Thoughts For Thursday: Flat To Down?

Stocks didn't do much of anything on Wednesday and are poised to fall today, based on the morning action in market futures. Volume has been low in the run-up to Friday's options expiration.

Yesterday the S&P 500 closed at 4,155, down less than one point, the Dow closed at 33,897, down 80 points and the Nasdaq Composite closed at 12,157, up 4 points.

Major losers were in Tech and Healthcare issues with CDW Corp. (CDW) taking the largest loss, losing 13.2% followed by Elevance Health (ELV), down 5.3% and Hewlet Packard Enterprise (HPE), down 5.2%.

Chart: The New York Times

In morning futures action S&P 500 market futures are trading down 30 points, Dow market futures are trading down 142 points, and Nasdaq 100 market futures are trading down 136 points.

TalkMarkets contributor Paul Schatz looks at a Tax Day Trend & Two Sectors.

"Tax day and the day after tax day are seasonally strong days. This year that is April 18th and 19th. The theory goes that there is a surge in IRA money sent to banks, brokerages, and mutual fund companies that has to get invested quickly.

As I wrote about the other day, there has been a lot of good news and the market is only marginally higher. It looks a bit tired with good news becoming a time to sell. Nothing big. Perhaps just a pause to refresh or mild pullback. I do not see any danger signs flashing, just a continuous stream of pundits who hate and disavow the rally."

"As for the recession talk, the consumer and consumer discretionary stocks are resilient after a horrendous 2022. They should be much weaker if recession was imminent."

Contributor Przemyslaw Radomski notes Gold Price Back Below $2,000.

"Gold just moved below $2,000 one more time, and it looks like this time, it’s a move that will last.

Here’s what’s happening at the moment of writing these words:

Gold and silver are moving lower. And why would this be the case? Except for the fact that they got overbought on a short-term basis and except for the situation in real interest rates, multiple analogies to previous declines…

The USD Index moved a bit higher today, and it was all it took for the precious metals to rally visibly.

The USDX is back above its mid-2022 and early-2023 lows, and despite yesterday’s (Apr. 18) intraday move lower, it didn’t move back below the above-mentioned lows. It’s moving higher again, which makes the invalidation of the breakdown much more credible...

Consequently, what I’ve been emphasizing previously was just confirmed. The USD Index’s invalidation preceded gold’s invalidation...

In Tuesday’s analysis, I wrote the following:

Now, this isn’t to say that there will definitely be no more bumps on this road. No. In fact, it’s common to see a daily or two-day pause or small rebound right after gold tops. That pause is then followed by a huge slide that takes most people by surprise.

Indeed, it seems that we saw that pause during Tuesday’s session. And it seems that it’s over."

Conversely Power Hedge writes Gas And Oil Prices Rise, Likely To Continue.

"On Tuesday, April 18, 2023, fuel price tracking company GasBuddy reported that the average price of gasoline in the United States reached its highest price this year. The company stated that the average price of gasoline in the United States is now $3.65 per gallon, which represents a $0.076 increase over the past week. This price is also $0.221 per gallon higher than a month ago. So, if you suspect that it is more expensive to fuel your car than it was a few weeks ago, you are not dreaming...

As GasBuddy correctly points out, crude oil prices have once again started to rise, following some price weakness in the first three months of this year:

Source: Business Insider

As we can see, the price of West Texas Intermediate crude oil is up 3.1% year-to-date despite the fact that it is down 2.05% in morning trading (this chart is as of 10:38 a.m. EST). We can see a very steep increase from the middle of March, where fears of a near-term recession pushed down crude oil futures prices. That is logical, as recessions typically result in lesser demand for gasoline and diesel fuel. Based on current action in the stock market, these recessionary fears have subsided...it appears that barring a recession, gasoline prices are likely to rise over the coming months. This could result in a significant setback in the progress that the Federal Reserve has seemingly made in its fight against inflation. That could even make the market’s prediction of a near-term pause or pivot in the current monetary tightening policy look very optimistic. Thus, we could actually see a repeat of 2022 in which everything outside of the energy sector declines in price."

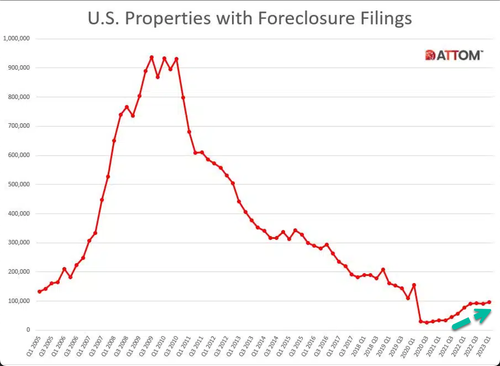

While recession fears may be falling to the side TM contributor Tyler Durden finds that Home Foreclosures And Missed Credit Card Payments Surge As Consumers Buckle.

"In the first quarter of this year, home foreclosures surged, as reported by property data firm Attom. Following a two-year lull, pandemic-related housing assistance programs are winding down. Homeowners who chose not to make mortgage payments are now either negotiating new terms with lenders, selling their properties, or, as current trends suggest, facing foreclosure. This troubling rise coincides with consumers falling behind on their credit card payments."

"Making matters worse is 24 months of negative real wage growth for consumers who've maxed out credit cards and drained personal savings. Lower-tier consumers are coming under pressure as big banks are beginning to notice a startling uptrend in credit card and loan payment delinquencies.

"We've seen some consumer financial health trends gradually weakening from a year ago," Wells Fargo Chief Financial Officer Mike Santomassimo said on an earnings call last Friday.

Banks have tightened their lending standards ahead of expected turmoil among consumers.

Wells Fargo set aside $1.2 billion in the first quarter to cover potential loan losses.

Bank of America provisioned $931 million for credit losses in the quarter, much higher than the $30 million a year prior but below the fourth quarter $1.1 billion provision.

JPMorgan more than doubled the amount it set aside for credit losses in the first quarter from a year earlier to $2.3 billion, reflecting net charge-offs of $1.1 billion. -Epoch Times

UBS analysts led by Erika Najarian believes mounting macroeconomic headwinds would lead to "credit deterioration throughout 2023 and 2024 with losses eventually surpassing pre-pandemic levels given an oncoming recession."

Najarian said loan defaults are forecast to stay "below the peaks experienced in prior downturns."

However, we're noticing that consumers are buckling under financial pressure—an ominous sign of trouble ahead."

We get some good news in a rich Editor's Choice column from TalkMarkets contributor Sam Subramanian who discusses the Best ETFs, Funds, And Stocks Of Q1 2023; Preview Of Q2.

It is a long article. Below are some of the highlights:

"Best ETFs of Q1 2023

ETFs that focused on cryptocurrencies, Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE), topped the performance charts for the quarter, gaining 97% and 80%, respectively. Among non-crypto assets, shares of high-growth companies involved in internet, fintech, and semiconductor technologies posted robust gains.

- ARK Next Generation Internet ETF, ARKW +39.1%

- ARK Fintech Innovation ETF, ARKF +31.8%

- VanEck Semiconductor ETF, SMH +29.7%

- ARK Innovation ETF, ARKK +29.1%

- iShares Semiconductor ETF, SOXX +28.1%

Best S&P 500 Stocks of Q1 2023

The top five performers in the S&P 500 included companies from the information technology, communication services, consumer discretionary, and health care sectors. Semiconductor chipmaker Nvidia claimed the top spot. Facebook parent Meta Platforms from the communication services sector and orthodontic equipment maker Align Technology claimed the second and fifth spots. Consumer discretionary sector members, Tesla and Warner Brothers Discovery, took spots three and four.

- Nvidia Corp., NVDA +90%

- Meta Platforms Inc. Class A, META +76%

- Tesla, TSLA +68%

- Warner Brothers Discovery, WBD +59%

- Align Technology, ALGN +58%

Looking ahead to Q2 2023

The second quarter has kicked off amid signs the Federal Reserve’s interest rate policy is impacting the economy.

There are some welcome signs on the inflation front. The ISM services and factory price indices declined in March, suggesting inflation may be slowing.

Updates on inflation at retail and wholesale prices are also due this week. Investors’ inflation fears could ease if the March consumer and producer price data confirm the decline in inflation implied by the ISM measures.

Cooling inflation and easing recession fears can help stocks extend their advance into the second quarter."

Let's hope so.

Have a good one.

Image: D. Marshall

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: Good News Stuck In Neutral

Tuesday Talk: Eggs Still In The Basket