TalkMarkets Tuesday Talk: The Higher You Go, The Harder You Fall?

The Dow Jones closed 1.7% higher on Monday with the Nasdaq and the S&P 500 following close behind at 1.13% and 1.2%, respectively. The Dow at 27,572, is up about 8% from a week ago when it stood at 25,475. As kids quickly learn playing on the see-saw in the playground and to paraphrase a famous Jimmy Cliff song, the higher you go, the harder you fall. How high will the market go and when will it fall are two questions on the minds of many this morning. Here's what some TalkMarkets contributors have to say:

Michael J. Kramer in his article, A Stock Market Reversal May Be Closer Than You Think, is clearly very concerned that the market will fall.

He begins by noting that, “The comeback for the market has been somewhat unusual, and surprising given the economic backdrop and lack of clarity around just how long it will take for the economy to recover.”

Looking at the S&P chart below, Kramer has the following to say:

“…the S&P 500 reached 3230 and now finds itself with an RSI of almost 75. While I was more than happy to support the rally in the market since mid-May, with great caution, I am no longer supportive of this rally and feel it is ready to pop at a moment’s notice. There may be another 1% more to the upside, but at this point, this market is overbought by a wide margin, and Wednesday could mark a critical turning point from the Fed meeting.”

I imagine that trading in the market today will reflect the anticipation surrounding the Fed meeting on Wednesday. Michael Kramer also notes that Nasdaq 100 stocks, “are also overbought and are very close to completing the rising wedge pattern, I have identified. Again, it may only be a matter of time before the market turns sharply lower.” See the chart in his article.

In particular some of the stocks that he believes could tumble sometime soon are, Apple (AAPL), Nvidia (NVDA), Home Depot (HD) and Shopify (SHOP). All charted in the article, as well.

In a highly detailed and well researched piece, 20/20 Economic Projections Will Leave Everyone Disappointed, TalkMarkets contributor, Lance Roberts says that expectations for a “v-shaped” economic recovery are likely to leave everyone disappointed. In this he squares against Federal Reserve Vice Chairman Richard Clarida, who he quotes as saying in a CNSBC interview that “a third-quarter rebound is one possibility. That is personally my baseline forecast.” and says that Clarida’s statement inspired him to dig deep.

The quarterly GDP chart below is what a perfect “v” recovery of the current economy would look like.

Roberts created the chart assuming “… the Atlanta Fed is correct in its current assessment, Q2-GDP will be down more than 50% on an annualized basis. We will also assume the mainstream media analysis is correct of a V-shaped recovery. In this case, we will assume optimistic projections of a 30% recovery in Q3 and an additional 20% in Q4.”

But there a more than a few problems with this view, “The first problem with these assumptions is that there are no previous periods in history to which we can refer to. All of these projections simply dwarf any other period of decline or recovery going back to 1947. More importantly, for the economy to return to pre-pandemic levels, there will need to be a vaccine widely available.”

And further down the page, Roberts writes, “the “return to economic normality” faces immense challenges. High rates of unemployment, suppressed wages, and elevated debt levels, makes a “V-shaped” recovery unlikely.

He notes that the Congressional Budget Office, seems to take a view much more in line with his and the math that supports it:

“While my projections are a bit more optimistic than the CBO, the shape and duration of the recovery are similar and push out full recovery until 2030.”

Robert Lance’s article is almost, must reading.

Gene Inger, in his Daily Market Briefing For Tuesday, June 9, a TalkMarkets exclusive, notes that despite having predicted both the March 23, market bottom and the current rebound due to as he says “a Fed Crutch”, which he defines as “a less patronizing way for Wall Street to describe a few months of incredible ease and funding”, there is no reason to think that the market will go higher at its current rate. In fact he notes that bearish pundits turning bullish is as good a warning signal as any.

The Fed’s action “was the basis for opposing all the naysayers (among them some of the best known analysts, managers, or the Wall Street strategists, the majority of) which were bearish on extending the run. Now you have more unanimity of accepting the upside, which increases risks of a topping process as the S&P climbs the worry wall.”

Contributor Bob Lang in, Why The Stock Market Predicts Economic Data Will Improve, takes a firmly bullish stance. He says that “the stock market is forward-looking, and as far as its performance as an indicator goes, it’s right most of the time.”

Lang says the market has clearly discounted the bad economic situation, largely due to the Fed’s action, and in fact is already looking beyond the November elections and into 2021.

“So far in 2020, the SPX 500 is down just 4% (through June 4) and the Nasdaq is higher by 10%. These are truly stunning moves after such a severe market crash. They seem to indicate a belief that the economy will get better faster than anyone believes.”

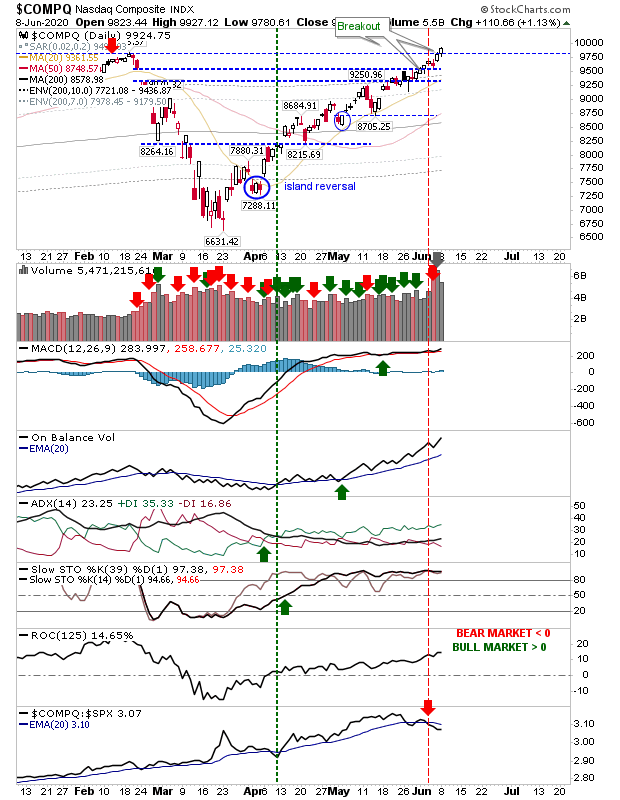

Declan Fallon writing in his blog post, Nasdaq Breakout gives a straightforward take on the market at the start of the week by looking at the charts.

He notes that “Today’s (Monday’s) gains were small but they were enough to see a breakout in the Nasdaq. Buying volume was down on yesterday's (Friday’s) but heavier than usual.”

Fallon notes that the S&P 500 (SPY) and the Russell 2000 (IWM) showed similar bullish technical strength yesterday.

“…on today's (Monday’s) action. I suppose the main thing was that there was no divergence in primary indices.”

The American author, John Steinbeck wrote, “In early June the world of leaf and blade and flowers explodes, and every sunset is different.”

Perhaps we should expect that for this week’s market closes, as well. Have a good week.

MOST unfortunately this analysis seems to be reasonable and totally believable. That does seem like rather bad news.

So I am really hoping that somehow the analysis has missed some detail and is incorrect. Hope, not believe.

I'd agree with that assessment unfortunately.