Daily Market Outlook - Thursday, Aug. 22

Image Source: Pixabay

Following the generally positive signals from global markets overnight, Asian stock markets are mostly up on Thursday. The Japanese market reversed the losses from the previous session and is now much higher on Thursday. The Nikkei 225 is trading back above the 38k handle supported by financial, technology, and exporter firms. The market leader SoftBank Group is flat, while Fast Retailing, the company that runs Uniqlo, is up about 3%. Among automakers, Honda is slightly increasing by 0.1% while Toyota is losing 1.5%. However, traders are cautious after revised data revealed that US job growth was lower than previously reported in the year ending in March 2024, raising some growth concerns. Nonetheless, it is anticipated that the US Federal Reserve will lower interest rates next month. The minutes of the US Federal Reserve's most recent meeting on monetary policy appeared to lend further credence to predictions of a September interest rate reduction. Following the release of the minutes, interest rate cuts by the Fed are expected to occur next month. According to CME Group's FedWatch Tool, there is a 61.5 percent likelihood of a quarter point rate drop and a 38.5 percent chance of a half point rate cut.

Since U.S. short-term rates are currently on the back foot, traders have been gradually selling the dollar, believing that they still have more room to fall. By year-end, the markets have priced in 161 basis points of easing in Europe and 135 bps in Britain, compared to 222 bps in the United States. The euro and sterling have both breached significant resistance, and the dollar has reached one-year lows as investors speculate about the possibility of a cyclical decline in the currency. The relative momentum in each economy may be determined by purchasing managers' index data for the United States and Europe, which are expected later on Thursday.

The purchasing managers indexes shocked last month when the manufacturing sector experienced a steeper decline than anticipated. Germany continued to be the pressure point. The UK, on the other hand, has shown itself to be resilient; in May, manufacturing resumed its expansionary trajectory. It is anticipated that the increase in production (52.0 from the 52.1 reading in July) will continue. An crucial factor will be whether or not the decline in services activity happens again this month. According to the median forecast, services will increase in Britain while falling a few percentage points in the Eurozone. It is possible, though, that UK activity will also weaken (52.4 from 52.5) as part of the (short) bounce in post-election activity unwinds. Less weight is given to the US PMIs, which are thought to be a worse indicator than the more reliable ISM surveys. However, the disparity between better and worse services and manufacturing should also be apparent. Given the enduring weakness of manufacturing and the dependence of service firms on the production side (manufacturing should lead services in a business cycle), it is worthwhile to contemplate the longevity of this imbalance. That point of risk is reinforced by the fact that this disparity is worldwide.

Overnight Newswire Updates of Note

- Fed Minutes Point To ‘Likely’ Rate Cut Coming In September

- Dollar Doldrums Deepen On Dovish Fed Minutes

- Hawkish RBA Struggles To Sway Market That Expects Rate Cuts

- Strong Australian PMI Data Argues Against RBA Rate Cuts

- BoJ’s Ueda Is Set To Face Intense Scrutiny After Market Chaos

- PBoC Warnings On Long-dated Bonds To Curb Systemic Risks

- US Job Growth In Year Till March Was Far Lower Than Estimated

- Deutsche Bank Sees €430M Gain After Deal In Postbank Case

- Ford Slows EV Production Plans To Cut Costs

- PwC Braced For 6-month Ban In China Over Evergrande Audit

- Rise In Tech And Mining Stocks Extend ASX’s Winning Streak

- Oil Prices Slow Sell-off As Expectations Of Fed Rate Cut Grow

- Oil Tanker On Fire And Adrift In Red Sea After Multiple Attacks

- China’s Plunging Coal Plant Approvals Signal Energy Policy Pivot

- New Binance CEO: No IPO Need, Plots 100Y Exchange Strategy

- Global Investors Pile Into Chinese Bank Bonds

- Enbridge CEO Ebel Sees ‘Colossal’ AI Power To Double LNG Use

- Israeli Strikes In Gaza, Blinken Visits Shows No Breakthrough

- Biden, In Call With Israel’s PM, Stresses Urgency Of Gaza Ceasefire

- Zelenskiy: Ukraine Is Boosting Its Forces To Resist Russian Advance

- EU Top Diplomat Calls For Lifting Weapons Restrictions For Ukraine

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1040-50 (1.3B), 1.1060-70 (1.0B), 1.1100-10 (2.6B), 1.1160 (350M)

- USD/JPY: 145.60-70 (1.4B), 146.20 (1.2B), 147.00-10 (1.3B), 148.00 (1.6B)

- USD/JPY: 148.65 (1.7B). EUR/JPY: 159.95-160.00 (1.6B)

- AUD/JPY: 98.83 (300M), 101.75 (300M)

- USD/CHF: 0.8800 (396M), 0.8950 (382M)

- EUR/CHF: 0.9400 (750M), 0.9500-10 (1.3B)

- EUR/GBP: 0.8350 (1.3B), 0.8475 (833M), 0.8485 (395M)

- AUD/USD: 0.6600 (422M), 0.6630 (1.2B), 0.6650 (1.4B), 0.6650-60 (2.5B)

- AUD/USD: 0.6670 (794M). NZD/USD: 0.5920 (500M), 0.5940 (1.3B), 0.5955 (307M)

- AUD/NZD: 1.0920-25 (451M), 1.1050 (513M)

- USD/CAD: 1.3625-35 (1.1B), 1.3650 (500M)

CFTC Data As Of 16/8/24

- Japanese Yen net long position is 23,104 contracts

- Euro net long position is 26,983 contracts

- Bitcoin net long position is 395 contracts

- British Pound net long position is 47,812 contracts

- Swiss Franc posts net short position of -21,664 contracts

- Equity fund speculators increase S&P 500 CME net short position by 63,926 contracts to 286,781

- Equity fund managers raise S&P 500 CME net long position by 70,558 contracts to 952,091

Technical & Trade Views

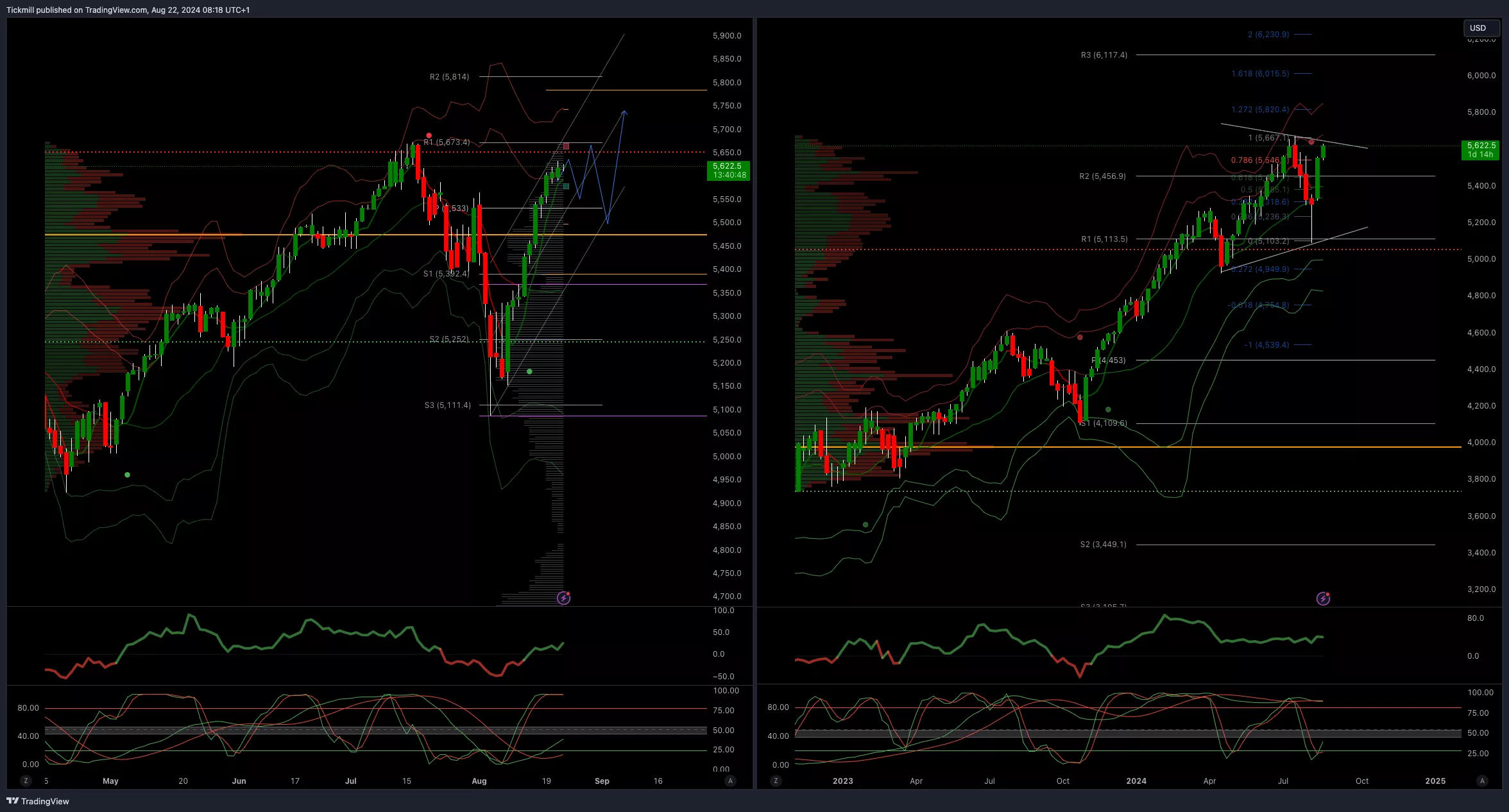

SP500 Bullish Above Bearish Below 5550

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5470 opens 5670

- Primary support 5480

- Primary objective is 5670

(Click on image to enlarge)

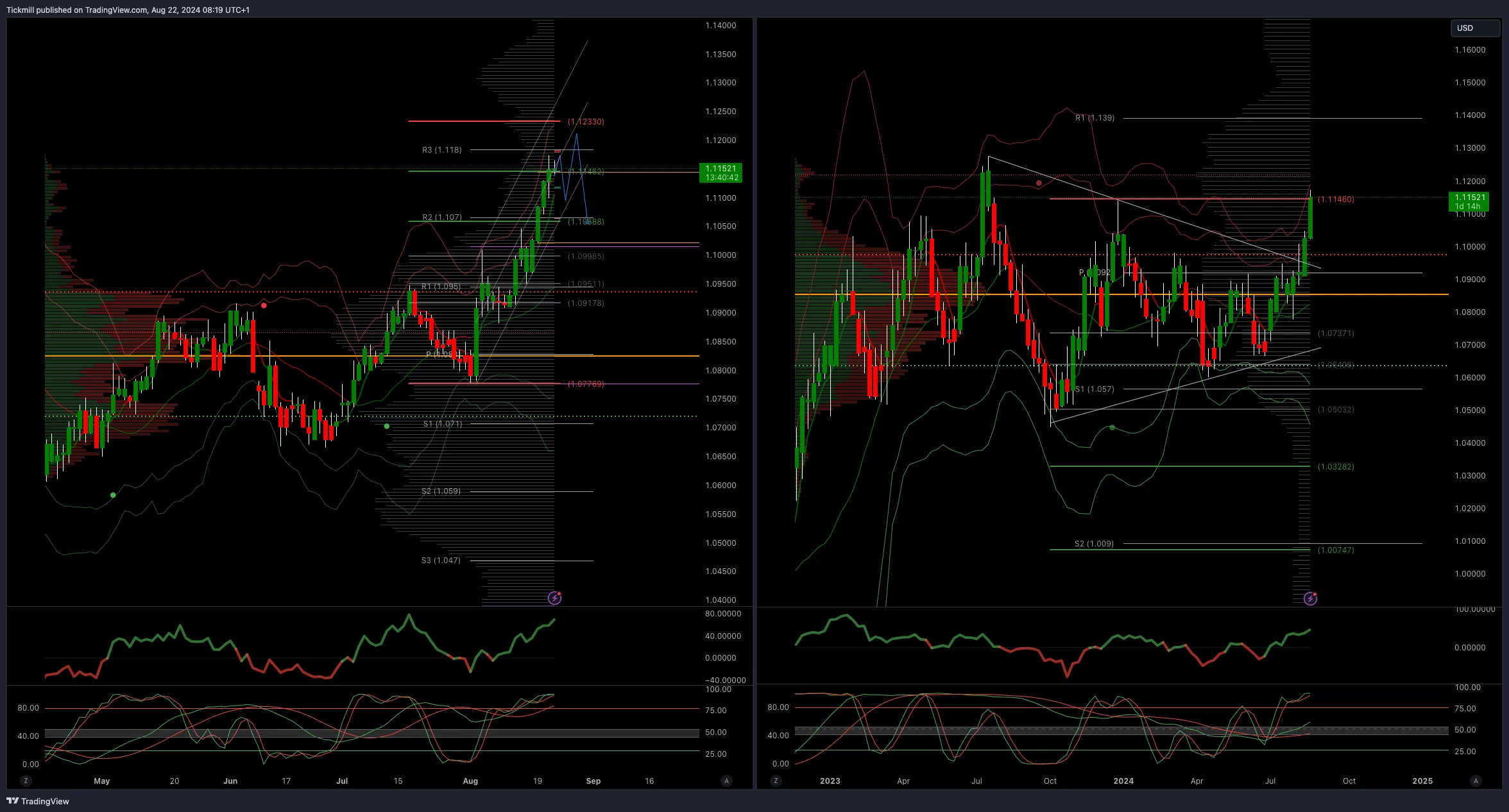

EURUSD Bullish Above Bearish Below 1.10

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 1.10 opens 1.0950

- Primary resistance 1.0981

- Primary objective is 1.1150 - Target Hit New Pattern Emerging

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.30

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 1.2950 opens 1.2850

- Primary support is 1.2690

- Primary objective 1.3150

(Click on image to enlarge)

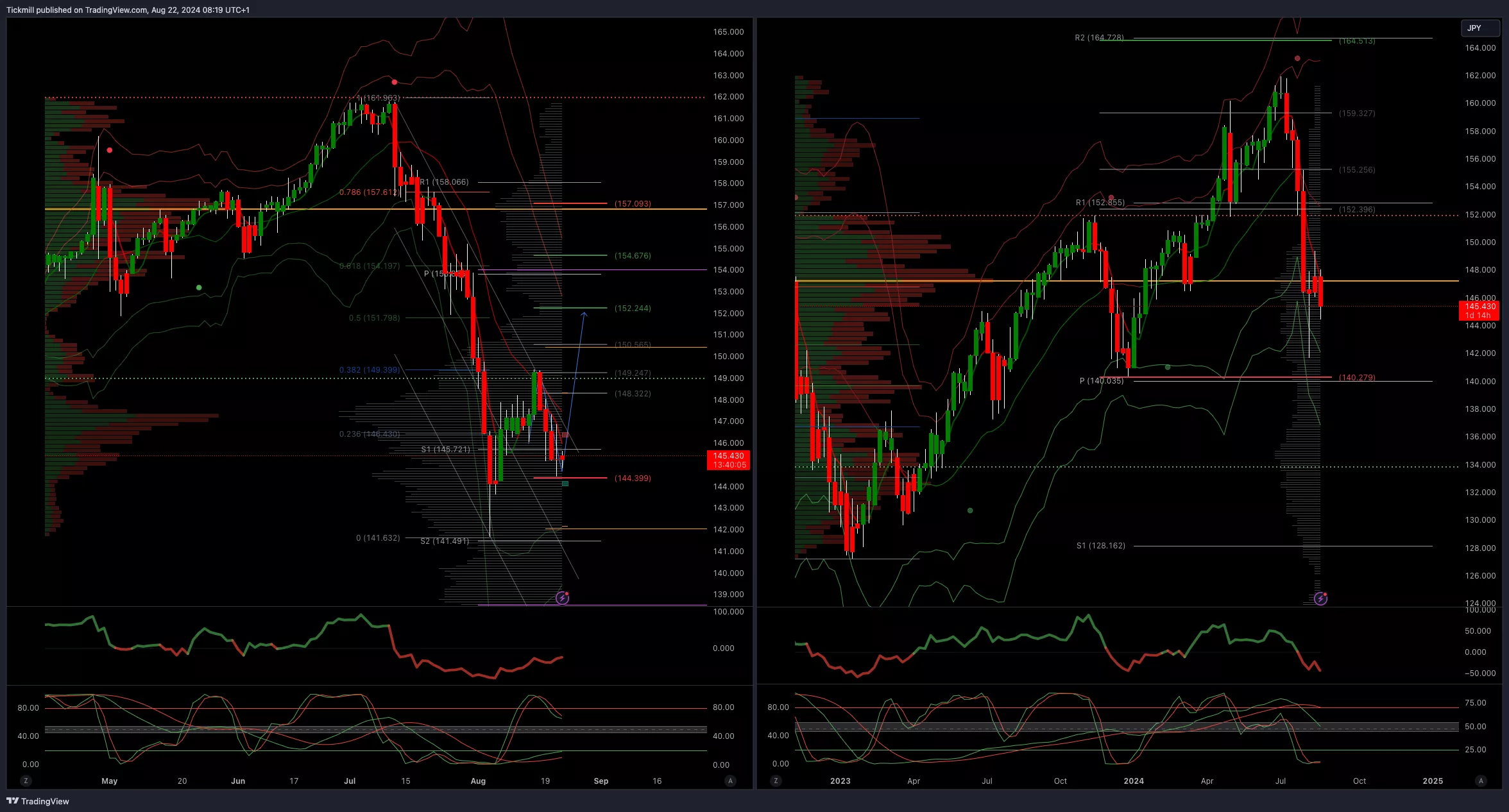

USDJPY Bullish Above Bearish Below 149

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 145 opens 144

- Primary support 140

- Primary objective is 151.80

(Click on image to enlarge)

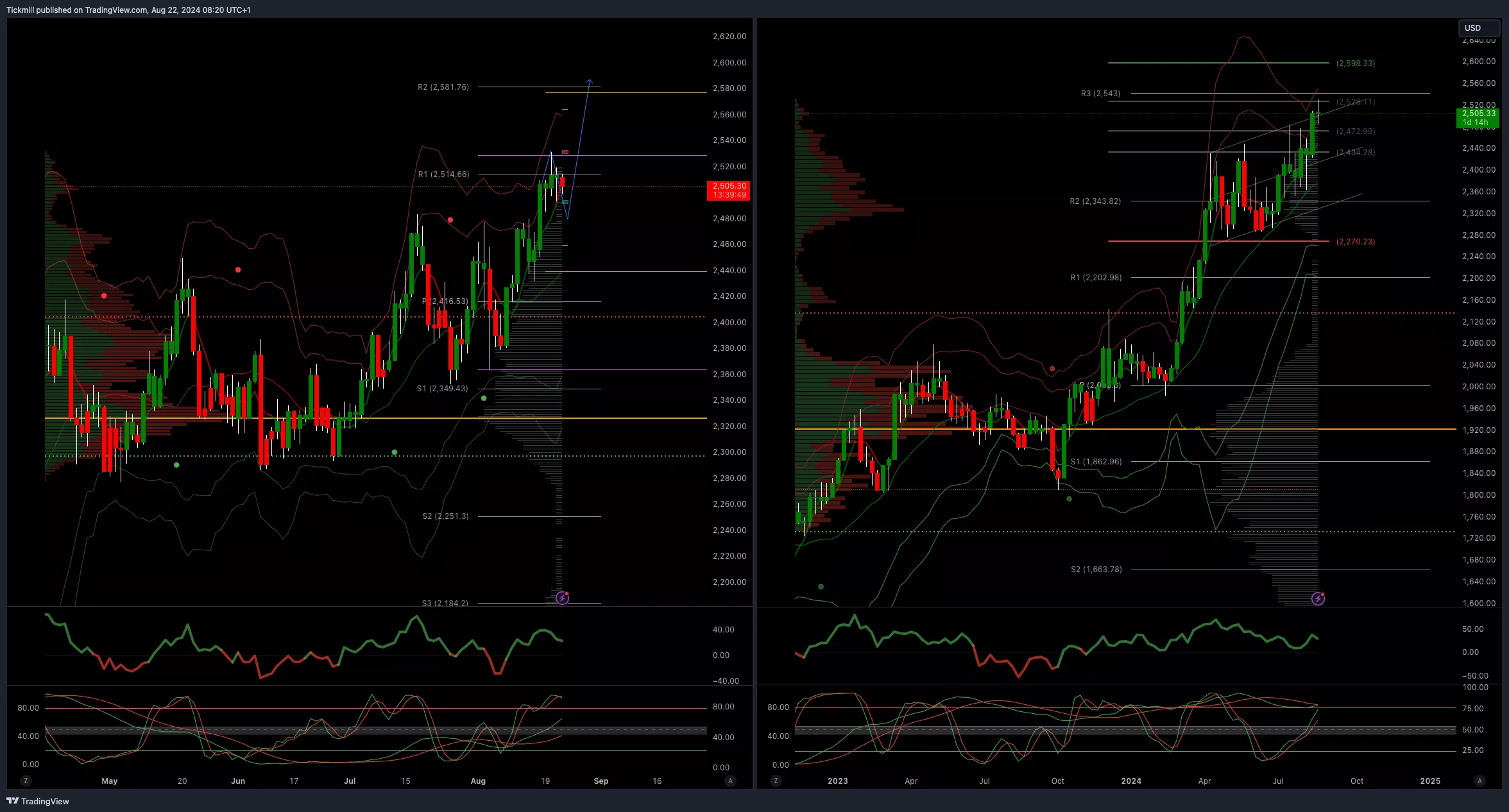

XAUUSD Bullish Above Bearish Below 2480

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

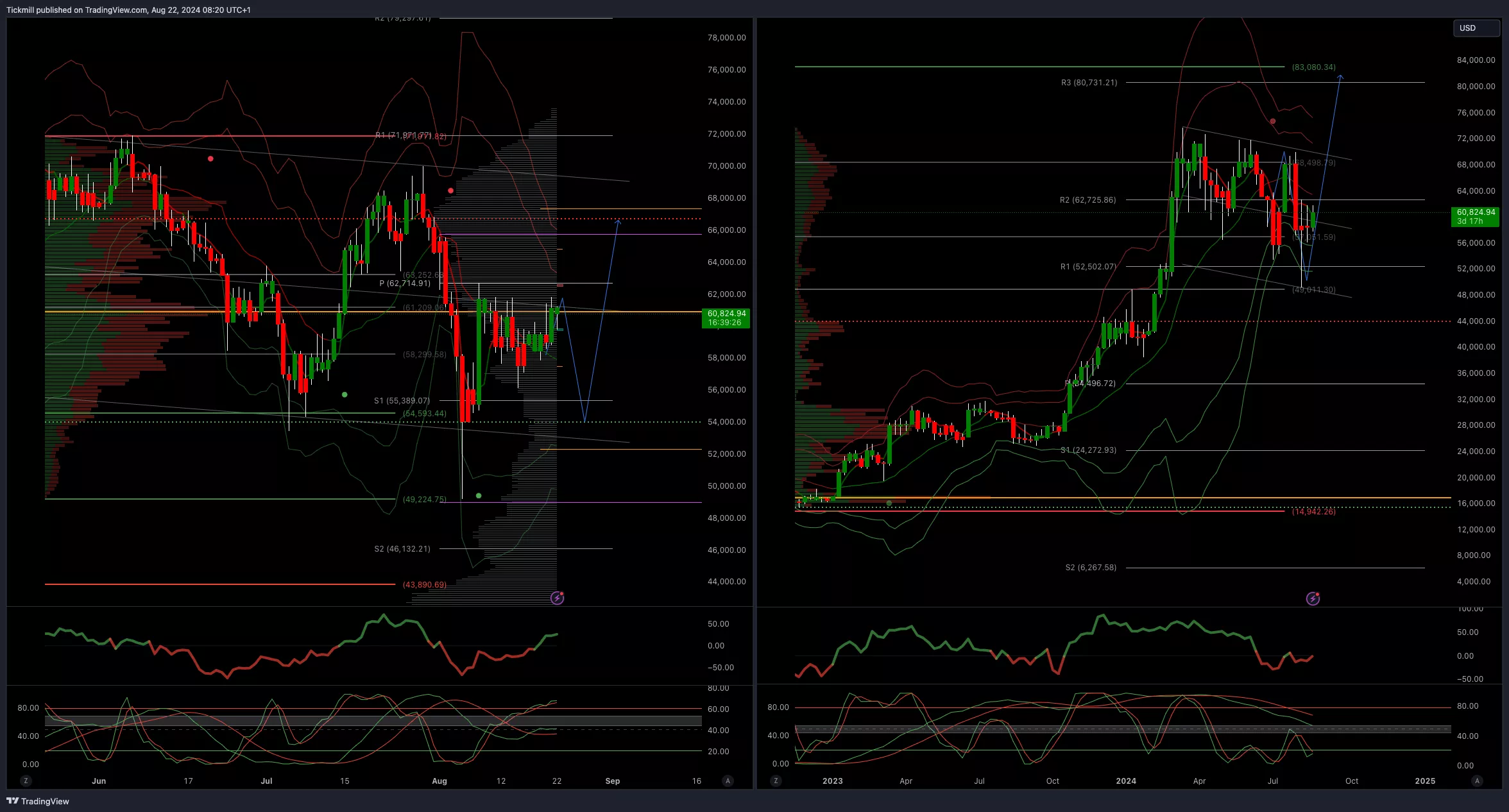

BTCUSD Bullish Above Bearish Below 58000

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 61000 opens 68000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

FTSE Flatlining Ahead Of Central Banker Conclave In Jackson Hole

US500 Daily Trade Plan - Wednesday, August 21

Daily Market Outlook - Wednesday, Aug. 21