Relief Rallies Stall For Now

No surprise given the selling which has come before that the nascent rallies now find themselves moving into areas of prior supply. Today's candlesticks are not great but are more neutral in tone than outright bearish.

For the Nasdaq, we had a bearish 'black' candlestick below all key moving averages. Supporting technicals are all bearish and there hasn't been enough of a recovery in relative performance to suggest this bounce can last much longer.

The Russell 2000 had managed over the latter part of December to make up some lost ground against the Nasdaq, but today's bearish cloud cover means its once again underperforming relative to the Nasdaq. If the triple bottom around $212 ($IWM) is lost then it could get ugly for this index.

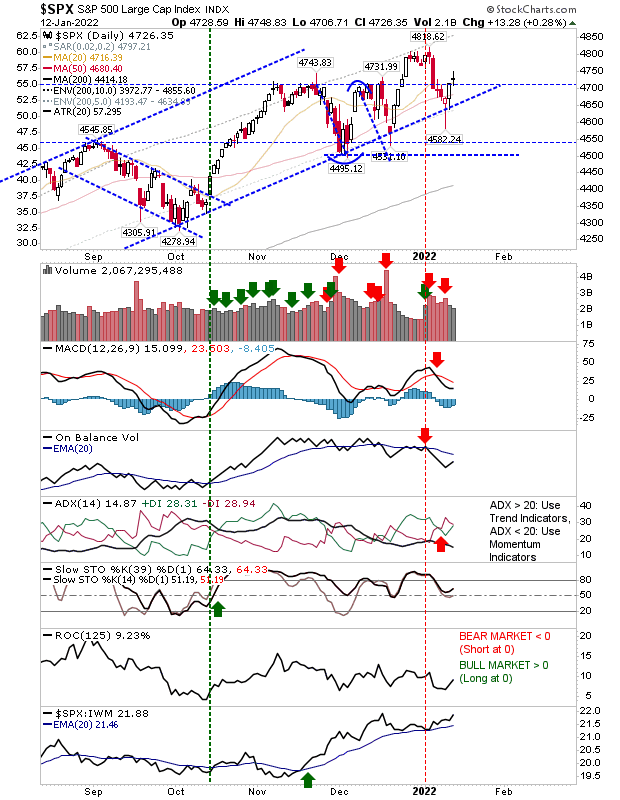

The S&P finished the day with a doji just above major support of 4,700. The candlestick is neutral but after the gains from the start of the week it's a little disappointing. The index is outperforming both the Nasdaq and Russell 2000 although technicals are mixed with stochastics/momentum still on the bullish side of the fence.

For tomorrow, a close above today's highs would negate the neutral outlook for the indices. A close below today's lows would bring more pressure on the recovery - particularly for the Russell 2000 which already took a significant hit today.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more