TalkMarkets Tuesday Talk: Optimism Advancing On Turkeys

Optimism continues to advance in the market as we approach the Thanksgiving holiday. Boosted by the the AstraZeneca vaccine news, US markets closed higher on Monday. Encouraged by the GSA release of Presidential transition funds post-close, Tuesday market futures are trading in the green. On Monday the Dow Jones Industrial Average rose 328 points, closing at 29,591. The S&P 500 closed at 3,578, up 20 points; while the Nasdaq 100 rose 36 points to close at 11,905. Dow futures are currently at 29,854, S&P 500 futures at 3,603 and Nasdaq 100 futures are at 11,937.

TalkMarkets contributors are taking stock across the spectrum on a variety of topics as the Thanksgiving holiday draws near. Nelson Alves writing in Framing The Macro Scenario For The Post-COVID-19 World, a TalkMarkets Editor's choice column, looks at major indicators and finds that they stack up to a positive outlook going forward.

"Now that there seems to be a vaccine on the way, we should make some considerations about the current market environment. There is one wrong assumption that most market pundits have about the current economic landscape. I am referring to the consideration that GDP and CPI figures are roughly correct approximations for economic growth and inflation, respectively. They aren’t... The pandemic brought even more digitalization that does not have a proper reflection in the current statistics. The inflation is likely to be even lower than the current already low figures due to unaccounted productivity gains.

The confluence of these two factors justifies a fast recovery. First, the economic figures may not be as bad as perceived in the media, and second, the low inflation will likely be a fertile ground for further stimulus, perhaps, even before the inauguration ceremony. "

Alves while cautioning with regard to overheated pockets in the market notes the following:

"Looking ahead, the new administration will likely push for more stimulus, which guarantees an expansion of the monetary mass against a roughly fixed supply of gold. I’m still playing this with miners like Barrick (GOLD) and Kinross (KGC), which I believe are well-positioned to take advantage of the advance in the price of gold."

"One sector where I would argue that there is value is in genomics. The health sector went through a tough time during and after the 2016 election, underperforming the S&P 500 by a wide margin... Illumina (ILMN), one of the main contributors to the development of the sector, is trading at 44 times 2019 earnings (although earnings are likely to shrink in 2020). That’s a far cry from stay-at-home stock valuations. Another interesting name is Vertex Pharmaceuticals (VRTX) trading at just 22 times forward earnings. The company is poised to resume earnings growth this year."

A good read with charts as validation points for the optimism.

Looking at the recovery across the pond in Europe, Carsten Brzeski in Germany: Strong In The Rearview Mirror But Obstacles Ahead, finds that the German economy recovered nicely in the third quarter, but the continued rise in COVID-19 cases continues to wreak havoc and Brzeski cites concern of a possible double-dip recession due to expected additional lockdown measure to be taken by the German government this week.

.jpg/1200px-17_20_pm_(570903628).jpg)

"...the extension of the lockdown will make a double-dip, ie a contraction of the economy, in the final quarter of the year inevitable. The only hope for the economy to avoid a contraction comes from a surprisingly strong manufacturing and export sector. However, with more precautionary savings, an even higher risk of companies going out of business, and the currently discussed option of closing factories during the last two weeks of the year, all do not bode well for the short-term outlook...the old saying that things will first get worse before they get better doesn't only apply to the current state of the German national soccer team but also to the entire economy."

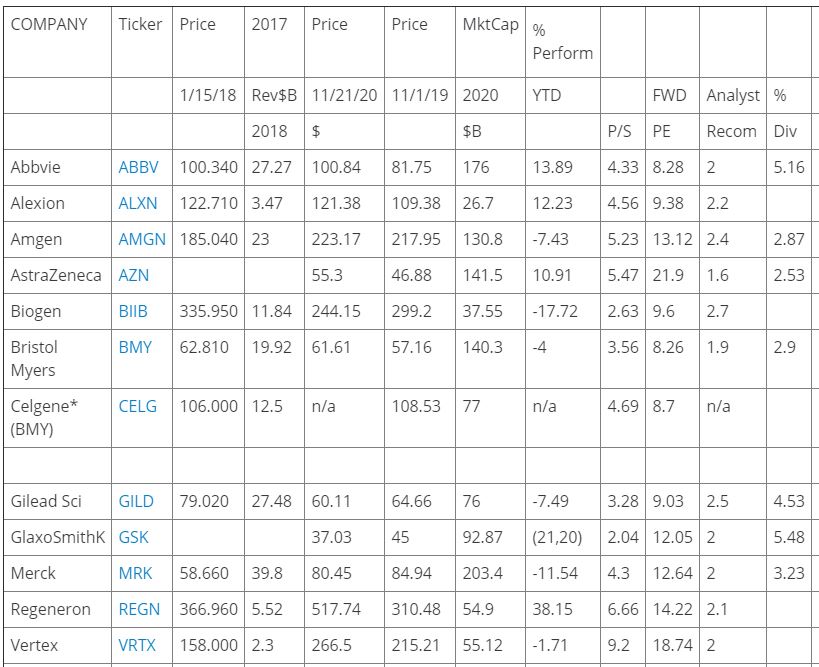

Closer to home and on the heels of all the good news about COVID-19 vaccines, TalkMarkets contributor Rod Raynovitch takes a look a look at how the Pharma sector scored in Q3 in his article Large Cap Biopharma Performance And Metrics Q3 2020; ETFs Are Winners. Overall Raynovitch is positive on the sector. Below are his main takeaways and his chart of how companies stack up currently:

- "The best portfolio bet in 2020 for non-traders would have been the IBB up 15% YTD or even the Fidelity Biotechnology Fund (FBIOX) up 25%.

- For aggressive portfolios and as we have commented on many times the XBI up 32% YTD is the best trade but volatile on down NASDAQ days.

- Laggards in 2020 are Biogen (BIIB) and Gilead Sciences (GILD) for good reasons.

- Bristol-Myers Squibb (BMY) is still assimilating the Celgene acquisition so another laggard.

- AstraZeneca (AZN) is a favorite from analysts for EPS growth in 2021 and also has a COVID vaccine candidate.

- And of course, the Nasdaq-100 (QQQ) ETF up 36% leads all popular ETFs in 2020"

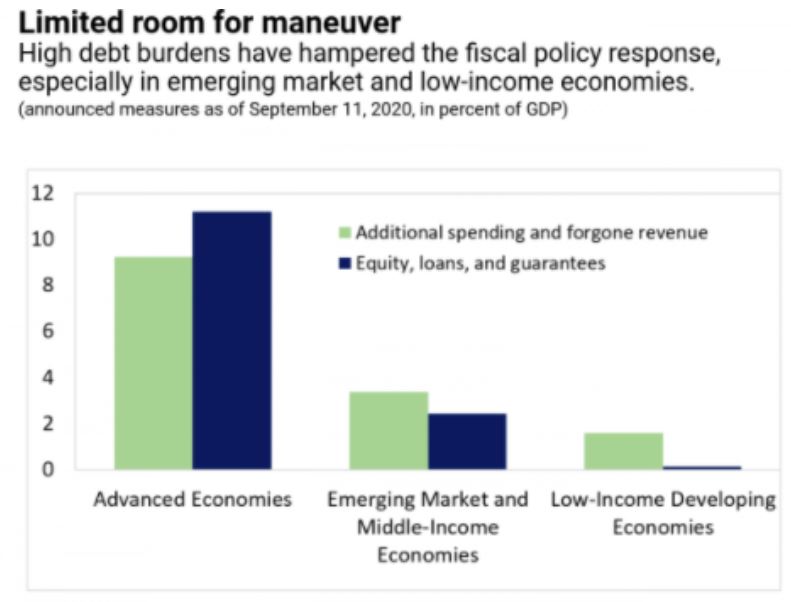

Arthur Donner in an exclusive for TalkMarkets, Recovering From The Recession Will Be Difficult For The Emerging And Low-Income Countries states what may perhaps be obvious to many, but certainly bears repeating:

"Because of the severity of the pandemic recession, massive central bank financing was required to support the huge expansion of government debt. Coming out of the recession it will be far more difficult for the emerging markets, low-income countries than for the advanced economies. The reason is that the emerging market countries were unable to provide the same level of support as the wealthier countries."

Donner includes the following chart which illustrates the dichotomy between advanced and emerging market economies.

Just in time for the holiday Jill Mislinski has a current world stock market update for readers, World Markets Update - Monday, Nov. 23 shows where the major exchanges are year to date. Mislinski reports that, "Four of eight indexes on our world watch list posted YTD gains through November 23, 2020. The top performer is China's Shanghai with a gain of 11.95%. Our own S&P 500 is in second with a gain of 10.73% and in third is Tokyo's Nikkei 225 with a gain of 7.91%. Coming in last is London's FTSE 100 with a loss of 16.02%."

Below is the chart and table of eight world indexes 2020 YTD.

As of this writing it appears that Trump may be on the cusp of conceding the election to Joe Biden. In that vein, I leave you with this short quote from the President-elect.

“It’s time to reach deep into the soul of this country and once again give everyone — and I mean everyone — the opportunity to achieve the impossible.”

Happy Thanksgiving.

Some interesting articles and interesting thinking as well. There will be a recovery and it may be rapid if it is not slow and drawn out. I can agree with that, although I am not even certain that there will be a real recovery so that business approaches what we had "before."

And a VERY ALARMING suggestion for caution comes from a Bible scholar friend. That is a warning that these years may be "the last times" as described in the book of Revelation in the Christian Bible.

I am not sure what I think about that warning.

But if the world does end, nothing we can do to stop it, and so carry on as if it will not end. And then, if it does not end, well, one would be prepared for the post-pandemic-period, where the world does not end as predicted.