Goldman Is "Taking Profits On Tech & Moving To Other Sectors"

Image Source: Unsplash

'Sell, Mortimer, sell!' That seems to be the message (our translation) from Goldman Sachs Asset Management (GSAM), who told Bloomberg today that they are taking profits from high-flying technology shares and putting the money into cheaper companies.

“We like taking profits on technology and moving toward other sectors,” Alexandra Wilson-Elizondo, co-chief investment officer of multi-asset solutions said in a phone interview. The firm believes tech shares will come under pressure and prefers areas like energy and Japanese shares.

In the tech industry, “the risk-reward profile is skewed to the downside,” she added.

“While we still believe in being long equities and having them in the portfolio, we think that there are some more attractive opportunities to access.”

We wouldn't argue with them, as valuations on the US Tech sector are 'high' to say the least (and seemingly at a historically crucial resistance level).

Source: Bloomberg

Additionally, the AI-bubble has stalled in the last month.

Source: Bloomberg

This rings true for the 'Magnificent 7' basket of stocks as well.

Source: Bloomberg

GSAM is holding an overweight position on energy shares as a hedge against inflation and geopolitical risks, said Wilson-Elizondo. That has been a good trade year-to-date.

Source: Bloomberg

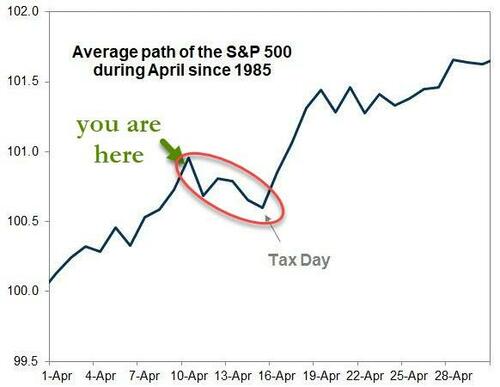

She said they’re still cautious on utilities and REITs, as well as small-caps because of their sensitivity to high-interest rates. And, finally, as we previously noted, this time of the year is a seasonally weak period into Tax Day.

Source: Goldman Sachs

As we also detailed previously, given the massive gains many saw, perhaps the effect will be even larger this year?

More By This Author:

Pump-Prices Surge To 6-Month Highs Ahead Of CPI, Crude Inventories See Another Build

Ugly 3Y Auction Tails The Most In Over A Year As Foreign Buyers Flee Ahead Of CPI

Bitcoin & Bullion Back Near Record Highs As Rate-Cut Bets Battered

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more