Daily Market Outlook - Wednesday, Aug. 21

Image Source: Pexels

Asian stock markets are primarily trading lower on Wednesday, as a result of the broad negative signals from global markets overnight. Japan's Nikkei index declined by 1% at the start of trading, as its recovery from the sharp drop in early August faces resistance around the 38,000 level, and the strengthening of the Japanese yen further dampened investor sentiment. Traders are taking profits following the recent recovery rally in the markets. In addition, they appeared to be hesitant to make substantial bets in anticipation of critical events that could potentially affect the interest rate outlook later this week.

The UK had a marginally larger than anticipated deficit in July, with borrowing ex-banking groups coming in at £3.1 billion (median £1.5 billion) as opposed to a downwardly revised £13.5 billion (from 14.5 billion) in June. The total net borrowing was £2.2 billion, down from the initial £13.6 billion read. Due in part to a Linker redemption, the central government net cash requirement (CGNCR) exceeded £29.6 billion. That is more than the OBR's £26.2 billion prediction from March, which was up from £14.5 billion in June. This results in a cumulative year-to-date CGNCR of £87.1 billion, which is £13 billion over the relatively out-of-date OBR estimate. The government is still facing financial constraints, which means that in order to finance the spending goals outlined in the manifesto, more tax measures will probably be needed rather than less. This increased economic pressure serves as a reminder of both of these points. It also suggests that the Gilt remit is under pressure to rise, but more clarity on that will come following the budget announcement on October 30.

Stateside, traders will scrutinize the minutes of the most recent monetary policy meeting of the US Federal Reserve, which are scheduled to be released later in the day, in order to gain further insight into the probability of a rate cut next month. Additionally, the Jackson Hole Economic Symposium is anticipated to generate interest later in the week, as Fed Chair Jerome Powell and other Fed officials are expected to deliver speeches. As per the FedWatch Tool of CME Group, there is a 73.5 percent likelihood of a quarter point rate cut next month and a 26.5 percent likelihood of a half point rate cut.

Market momentum is stagnating at the point where the selling began two weeks ago, which brings us full circle in terms of the economic outlook: awaiting data to assess the risk of recession and monitoring polling to evaluate the U.S. presidential contest. Obama, the former president of the United States, returned to the national stage on Tuesday night to provide support to his longstanding Democratic ally, Kamala Harris, in her 11th-hour presidential campaign against Republican Donald Trump.

U.S. labor data revisions are due later on Wednesday, in addition to the minutes of the Federal Reserve. Goldman Sachs anticipates a decrease in the number of jobs added, between 600,000 and 1 million, despite its contention that this would exaggerate the labor market's fragility. Additionally, the employment market will be a significant factor in the upcoming U.S. labor report, which is scheduled for release on September 6. This is due to the fact that inflation appears to be decreasing.

Overnight Newswire Updates of Note

- Cooling US Jobs Market Looms Over Central Bankers, JH Event

- Japan's Exports Grew In July On Semiconductors, Automobiles

- RBA Faces Crunch Time In Resistance To Rate Cuts

- BNZ, Adminis Sign First Banking API To Streamline NZ FX

- China’s PBoC Dials Back Support For Yuan As Currency Steadies

- China Lending At 15-Year Low As Central Bank Holds Rates

- China’s $70B Property Rescue Plan Limps Off Starting Line

- Brightmine Survey: UK Employer Pay Awards Soften In 3M To July

- US Money Market Funds Atrracts $90B, Ahead Jackson Hole

- US Appeals Court Revives Google Privacy Class Action

- US FAA Requires Inspections Of Boeing 787 Planes

- China: EU Draft On Tariffs For Chinese EVs Brings 'Enormous Risks’

- Walmart Seeks To Raise Up To $3.74B In Sale Of JD.Com Stakes

- MUFG Sheds $1B In US Bancorp Shares

- US Elections-Linked BTC Options Draw, $350M In Open Interest

- Biden Approved Secret Nuclear Strategy Refocusing On Threats

- Blinken Wraps Up Middle East Trip With Gaza Deal Still Elusive

- Russia: Advances In Eastern Ukraine, Regroups After Incursion

- Russian Air-Def. Systems Repel Ukraine 12-Drone Attacks

- Kyiv: Forces Under Heavy Russian Attack In East Ukraine

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1000 (1.4B), 1.1010 (435M), 1.1025 (910M), 1.1050 (415M)

- EUR/USD: 1.1095-1.1100 (1.6B)

- USD/JPY: 146.60 (743M), 146.75(957M), 148.00 (780M)

- EUR/GBP: 0.8625 (401M). EUR/CHF: 0.9580 (300M)

- USD/CHF: 0.8550-60 (447M), 0.8625-30 (504M), 0.8740-50 (592M)

- AUD/USD: 0.6545 (624M), 0.6645 (486M). NZD/USD: 0.5950 (650M))

- AUD/NZD: 1.0800 (580M), 1.0975 (300M), 1.1105-10 (1.1B)

- USD/CAD: 1.3710-20 (722M), 1.3735-40 (529M))

CFTC Data As Of 16/8/24

- Japanese Yen net long position is 23,104 contracts

- Euro net long position is 26,983 contracts

- Bitcoin net long position is 395 contracts

- British Pound net long position is 47,812 contracts

- Swiss Franc posts net short position of -21,664 contracts

- Equity fund speculators increase S&P 500 CME net short position by 63,926 contracts to 286,781

- Equity fund managers raise S&P 500 CME net long position by 70,558 contracts to 952,091

Technical & Trade Views

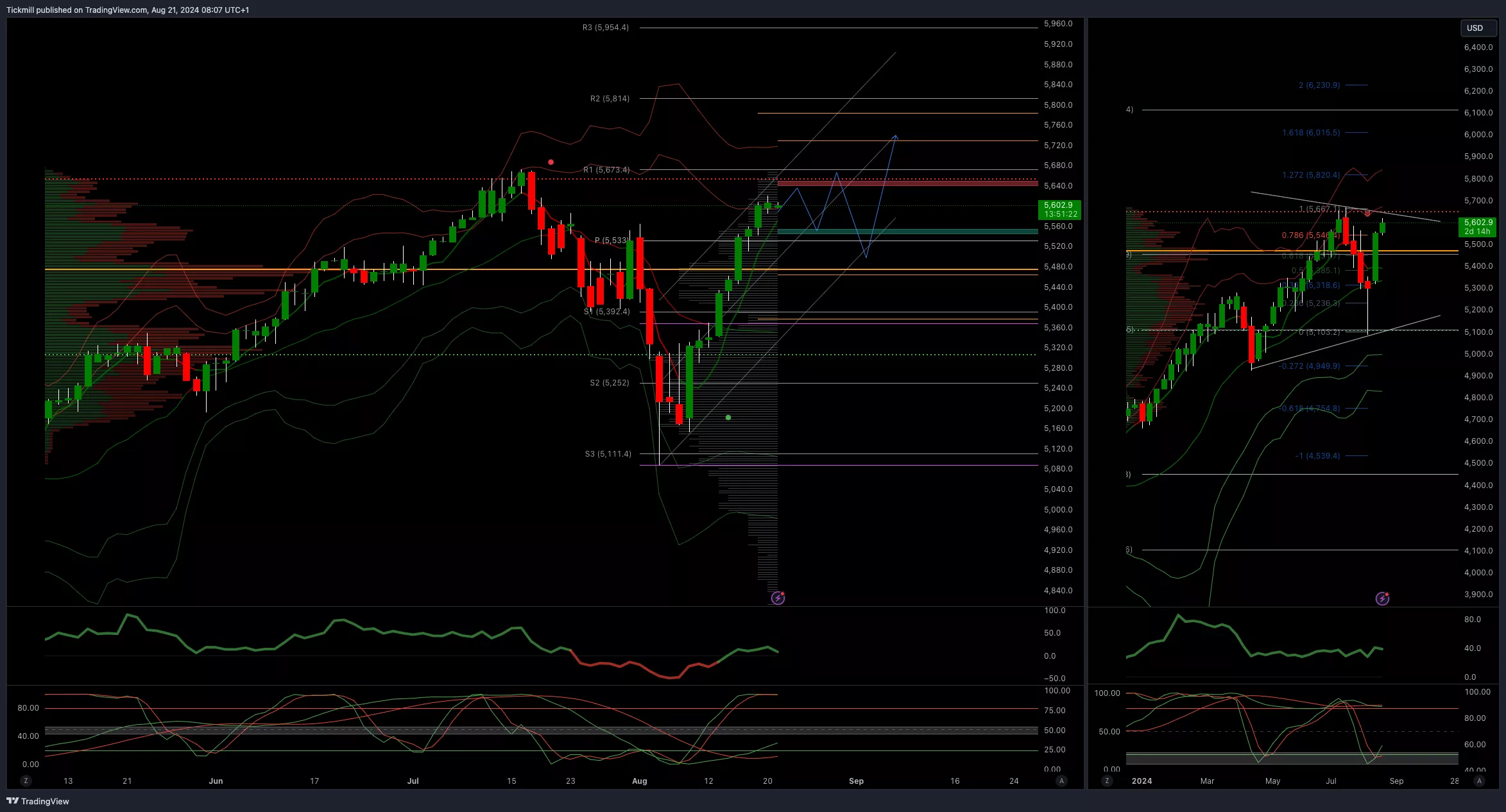

SP500 Bullish Above Bearish Below 5550

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5470 opens 5670

- Primary support 5480

- Primary objective is 5670

(Click on image to enlarge)

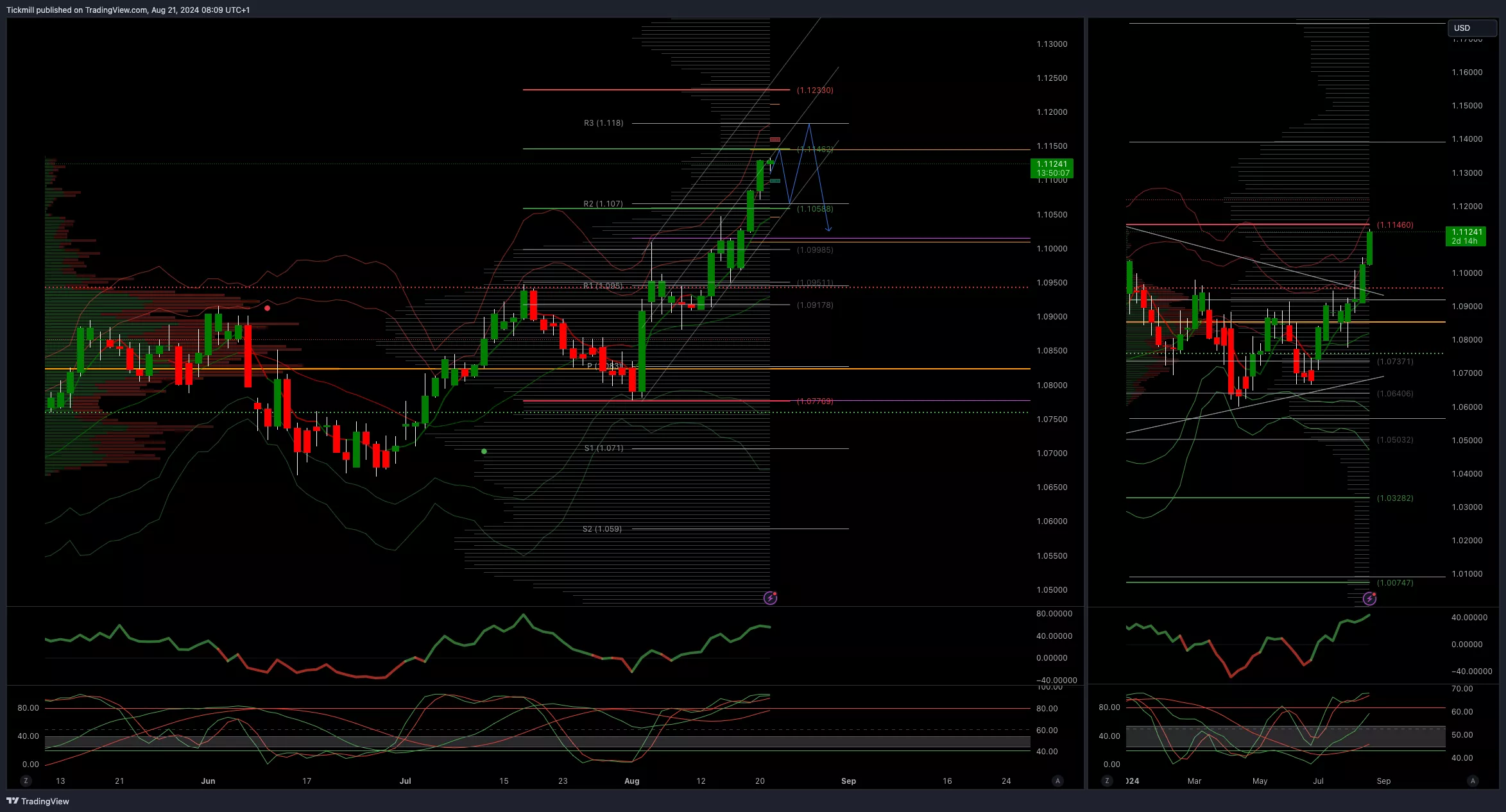

EURUSD Bullish Above Bearish Below 1.10

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 1.10 opens 1.0950

- Primary resistance 1.0981

- Primary objective is 1.1150

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.30

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 1.2950 opens 1.2850

- Primary support is 1.2690

- Primary objective 1.3150

(Click on image to enlarge)

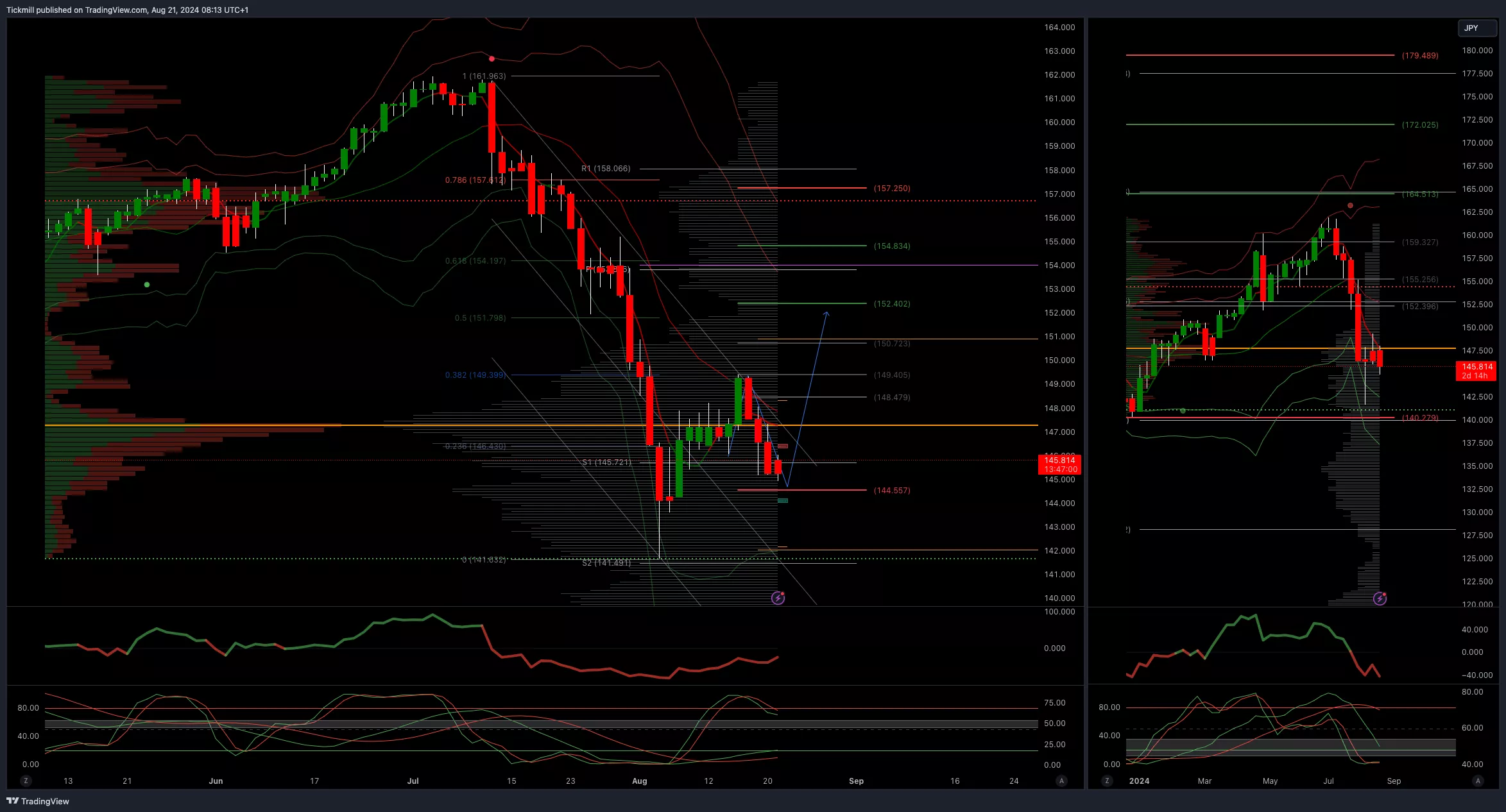

USDJPY Bullish Above Bearish Below 149

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 145 opens 144

- Primary support 140

- Primary objective is 151.80

(Click on image to enlarge)

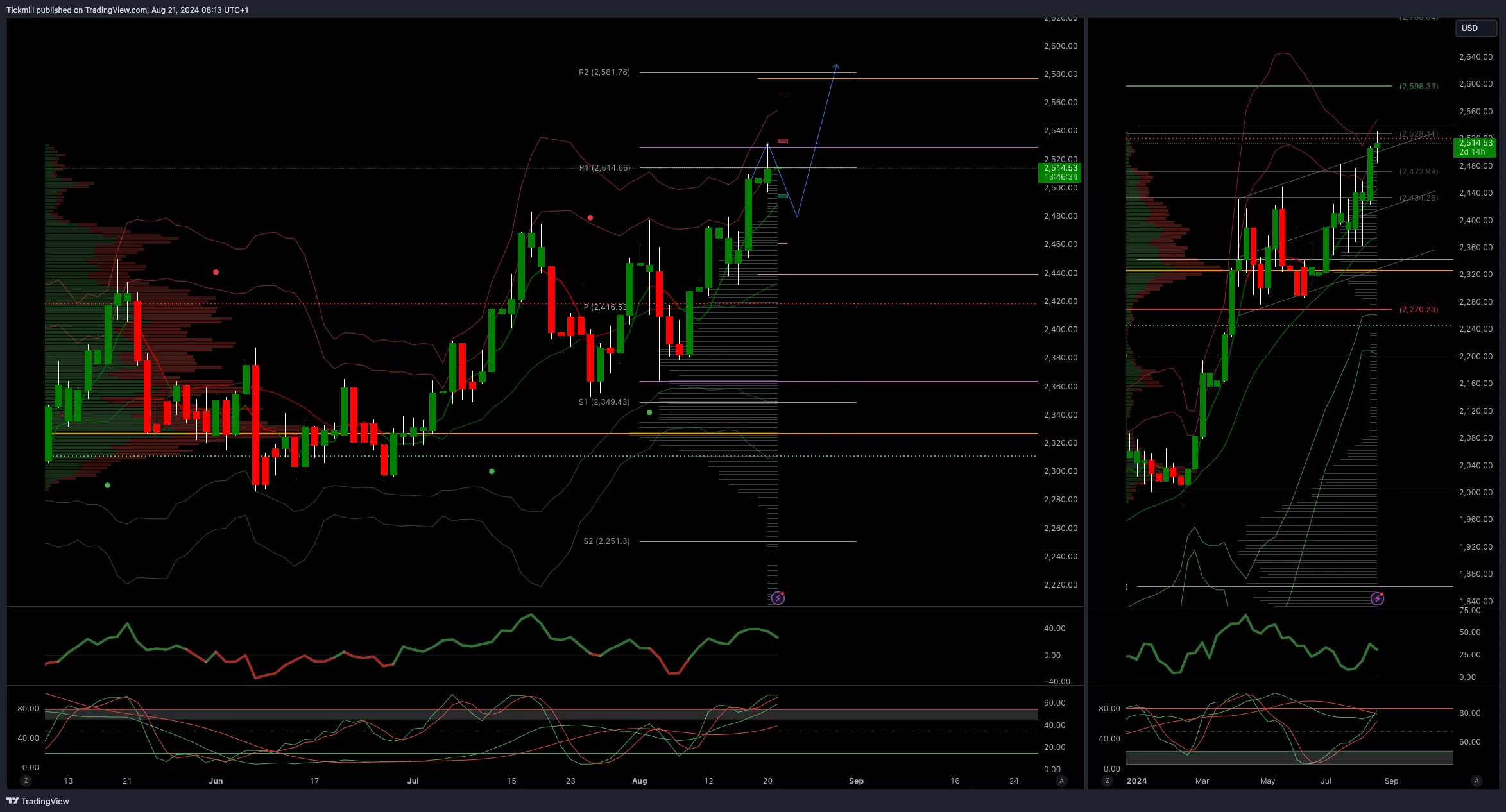

XAUUSD Bullish Above Bearish Below 2480

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

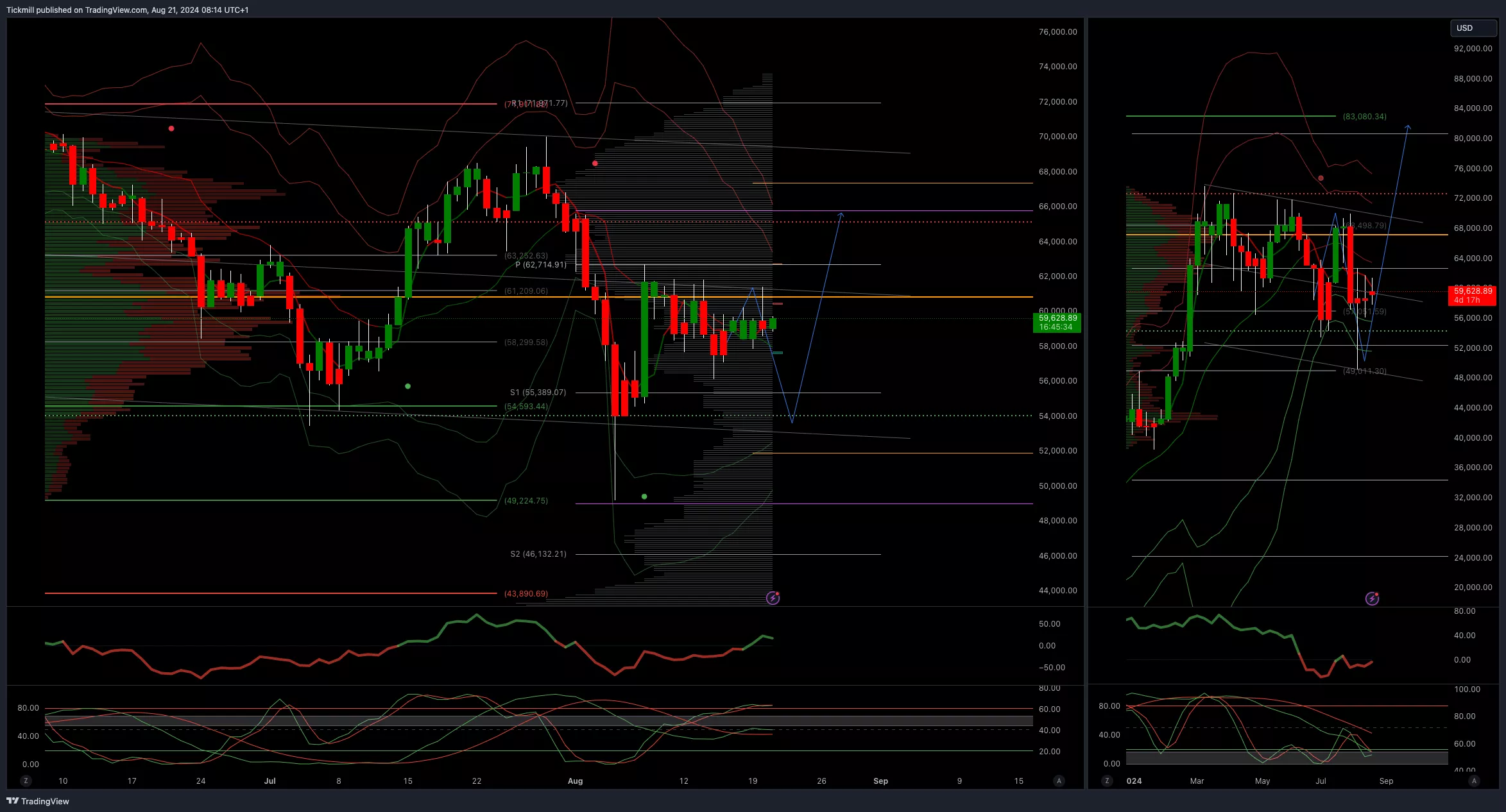

BTCUSD Bullish Above Bearish Below 58000

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 61000 opens 68000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

FTSE Energy And Miners Weigh, Breaking The Winning Streak

US500 Daily Trade Plan - Tuesday, August 20

Daily Market Outlook - Tuesday, Aug. 20