Tuesday Talk: COVID Summer, Take 2

It's take 2 for COVID this summer, with vaccinations and the Delta variant sharing the billing. Positive signs on the job front clashing with inflation and continuing corona concerns have left some investors chewing popcorn till something happens.

Monday, the markets didn't move much. The S&P 500 closed at 4,432, down 4 pts, the Dow Jones closed at 35,102, down 106 pts, while the Nasdaq Composite closed at 14,860, up 24 pts. Currently S&P futures are down 1 pt, Dow futures are down 20 pts and Nasdaq futures are up 12 pts. None of this is to say there was no action on the street, yesterday. Moderna (MRNA), the vaccine superstar jumped 17%, while Ball Corp. (BLL) a maker of aluminum cans, as well as defense and aerospace related hardware and systems, jumped 2.5% on strong Q2 earnings.

Chart: The New York Times

2020 saw many investors savvy and unsavvy alike, get into precious metals. The results seemed to be pretty good, where as 2021 is proving to be somewhat bumpier. TalkMarkets contributor Clint Siegner in his article Bullion Investors Hang Tight urges investors to hang tight and be mindful of history both past and future. More of an Op-Ed than a news piece, here is some of what he has to say:

"Officials introduced paper gold and silver contracts specifically to increase price volatility and discourage physical ownership of metals. After nearly 50 years (since Nixon moved America off the gold standard), it is safe to say their strategy was a success. It is often excruciating to own metal when the short-run price action is completely disconnected from fundamentals.

The price smash in the last couple of trading days is a case in point. Nobody can make a coherent fundamental case for the move lower. It is best to simply remember there are very good reasons to own physical metal even when it feels like you are being punished for doing the right thing."

Some of the reasons Siegner gives for owning physical gold or silver are these:

"Paper money always dies. The U.S. dollar’s reign as world reserve currency is long in the tooth, and the greenback looks set to lose its privileged status in the years ahead...Coins, rounds, and bars are private, portable, and off the grid. It is possible to put a million dollars’ worth of gold coins into a suitcase and travel anywhere in the world. When you arrive, those coins can quickly and easily be converted into the local currency...Precious metals do perform well over the long term, even if it often doesn’t feel that way in the short term. Two years ago, silver was priced below $15/oz. Twenty years ago silver was under $5/oz (SLV). Gold (GLD) has outperformed stocks over the past two decades."

Perhaps, but readers will recall that Saddam Hussein was captured with $750,000 in cash, an AK-47, and no bars of gold bullion.

Contributor Jim Mosquera, also taking note of the anniversary of Nixon's decision to upend the Bretton Woods conference in a piece entitled The Ghost Of Richard Nixon And The Golden Anniversary suggests that 50 years on, cryptoassets are gold's replacement challengers to sovereign currencies. It's an idea that has been getting a fair amount of play on the airwaves and the ether as of late.

"In 2008, someone, or perhaps more than one person, with the pseudonym Satoshi Nakamoto penned a whitepaper for a cryptographically secured digital currency that operated in a trustless environment. What was that trustless environment? The Internet. Since that time, Bitcoin (BITCOMP) has become a de facto USD on the Internet. It's become money for the Internet. Have you ever noticed that Bitcoin's graphical representation is frequently painted in gold? That's no coincidence."

"Despite everything (you just read), the USD is not going to die anytime soon. In fact, I suspect in the near-term you'll see the USD rise against a basket of currencies...despite misgivings you may have about cryptocurrencies like Bitcoin, they are not going away. No one knows what Bitcoin's ultimate exchange value will be relative to the USD. To believe, however, that given our checkered history with money, geopolitics, central bank and government interventions in the economy, and wealth/income inequality, that somehow digital currencies like BTC will seek to exist, is at best myopic."

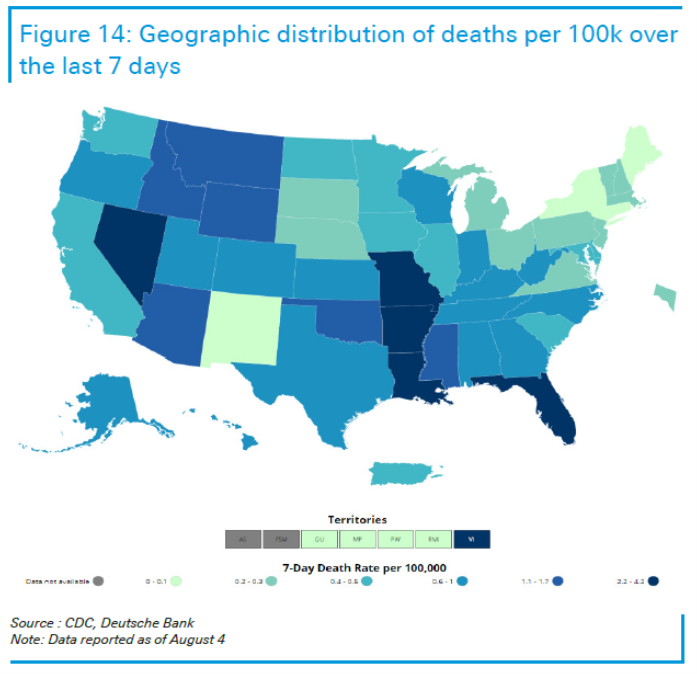

TalkMarkets contributor Menzie Chinn, a University of Wisconsin economist who is want to explain economic activity using charts and graphs provides his latest take in GDP At (COVID) Risk? – And State And Behavioral Response.

"As of last week, GDP originating in counties with rising death rates accounts for 60% of total; still below the 80% recorded in the Winter.

Source: Deutsche Bank, Covid Tracker, 5 August 2021.

These are results based on reported data as of 4 August.

It is unclear what the economic implications of high COVID death rates would be. If state authorities impose public health measures such as restricting indoor business activity, then one might see a decline in high contact service-related activity and hence output. However, reaction functions vary widely across states. For instance, we can see hospitalization rates rising above peak in Florida, and yet there is no evidence of a state government response. Hence, there may be no short-run impact on activity (although risk averse behavior might come into play, reducing economic activity nonetheless)."

Addressing inflation concerns Michael Ashton gets ahead of the week's pending CPI data in CPI Forwards Show Inflation Concerns Aren’t Ebbing. He starts off with a primer on inflation which is short and fairly to the point and leads up to his current assessment of inflation now and going forward.

"How much of a permanent loss have we seen in the last couple of years? Here are my calculations of the theoretical futures curve for CPI, as of August 1st, 2019 compared to last Friday. The last column shows how much higher investors think prices will be on those dates today, compared to what they thought two years ago.

Notice that this is from well before the crisis, and so takes into account the plunge in prices from early 2020 and the recent increases. After all of the zigzags, investors expect prices to be about 5% higher in 2023 than they would have thought previously, and about 8% higher in 10 years. And I think they’re too sanguine."

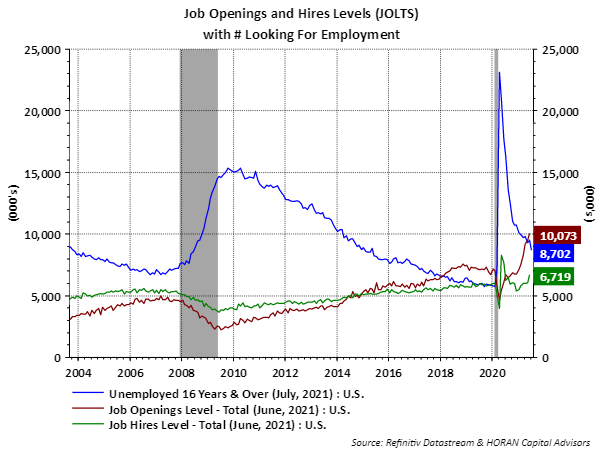

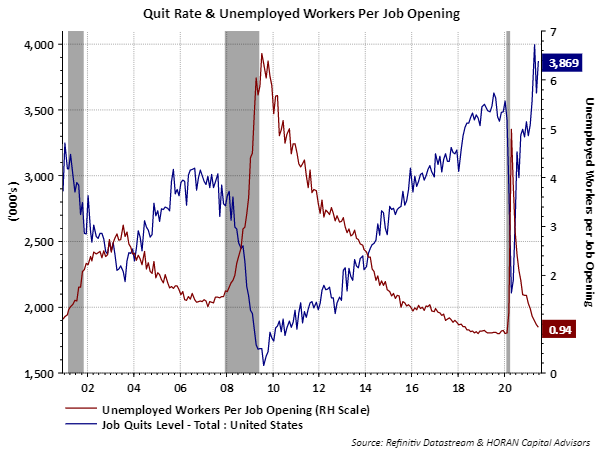

David Templeton weighs in on the July NFP data in Job Openings At A High with a detailed set of charts. Here are a few.

"The Bureau of Labor Statistics reported a series high for job openings in June to 10.1 million positions. The job openings level is on top of the strong July nonfarm payroll report last week with nearly 1 million jobs added. The openings of 10.1 million once again exceed the number of those seeking employment, i.e., 8.7 million. The last time openings were greater than the number of unemployed was March 2018.

As a result of this tight job market the quit rate is once again moving higher after declining in the May, 2021 report. Also showing on the below report is the unemployed worker to open position ratio.

A bit surprising is the fact this tight labor market situation is occurring at a relatively high level of job openings. With the Pandemic Unemployment Assistance ending on September 6, it likely leads to more individuals seeking and taking a new job position. It is probable with some of the extra unemployment benefits ending next month, nonfarm payroll gains might just run near 1 million per month for several months, all else being equal."

See the full article for the rest.

While the metals markets have been taking hits as of late, TalkMarkets contributor Frank Holmes writes in How To Participate In The Coming Electric Vehicle (EV) Boom that in addition to the EV manufacturers themselves, investing in some of the key raw materials (needed for EVs) may be the way to go.

"Investing in select carmakers looks attractive—we invest in a few ourselves, including Tesla (TSLA) and Volkswagen (VWAGY)—but my preferred way to get exposure is with the commodity producers supplying the metals and other materials that will be required to ramp up EV production. The metals that most people think of when it comes to EVs are lithium or copper (JJC)... But it’s important not to overlook other key metals. According to BloombergNEF, global nickel and aluminum demand could grow as much as 14 times between now and 2030, phosphorus and iron 13 times. Silver demand should also benefit over the coming years."

Holmes is bullish not only on EV related sectors, but on the US economy as a whole. He concludes his piece with the following:

"Contributing to my bullishness are the rate at which S&P 500 companies are beating earnings expectations and last month’s stunningly positive manufacturing and services PMI readings. So far, 87% of companies in the S&P 500 have reported results for the second quarter, and of those, 87% have beaten Wall Street projections. If 87% were the final rate for the quarter, it would mark the highest such percentage since (FactSet began tracking this data back in) 2008."

Orville Redenbacher's parent Conagra (CAG) is trading at $33.15 per share, well below it's 52 week high of $39.34. Last month Conagra announced its dividend will be increasing to US$0.31 per share on September 2. ![]()

Caveat Emptor.

Have a good week.