Framing The Macro Scenario For The Post-COVID-19 World

- Most market pundits take GDP and inflation statistics at face value. They shouldn’t.

- Likely, the economic scenario is more benign than anticipated.

- That leaves us looking for pockets of value in a market populated with overstretched valuations.

Now that there seems to be a vaccine on the way, we should make some considerations about the current market environment. There is one wrong assumption that most market pundits have about the current economic landscape. I am referring to the consideration that GDP and CPI figures are roughly correct approximations for economic growth and inflation, respectively. They aren’t. I have alluded to that assertion in prior discussions, but I believe that COVID-19 has just exacerbated this point. The growth measures rely on a methodology for the industrial age instead of the digital age. The pandemic brought even more digitalization that does not have a proper reflection in the current statistics. The inflation is likely to be even lower than the current already low figures due to unaccounted productivity gains.

The confluence of these two factors justifies a fast recovery. First, the economic figures may not be as bad as perceived in the media, and second, the low inflation will likely be a fertile ground for further stimulus, perhaps, even before the inauguration ceremony. In this scenario, we can expect a couple of thought-provoking things.

Photo credit: 5chw4r7z

There a couple of other interesting figures that seem odd, given the negativity in the financial media. First, the savings rate was very high prior to the crisis, and it has only increased after the pandemic. That is reassuring in the sense that there is available capital to deploy at a time that the economy needs it so badly.

(Source: FRED)

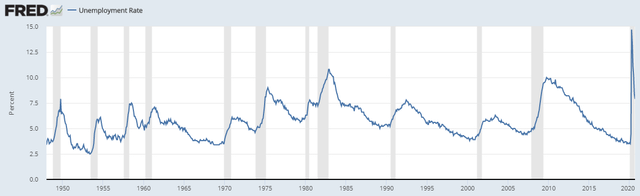

Additionally, we can see that, in other recessions, the unemployment rate has been a lagging indicator, only trending lower a couple of months after the recession ended. However, in the present situation, it has already started to go lower. I interpret this as a possible sign that the recession will be short-lived. Only time will tell if that’s a fair assumption.

(Source: FRED)

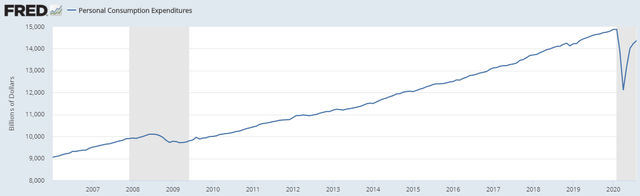

Finally, consumption has strongly rebounded. In part, this is thanks to the stimulus checks, but it is an encouraging sign.

(Source: FRED)

All that points to a scenario with positive underlying currents. Basically, there is a clear incentive for the administration to put forth an extra package of stimulus, while the economic foundations are far from destroyed.

Gold is a likely winner

Gold has been my biggest bet for this year, and although it has underperformed other asset classes (i.e., tech stocks), the truth is that it has been a solid performer. Looking ahead, the new administration will likely push for more stimulus, which guarantees an expansion of the monetary mass against a roughly fixed supply of gold. I’m still playing this with miners like Barrick (GOLD) and Kinross (KGC), which I believe are well-positioned to take advantage of the advance in the price of gold.

However, hindsight has been a tough teacher, and I’m now inclined to look closer at riskier equities. I think that the bond market is in a clear bubble, which is bullish for equities, at least while it lasts (i.e., low-interest rates). Nevertheless, the truth is that a high savings rate, with unemployment trending lower, and further fiscal stimulus make a good case for an equity bull market. Therefore, I feel that we are at a crossroads. On the one hand, we will have an unwind of the bond market that will take its toll on the equity market because of higher interest rates. On the other, there might be 18 to 24 months before that happens. FOMO has never been so high. In my opinion, the solution must be to maintain a balanced portfolio with gold and to search for some value within the positive secular trends.

Productivity will keep us going

After the dotcom bubble, there was a sense of disillusion regarding the promises of the new economy. That might have been because the euphoria around the internet revolution was a decade too early. Once the infrastructure around the internet was ready to go directly into your pocket and to transmit heavy loads of data, the revolution gained momentum. For instance, iTunes changed the way music is commercialized. Every year, the sale of music increased even if the sales of CDs decreased, meaning that, all else equal, the GDP figures were getting a lower contribution from the music sector.

Now, we’re seeing that revolution is getting to every sector. Even the smallest company has access to incredible processing power through datacenters. That means artificial intelligence, connectivity, automation reaching even the most remote corners of the economy. The tight network covering the world is spreading innovation faster and faster. Even companies connoted with the old economy like Deere (NYSE:DE) now deploy automated drones capable of making the human presence even more redundant in agriculture.

Crisis brings problems, and problems demand new solutions and innovation. The coronavirus was the trigger to novel struggles, and, with it, companies are now presenting new solutions, which is also disruptive. In my opinion, part of that rally was overdone. It was too focused on some companies related to the stay-at-home boom and in some passive indexes like the S&P 500. However, there are plenty of problems that still need to be solved. Global warming, health problems related to contemporary life (e.g., cancer), efficient production systems are all examples of headaches that still lack definitive solutions. Within these themes, there are still companies whose valuation may not be exhausted.

Pockets of value

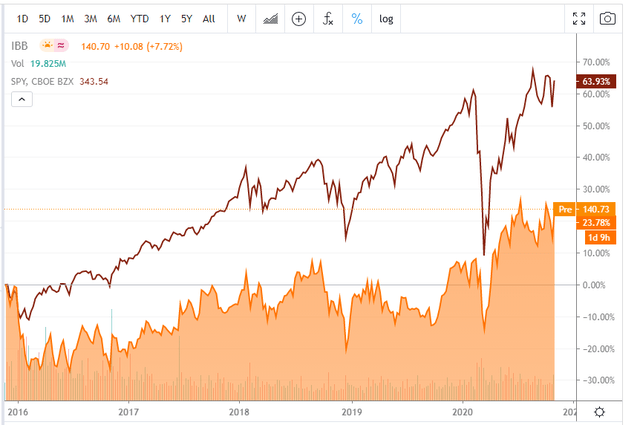

One sector where I would argue that there is value is in genomics. The health sector went through a tough time during and after the 2016 election, underperforming the S&P 500 by a wide margin. Look at the iShares Nasdaq Biotechnology ETF (Nasdaq:IBB):

(Source: Seeking Alpha)

At the time of the 2016 presidential race, the rhetoric against drug pricing was at a climax, and the truth is that, after the election, biotech companies have underperformed. I think that might change soon. For instance, in the genomics space, Illumina (Nasdaq:ILMN), one of the main contributors to the development of the sector, is trading at 44 times 2019 earnings (although earnings are likely to shrink in 2020). That’s a far cry from stay-at-home stock valuations. Another interesting name is Vertex Pharmaceuticals (Nasdaq:VRTX) trading at just 22 times forward earnings. The company is poised to resume earnings growth this year.

Another sector that was pretty much beaten was Chinese stocks. The trade war is one of the hallmarks of the Trump Administration. The market assumed the US would win, and trashed Chinese stocks. Now, not that I think that the Biden Administration will completely change the tune on China, but it is likely that the harsh rhetoric will be substituted by a more comprehensible approach. In that case, Alibaba (NYSE:BABA) trading at 28 forward earnings might be considered a value play with lots of benefits. Allows a diversification from the US dollar (the company’s operations are based on RMB), it is a tech and digital play on an economy that seems completely recovered from the virus.

Conclusion

The economic framework is exhibiting some interesting indicators. Unemployment, savings rate, and consumption data seem to corroborate the thesis of a sustained recovery. A new stimulus package and a coronavirus vaccine may very well do the rest. In that case, gold miners should add to portfolio diversification, while pockets of value within non-consensus investment themes like China and biotech might very well do the trick.

Disclosure: I am/we are long GOLD, BABA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more

The author sees a lot more sunshine than I do, that is certain. Some signs do look good today, but will that last? People are still getting this disease and people are still dying and death is such a downer for most folks to see happening.

This is not like the more recent recessions because the government keeps shutting much of the business down to prevent the spread of death. One thing is certainly correct, which is that the economy was in trouble before this plague arrived. The savings interest rate approaching zero is irrefutable evidence of that problem. The existence of a problem was clear even to folks like me, not a financial wizard.

And now we have the financial stimulus money being fed into the economy. Certainly a lot of folks do need assistance, and so the help was good, But ultimately the increase in available money will lead to inflation. Not today or tomorrow, but soon. So the stock market will still be making some people rich, there will be a large crowd not getting rich at all. And when that inflation does hit, that large crowd of folks may be rather angry.

How likely is another stimulus package at this point? It seems like our politicians have no interest in even trying to come to an agreement on the matter. Their salaries are secure, so what do they care?

Great read!