This Combination Of 3 Stocks Provides Monthly Income

Image Source: Pixabay

While most stocks pay quarterly dividends, investors can still construct a portfolio that allows them to get paid monthly.

How? Let me explain –

The first stock pays dividends in January, April, July, and October. The second stock pays out in February, May, August, and November. And finally, the third stock will pay its dividend in March, June, September, and December.

So, investors can reap steady monthly paydays with just a little positioning.

A combination of Coca-Cola (KO - Free Report), Caterpillar (CAT - Free Report), and McDonald’s (MCD - Free Report) shares would provide precisely the blend needed for this portfolio. Let’s take a closer look at each one.

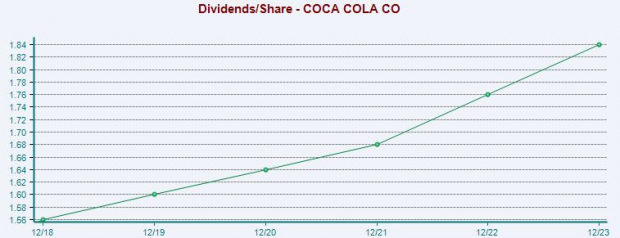

Coca-Cola

Coca-Cola is an American multinational corporation best known for its flagship Coca-Cola beverage. The company has seen its earnings outlook for its current and next fiscal year drift higher as of late, helping land the stock into a Zacks Rank #2 (Buy).

Reflecting an unparalleled commitment to shareholders, KO is a Dividend Aristocrat, a title held by companies with a minimum of 25+ consecutive years of increased payouts. Currently, Coca-Cola’s dividend yields 3.3% annually, nicely above the Zacks Consumer Staples sector average of 3.1%.

The company’s shareholder-friendly nature is illustrated below.

Image Source: Zacks Investment Research

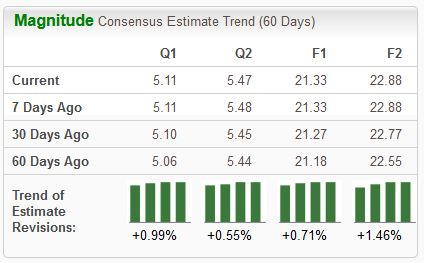

Caterpillar

Caterpillar is the world’s largest construction equipment manufacturer. We see its iconic yellow machines at nearly every construction site. The company’s earnings outlook has inched higher across the board, reflecting optimism among analysts.

Image Source: Zacks Investment Research

Like KO, the company is a member of the elite Dividend Aristocrats group, with shares currently yielding 1.4% annually. While the current yield may be on the lower end, Caterpillar’s 6.8% five-year annualized dividend growth rate picks up the slack.

Image Source: Zacks Investment Research

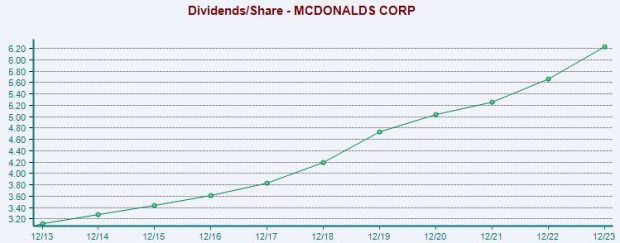

McDonald’s

We’re all familiar with the restaurant titan McDonald’s, seeing those golden arches at seemingly every stop. Analysts have become bullish on the company’s current year outlook, with the $12.34 Zacks Consensus EPS estimate up nearly 3% over the last year and suggesting 3.3% growth.

Image Source: Zacks Investment Research

MCD shares presently yield 2.5% annually paired with a payout ratio sitting at 56% of the company’s earnings. Dividend growth has been solid, with MCD sporting a 7.4% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

Investors love dividends, as they provide a nice buffer against the impact of drawdowns in other positions and provide a passive income stream.

And while most companies pay their dividends on a quarterly basis, investors can construct a portfolio that allows for monthly payouts with just a bit of positioning.

For those interested in this type of portfolio, the combination of all three stocks above – Coca-Cola, Caterpillar, and McDonald’s – would provide the necessary blend needed.

More By This Author:

3 Quarterly Releases To Watch Next WeekBear Of The Day: Boeing

3 Tech Stocks To Buy For Passive Income