Thoughts For Thursday: Waltzing With Walz

On Wednesday night Tim Walz officially accepted his party's nomination as the 2024 Democratic nominee for Vice President. It remains to be seen if the market will find favor with Walz's brand of midwestern common sense, Kamala Harris and the Democratic platform.

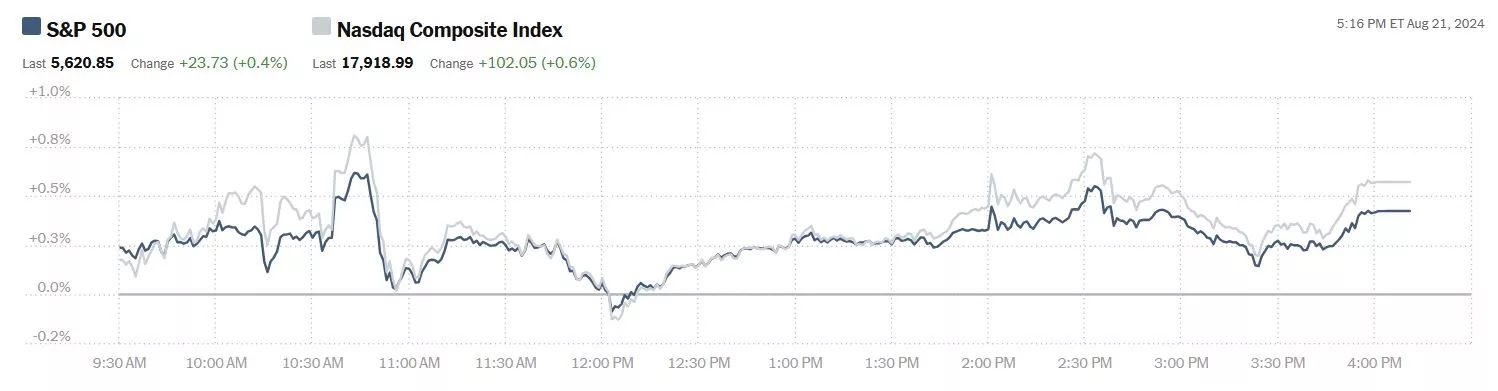

So far so good. Yesterday the S&P 500 closed at 5,621, up 24 points, the Dow closed at 40,890, up 55 points and the Nasdaq Composite closed at 17,919, up 102 points.

Chart: The New York Times

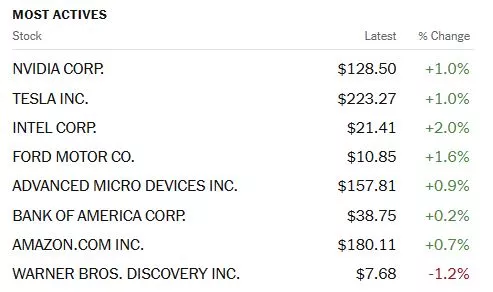

Most actives were led by Nvidia (NVDA), up 1%, followed by Tesla (TSLA), up 1% and Intel (INTC), up 2%.

Chart: The New York Times

In morning trading, S&P 500 market futures are up 16 points, Dow market futures are up 52 points, and Nasdaq 100 market futures are up 93 points.

TalkMarkets contributor Patrick Munnelly takes a current look at the markets in his Daily Market Outlook - Thursday, Aug. 22.

"Asian stock markets are mostly up on Thursday. The Japanese market reversed the losses from the previous session and is now much higher on Thursday. The Nikkei 225 is trading back above the 38k handle supported by financial, technology, and exporter firms. The market leader SoftBank Group is flat, while Fast Retailing, the company that runs Uniqlo, is up about 3%. Among automakers, Honda is slightly increasing by 0.1% while Toyota is losing 1.5%...it is anticipated that the US Federal Reserve will lower interest rates next month. The minutes of the US Federal Reserve's most recent meeting on monetary policy appeared to lend further credence to predictions of a September interest rate reduction...

Since U.S. short-term rates are currently on the back foot, traders have been gradually selling the dollar, believing that they still have more room to fall. By year-end, the markets have priced in 161 basis points of easing in Europe and 135 bps in Britain, compared to 222 bps in the United States...the dollar has reached one-year lows as investors speculate about the possibility of a cyclical decline in the currency...

The purchasing managers indexes shocked last month when the manufacturing sector experienced a steeper decline than anticipated. Germany continued to be the pressure point. The UK, on the other hand, has shown itself to be resilient; in May, manufacturing resumed its expansionary trajectory. It is anticipated that the increase in production (52.0 from the 52.1 reading in July) will continue. An crucial factor will be whether or not the decline in services activity happens again this month...Less weight is given to the US PMIs, which are thought to be a worse indicator than the more reliable ISM surveys...Given the enduring weakness of manufacturing and the dependence of service firms on the production side...it is worthwhile to contemplate the longevity of this imbalance. The point of risk is reinforced by the fact that the disparity is worldwide."

See the article for technical market updates, FX trades and more.

Contributor Diya Podder takes a look at US Job Growth Cut By 30% In Revised Data - IT, Retail, And Manufacturing Sectors Hit Hardest.

"The US economy’s strength has been a topic of heated debate, especially as the country approaches the next presidential election.

The Labor Department’s latest report revises the number of jobs created between April 2023 and March 2024, showing that job growth was approximately 174,000 per month rather than the 240,000 previously believed.

Sectors such as information, retail, and manufacturing were particularly affected by these downward adjustments...

The report, however, has not been universally accepted without scrutiny. Some experts argue that the revision may not account for jobs held by unauthorized workers, potentially underestimating actual job growth.

As the US has seen a recent increase in immigration, this factor could be contributing to discrepancies in the job numbers...

Many analysts believe that the softer-than-expected job growth strengthens the case for the central bank to cut rates in November 2024.

Such a move would be aimed at preventing further weakening in the labor market, which could otherwise slow down the broader economy.

Despite the revision, financial markets have remained relatively stable, suggesting that the new data aligns with investor expectations...

The revision to job growth figures has political implications as well, with Republicans using the data to question the effectiveness of the Biden administration’s economic policies...

As the political debate continues, the revised job figures are likely to remain a focal point in discussions about the US economic outlook."

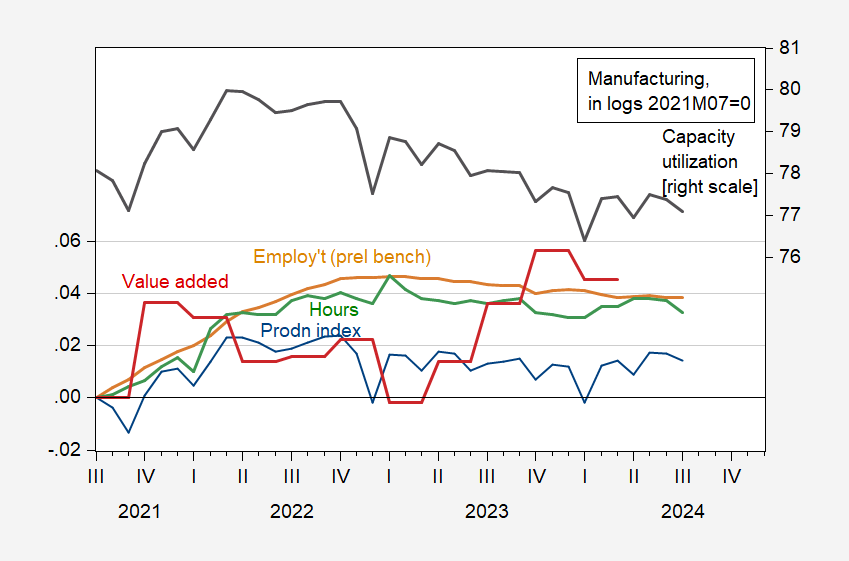

TM contributor and economist Menzie Chinn checks the data and asks is Manufacturing In Recession?

"Preliminary benchmark revision takes down March employment by 0.9%. Here’s a picture of various series relevant to the manufacturing sector.

Figure 1: Manufacturing production (blue, left scale), implied employment from preliminary benchmark (tan, left scale), aggregate hours (green, left scale), and real valued added (red), all in logs, 2007M12=0, and capacity utilization in manufacturing, in % (black, right scale). NBER defined peak-to-trough recession dates shaded gray. Note: 2007M12 is NBER’s business cycle peak. Source: BLS via FRED, Federal Reserve, BLS, BEA via FRED, NBER.

With employment and production essentially flat (but below end-2023 peaks), I’d be hard pressed to say manufacturing is in recession, but here recession is in the eye of the beholder (given there’s not a technical definition of recession for a subsector).

Note that GS believes the aggregate (NFP) benchmark revision of -818K is too large; rather, they believe that given less than total coverage of QCEW and likely revisions, the aggregate revision is more like -300K. This would suggest a smaller downward revision in manufacturing employment."

Gauging geopolitical risk is difficult, however TM contributor Lallalit Srijandorn notes WTI Holds Below $72.00 As Wider Middle East Conflict Fade.

"West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $71.70 on Thursday. WTI price edges lower on the back of easing fears of a wider Middle East war. However, firmer expectations of the Federal Reserve (Fed) rate cut in September after the FOMC Minutes might cap its downside.

WTI prices have edged lower as Iran has refrained so far from attacking Israel in response to the killing of a senior Hamas leader in Tehran in late July. The United States hoped that a cease-fire in Gaza would prevent a wider war in the region. "Oil prices are falling, extending losses from the previous week amid ongoing concern over demand in China and amid progress in Middle Eastern ceasefire talks," said City Index analyst Fiona Cincotta...a decline in US oil inventories and the minutes from the US Fed indicating a likely September rate cut might lift the black gold...

Oil traders will monitor the preliminary US S&P Global Purchasing Managers Index (PMI) for August for fresh impetus. The attention will shift to Fed Chair Jerome Powell’s speech at Jackson Hole on Friday, which might offer some hints about interest rate plans in the future."

Closing out the column today we have an update on Ford Motor Co. (F) from TalkMarkets contributor Mish Shedlock who writes Ford Cancels Plans For Electric SUV, Expects A $1.9 Billion Loss.

"Say goodbye to a vehicle that never should have been conceived in the first place. Customers don’t want it.

The Wall Street Journal reports Ford Cancels Plans for Electric SUV

Ford is canceling plans for a large electric sport-utility vehicle and expects to take $1.9 billion in related special charges and write-downs, as automakers continue adjusting their EV plans because of softer-than-expected demand.

The Dearborn, Mich., automaker this spring said it would delay plans for an electric three-row SUV by two years to a 2027 release date. On Wednesday, the company said it is scrapping the model altogether, citing tough pricing pressure as automakers resort to aggressive discounts to move their EVs.

Ford instead will offer a hybrid gas-electric version of a future large, three-row SUV, a popular vehicle category that includes the brand’s Explorer and Expedition nameplates.

The company also pushed back the launch of a new electric pickup truck by one year, until 2027. In addition, Ford said it would trim its capital spending on fully electric vehicles to about 30% of its budget, from 40%.

Ford has said its EV business is on pace to lose about $5 billion this year. Executives have said the company is trying to reduce those losses on its current EV lineup while making sure future offerings turn a profit.

While Ford is recalibrating its plans to include more hybrids, it also is moving ahead with the rollout of several full EVs. It will start making an electric commercial van in 2026 and two new pickup trucks a year later.

Ford Chief Executive Jim Farley has said that China’s EV companies have the advantage of a lower-cost supply chain and that Ford needs to find ways to lower its own costs to compete.

“We believe that the fitness of the Chinese in EVs will eventually wash over our entire industry in all regions,” Farley told analysts last month.

On April 26, I reported Ford Loses $132,000 on Each EV Produced, Good News, EV Sales Down 20 Percent

Ford (F) reports a huge loss on every EV. Sales are down 20 percent holding the losses to $1.3 billion.

Losses have been revised up twice and now tack on another $1.9 billion today.

Congrats!"

Nevertheless, Ford stock was up 1.6% in yesterday's trading.

That's a wrap for today.

Be careful not to trip while "Walzing".

Peace.

More By This Author:

Tuesday Talk: Jackson Hole And Digging Holes

Thoughts For Thursday: Won't You Please Come To Chicago

Tuesday Talk: Stabilized But Still Spooky