CPI Forwards Show Inflation Concerns Aren’t Ebbing

One of the most important things I learned as a markets person was the relationship between “spot” prices and “forward” prices. A spot price is the price today if you buy a particular investment or commodity. A forward price is the price that you agree today to pay in the future on some date for delivery of that investment/item.

To a non-markets person, this seems odd. If I want to buy a carton of milk, but the grocery store is out of milk so I tell the grocer “hold one of those cartons for me when they come in,” it wouldn’t occur to me that I should pay a different price than is on the shelf. Or, maybe, I might expect to pay whatever the price is when the milk comes in. But I wouldn’t think that today I should arrange for a different price for that milk just because I get it in the future.

But of course, the idea of the present value of money is super important in investing. A dollar received in the future is worth less than a dollar received today. (That is, unless interest rates are negative. In that case, a dollar in the future is weirdly worth more than a dollar today, and we are in that bizarre situation I described once, in a really neat post, as ‘Wimpy’s World.’) But it isn’t just money that has a different value for future delivery than it does today. There are at least two ways that I can own a pound of gold six months from now. One is to buy a pound of gold and pay for storage and for insurance for six months. The other is to arrange with someone today to deliver me a pound of gold in six months. In that case, I don’t have to pay for storage and insurance, so I’ll be willing to pay more for gold in the future. In commodities markets, we say that this curve is in “contango,” where futures prices are above spot prices.

The important thing to realize, though, is that all of these things converge. The spot price of gold will eventually converge to the 6-month forward price of gold…in, as it happens, about six months. If there is no change in the price of insurance and storage, every day the spread of the futures price over the spot price will decline by one day’s worth of those expenses. (n.b. – there are other parts of the carry, too; I’m abstracting here for illustration). If nothing else in the market changes, then the spot price will gradually rise towards that forward price. Here is the important bit that markets people learn: in some sense, that is not a true profit:

Buy today: $1700 plus $10 storage plus $10 insurance = $1720 cost of gold 6 months’ forward

Buy for forward delivery: $1720.

In both cases, if I sell the gold six months and one day from now at $1720, I have made zero money, even though in the first case I paid $1700 for it. But it looks like gold rallied.

I’m not really here to talk about gold. I’m here to talk about economists.

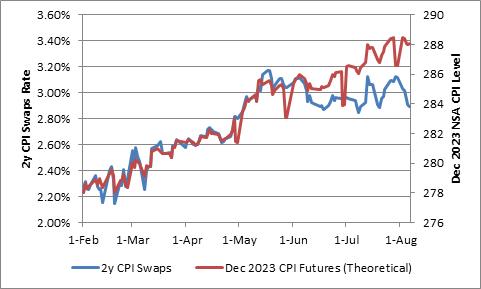

Economists don’t really internalize this well. Case in point is the question about whether inflation expectations are ‘anchored.’ An economist – in particular, a Fed economist – looks at the following chart of 2-year inflation swaps since February and says “Expectations for inflation two years in the future rose between February and May, and then have been flat-to-down since then.”

But that’s not really what happened.

Someone who bought inflation swaps in early May got something that a buyer of inflation swaps today doesn’t get. The May 15th version of inflation swaps, because of the way they work with a 3-month lookback, got half of the 0.6% March CPI print, plus the 0.8% April print, the 0.6% May print, and the 0.9% June print. The person who buys inflation swaps today doesn’t get March and April, and only half of the May uptick (plus June). Ergo, if nothing else changes we would expect the price for a 2-year inflation swap today to be lower than the price in mid-May.

As the high prints from the last few months pass into the rearview mirror (although there will be some high ones to come, I don’t really expect +0.9% m/m any time soon), the inflation swaps, and breakevens markets should look softer. It’s just carry. But how much softer?

One way to find out what is really happening to inflation expectations is to look at the forwards. Let’s pretend for a minute that the CME had actually launched CPI futures a few years ago, and we had a CPI futures contract that traded in December 2023 (settling to the November CPI print that comes out that month). Over the last few months, what would have happened to the price of that futures contract? The chart below shows that it would have enjoyed a very steady rise over the last six months. The CPI futures contract settles (or anyway, it would have) to a particular price level. We would almost always expect the futures prices to be above the current NSA CPI number, which was 271.696 in June. But these prices – which I’ve calculated from an inflation swaps curve I build every day – are showing that investors have responded to these higher CPI prints by steadily raising their expectation of future prices.

If investors thought these last few months were going to be reversed in the coming months, then the forwards wouldn’t have responded in this way. Investors would be betting that the high prints would be followed by low prints that reverse the changes. However, that’s not what is happening. Investors are taking these high prints and putting them in the bank. While they might think the rise in the inflation rate is transitory, they don’t think the rise in the price level is transitory.

This is a key distinction. The inflation we are seeing, even if it later slackens, represents a permanent loss of purchasing power. How much of a permanent loss have we seen in the last couple of years? Here are my calculations of the theoretical futures curve for CPI, as of August 1st, 2019 compared to last Friday. The last column shows how much higher investors think prices will be on those dates today, compared to what they thought two years ago.

Notice that this is from well before the crisis, and so takes into account the plunge in prices from early 2020 and the recent increases. After all of the zigzags, investors expect prices to be about 5% higher in 2023 than they would have thought previously, and about 8% higher in 10 years.

And I think they’re too sanguine.