Daily Market Outlook - Tuesday, Aug. 20

Image Source: Unsplash

Following an unexpected reduction in July, the People's Bank of China maintained its benchmark loan prime rate steady, causing Asian stocks to trade mostly higher ex China, which saw a decline of 0.5%. The MSCI ACWI Index, which encompasses both emerging and mature equities, is poised to extend its winning streak to nine consecutive days, the longest since December. Japan's Nikkei share average rose in tandem with Wall Street on Tuesday, overcoming the impact of the yen's recent gains, as an optimistic U.S. economic outlook continued to bolster risk appetite globally. The Nikkei regained the 38k handle, recovering from the previous session's losses after the yen's appreciation weighed on Japanese equities.

To assess the timing and speed of interest rate cuts, investors also evaluated the minutes from the Reserve Bank of Australia's August meeting. Investors await the release of FOMC meeting minutes and Fed Chair Jerome Powell's Jackson Hole speech. The assumption that the Federal Reserve will soon announce it is ready to start decreasing interest rates caused the dollar to hold close to a seven-month low and Treasury yields to decline. The US Federal Reserve is anticipated to lower interest rates by 25 basis points at each of the next three sessions in 2024, as concerns about a recession subside. The price of gold in Asian trading remained above $2,500 per ounce. Oil continued to decline after dropping by roughly 2% on Monday due to ongoing concerns about Chinese demand and Israel's acceptance of a proposal to resolve differences preventing a ceasefire accord in Gaza.

In its policy announcement on Tuesday, the central bank of Sweden is predicted to decrease interest rates by a quarter of a percentage point. Two further rate cuts are anticipated by analysts before the year ends. Data on inflation for July will be released by Canada, and it is expected to decline from 2.7% in June to 2.5% yearly, which will support the case for more rate reductions by the Bank of Canada.

Overnight Newswire Updates of Note

- China Leaves Key Lending Benchmarks Unchanged

- Asia Shares Hit Monthly High, Investors Bet On A Dovish Fed

- At Jackson Hole, Fed Faces Pivotal Test On Unemployment

- ECB May Need To Cut Rates Again In Sept

- RBA Rules Out Rate Cut In Short Term; Vigilant To Inflation Risks

- Big Banks Pre-empt RBA Move By Cutting Rates On Term Deposits

- Starmer Faces Growing UK Strike Action In Next Test For Premier

- US China Agree To Work More Closely In Times Of Financial Stress

- China Provides Financing Tool To Boost Start-ups

- HK Monetary Authority To Help SMEs Struggling To Repay Loans

- Democrats' Platform Vows To Combat Oil 'Price Gouging

- Nord Stream Revelations Ignite Dispute Between US Allies

- Kroger Seeks To Block FTC Case Against Albertsons Acquisition

- Russia Rules Out Peace Talks, Zelensky Claims Kursk Success

- Zelensky Seeks Out Use Of Long-range Weapons

- Kursk Incursion Heaps Pressure On Ukraine’s East

- Blinken: Hamas Should Accept US Proposal To End Gaza War

- Hamas Claims Tel Aviv Bomb Explosion As Suicide Attack

- Ceasefire In Gaza 'Unrelated' To Iran's Retaliation Plans

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/JPY: 148.00 ($1.21b), 145.00 ($750.4m), 142.50 ($750m)

- EUR/USD: 1.0925 (EU1.84b), 1.1000 (EU1.47b), 1.0900 (EU642.1m)

- USD/CAD: 1.2875 ($500m), 1.2850 ($500m), 1.3595 ($460m)

- AUD/USD: 0.6550 (AUD504.1m), 0.6600 (AUD430.2m), 0.6515 (AUD311.3m)

- USD/CNY: 7.2625 ($411.3m), 7.2500 ($400m), 7.2865 ($352.7m)

- GBP/USD: 1.1810 (GBP680m), 1.2260 (GBP350m), 1.2784 (GBP312.9m)

CFTC Data As Of 16/8/24

- Japanese Yen net long position is 23,104 contracts

- Euro net long position is 26,983 contracts

- Bitcoin net long position is 395 contracts

- British Pound net long position is 47,812 contracts

- Swiss Franc posts net short position of -21,664 contracts

- Equity fund speculators increase S&P 500 CME net short position by 63,926 contracts to 286,781

- Equity fund managers raise S&P 500 CME net long position by 70,558 contracts to 952,091

Technical & Trade Views

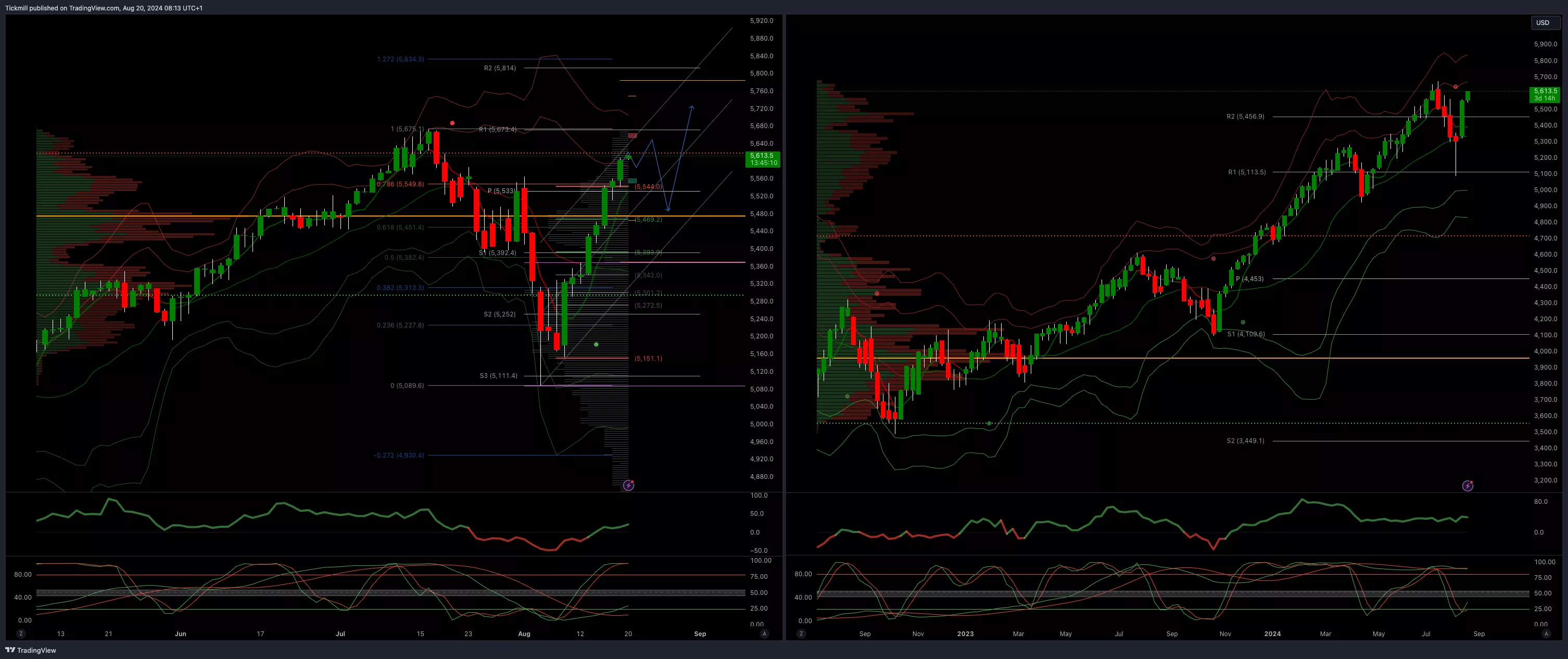

SP500 Bullish Above Bearish Below 5550

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5470 opens 5670

- Primary resistance 5670

- Primary objective is 5400

(Click on image to enlarge)

EURUSD Bullish Above Bearish Below 1.0960

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 1.10 opens 1.0950

- Primary resistance 1.0981

- Primary objective is 1.1150

(Click on image to enlarge)

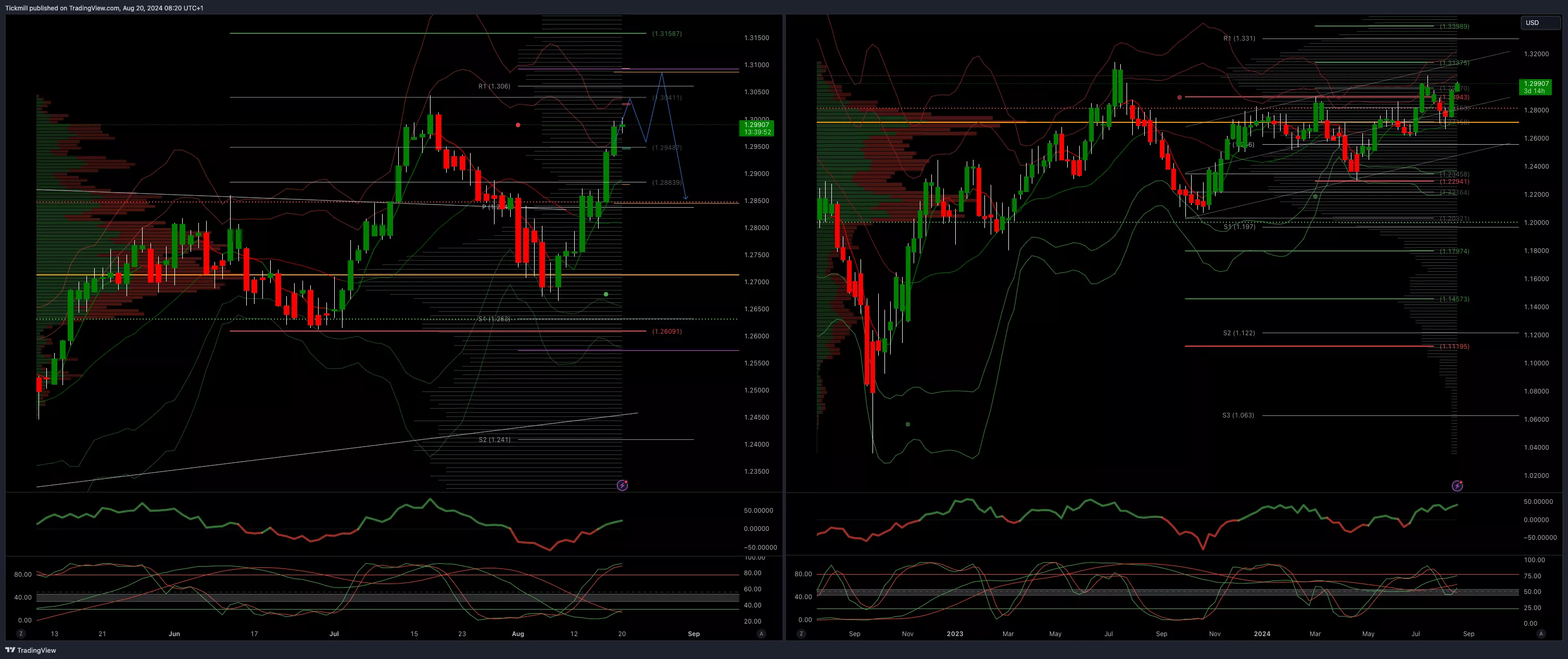

GBPUSD Bullish Above Bearish Below 1.29

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 1.2950 opens 1.2850

- Primary support is 1.2690

- Primary objective 1.3150

(Click on image to enlarge)

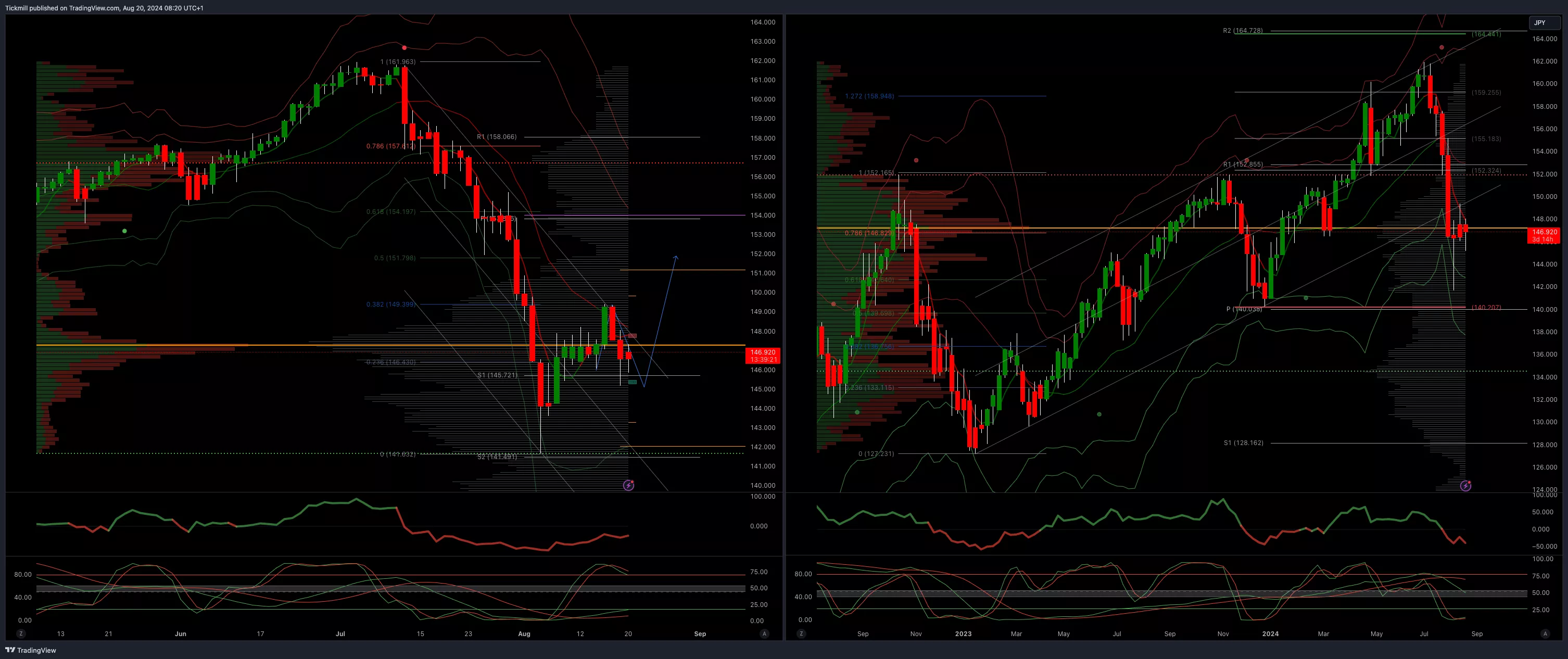

USDJPY Bullish Above Bearish Below 149

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 150 opens 153

- Primary support 140

- Primary objective is 153

(Click on image to enlarge)

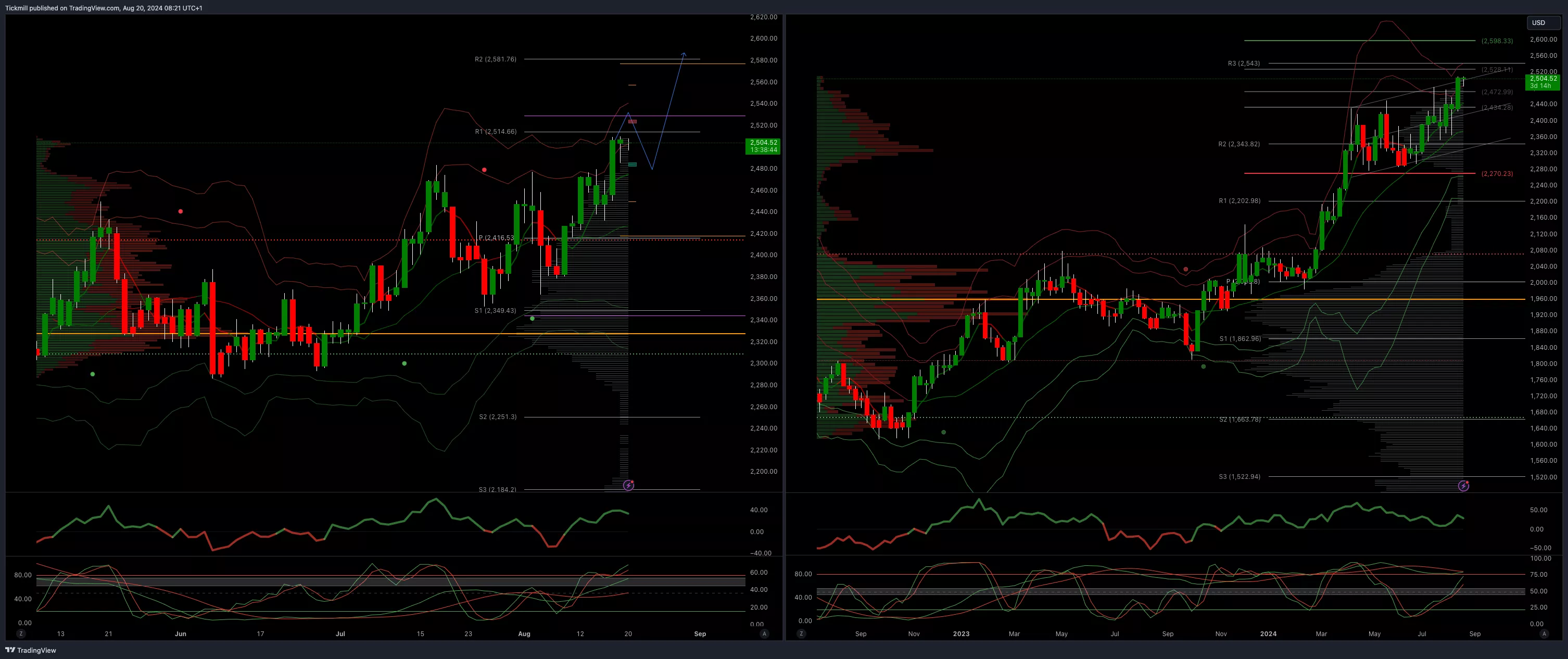

XAUUSD Bullish Above Bearish Below 2480

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

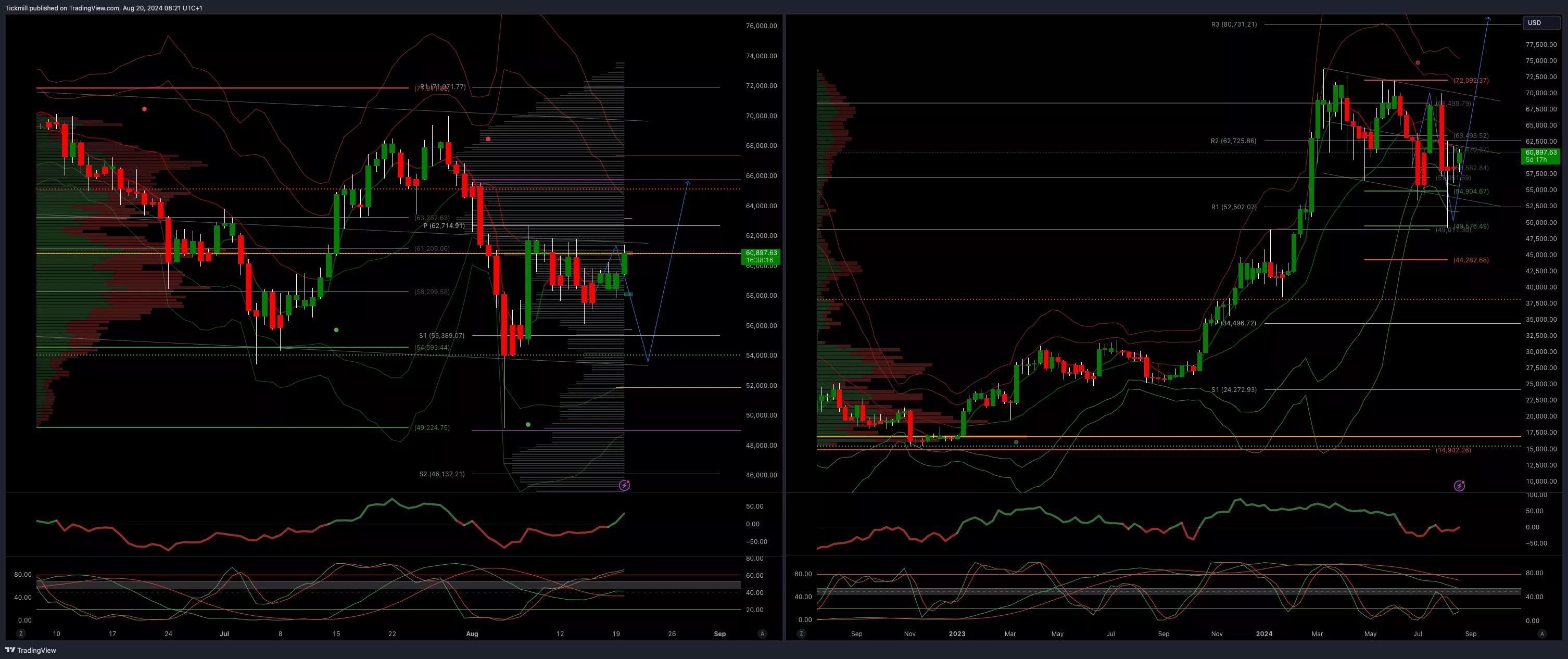

BTCUSD Bullish Above Bearish Below 58000

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 61000 opens 68000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

FTSE Extends Last Week’s Gains Ahead Of Central Bank Speakers

Daily Market Outlook - Monday, Aug. 19

Daily Market Outlook - Friday, Aug. 16