Thoughts For Thursday: Won't You Please Come To Chicago

The 2024 Democratic Convention kicks-off next Monday, August 19. It remains to be seen if the market will get a lift similar to that expected by the Harris-Walz ticket. August doldrums be damned.

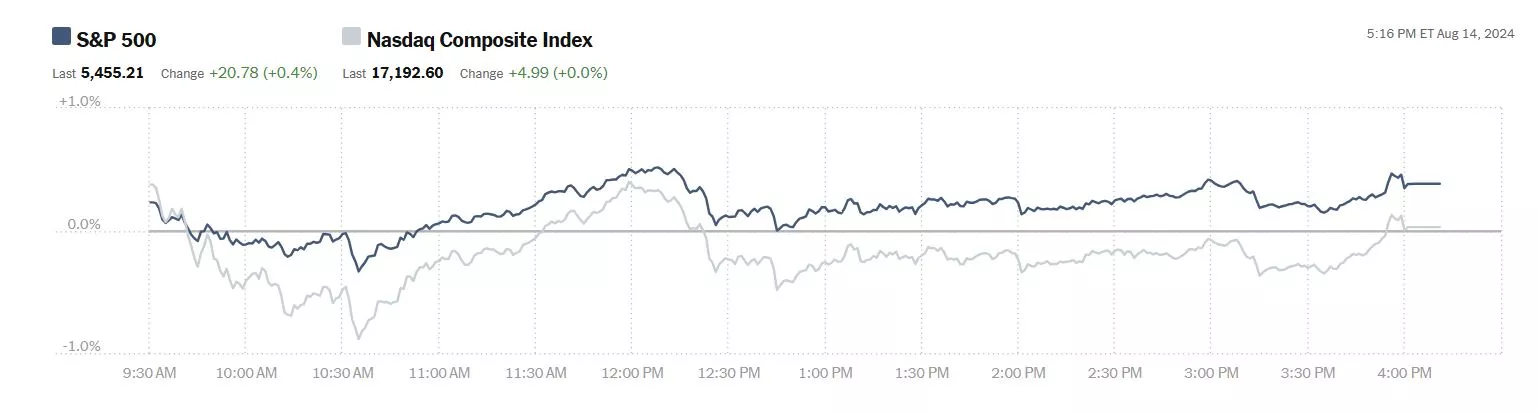

Wednesday the S&P 500 stayed well above 5,000, closing at 5,455, up 21 points. The Dow closed at 40,008, up 243 points, while the Nasdaq Composite closed at 17,193, up 5 points, barely moving the needle.

Chart: The New York Times

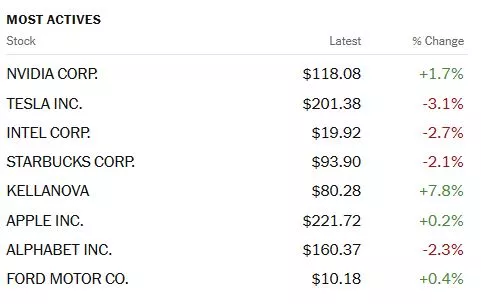

Shuffling around a bit most actives were still led by Nividia (NVDA), up 1.7%, followed by Tesla (TSLA), down 3.1% and Intel (INTC), down 2.7%.

Chart: The New York Times

In futures trading this morning, S&P market futures are up 50 points, Dow market futures are up 379 points and Nasdaq 100 market futures are up 219 points.

TalkMarkets contributor Kenny Fisher notes that US Inflation Dips To 2.9%, Lowest Level In Over Three Years.

"The US consumer price index (CPI) climbed 2.9% year-on-year in July, down a notch from 3.0% in June which was also the market estimate. This marked the lowest inflation rate in the US since March 2021, when inflation started its upswing which saw it move as high as 9.1% in June 2022. Notably, headline CPI has slowed for a fourth consecutive month...

Core CPI, which excludes food and energy and is closely watched the Federal Reserve, eased to 3.2% in July, just below the June reading of 3.3% which was also the market estimate. Monthly, core CPI rose 0.2%, above the June gain of 0.1% and in line with the market estimate...

Today’s data confirms expectations of a slowdown in US inflation and has boosted market expectations of a 50-basis point cut when the Fed meets next on September 18. The markets have priced in a 50-basis point cut at around 60% and a quarter-point cut at 40%...

The likelihood of a 50-point reduction has soared in recent weeks, as the US has posted weaker-than-expected data which triggered a meltdown in the global markets last week...

Today’s inflation report was within expectations and the response of the US Dollar has been muted, with small losses against the major currencies.

The EUR/USD currency pair rose 0.15% following the inflation report and the GBP/USD currency pair rose 0.10%. Other major currencies also posted small gains against the US Dollar..."

Contributors Chris Turner, Francesco Pesole & Frantisek Taborsky echo Kenny Fisher's remarks in Pieces Falling Into Place For A September Fed Rate Cut.

"Now that US inflation is back on target, the main question is whether the Fed starts its easing cycle with a 25bp or 50bp rate cut. Today’s US data will not have a major say in that, but any downside surprise in July retail sales or upside surprise in weekly initial claims can soften the dollar...

Core inflation is running at a 1.6% three-month annualized rate – under the Fed's 2% target. Most of the components of this week's PPI and CPI releases point to an on-target 0.2% month-on-month release of the July core PCE inflation data on 30 August. We should now be expecting some dovish commentary coming through from the Fed...

Activity data will now determine whether the Fed cuts by 25bp or 50bp in September. The August jobs data on 6 September will have a major say here. In advance of that, today sees retail sales for July. The bounce back in auto sales is expected to support the headline number, but the market will focus on the retail sales control group. This is expected to rise 0.1% MoM after stellar 0.9% gains in June. The consensus is 0.1% MoM and any MoM decline here (-0.1%, -0.2% are possible) could weigh on the short end of the US rates curve and the dollar. The market will also be paying close attention to the weekly initial claims to see whether any of the recent layoff announcements are finally lifting the claimant count..."

TM contributor Mish Shedlock weighs in on the question as well, in Will The Fed Cut Interest Rates By 0.25 Points Or 0.50 Points In September?

Image from CME Fedwatch, annotations by Mish.

- There is currently a 43.5 percent chance of a 50 basis point cut in September.

- The odds were 53.0 percent yesterday and 69.0 percent a week ago.

The Wall Street Journal reports Cooling July Inflation Sets Stage for Fed’s September Rate Cut

I find that headline somewhere between useless and laughable, but more toward the latter.

A month ago, the odds of at least a quarter-point cut were 90.3 percent. That’s when the stage was set.

The question now is not whether the stage is set, but for how much.

Six-Point Case for 50 Basis Points

- Major Hurdle: We cleared a major hurdle today, despite the odds going the other way. Year-over-year the CPI dipped to 2.9 percent. That’s the first sub 3.0 percent reading since 2.6 percent in March of 2021.

- Fed Bias: At the last FOMC meeting, the Fed has changed its bias from inflation to balanced. That means it is treating unemployment and inflation equally. Inflation has risen 0.7 percentage points from the low.

- Recession: The odds of recession are high and rising. Few economists see this yet.

- Next CPI Report: There is another CPI report between now and the next Fed meeting. The next FOMC meeting is September 18. The next CPI report is on September 11. I am confident of a very good report, especially year-over-year.

- Last Jobs Report and Next Jobs Report: The next jobs report is September 6, ahead of the FOMC meeting. There is no reason to expect a good report but gaming monthly jobs reports is such a crapshoot that I don’t try.

- Negative Jobs Revisions: Major negative jobs revisions are coming this month. In contrast to the monthly jobs reports, I am very confident of this...

I do not believe the Fed should have a dual mandate and I believe inflation is historically understated by excluding actual home prices.

I am commenting on what I believe the Fed will do with what I expect the data to be.

That’s the case for a 50 basis point cut. If what I suggest happens, does happen, I will agree with the decision based on a dual mandate.

However, I do not think there should be a Fed at all. The market would do a better job.

The Fed is constantly creating boom-bust cycles then chasing its own tail (and tales) to fix mistakes it made."

Switching gears TM contributor Sheraz Mian notes Earnings Estimates Face Pressure: What To Know.

Below is a bit of what he has to say:

- "The overall picture that has emerged out of the Q2 earnings season is one of a stable and improving earnings outlook, with management teams generally providing a reassuring view of the economic ground reality. That said, estimates for the current period have started to weaken faster than we saw in the last two periods.

- Looking at Q2 as a whole, total earnings for the index are expected to be up +9.4% from the same period last year on +5.4% higher revenues. This will be the highest earnings growth pace since the +10% in the first quarter of 2022.

- For 2024 Q3, total S&P 500 earnings are currently expected to be up +4.3% from the same period last year on +4.6% higher revenues. Estimates for the period have been coming down since the quarter got underway, with the current +4.3% earnings growth pace down from +6.9% in early July.

- The Q3 negative revisions trend is far bigger than what we had seen in the comparable periods of the preceding two quarters. Estimates have come down for 14 of the 16 Zacks sectors, with the biggest declines in the Energy, Medical, Transportation, and Business Services sectors. Estimates for the Tech and Finance sectors have gone up.

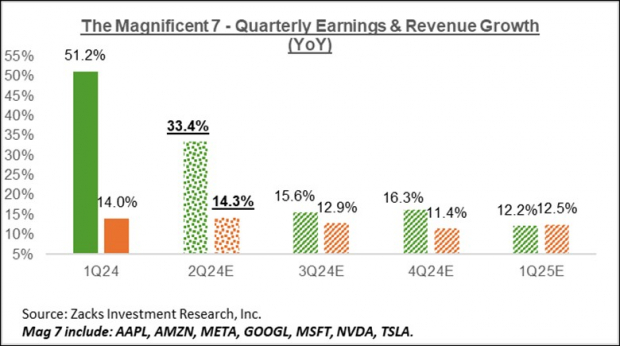

The ‘Magnificent 7’ stocks - Microsoft (MSFT - Free Report), Alphabet (GOOGL - Free Report), Amazon (AMZN - Free Report), Apple (AAPL - Free Report), Meta Platforms (META - Free Report), Tesla (TSLA - Free Report) and Nvidia (NVDA - Free Report) – were in the spotlight in the recent market turmoil. This followed these companies’ Q2 quarterly releases that mostly failed to impress market participants, particularly the reports from Alphabet, Microsoft, Amazon, and Tesla...

Chart: Zacks Investment Research

Beyond the Mag 7, Q2 earnings for the Tech sector as a whole are expected to be up +20.6% from the same period last year...

For full-year 2024, Tech sector earnings are expected to be up +17.6%, followed by another strong showing expected next year...

The chart below shows the overall earnings picture on an annual basis.

Chart: Zacks Investment Research

Please note that this year’s +8.1% earnings growth on only +1.8% top-line gains reflects revenue weakness in the Finance sector. Excluding the Finance sector, the earnings growth pace changes to +7.8%, and the revenue growth rate improves to +4.2%. In other words, about half of this year’s earnings growth comes from revenue growth, with margin gains accounting for the rest."

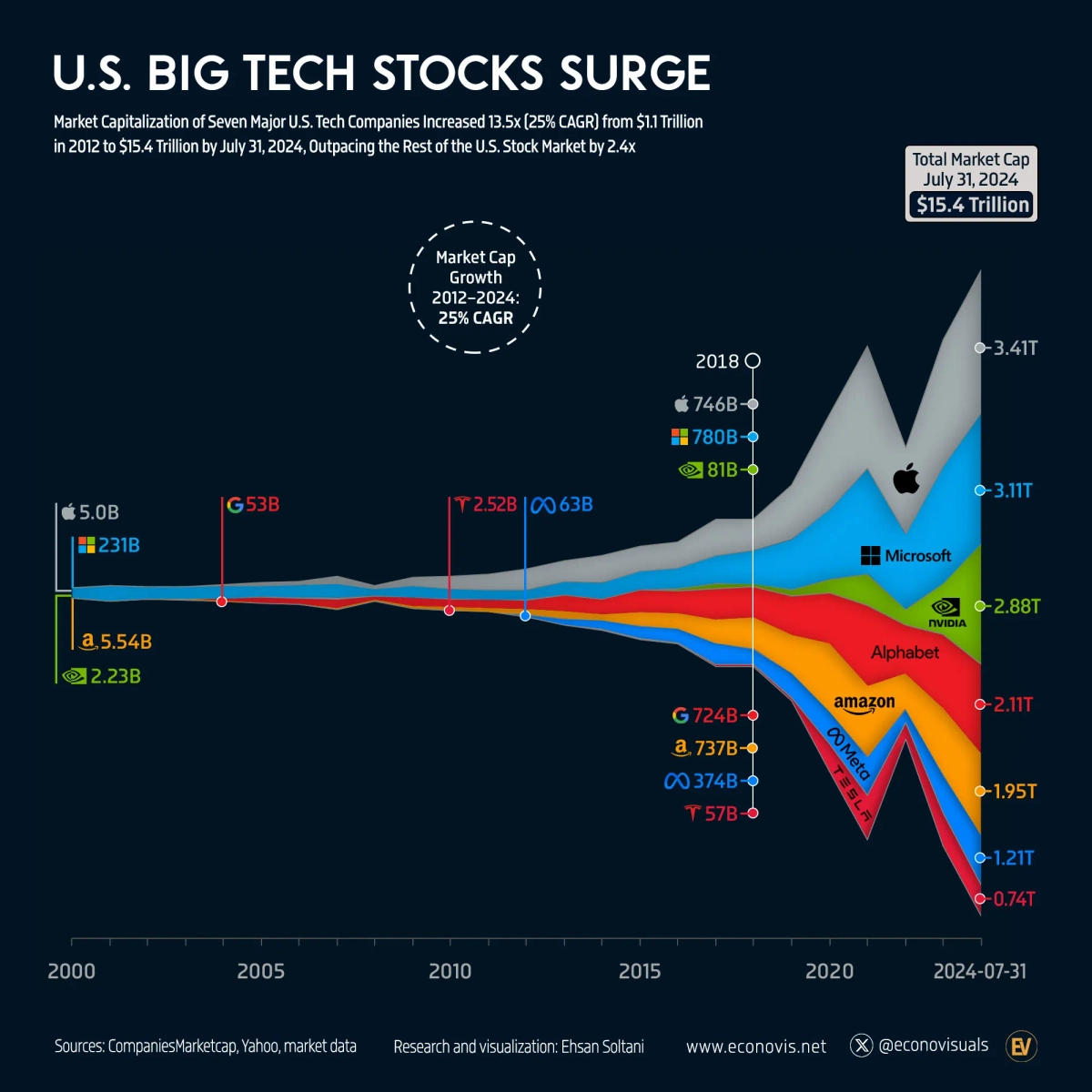

Contributor Ehsan Soltani in a TalkMarkets Editor's Choice piece, presents: Charted: The Surging Value Of The Magnificent Seven (2000-2024).

"...As of July 2024, the Magnificent Seven companies are worth $15.4 trillion combined.

Since 2012, the first year all seven companies were public, the Magnificent Seven has grown 13.5 times larger. Nvidia has seen the highest relative growth, with its market cap jumping 360 times larger over the same time frame. Nvidia’s size is especially impressive when you compare its market cap to other chipmakers.

At the other end of the scale, Apple’s market cap has only grown seven times higher since 2012. This smaller relative jump is because Apple was already worth $500 billion by the end of 2012, while Nvidia was only worth $8 billion at the time.

Fast forward to 2024, and the Magnificent Seven companies are major players in the U.S. stock market. They drove 49% of the S&P 500’s total gains in the first half of 2024.

However, their performance has taken a downturn in recent weeks amid recession fears and concerns about overspending on AI. On top of this, Warren Buffett’s company Berkshire Hathaway sold half of its stake in Apple, and reporters said Nvidia’s newest AI processor could be delayed due to production issues.

Some market analysts have argued that the recent dip indicates a potential buying opportunity, since the Magnificent Seven companies are now at lower valuations."

Caveat Emptor!

Here's to a raucous time on the convention floor in a positive way, and relative calm on the streets of Chicago.

Peace.

More By This Author:

Tuesday Talk: Stabilized But Still Spooky

Thoughts For Thursday: Markets And Mayhem

Tuesday Talk: A Big Dip