Daily Market Outlook - Monday, Aug. 19

Image Source: Pexels

Asian stock markets are exhibiting a mixed performance on Monday, reflecting the mixed signals from global markets on Friday. This comes amid growing optimism that the U.S. economy is poised for a soft landing, driven by upbeat U.S. retail sales data and improving U.S. consumer sentiment. These factors have also increased confidence that the U.S. Federal Reserve will begin cutting interest rates next month, albeit at a less aggressive pace. Remarks from Atlanta Fed President Raphael Bostic and Chicago Fed President Goolsbee have further strengthened market anticipation that the central bank will commence reducing interest rates in September. The Japanese stock market is experiencing a slight decline today, ending a five-day period of gains. The benchmark NIkkei index has fallen below the 38K handle. SoftBank Group, a major player in the market, is up over 1%, while Fast Retailing, the operator of Uniqlo, is down slightly by 0.5%. In the automotive sector, Honda is gaining close to 1%, while Toyota is down nearly 1%.

This week's financial market movements will be influenced by speeches made by international central bank representatives at the Federal Reserve's Jackson Hole Economic Policy Symposium, flash PMIs for the world's largest economies, and China's monthly loan prime rate setting.

The Jackson Hole event, which has historically been used to lay the groundwork for future policy, is scheduled for August 22–24. On Friday, Fed Chair Jerome Powell will give a speech about the prospects for the economy. Powell may hint at an impending relaxation but is unlikely to support the lingering expectations of significant rate cuts, given that U.S. inflation is down but remains sticky and the labor market is deteriorating. On Wednesday, the minutes of the Federal Reserve's July 30-31 meeting, which paved the way for rate cuts are expected. The main data releases are the weekly unemployment claims, the flash S&P Global PMIs for August, and the existing and new home sales for July.

The final July HICP and current account figures for the euro zone are scheduled on Tuesday, while the flash August PMIs and consumer confidence are due on Thursday. The European Central Bank publishes the minutes of its July monetary policy meeting.

The sole noteworthy release on the UK calendar is the flash August PMIs. Governor Andrew Bailey of the Bank of England will speak at Jackson Hole on Friday, and he might offer some policy hints after positive inflation statistics in September stoked speculation about rate cuts.

Japan will release its July CPI as well as trade, flash PMIs, orders for machinery, and countrywide data. After GDP statistics last week revealed that consumption increased for the first time in five quarters, suggesting another impending rate hike by the Bank of Japan, the CPI may become crucial.

Following a surprise drop in July, China is expected to keep its one-year and five-year LPRs unchanged on Tuesday. However, last month's drop in new home values was the fastest in nine years, making the economic downturn worse. The minutes of the August meeting, in which the Reserve Bank of Australia ruled out a short-term rate drop, are made public.

Overnight Newswire Updates of Note

- Funds Go Long Yen For First Time In Four Years

- High Stakes At Jackson Hole, Powell Surveys US’s Rocky Prospects

- Traders Need Fed Go Sign In Jackson Hole To Keep Stocks Rallying

- Fed’s Daly: It Is Time To Consider Adjusting Borrowing Costs

- Austan Goolsbee: No “Certainty” That Fed Will Lower Rates In Sept

- JPMorgan, Aviva Shrug Off EM Rout On Bets For Soft US Landing

- Vanguard, BlueBay Bet There’s More Juice In BoJ Rate-hike Trades

- Oil Prices Ease On China Demand Fears, Focus On Mideast Talks

- Asia Shares, Gold Underpinned By Rate Cut Hopes

- Foreign Venture Capital Funds Increase Japan Investment 70%

- Westpac Profit Rises As Margin Pressure Shows Signs Of Easing

- China’s Faltering Growth Revives Cash Vouchers Talk

- Samsung Bets On CXL Memory To Become Next AI Darling

- Japan’s LDP Race Heats Up As Emerging Players Eye Runs

- UK Estate Agents Report More Buyer Interest After BoE Rate Cut

- Blinken To Sit With Herzog Ahead Of Netanyahu Meeting

- Ukraine: Struck Second Key Bridge In Russia’s Kursk Region

- Russia Denies Report About Indirect Talks With Ukraine

- Hamas Rejects New US Proposal For Hostage, Ceasefire Deal

- Bitcoin Miners Shifting To AI And High-performance Computing

- 110K Ether Pours Into Liquid Staking Platforms, Boosting Defi Hold

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/JPY: 146.00 ($1b), 147.80 ($620m), 130.00 ($600m)

- EUR/USD: 1.0980 (EU825.1m), 1.1090 (EU764.6m), 1.0850 (EU529.1m)

- AUD/USD: 0.6675 (AUD780.5m), 0.6425 (AUD399.6m)

- USD/CAD: 1.3900 ($1.32b), 1.3700 ($655m), 1.2900 ($440m)

- USD/CNY: 7.0000 ($400.9m), 7.1500 ($302m), 7.0800 ($300.1m)

- USD/MXN: 19.45 ($625.6m), 19.63 ($326m)

- GBP/USD: 1.2675 (GBP778.8m), 1.2850 (GBP645.5m)

- EUR/GBP: 0.8685 (EU453.7m)

CFTC Data As Of 16/8/24

- Japanese Yen net long position is 23,104 contracts

- Euro net long position is 26,983 contracts

- Bitcoin net long position is 395 contracts

- British Pound net long position is 47,812 contracts

- Swiss Franc posts net short position of -21,664 contracts

- Equity fund speculators increase S&P 500 CME net short position by 63,926 contracts to 286,781

- Equity fund managers raise S&P 500 CME net long position by 70,558 contracts to 952,091

Technical & Trade Views

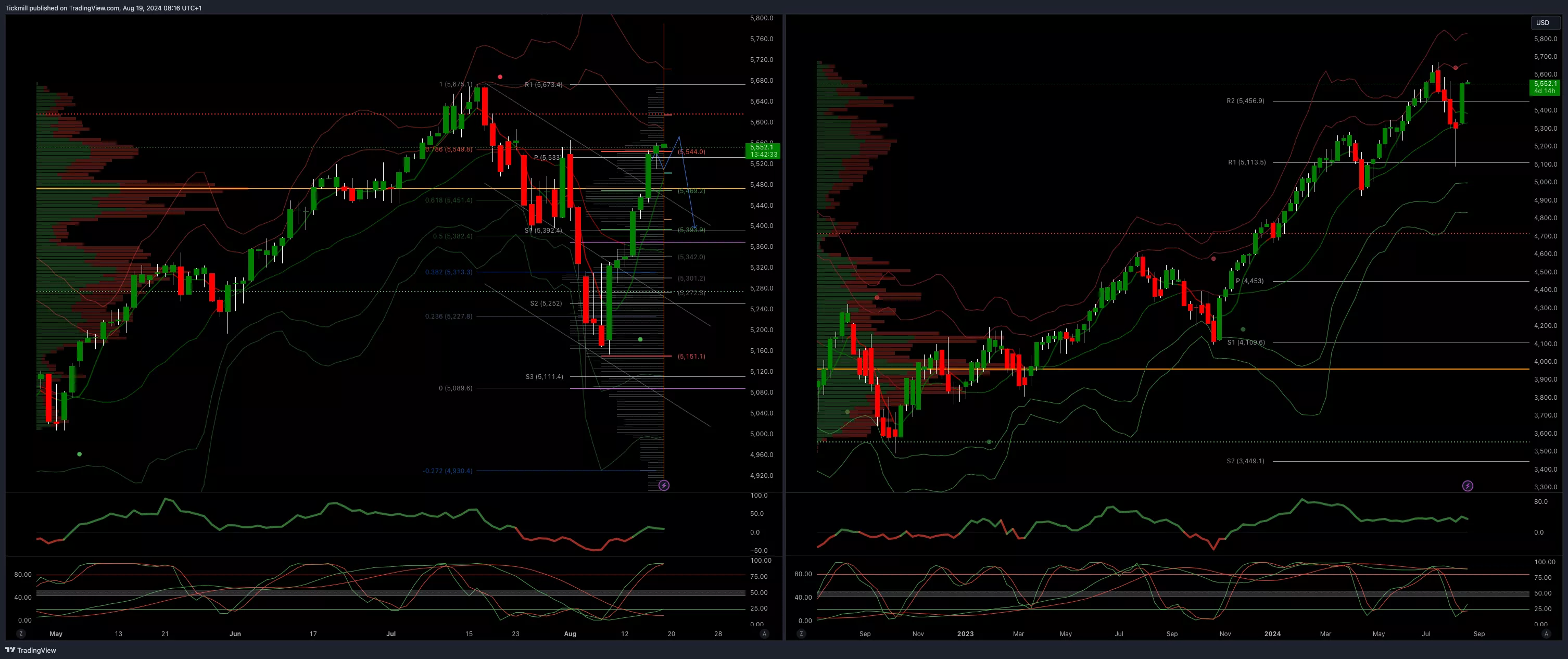

SP500 Bullish Above Bearish Below 5475

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5470 opens 5670

- Primary resistance 5670

- Primary objective is 5400

(Click on image to enlarge)

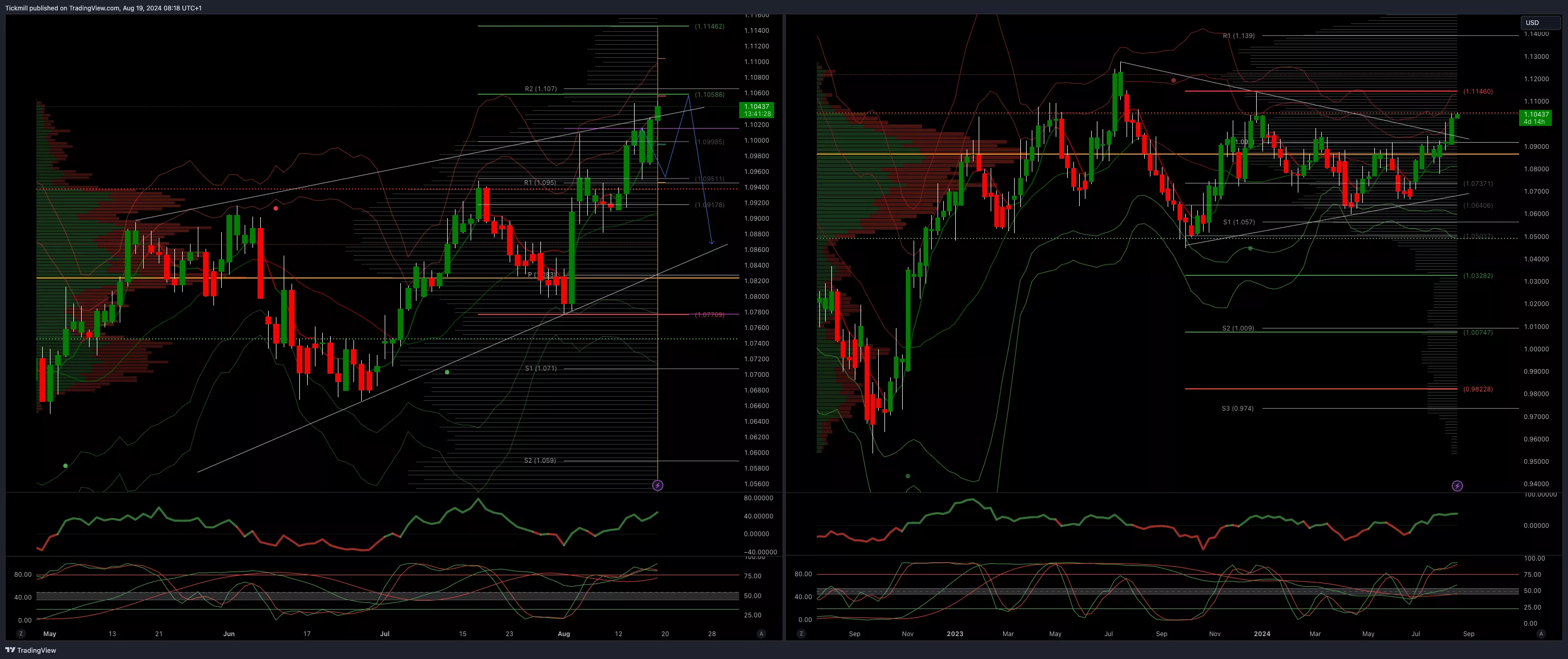

EURUSD Bullish Above Bearish Below 1.0960

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.1060 opens 1.1140

- Primary resistance 1.0981

- Primary objective is 1.0860

(Click on image to enlarge)

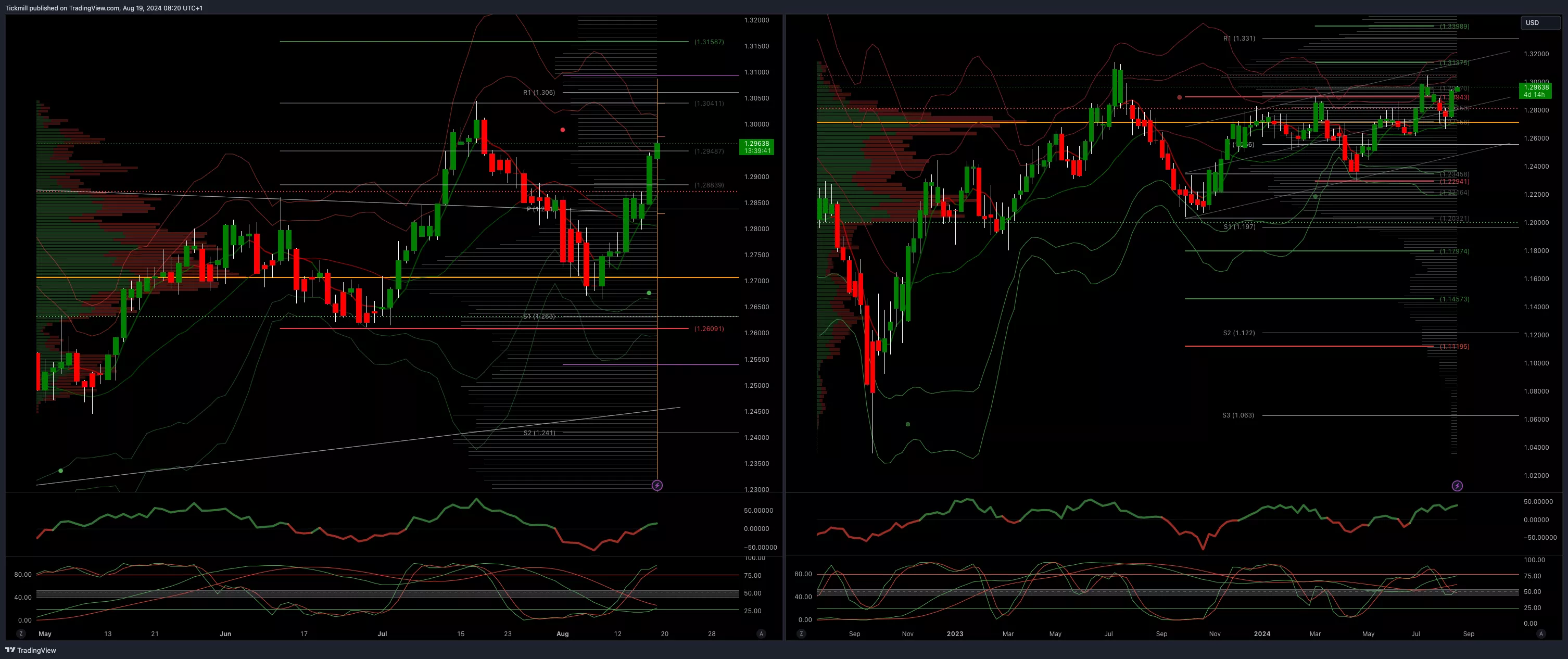

GBPUSD Bullish Above Bearish Below 1.29

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 1.2870 opens 1.27

- Primary support is 1.2690

- Primary objective 1.3150

(Click on image to enlarge)

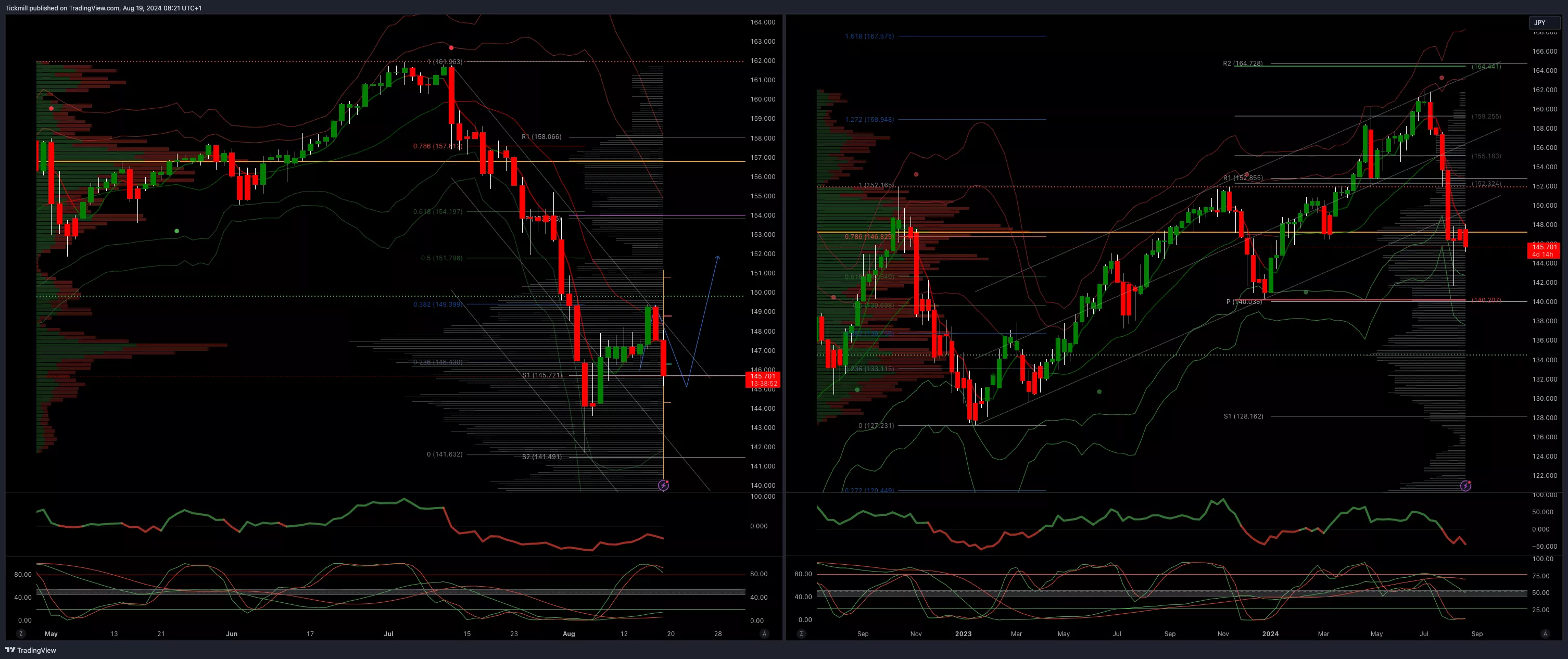

USDJPY Bullish Above Bearish Below 149

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 150 opens 153

- Primary support 140

- Primary objective is 153

(Click on image to enlarge)

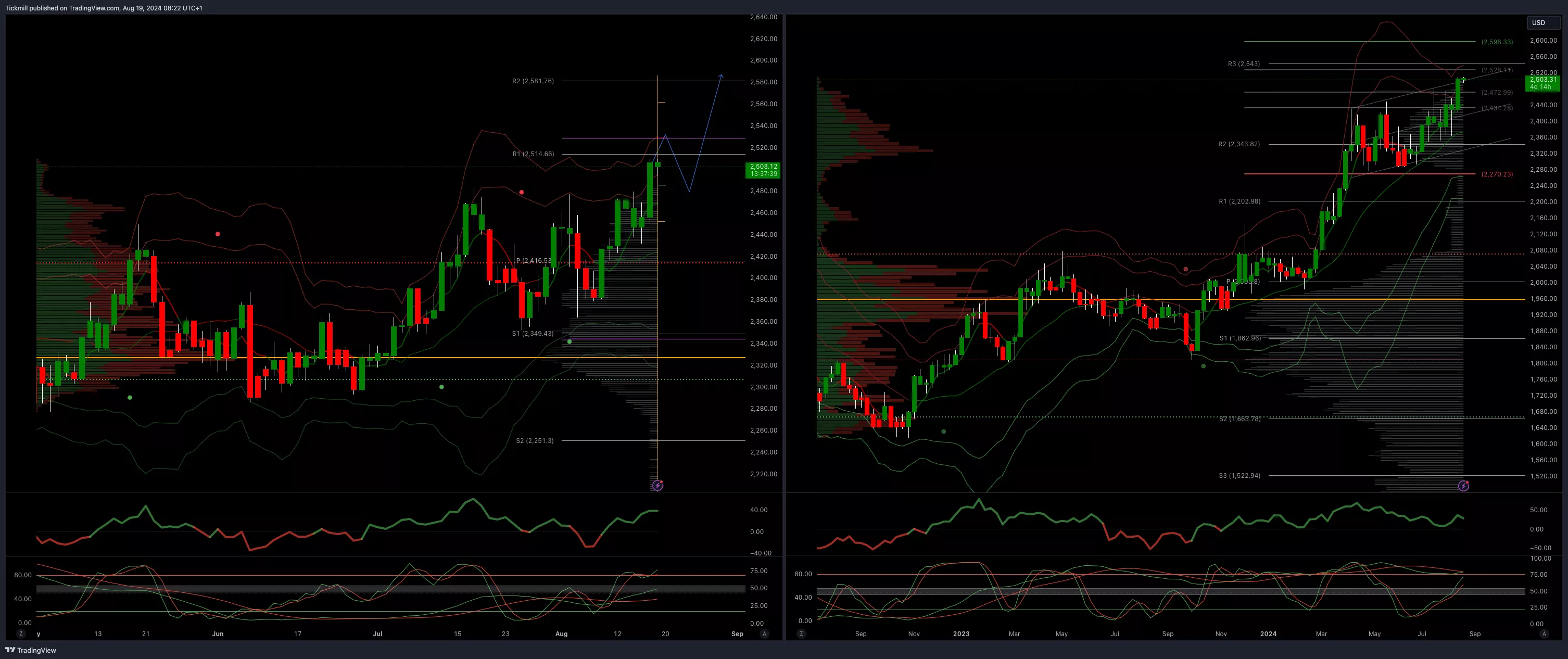

XAUUSD Bullish Above Bearish Below 2480

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

BTCUSD Bullish Above Bearish Below 58000

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 61000 opens 68000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Aug. 16

S&P Daily Trade Plan - Wednesday, August 14

Daily Market Outlook - Wednesday, Aug. 14