stock bulls because the Street is always late to the party in value stocks so valuations remain depressed for some time. It’s easy to add to your position and still get in at an attractive price.

Buffett Gets Out the 1970s Playbook

We’re already seeing Buffett, and Berkshire Hathaway (BRK-B), mimicking the strategy of the 1970s.

Berkshire has started deploying its cash hoard into cheap companies that have record free cash flows.

If stocks continue to get cheaper in the second half of this year, we’ll likely see Berkshire dollar cost average into what it considers to be the most attractive companies.

While the overall stock market lagged until 1981, the top value managers like Buffett and Fidelity’s Peter Lynch became investing legends as value investing saw great success.

There will be new investing legends created in this decade’s value stock rally as well.”

Caveat Emptor!

Watch out for the draft!

I'll be back on Tuesday