3 Top Rated Stocks To Buy After Q1 Earnings Beat Estimates

Several top-rated Zacks stocks are starting to look more attractive after reporting favorable first-quarter results on Tuesday.

Reconfirming their attractive earnings outlook, these companies were able to surpass Q1 bottom line expectations making now a suitable time to invest.

Interactive Brokers (IBKR - Free Report)

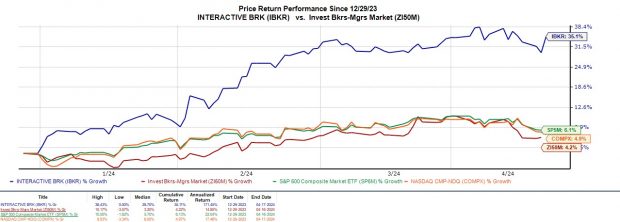

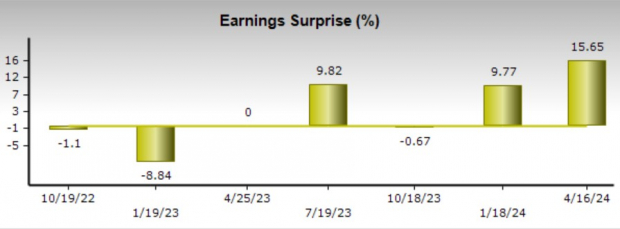

Going into its Q1 report, Interactive Brokers stock was bumped up to a Zacks Rank #1 (Strong Buy) and the global electronic market broker was able to deliver. First-quarter earnings of $1.64 per share slightly beat Q1 EPS estimates of $1.63 and climbed 21% from $1.35 a share in the comparative quarter.

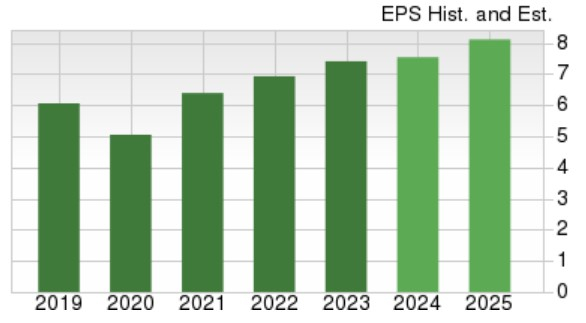

Interactive Brokers beat top-line estimates by 1% with Q1 sales at $1.2 billion which was a 14% increase from a year ago. Notably, IBKR has soared +35% year to date with annual earnings now expected to rise 10% in fiscal 2024 to $6.36 per share.

Furthermore, while Interactive Brokers’ EPS is projected to slightly dip next year to $6.32, earnings estimate revisions are noticeably higher over the last 30 days for both FY24 and FY25.

Image Source: Zacks Investment Research

Northern Trust (NTRS - Free Report)

Also standing out among the finance sector is Northern Trust which boasts a Zacks Rank #1 (Strong Buy) as well. As a leading provider of wealth management services, Northern Trust impressively exceeded its bottom line expectations with Q1 EPS at $1.70 and 15% higher than the Zacks Consensus of $1.47 a share. First quarter earnings rose 7% from the prior year quarter despite Q1 sales of $1.64 billion missing estimates by -8% and dipping from $1.74 billion last year.

Image Source: Zacks Investment Research

Still. the asset manager’s annual earnings are forecasted to rise 5% in FY24 and another 6% EPS growth is expected in FY25 with projections at $6.96 per share. More appealing is that Northern Trust’s stock trades at a reasonable 12.1X forward earnings multiple which is making the -4% YTD drop in NTRS look like a long-term buying opportunity.

Plus, FY24 and FY25 EPS estimates are up 4% and 3% in the last 60 days respectively. It’s also noteworthy that NTRS has a 3.77% annual dividend that is roughly on par with its industry average and nicely above the S&P 500’s 1.34%.

Image Source: Zacks Investment Research

Omnicom Group (OMC - Free Report)

We’ll pivot to the consumer discretionary sector for the last stock in Omnicom Group, one of the largest global advertising firms. Sporting a Zacks Rank #2 (Buy), Omnicom’s first-quarter earnings of $1.67 per share exceeded estimates by 10% and rose 7% from Q1 2023. Quarterly sales of $3.63 billion beat by 1% and rose 5% year over year.

Omnicom’s increased profitability is compelling with OMC trading at an 11.7X forward earnings multiple. Fiscal 2024 earnings are expected to increase 4% with FY25 EPS projected to rise another 7% to $8.27 per share. Omnicom’s stock is down -2% YTD but earnings estimate revisions for both FY24 and FY25 have remained modestly higher over the last 60 days. Plus, OMC offers a 3.08% annual dividend yield to bolster its steady expansion and enticing valuation.

Image Source: Zacks Investment Research

Bottom Line

The positive trend of rising earnings estimate revisions looks likely to continue for these top-rated stocks after exceeding their Q1 bottom-line expectations. Interactive Brokers, Northern Trust, and Omnicom’s stock should also be viable investments for 2024 and beyond making now an ideal time to buy.

More By This Author:

Nucor To Report Q1 Earnings: What's In The Cards?3 Must-Buy Funds With Retail Sector Staging Solid Rebound

4 Stocks To Buy From The Booming Water Supply Industry

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more