Thoughts For Thursday: A CPI High

The 2021 CPI came in at 7%, it hasn't been that high in 40 years. Of course there hasn't been a world pandemic like the one we're experiencing in 100, no, 102 years now, and the world supply-chain has never been so closely coupled in history than it is now. Furthermore, rarely have governments in developed economies provided so much stimulus in the form of cash to its citizens, (in addition to the U.S., Israel is another example). Supply and demand issues are bound to surface in light of such events. While the markets look for new moves and tricks (like stock memes) to dance higher out of this disruption, governments would be wise to look for more tangible ways to "WIN" (Whip Inflation Now).

Trying hard to make the most of a bad thing, the market ended the day in positive territory after sloshing around in a negative puddle in the second hour of trading. The S&P 500 closed at 4,726, up 13 points, the Dow Jones Industrial Average closed at 36,290, up 38 points and the Nasdaq Composite closed at 15,188, up 35 points. In early morning trading market futures are splashing around in shallow pools of both red and green. S&P futures are trading up 1.5 points, Dow futures are trading down 2 points and Nasdaq 100 futures are trading up 10 points.

The most actives in Tuesday's trading session were across sectors and all large cap issues.

Chart: The New York Times

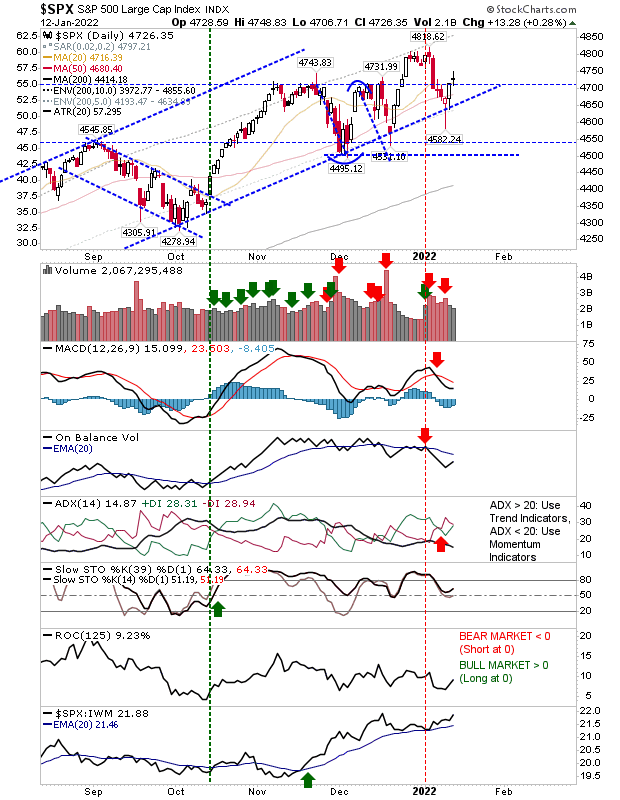

TalkMarkets contributor and chart maven Declan Fallon provides these insights to yesterday's market action in Relief Rallies Stall For Now.

"Today's candlesticks are not great but are more neutral in tone than outright bearish...For the Nasdaq (QQQ), we had a bearish 'black' candlestick below all key moving averages. Supporting technicals are all bearish and there hasn't been enough of a recovery in relative performance to suggest this bounce can last much longer. "

"The S&P (SPY) finished the day with a doji just above major support of 4,700. The candlestick is neutral but after the gains from the start of the week it's a little disappointing. The index is outperforming both the Nasdaq and Russell 2000 although technicals are mixed with stochastics/momentum still on the bullish side of the fence."

"For tomorrow, a close above today's highs would negate the neutral outlook for the indices. A close below today's lows would bring more pressure on the recovery - particularly for the Russell 2000 which already took a significant hit today (Tuesday)."

See the full article for the Russell 2000 (IWM) chart.

Contributors on the Staff at Bespoke Investment Group ask Another CPI Spike… Now What?

The authors note that "there have only been four other periods since 1950 that y/y CPI reached 7.0% or more (1951, 1973, 1977, 1978)" and their article takes a visual look at how that has played out in the market each time. While providing a historical backdrop as well as data points as to how this has played out in the market in the past I found the following observation to be particularly informative:

"As you can see from the charts...the S&P 500 has acted differently each time (the) CPI topped 7.0% on a Y/Y basis."

The article goes on to note that, "In the early 1950s, when the elevated level of inflation was short-lived, equities, which were already near 52-week highs, performed fine. In the 1970s, though, when inflation was more entrenched, the backdrop for equities was negative."

We are close to halfway through the first month of the year and that means we are at peak time for 2021 lookbacks and 2022 lookaheads.

In a TalkMarkets "Editor's Choice" column, contributor Lance Roberts posits about Speculative Mania – Was 2021 The Peak? It is an interesting and fairly long piece, so I will only note a few choice observations, here.

"Speculative is a word that aptly sums up the year 2021. The question that remains, however, is whether we have seen the peak in that speculative behavior, or will 2022 continue the trend?...many of the headwinds that supported the ramp in speculative behaviors have, or will, reverse in the months ahead. To wit:

- Tighter monetary policy, and high valuations.

- Less liquidity globally as Central Banks slow accommodation.

- Less liquidity in the economy the previous monetary injections fade.

- Higher inflation reduces consumption

- Weaker economic growth

- Weak consumer confidence due to inflation

- Flattening yield curve

- Weaker earnings growth

- Profit margin compression

- Weaker year-over-year comparisons of most economic data."

"While not a direct measure of speculative activity, share buybacks hit a record last year as companies rushed to improve bottom-line EPS reports."

"Another sign of excess speculation has been a record flood of liquidity into global equity funds over the last 18-months. Since the 2020 pandemic-driven economic shutdown, roughly $1.3 trillion in capital flowed into equity funds globally."

"In 2021, demand for products was exceedingly strong, from ESG funds to electric vehicles, disruptive technologies, and cryptocurrencies. So if Wall Street could not get the company to market using a traditional IPO (initial public offering) process, a SPAC (Special Purpose Acquisition Company) was a quick way to get it done."

"The best measure of speculation in the market, in my opinion, is the number of people willing to pay more than 10x price-to-sales for an investment. But what about 20x? Kailash Capital recently showed an increase in the market capitalization of stocks with price-to-sales ratios greater than 20x."

See Roberts' full article for more scary stuff.

And Just Like That 2022 is the title of contributor Tea Muratovic's article where she looks to the entertainment industry and particularly streaming media to brighten the New Year:

"The entertainment industry has stepped up to help us forget our sorrows and enticed us to the front row by bringing different content to the big screen...We can see with our own eyes that the COVID-19 pandemic accelerated the streaming entertainment trend. However, there is also another fact: demand for entertainment content has historically been relatively resilient, even during periods of economic uncertainty and downturn."

Two industry picks Muratovic likes for 2022 are Netflix (NFLX) and Tencent (TCEHY).

"Looking at the seasonal chart of Netflix, I can conclude that over the past 15 years it has entered into a strong seasonal period from January 15 to February 17. In that time span of only 23 trading days, shares rose on average by a spectacular 20.89%...the pattern returns in this time frame have been consistent and positive since 2007. There has been just one outlier year during this period, in 2016 when the stock posted a loss of 8.92%."

Pattern return for Netflix every year since 2007

"Tencent Holdings definitely holds place in the front row as China’s biggest technology and media conglomerate...over the past 10 years there is a strong seasonal tendency from January 3 to February 19. In this time span of 32 trading days, shares rose on average by 12.15%. Moreover, the pattern returns in that period have been consistent and positive since 2012, with just one outlier year in 2016."

Seasonal pattern of Tencent Holdings over the past 10 years

Two possible picks for the day traders among us, in any case.

Big Pharma and BioTech were both market champions and public health champions in 2021. Contributor Timothy Taylor in another TalkMarkets "Editor's Choice" article US Pharmaceuticals: A Bifurcated Market takes a look at why branded drugs manufactured by American pharmaceutical companies cost much more in the U.S. than in many places abroad, while generic drugs can cost less.

"The US pharmaceutical industry faces two important goals–which conflict with each other. One goal is to provide needed drugs at the lowest possible price. The other is to provide incentives for research and development of new drugs, which requires some form of compensation for the risks of undertaking such efforts. The US patent system allows inventors to have a temporary monopoly on their discovery, so that they can charge higher prices for a time. After the patent expires, it then becomes legal for others to produce generic equivalents. The result is a two-part market for US pharmaceuticals: expensive drugs still under patent and inexpensive generic drugs."

"A common complaint about the US pharma industry is that brand-name drugs sell for more in the United States than in other countries, which often impose price controls and other rules on drugs from US firms. What is less-heard is that prices for generic drugs are typically lower in the United States...When adjusted for manufacturer discounts (“net pricing correction”), branded drugs cost about twice as much in the US as in Japan, Germany, and the UK. However, generic drugs in the US cost about one-third less than Germany and the UK, and less than half as much as in Japan."

Taylor includes these eye-opening charts:

The data in this second chart really jumps out at you.

"When adjusted for manufacturer discounts (“net pricing correction”), branded drugs cost about twice as much in the US as in Japan, Germany, and the UK. However, generic drugs in the US cost about one-third less than Germany and the UK, and less than half as much as in Japan."

One needs a cup of herbal tea to relax after looking at those numbers.

Channeling the idea that the markets in 2022 are likely to provide returns less stellar than 2021 the team at Zacks Equity Research chooses 3 Technology Mutual Funds That Should Be On Your Radar. All three funds seek long term appreciation.

Image: Bigstock

"T. Rowe Price Global Technology Fund (PRGTX), Fidelity Select Technology Portfolio (FSPTX), and BlackRock Technology Opportunities Fund Investor A Shares (BGSAX). Each has earned a Zacks Mutual Fund Rank #1 (Strong Buy) and is expected to outperform peers in the future."

Abbreviated fund descriptions are noted below. See the full article for more details.

"T. Rowe Price Global Technology Fund aims for long-term capital growth. PRGTX invests most of its assets in the common stocks of companies that...will generate the majority of their revenues from the development, advancement and use of technology...(it) invests about one-fourth of its assets in non-U.S. companies...(The fund) has three-year annualized returns of 38.4%."

Fidelity Select Technology Portfolio fund aims for capital appreciation. FSPTX invests primarily in equity securities, especially common stocks of companies engaged in offering, using or developing products, processes or services that will provide or benefit significantly from technological advances and improvements...(The fund) has three-year annualized returns of 39.7%.

BlackRock Technology Opportunities Fund Investor A Shares aims for long-term capital appreciation. BGSAX invests the majority of assets in equity securities issued by domestic as well as foreign technology companies across all market capitalization ranges...(The fund) has three-year annualized returns of 40.1%. As of the end of November 2021, BGSAX held 135 issues with 4.77% of its assets invested in Apple Inc."

Caveat Emptor.

That's a wrap for this Thursday morning.

Have you had yours?

Have a good one!

Excellent info and great charts. Thank you David Marshall!