Thoughts For Thursday: Earnings In Earnest

Even as Q1'24 earnings are beating expectations S&P 500 excesses are pulling the market down. Add Iranian War risk and the impending Trump trials effects on the election, investors should be ready for a bumpy ride. Some of those bumps are already starting to be felt in the market this month.

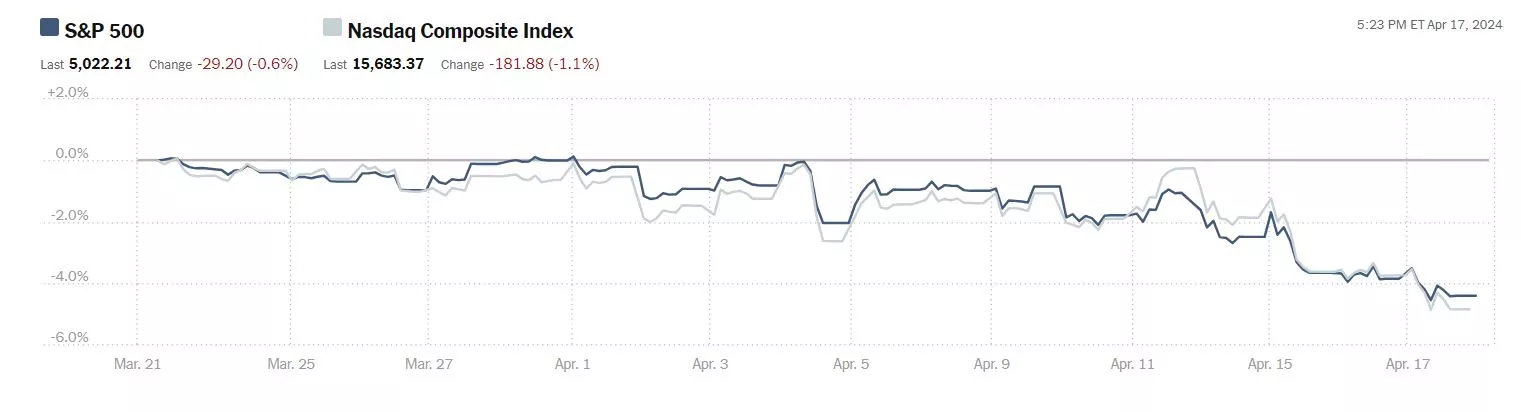

Wednesday the S&P 500 closed at 5,022, down 29 points, the Dow closed at 37,753, down 46 points and the Nasdaq Composite closed down 182 points, at 15,683. Looking at the monthly S&P 500 and Nasdaq chart one can see the movement downward (easily).

Chart: The New York Times

Most actives were led by Tesla (TSLA), -1.1%, followed by Advanced Micro Devices (ADM), down 5,8%, and United Airlines (UAL), up 17.4%.

Chart: The New York Times

In morning futures trading, S&P 500 market futures are down 3 points, Dow market futures are up 119 points and Nasdaq 100 market futures are trading down 39 points.

TalkMarkets contributor Sheraz Mian says Earnings Expectations Are Moving Higher.

"A notable favorable development on the earnings front is signs of improvement in the overall revisions trend, with estimates in the aggregate starting to go modestly up. We are seeing this trend for the current period (2024 Q2) as well as for full-year 2024 estimates.

- We are off to a good start in the Q1 earnings season, with the earnings growth pace modestly accelerating from the trend line of the last few quarters, though revenue growth remains on a decelerating trend, and positive surprises are tracking below historical average levels. Importantly, earnings estimates are going up.

- Total earnings for the 48 S&P 500 members that have reported Q1 results are up +9.5% from the same period last year on +4.5% higher revenues, with 77.1% beating EPS estimates and 64.6% beating revenue estimates.

- The earnings growth pace for these 48 index members represents an acceleration from what we had seen in other recent periods, though the EPS and revenue beats percentages are tracking modestly below the 12-quarter averages for this group of 48 index members.

- For the Finance sector, we now have Q1 results for 39.7% of the sector’s market capitalization in the S&P 500 index. Total earnings for these Finance companies are up +4.6% from the same period last year on +4.7% higher revenues, with 77.8% beating EPS estimates and the same proportion beating revenue estimates...

The chart below shows how S&P 500 aggregate earnings estimates for full-year 2024 have evolved...

A big part of this year’s earnings growth is expected to come from margins reversing last year’s declines and starting to expand again. The expectation is that aggregate net margins this year get back to the 2022 level, with the Tech sector driving most of the gains."

Looking at the SPX from a divident payout point of view, contributor Ironman says Turbulence Signaled By S&P 500 Dividend Futures Arrives.

"Nearly four weeks ago, we put down a marker for what lay ahead for the S&P 500 based on the index' quarterly dividend futures.

Looking beyond 2024-Q2, you'll see something unusual. There's projected drop-off in quarterly dividends between 2024-Q2 and 2024-Q3. It's unusual because we would ordinarily expect to see the third quarter's anticipated dividends fall in between the projected values for the second and fourth quarters. And since the outlook for the index' dividends in all quarters has been improving, we would have at least expected to see it close the gap between the second and fourth quarter's values.

But it hasn't. If anything, the projected drop-off in the dividends expected to be paid from 2024-Q2 to 2024-Q3 has been remarkably persistent in all the months we have been observing it and has increased in size. That persistence suggests investors have potentially built in expectations of turbulence ahead for dividend paying stocks.

That market turbulence would most likely take place during the upcoming quarter of 2024-Q2, which would subsequently show up in the dividends paid in the following quarter of 2024-Q3.

We're not even three full weeks into 2024-Q2 and the leading edge of that forecast market turbulence would appear to have arrived. The S&P 500 has dropped nearly four percent from the record high level it reached at the end of March 2024. Here's what the S&P 500's quarterly dividend futures look like as of Monday, 15 April 2024:

As expected, we've also had to reset the vertical scale of this chart to accommodate the dividends expected to be paid out in 2024-Q2, which has risen from $18.96 to $19.11 per share since our last snapshot.

Meanwhile, the amount of dividends expected to be paid out by S&P 500 firms during 2024-Q3 has decreased, falling from $17.82 to $17.72 during the last four weeks. The projected dividends for 2024-Q4 has likewise fallen, dropping from $18.45 to $18.31 during this interval.

The decline in expectations for the S&P 500's quarterly dividends in these future quarters is a consequence of a change in expectations for how the Federal Reserve will set short term interest rates in the U.S....

There is a bright spot in this outlook, for which we also put down a marker with its own cautionary note:

Since quarterly dividends are projected to rise in 2024-Q4, that suggests investors expect this turbulence will be relatively short-lived.

At least, that's the implied expectation at this juncture. The most important thing to remember about the future is that it's subject to change with little notice...

Our next planned snapshot of S&P 500 quarterly dividend futures and what they indicate will be in five weeks."

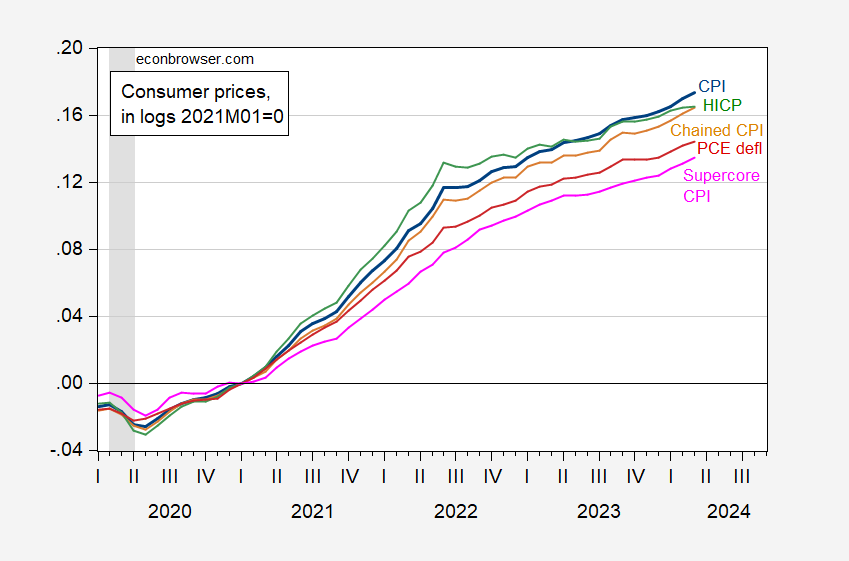

With election choices in mind, investors continue to keep tabs on prices, as noted by Menzie Chinn in Different Measures Of Consumer Prices.

"Since 2021M01, the CPI has risen 17.3% (log terms). By comparison, chained CPI and HICP have risen by approximately 16.5%. The PCE deflator has risen only 14.4% by March 2024 – but these are prices of goods and services produced, not of prices faced by consumers.

Figure 1: CPI (blue), HICP (green), chained CPI (tan), PCE deflator (red), supercore CPI (pink), all in logs 2021M01=0. HICP and chained CPI seasonally adjusted by author using Census X-13/X-11. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Eurostat, BEA via FRED, BLS, NBER, and author’s calculations."

In the midst of all the current excitement we flip a couple of light switches on for you, in the "Where To Invest Department".

TM contributor Shaun Pruitt selects 3 Top Rated Stocks To Buy After Q1 Earnings Beat Estimates.

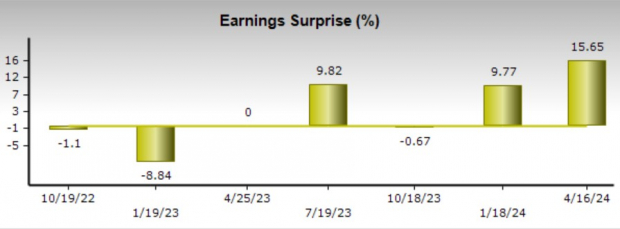

"Reconfirming their attractive earnings outlook, these companies were able to surpass Q1 bottom line expectations making now a suitable time to invest.

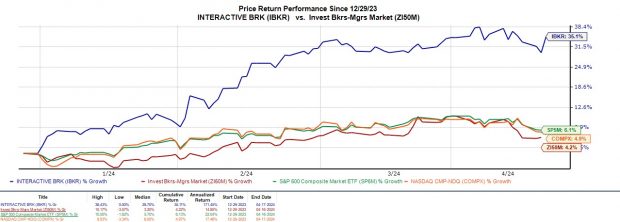

Interactive Brokers (IBKR - Free Report)

Going into its Q1 report, Interactive Brokers stock was bumped up to a Zacks Rank #1 (Strong Buy) and the global electronic market broker was able to deliver. First-quarter earnings of $1.64 per share slightly beat Q1 EPS estimates of $1.63 and climbed 21% from $1.35 a share in the comparative quarter.

Interactive Brokers beat top-line estimates by 1% with Q1 sales at $1.2 billion which was a 14% increase from a year ago. Notably, IBKR has soared +35% year to date with annual earnings now expected to rise 10% in fiscal 2024 to $6.36 per share.

Furthermore, while Interactive Brokers’ EPS is projected to slightly dip next year to $6.32, earnings estimate revisions are noticeably higher over the last 30 days for both FY24 and FY25.

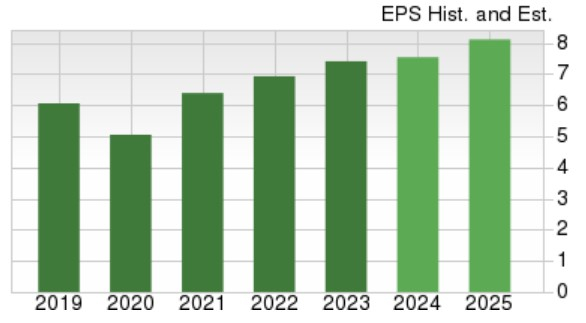

Image Source: Zacks Investment Research

Northern Trust (NTRS - Free Report)

Also standing out among the finance sector is Northern Trust which boasts a Zacks Rank #1 (Strong Buy) as well. As a leading provider of wealth management services, Northern Trust impressively exceeded its bottom line expectations with Q1 EPS at $1.70 and 15% higher than the Zacks Consensus of $1.47 a share. First quarter earnings rose 7% from the prior year quarter despite Q1 sales of $1.64 billion missing estimates by -8% and dipping from $1.74 billion last year.

Image Source: Zacks Investment Research

Still. the asset manager’s annual earnings are forecasted to rise 5% in FY24 and another 6% EPS growth is expected in FY25 with projections at $6.96 per share. More appealing is that Northern Trust’s stock trades at a reasonable 12.1X forward earnings multiple which is making the -4% YTD drop in NTRS look like a long-term buying opportunity.

FY24 and FY25 EPS estimates are up 4% and 3% in the last 60 days respectively. It’s also noteworthy that NTRS has a 3.77% annual dividend that is roughly on par with its industry average and nicely above the S&P 500’s 1.34%.

Image Source: Zacks Investment Research

Omnicom Group (OMC - Free Report)

We’ll pivot to the consumer discretionary sector for the last stock in Omnicom Group, one of the largest global advertising firms. Sporting a Zacks Rank #2 (Buy), Omnicom’s first-quarter earnings of $1.67 per share exceeded estimates by 10% and rose 7% from Q1 2023. Quarterly sales of $3.63 billion beat by 1% and rose 5% year over year...

Omnicom’s increased profitability is compelling with OMC trading at an 11.7X forward earnings multiple. Fiscal 2024 earnings are expected to increase 4% with FY25 EPS projected to rise another 7% to $8.27 per share...

Image Source: Zacks Investment Research"

TalkMarkets contributor Derek Lewis finds that This Combination Of 3 Stocks Provides Monthly Income.

"While most stocks pay quarterly dividends, investors can still construct a portfolio that allows them to get paid monthly...

The first stock pays dividends in January, April, July, and October. The second stock pays out in February, May, August, and November. And finally, the third stock will pay its dividend in March, June, September, and December.

So, investors can reap steady monthly paydays with just a little positioning.

A combination of Coca-Cola (KO - Free Report), Caterpillar (CAT - Free Report), and McDonald’s (MCD - Free Report) shares would provide precisely the blend needed for such a portfolio."

If you are interested, then my suggestion would be to take a good look at each company and pop-open the Excel and play around with what combo works best for you.

As always, Caveat Emptor.

Have a good one.

Peace.

More By This Author:

Tuesday Talk: Money And War Go Together Like...

Thoughts For Thursday: About Those Rate Cuts

Tuesday Talk: April Is The Cruelest Month?