Thoughts For Thursday: The Art Of The Pause

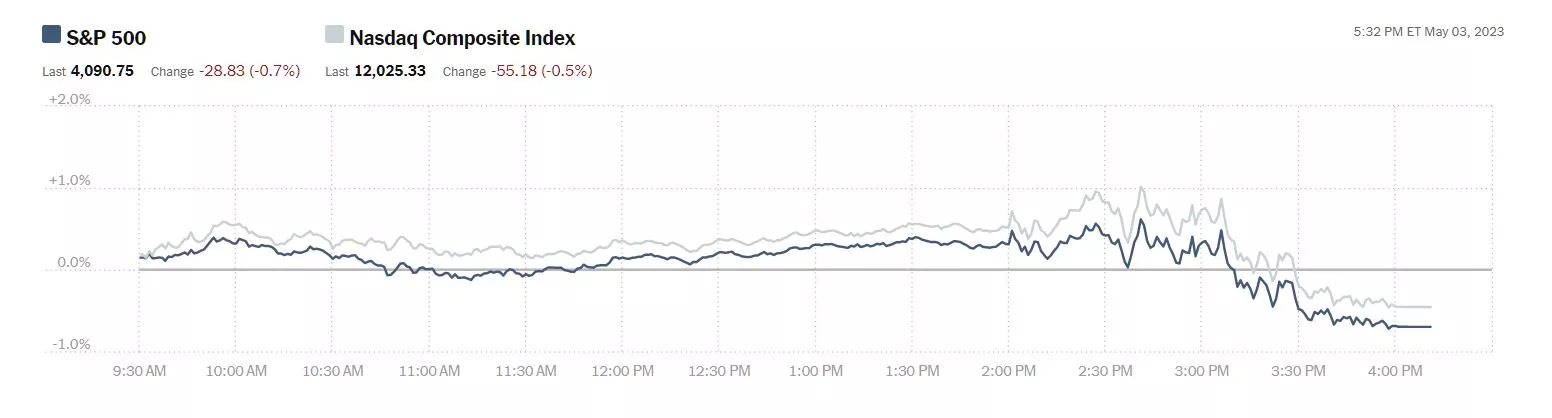

While Fed Chairman Jerome Powell did not announce a pause in rate hikes following yesterday's anticipated 25 bps raise, he certainly left the idea on the table. However his failure to calm investors with his remarks regarding the nation's debt limit sent stocks into negative territory at the end of trading on Wednesday.

The S&P 500 closed at 4,091, down 29 points, the Dow closed at 33,414, down 270 points and the Nasdaq Composite closed at 12,025, down 55 points.

Chart: The New York Times

Major losers for the day were Estee Lauder (EL), whose share plummeted 17.3% on lower guidance for 2023 due to a lag in a recovery in sales in China; followed by Advanced Micro Devices (AMD), down 9.2% on a significant percent downturn in chip sales and Starbucks (SBUX), also down 9.2%, despite an excellent earnings report.

Chart: The New York Times

Currently, in morning futures trading S&P 500 market futures are down 14 points, Dow market futures are down 105 points and Nasdaq 100 market futures are down 21 points.

Contributor Mish Shedlock brings readers the takeaways, actions and opinions of the FOMC in Fed Says Banking System Is Sound And Resilient, Hikes Interest Rate A Quarter Point.

"Six Key Points

- Inflation is elevated

- Banking system is sound and resilient

- Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.

- The Committee will take into account lags from rate hikes

- Quantitative Tighten (QT), balance sheet reduction of treasuries and mortgage backed securities will continue

- The Committee is strongly committed to returning inflation to its 2 percent objective"

Here some excerpts from the FOMC press release that Shedlock includes in his article.

"The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain...The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 5 to 5-1/4 percent. The Committee will closely monitor incoming information and assess the implications for monetary policy. In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments...The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments."

Shedlock further informs, "Notably, the Fed dropped the phrase that additional policy increases might be appropriate. There is no dot plot or projection materials of expected hikes or economic activity.", and provides a link to Powell's press conference, yesterday afternoon.

Reflecting on the substance of the Fed's remarks, TalkMarkets contributor Michael Maharrey writes What The Fed Says Today Really Isn’t Relevant Tomorrow.

"Is the rate hike pause in play?

That question remains up for debate after the May Federal Reserve Open Market Committee meeting.

But when you break it all down, the underlying economic reality is far more important than the messaging coming from Powell and Company. And the underlying economic reality is that inflation isn’t beat and the economy is heading toward a cliff...

The FOMC statement emphasized that “the Committee is strongly committed to returning inflation to its 2 percent objective...

It’s important to remember that inflation is an increase in the money supply. Price inflation measured by the CPI is a symptom of monetary inflation. Since 2008, the Fed has created nearly $8 trillion. The central bank can’t ring that amount of liquidity out of the system with 5% interest rates.

But it can burst a lot of bubbles and break a lot of things in an economy dependent on easy money with 5% interest rates...

As just one example of the rot in the economy, the Conference Board Leading Economic Index (LEI) for the US fell by 1.2% in March. It was the 12th straight month of declines in the LEI.

No matter what Powell says, it’s only a matter of time before the Fed has to abandon the pretense of an inflation fight, pivot, and start cutting rates. Even if this tightening cycle brings down CPI in the next few months, it will only be temporary. The moment it is forced to reckon with the damage done by decades of easy money, it will return to easy money like a pig to mud — no matter what the central bankers are telling you today."

TM contributor Dennis Miller doesn't buy any of JP Morgan chief Jamie Dimon's explanations for the current banking crisis and writes that A Banking Crisis Shouldn’t Be The Taxpayer’s Problem.

"Chairman and CEO of JPMorgan Chase (JPM), Jamie Dimon wrote shareholders about banking turmoil, “As I write this letter, the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come.”

IGI Global defines a banking crisis:

1. Banking crisis reflects the crisis of liquidity and insolvency of one or more banks in the financial system. Due to bank’s sizable losses, bank encounters critical liquidity shortage…disrupting its ability in repaying the debt contracts and the withdrawals demanded by depositors.

2. A subset of financial crises that are felt acutely within the banking sector…having national and international implications wherein either the given capital of the banking system is practically exhausted,…or where the cost of resolving the problems of a financial system amounts to at least 3-5% of the national Gross Domestic Product.

Banks lose billions on high-risk investments, creating a tsunami of economic problems. Private businesses fail all the time. Why is the banking system treated differently?

No one worried about a “banking crisis” until 2008. The bank bailouts amounted to trillions, punishing savers & taxpayers in the process. Repealing the Glass-Steagall act in 1999 created “too big to fail”, mega casino-banks. JP Morgan, Wells Fargo, Bank of America, Citigroup and US Bancorp control 40% of the wealth of the nation.

Banks win, we lose!...

Jamie Dimon, head of the largest casino-bank lectures us about what should be done. Let’s dissect some of his preaching – with my emphasis and comments….

“The recent failures of Silicon Valley Bank (SVB) in the United States and Credit Suisse in Europe, and the related stress in the banking system, underscore that simply satisfying regulatory requirements is not sufficient. Risks are abundant, and managing those risks requires constant and vigilant scrutiny as the world evolves. Regarding the current disruption in the U.S. banking system, most of the risks were hiding in plain sight.”...

Hiding in plain sight? Your bank is part owner of the Fed, the bank regulator. The President of SVB was a director of the San Francisco Fed when it failed. No surprise the obvious risks were hidden, the system is wrong, and the regulators (Fed) should not be owned by the companies they oversee….

Jamie, you were on the board of the NY Fed, were your misdeeds in plain sight?

Transparency? The Fed has constantly fought Freedom Of Information Act requests, appealed court rulings, and stonewalled requests for information."

There is more of this in Miller's full article, but he does conclude with a positive call to action:

"A responsible Congress, keeping bankers out of the process, should follow his guidelines and do the following:

- Immediately reinstate (the) Glass-Steagall (Act), outlawing all banks from privatizing profits and socializing losses.

- Bank executives should be prosecuted for wrongdoing, with mandatory jail time for felony convictions. Executives should lose their jobs, benefits and golden parachutes.

- End the Fed; their track record is clear; including shielding criminal behavior at the expense of those they are supposed to protect.

- All banks must have adequate reserves on deposit at their bank to handle liquidity concerns.

- If a bank is deemed “too big to fail” it is too big. Break them up immediately."

I'll close out the column today by pointing you to an article by economist and TalkMarkets contributor Scott Sumner entitled, About That 2022 "Recession". It is an excellent primer on depressions and recessions and what does and does not cause them. It is not a particularly long piece and merits a full read, but here are some of the salient bits below.

"Between 2020 and 2022 we had roughly twice as much “austerity” as in 1937, at least in terms of the reduction in the budget deficit. And yet not only did we not have a major depression, we saw some of the strongest job growth in American history. Yes, we began 2022 with employment still a bit below normal, but that was even more true in 1937. And yes, the austerity of 2022 mostly reflected the decision to end Covid relief programs, but much of the austerity of 1937 was the decision to not repeat the big 1936 “bonus” payments to WWI veterans...

Why didn’t the big 1968 tax increase reduce inflation, as predicted by Keynesian economists? Why didn’t the 2013 austerity produce a recession, as predicted by Keynesian economists?

The answer to all of these questions is quite simple; it’s monetary policy that drives aggregate spending, not fiscal policy. Tight money caused the 1937 depression. It’s time to give up on the theory that fiscal policy drives aggregate demand. The Fed takes fiscal policy into account when it makes its decisions. It tries (not always successfully) to offset the effects...

It is very possible that we’ll have a recession in late 2023 (recessions are almost impossible to forecast). But if we do, it won’t be caused by banking turmoil. If the Fed thought credit problems were likely to lead to a recession, they would not be raising interest rates this week. If there is a major recession it will be because the Fed raised rates too much—it misjudged the situation. In contrast, a very small recession might in some sense be intentional—the Fed’s way of reducing inflation."

Have a good one.

Image: R. Schmitt

More By This Author:

TalkMarkets Image Library

Tuesday Talk: Rate Hike Backdrops And Trapdoors

Thoughts For Thursday: Flat To Down?