Tuesday Talk: Rate Hike Backdrops And Trapdoors

The drama of the fate of First Republic Bank ended in the wee hours of Monday morning when the FDIC greenlighted its acquisition by JP Morgan.

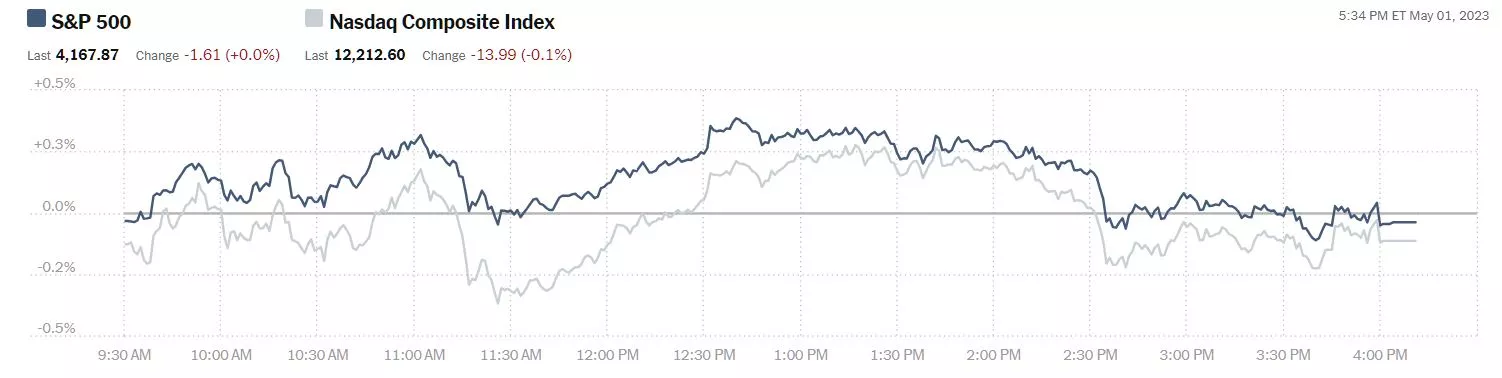

Applause was short lived as concerns about other regional banks holding under water U.S. securities continues to prevail. Nonetheless, this provided some air for the markets which dropped, surged higher and ended the trading day more or less where they started.

Chart: The New York Times

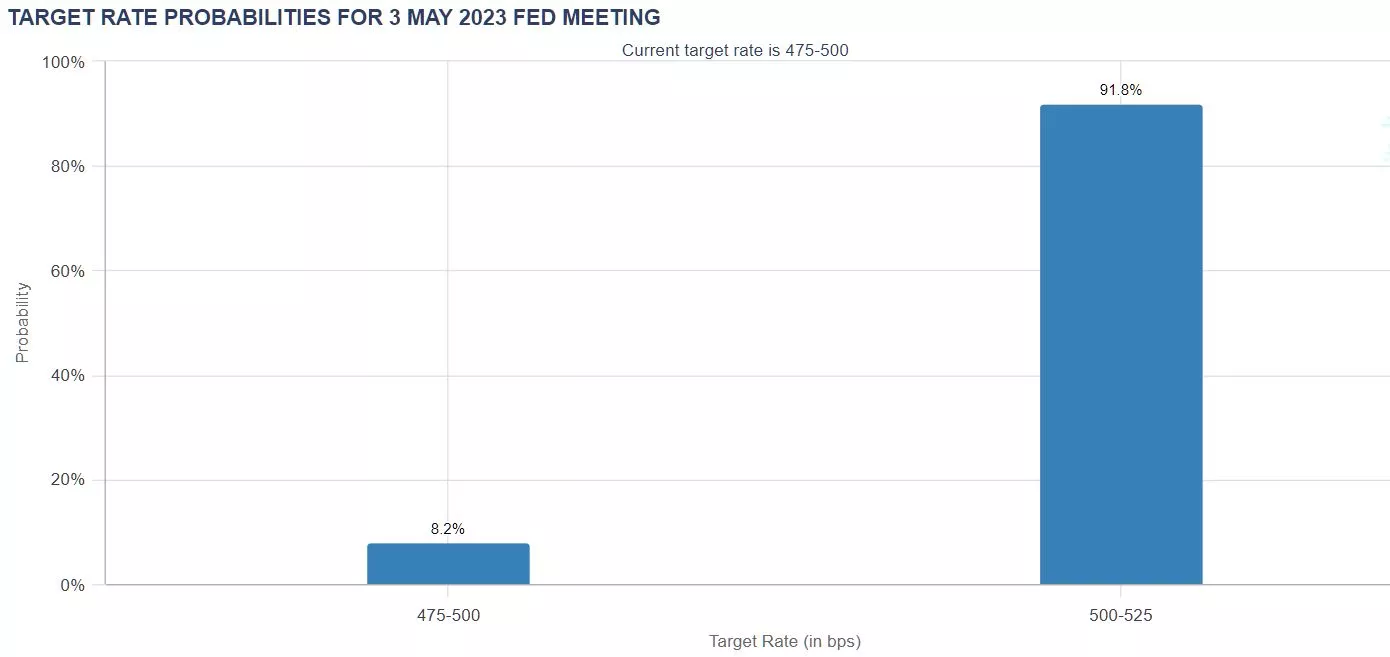

All this action is backdrop for the two day FOMC meeting which starts today. Consensus surrounding a 25 bps rate hike is high. Fed watchers as well as Jane and John investors are keen to hear what Fed Chair Jerome Powell will say about the path forward from May and whether the May FOMC meeting increase will be the end of the current QT cycle or if there will be more rate hikes to come.

Chart: CME FedWatch Tool

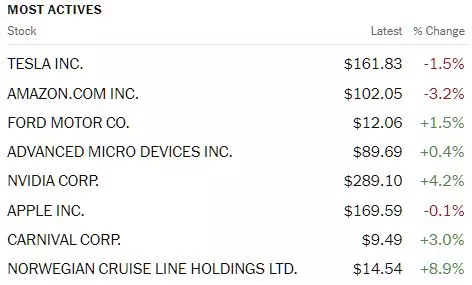

Monday the S&P 500 closed at 4,168, down 2 points, the Dow closed at 34,052, down 46 points and the Nasdaq Composite closed at 12,213, down 14 points. Most actives were led by Tesla (TSLA), down 1.5%, with Norwegian Cruise Lines (NCLH), up 8.9%, closing out the top eight.

Chart: The New York Times

Currently in morning futures trading S&P 500 market futures are down 7 points, Dow market futures are down 66 points and Nasdaq 100 market futures are down 2 points.

TalkMarkets contributor Brian Romanchuk writes that he is more concerned about credit risk than the actual demise of First Republic Bank, in Another Bank Bites The Dust.

"First Republic Bank was forced into a take over by J.P. Morgan Chase, and was yet another victim of bad banking risk management."

"My main complaint is that this appears to be another bank that blew itself up with interest rate risk, which makes my life of writing a banking primer more difficult. I had always made allowances for bad bank risk management in the United States, but I had underestimated how large an incompetent bank can get...

Other than for the unfortunate owners of securities issued by First Republic (and apparently wealthy people in San Francisco who wanted overly generous mortgages), the demise of this bank is not a big deal by itself for the macro-economy. Instead, the real issue is are there still other weak links in the banking system?...

My bias is to not pay too much attention to interest rate risk — credit risk is the killer for financial systems."

"Since the current bank failures were due to interest rate risk, we can blame them on Fed action. The question is whether these are enough to derail the economy?

...my concern is credit growth. One measure of credit that I like — commercial & industrial (bank) loans outstanding (above) — has rolled over.

As can be seen in the chart, C&I loans rolling over only tended to happen in recessions. However, we did see a lack of growth in the mid-2010's without a recession (circled episode), so I would be cautious about panicking.

I am not in the forecasting business, and do not want to be calling for recessions every six months. Although there are certainly negative vibes, one can still argue that they are consistent with a “soft patch,” which is a part of lengthy modern business cycles. You pay your money, and you take your chances."

Contributor Declan Fallon seems happy with the major indices at the moment, noting that Narrow Action For Markets Does Everthing But Breakout. Below are his takes on the Nasdaq and the Russell 2000.

"The Nasdaq delivered a narrow day at resistance, but still no breakout. There was no change in the technical picture, but the index is very close to a new 'buy' signal in the MACD.

The Russell 2000 (IWM) had a wider range day, but finished with an inverse 'hammer'. Technicals are not as bullish as for the S&P and Nasdaq, but there was no change in these despite the potential for a reversal. Because today's action remained within the bounds of support and resistance defined by March-April's trading it weakens the potential for today's candlestick to play as reversal, but don't get caught by hindsight.

Going forward, we still have the opportunity of a breakout and today's action has done everything *but* breakout. There is still plenty of time for this to happen, but the Russell 2000 will need to improve sharply should the S&P and Nasdaq breakout. "

See the article for Fallon's technical analysis of the S&P 500 (SPX).

TM contributor Gene Inger in his "In the Spotlight", Market Briefing For Tuesday, May 2 skewers the Fed and has a mostly positive take on reported Q1 earnings, among other comments. Here is some of what is on his mind this morning.

"Fed Chairman Powell continues to believe inflation remains a problem (it does); so he thinks they can help fight inflation with another rate hike (they actually can't). Powell basically (so far) isn't letting the prospect of a 'Default' (by the United States) derail fighting inflation, which is ridiculous.

Powell is not wrong that inflation remains a big problem for average people of course; however he's wrong believing the central elements of this is fixable by the Fed tightening longer and firmer to offset their own misdeed two years or more ago; by keeping 'emergency' rates too low for too long (as forewarned).

So the markets remain in a lurch... multiple dynamics where the Fed feels a need to keep leaning on inflation from 'their' perspective, while the economy weakens, and that's 'stagflation'."

"I would not make presumptions from many of the earnings reports; Boeing's (BA) was good, but they have other problems (although military contracts tend to be their fallback); JP Morgan looks good with First Republic assets a plus at the same time as it doesn't speak well to regional banks 'unless' the FDIC is able to extend more coverage for 'business accounts' (or money fund shifting automatically); VISA, McDonalds', our Chevron, all did fine; no surprises and somewhat 'in' the market's price.

Then there's Amgen, which had a so-so guidance; but usually emerges from short-term funks; IBM which did well in the 'cloud' and catch up in AI rapidly if they do a sharp acquisition for-instance (therefore risky to bet negative on big blue); and Goldman Sachs (GS), which had it's own trading problems plus losses in the effort to establish and expand Apple Card, which is why they're offering 'market level' realistic interest rates on Savings Accounts (to attract customers and it's a good rate compared to competition .. at least at first blush). Others reporting ok; like Dow Chemical and 3M; or Microsoft excellent as noted last week with Azure; but I'm unimpressed with Intel (INTC) and there's Apple on-tap as far as results."

"Future earnings power is not as weak as 'bears' contend' but that also might mean the Fed's mistaken view they can temper inflation with another hike could provoke both a market sell-off and ensuing rebound; depending on if they indicate 'one and done', which they might not intentionally overtly state."

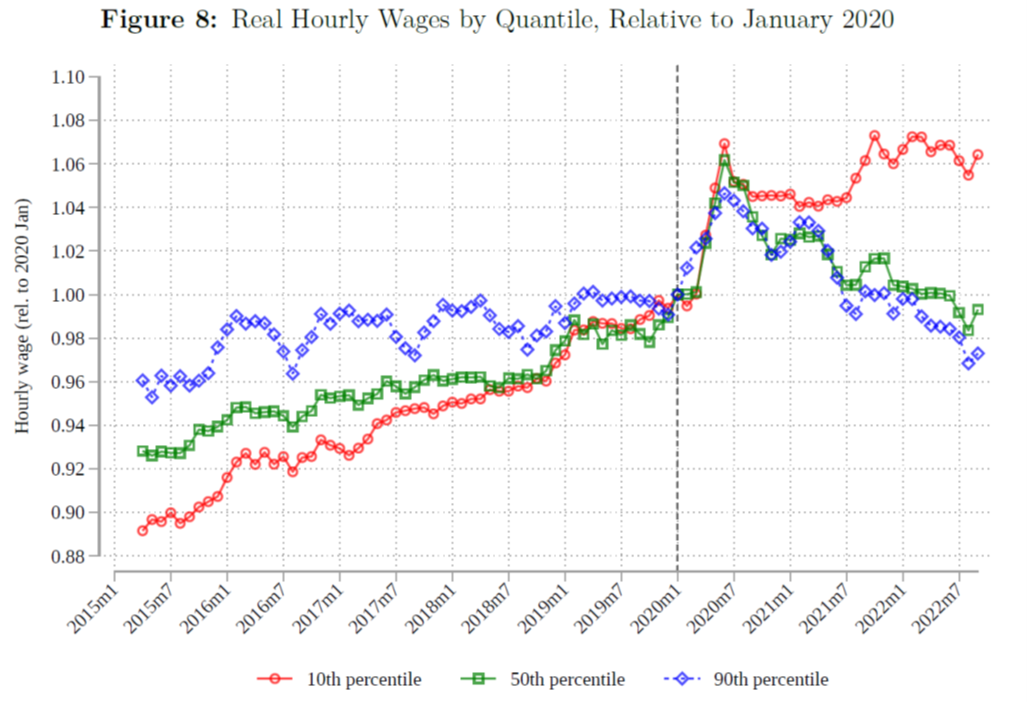

Check out the chart economist and contributor Menzie Chinn shows in his post entitled, Unexpected Compression.

"The unexpected compression of real wages. Or as the FT article summarizes it, “America’s lowest-earning workers are enjoying higher wage growth than top earners, after taking into account the effects of the recent bout of high inflation.” From Autor, Dube and McGraw (2023).

ChatGPT will not improve that chart.

TM contributor Tajinder Dhillon of Refinitiv provides an excellent reported to date, S&P 500 Earnings Dashboard Q1 23.

"Of the 272 companies in the S&P 500 that have reported earnings to date for Q1 23, approximately 78.3% reported above analyst expectations. This compares to a long-term average of 66%."

Closing out the column with a stop in the "Where To Invest" department, contributor Zacks Equity Research suggests 2 Consumer Staples Funds You Can Bank On For The Months Ahead.

"Consumer staples may not have the highest earnings growth or year-over-year revenue growth, but the sector has experienced relatively little disruption historically. On the positive side, these stocks make up for modest growth with low price volatility, reliable profits, dividends, and defensive positioning."

"We have thus selected two such (consumer staples) mutual funds that boast a Zacks Mutual Fund Rank #1 (Strong Buy), 2 (Buy), have positive three-year and five-year annualized returns, minimum initial investments within $5000, and carry a low expense ratio.

Fidelity Select Retailing Portfolio (FSRPX - Free Report) normally invests the majority of its assets in common stocks of companies principally engaged in merchandising finished goods and services primarily to individual consumers. FSRPX uses fundamental analysis of factors such as each issuer's financial condition and industry position, as well as market and economic conditions for its decisions.

As of November 2022, the top three holdings for FSRPX are 19.5% in Amazon, 12.1% in Home Depot and 8.6% in Lowe’s.

FSRPX’s 3-year and 5-year annualized returns are 15.1% and 10.1%, respectively. Its net expense ratio is 0.72% compared to the category average of 0.79%. FSRPX has a Zacks Mutual Fund Rank #2.

Fidelity Select Consumer Staples Portfolio (FDIGX - Free Report) invests the majority of its assets in securities of companies principally engaged in the manufacture, sale, or distribution of consumer staples. FDIGX uses fundamental analysis of factors such as each issuer's financial condition and industry position, as well as market and economic conditions for its decisions.

As of November 2022, the top three holdings for FDGIX are 15.1% in Coca-Cola, 14.6% in Procter & Gamble and 7.3% in Walmart.

FDIGX’s 3-year and 5-year annualized returns are 15.8% and 8.8%, respectively. Its net expense ratio is 0.74% compared to the category average of 0.76%. FDIGX has a Zacks Mutual Fund Rank #2."

Have a good one!

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: Flat To Down?

Thoughts For Thursday: Good News Stuck In Neutral