Thoughts For Thursday: About Those Rate Cuts

The March CPI came in a little hotter than expected, derailing Fed interest rate cut forecasts and encouraging additional flight to the mega-caps.

What would you do?

Wednesday, the S&P 500 closed at 5,161, down 49 points, the Dow closed at 38,462, down 422 points and the Nasdaq Composite closed at 16,170, down 136 points.

Chart: The New York Times

Most actives were led by Tesla (TSLA), down 2.9%, followed by Advanced Micro Devices (ADM), down 2.1% and Ford (F), down 3.5%

Chart: The New York Times

In morning futures trading, S&P 500 market futures are down 14 points, Dow market futures are down 100 points, and Nasdaq 100 market futures are down 36 points.

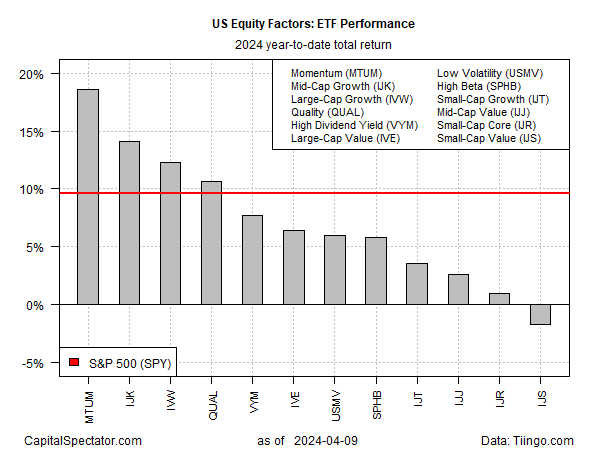

TalkMarkets contributor James Picerno takes the high road and notes Momentum Remains Top Equities Factor Performer In 2024.

"Most slices of the US equity market continue to enjoy solid gains so far in 2024, but the momentum risk factor is still the upside outlier, based on a set of ETFs through Tuesday’s close (Apr. 9).

The iShares MSCI USA Momentum Factor ETF (MTUM) is enjoying a sizzling 18.6% year-to-date rise. That’s well ahead of the broad market’s 9.6% advance (SPY) and a world above the worst equity factor performance in 2024: a 1.7% loss for small-cap value stocks (IJS).

Some of MTUM’s strong run this year may be linked to a recovery from its relatively weak performance in 2023, when the ETF underperformed the broad stock market (SPY) by a wide margin.

As for small-cap stocks, the frustration and regret rolls on. A number of analysts in recent years have flagged this slice of the market as poised to rally, but false dawns continue to endure.

“You’re taking on more risk because these companies are smaller and less established,” says Steve Sosnick, chief strategist at Interactive Brokers. “They typically do not have … bottom-line results that can be relied upon through thick and thin. That is often a real headwind for them, and unfortunately, this is one of those times.”

In the realm of what’s worked, it’s been tough to beat the broad market (SPY) from a factor perspective, with two exceptions: large-cap value (IVE) and quality (QUAL). Using the trailing 3-year window, both slices of the equities factor universe have outperformed the standard measure of US stocks."

See the full article for additional Y-T-D charts.

Contributor Stephen Innes cuts to the chase, So Much For Whispers, CPI Comes In Way Too Hot.

"According to the latest data released Wednesday by the Bureau of Labor Statistics, US consumer prices rose 3.5% over the past 12 months, with an increase in the previous month.

That's up monumentally from February's 3.2% rate and marks the highest annual gain in the past six months. And while gas and shelter costs contributed more than half of that monthly increase, prices rose in almost every major category last month, the BLS said.

Indeed, it's time for risk markets to face a reality check as the rates markets undergo harsh repricing and hopes for a June rate cut from the Fed have been dashed...

Now that the data has thoroughly shattered policymakers' dovish hopes, market participants are viewing the situation through a much less dovish lens, expecting only 50 basis points of easing for the remainder of 2024. And perhaps even that is a stretch as Fed board members may consider this outlook optimistic in light of the unexpectedly hotter price pressure.

The front end took a beating on Wednesday. Twos were cheaper by 21 basis points and threes by 22 basis points in the hours following the CPI release. It marked the most acute front-end selloff of 2024 and significantly flattened the curve.

A benign read on PCE prices later this month could offer some respite. However, with the anticipated robust advance read on Q1 GDP, the rate adjustment is expected to endure unless an unforeseen shock occurs.

The destiny of the equity rally rests on Q1 earnings season — the bedrock of fundamentals, if you may."

Always one never to miss falling stock news, contributor Michael J. Kramer writes Stocks Plunge Following Hotter CPI Report And Thinner Liquidity Levels.

"Stocks finished the day lower following the hotter CPI report. The S&P 500 was all over the place, though, trading with big swings. These swings seem to be a sign to me of a market that is becoming less liquid. We saw this a lot in 2022, especially as reserve balances held at the Fed fell.

Over the past few trading sessions, we have seen the size of the top of the book on the S&P 500 futures really start to thin out. While it is not as thin as we saw in 2022, it caught my attention enough that I thought I should point it out now, especially since we know that the Bank Term Fund Program is now unwinding, and reserve balances are likely to head lower from their current levels...

(Looking at CME Group data), the red and green bars represent the depth of the book, the wider periods represent more depth, and the smaller values show less depth. The light blue line is the S&P 500. The chart clearly shows how the depth of the book gets wider when the index rises and thinner when the index falls.

If it is the case that liquidity is leaving, and if it is the case that inflation is going to remain elevated, and if it is the case that rates and the dollar will rise and that financial conditions will tighten, then the peak in the index could very likely already be in, and the move lower may have already started."

In an In the Spotlight column Norman Mogil posits Suppose We Never Get Back To A 2% Inflation Rate.

"March headline inflation released by the BLS is running at 3.5% annualized and core inflation at 3.8%. Another month of disappointing news...The results of two years of dramatic rate increases have quelled inflation to a great extent, but not enough to reach that elusive 2% target. Simply put, monetary policy has taken too long, produced insufficient results, all the while real interest rates remain well above zero and discourage economic expansion...

So, let's suppose for a moment that inflation just never comes down to the 2%, no matter how hard a central banker works. What can be done?

- Continue on the current path. When push comes to shove, central bankers will argue that patience is required, that they are on the right path and it takes time to cool inflation; stay the course, seems to be the Fed’s and the Bank of Canada’s preferred option;

- Move the goal posts. To many monetary authorities, this is probably a heresy. Such a change is nigh impossible given the deeply embedded thinking that 2% only can be considered. Anything figure higher is tantamount to defeat. Yet, there is no theoretical basis for adopting the 2% measure, rather it is a convention and conventions should not be considered as sacred.

Raise rates until the job is done. However, economic growth is far from solid and any further hike in rates will mostly kill growth without any assurance that inflation will tumble."

TM contributor Dennis Miller is in no mood to forecast, Step Right Up, Place Your Bets, is what he says.

"Fed Chairman Powell is caught in a trap; high inflation, interest on the national debt, a stock market bubble about to burst, while “too big to fail” banks are ready to tumble. Powell is desperately trying to manipulate interest rates to keep everything from falling apart.

Powell said Congress needs, “an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path?“

No matter who is elected, forget “an adult conversation.” The cries for the Fed to “do something” will be overwhelming...

The result of “bad fiscal policy” is generally a currency and stock market collapse, hyperinflation, government default – and who knows what else.

“The people” must fend for ourselves...

John Williams at www.shadowstats.com calculates inflation as they did in the Volcker years, comparing it to today’s BLS numbers.

![CPI and ShadowStats Alternatie Inflation (1980) - Year-to-Year Percent Change - 1970 to February 2024, Not Seasonally Adjusted [ShadowStats, BLS]](https://milleronthemoney.com/wp-content/uploads/2024/04/ShadowStats-chart-recession-alternative.jpg)

“Charade” is an understatement. Powell’s 2% inflation target would have been 8-10% in the Volcker years."

There is more to read in the full column and it's not encouraging, per se.

To close out the column today let's take a look at what the "smart money" is doing. Contributor Tyler Durden reports Goldman Is "Taking Profits On Tech & Moving To Other Sectors".

"'Sell, Mortimer, sell!' That seems to be the message (our translation) from Goldman Sachs Asset Management (GSAM), who told Bloomberg today that they are taking profits from high-flying technology shares and putting the money into cheaper companies.

“We like taking profits on technology and moving toward other sectors,” Alexandra Wilson-Elizondo, co-chief investment officer of multi-asset solutions said in a phone interview. The firm believes tech shares will come under pressure and prefers areas like energy and Japanese shares.

In the tech industry, “the risk-reward profile is skewed to the downside,” she added.

“While we still believe in being long equities and having them in the portfolio, we think that there are some more attractive opportunities to access.”

We wouldn't argue with them, as valuations on the US Tech sector are 'high' to say the least (and seemingly at a historically crucial resistance level).

Source: Bloomberg

GSAM is holding an overweight position on energy shares as a hedge against inflation and geopolitical risks, said Alexandra Wilson-Elizondo. That has been a good trade year-to-date.

Source: Bloomberg

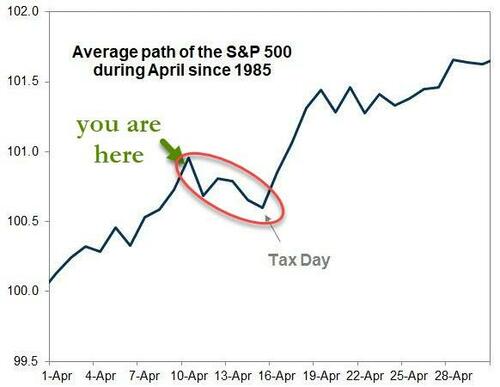

She said they’re still cautious on utilities and REITs, as well as small-caps because of their sensitivity to high-interest rates. And, finally, as we previously noted, this time of the year is a seasonally weak period into Tax Day."

Source: Goldman Sachs

That's wrap for now.

Have a good day.

Peace.

Rosana Schmidt

More By This Author:

Tuesday Talk: April Is The Cruelest Month?

Tuesday Talk: Big-Tech Under Attack

Thoughts For Thursday: The Fed Is In The House