Recovering From The Recession Will Be Difficult For The Emerging And Low-Income Countries

Because of the severity of the pandemic recession, massive central bank financing was required to support the huge expansion of government debt. Coming out of the recession it will be far more difficult for the emerging markets, low-income countries than for the advanced economies. The reason is that the emerging market countries were unable to provide the same level of support as the wealthier countries.

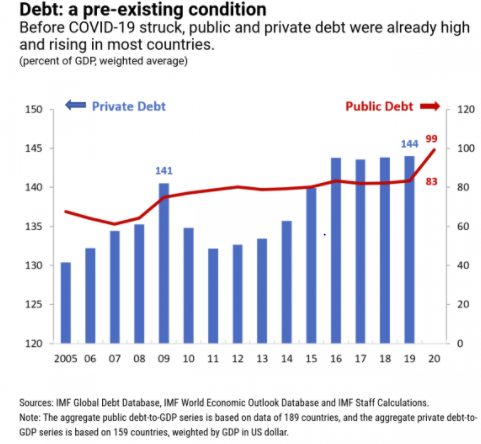

The pandemic recession has triggered a huge escalation in public and private debt across the advanced economies.

Normally such a massive build-up in debt would upset the financial markets. But in many cases, these are not normal times and central bank financing has filled the gap in Europe and North America.

Complicating matters, public and private sector debts were already high before the pandemic struck this year, and of course, central bank interest rates were already extremely low when the pandemic began.

Since the start of this year in most advanced economies as well as some of the emerging market economies, central bank purchases of additional government borrowing helped maintain interest rates at historic lows and supported large scale government borrowing

However, in many highly indebted emerging market and low-income countries, the financial markets provided their governments with very limited opportunities to increase borrowing. As one of the following charts illustrate, the emerging market countries have not been able to provide the same level of fiscal support during the pandemic as the advanced economies.

The less developed countries have always had a more limited ability to finance their government deficits than the advanced countries.

As a result, the emerging market countries did not have the fiscal room to scale up their borrowing as much as the advanced countries, and thus they were not able to provide as much fiscal support for their economies during the pandemic.

This is the principal reason why the advanced economies are expected to recover from the current economic downturn earlier and more strongly than the low income, emerging market countries.

The US themselves has dropped the ball lately, on offering some economic relief to its citizens.

Quite an accurate summary of the actual situation, I would say. And unfortunately it looks like accurate bad news, not good news at all. While some countries will be recovering faster than others, it will still be quite a while.

All of that debt will certainly slow the recovery a bit, no way around that this time.