Tuesday Talk: Risk-On, Risk-Off

The first trading days of February have seen risk-on, risk-off action. Whether this is just tethering of the January rally or the sign of a major pull-back remains to be seen.

Today is a major news day for the market with additional comments from Fed Chair Powell in the afternoon and President Biden's State of the Union address in the evening.

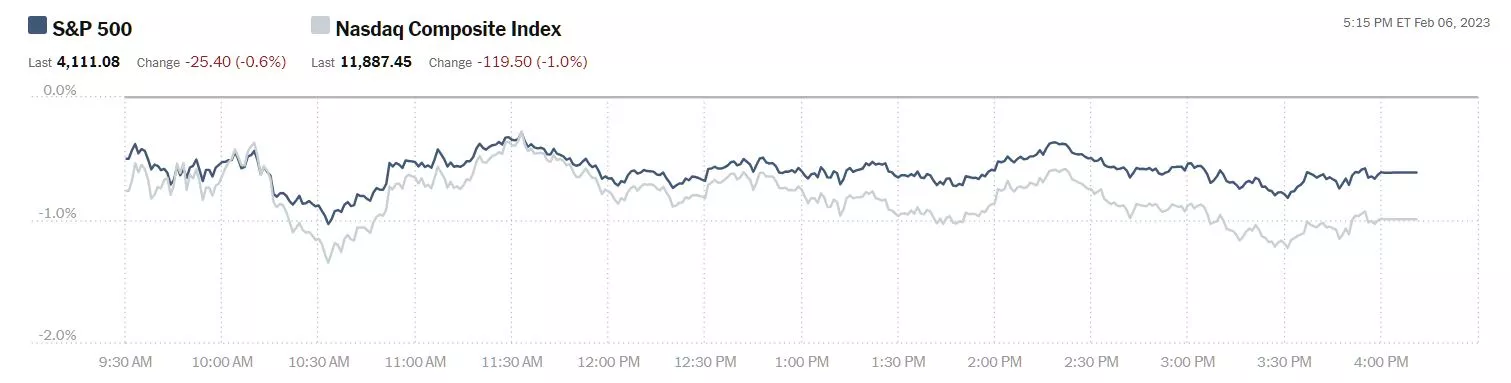

Yesterday the markets didn't fall off their tightropes, but all three major indices did end the day in the red. The S&P 500 closed at 4,111, down 25 points, the Dow Jones Industrial Avergae closed at 33,891, down 35 points and the Nasdaq Composite closed at 11,887, down 120 points.

Chart: The New York Times

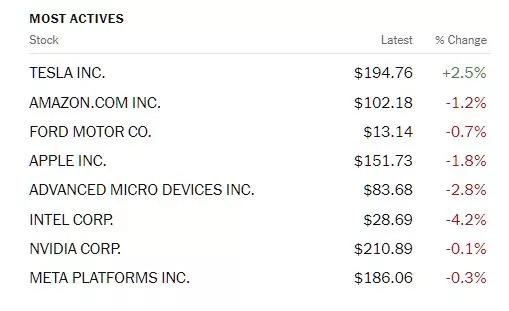

Most actives for the day were all tech issues, save for Ford (F) and all traded in the red except for Tesla (TSLA), reflecting the 1% loss in the Nasdaq Composite Index.

Chart: The New York Times

In morning futures trading S&P 500 market futures are up 4 points, Dow market futures are up 10 points and Nasdaq 100 market futures are up 25 points.

TalkMarkets contributor James Harte notes Equities Under Pressure From Resurgent USD.

"It’s been a difficult start to the week for global equities benchmarks. Leading indices have come under pressure on the back of Friday’s US jobs data which has fueled a shift in Fed expectations, leading to a stronger US Dollar. Friday’s data saw the headline NFP print coming in at 517k, vs 193k expected, with the unemployment rate tumbling to lows last seen in 1969 at 3.4%. These figures are diluting expectations of a near-term pivot from the Fed, downplaying the risks of a recession this year (or a deep one at least) and giving the Fed plenty of room to push ahead with further tightening this year. Traders now await comments from Fed chairman Powel later today with plenty of downside risks for equities should Powell reaffirm the Fed’s hawkishness.

The DAX has come under pressure today following the release of worse-than-expected German industrial orders data. Fears of a recession in Germany this year are still a big headwind to the eurozone economy particularly with ECB’s Holzmann and Mann warning yesterday that rates would need to stay at restrictive levels for longer.

The FTSE has been boosted today by a bumper set of earnings from BP. The oil giant posted record gains last year and announced an increase in the dividend as well as a $2.75 billion share buyback for Q1."

In Asian markets, Harte observes the action in the Nikkei as positive.

.webp)

"The rally in the Nikkei has seen the index trading back up to test the broken bull trend line and the bear trend line from last year’s highs. For now, this resistance is holding. However, if price can stay atop the 27422.9 level, focus is on further upside. Below there, risks of a full retreat towards 25500.5 are seen."

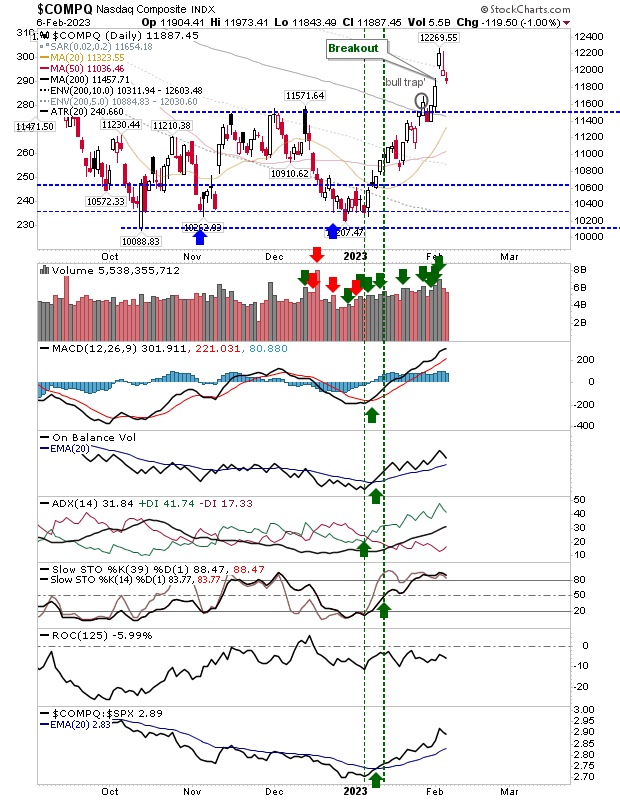

Contributor Declan Fallon reviews Monday's action and sees Tentative Steps Lower For Markets.

"It could have been worse, the potential for losses was quite high but markets were reluctant to give in to sellers, many markets finished where they started.

The Nasdaq was a case in point. Selling volume was lighter than Friday's as the index closed the breakout gap from last Wednesday. This should give swing traders an opportunity to trade the next move - using the high/lows of today to determine the entry point and risk (buy break of high - stop on loss of low/short loss of low - stop on break of high). Technicals favor bulls, so the long trade is more likely to succeed."

"Today was healthy action across indices. Losses were small and were banked at the open (following the weekend) and not over the course of the day. There was not a whole lot to add aside from this."

TM contributor New Deal Democrat is not taking last week's NFP data at face value as he reports in Scenes From The Blockbuster Jobs Report: In January, Nobody* Got Laid Off.

"(*hyperbole)...there was lots to digest about Friday’s blockbuster jobs report, which I have now done, so I’m going to spend a couple (maybe 3!) days diving in to the details. Today I’ll deal with how seasonality and a very tight labor market were decisively important in Friday’s report."

Below are some of the "scenes". See the full article for more.

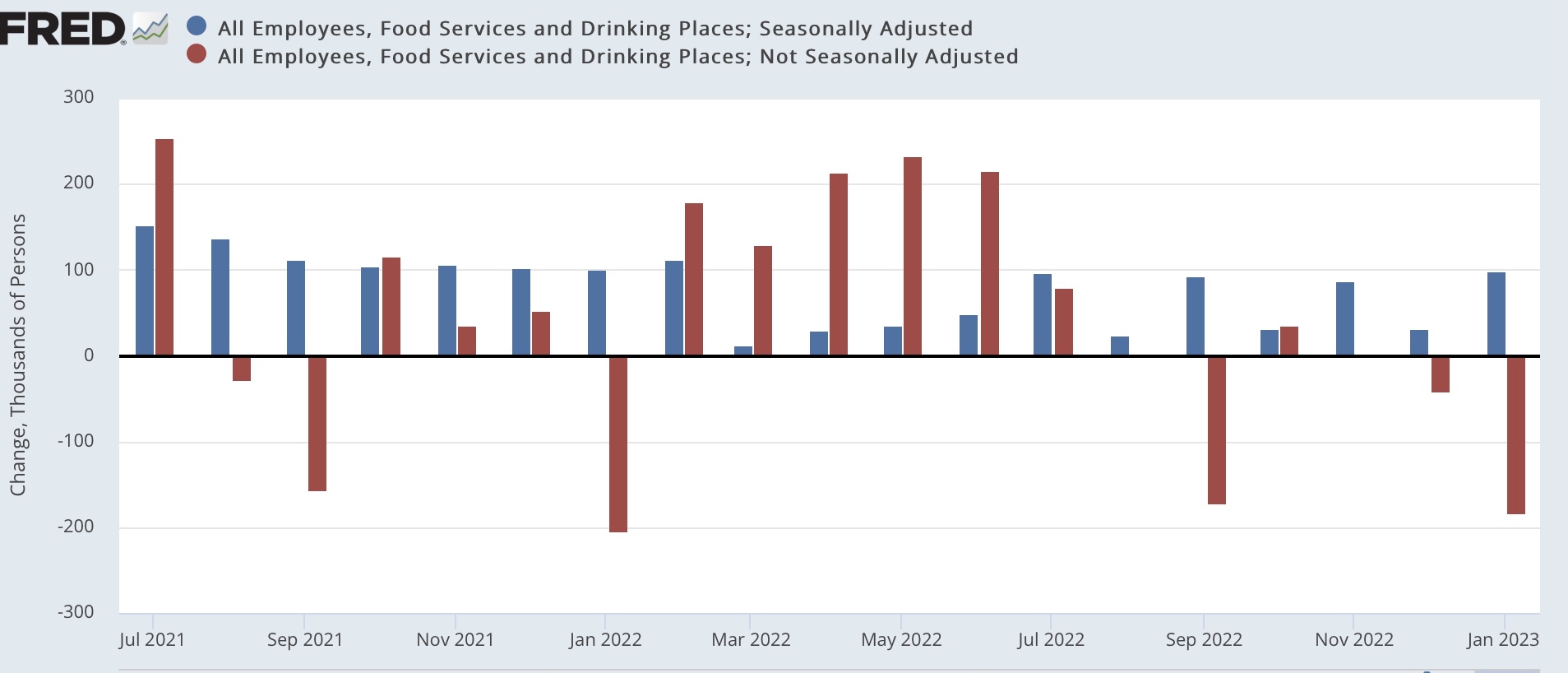

"Let me start off by running the following thought by you: do you really think that bars and restaurants hired almost 100,000 more people in January, as shown in the jobs report?

Yeah, me neither. And the truth is, they didn’t! Actually, in the aggregate, they let go of 183,000 employees. Here’s the seasonally adjusted (blue) vs. non-seasonally adjusted (red) numbers beginning in July 2021:"

"Here’s a close-up view of seasonally adjusted and non-seasonally adjusted initial claims in the last 18 months, showing that the typical early January sharp jump in claims simply did not materialize this year:"

"In essence, nobody* is getting laid off. There was a seasonal increase in hiring for the Holiday season, but in the aggregate businesses decided not to lay some of those people off, but keep them on the payrolls. That, plus the resolution of the California strike, is why payrolls jumped so much in January. (*hyperbole)

Let’s look at the revisions for 2022 which just took place:

"January 2022 was revised down from 504,000 to 364,000, while February was revised up from 704,000 to 904,000. These were the two biggest revisions of the entire year, suggesting that seasonality led those two months astray.

In conclusion, here’s what we have: in a very tight labor market, in the aggregate employers were reluctant to lay off seasonal hires in January, electing to keep them on payroll. This translated into blockbuster job gains on a seasonal basis. But we have to wait for February’s report to see whether this is a sign of renewed strength in the jobs market, or whether employers have less need to hire new workers as a result. In other words, will January’s strength continue in a month where actual hiring, not layoffs, are expected."

Q4'22 corporate earnings continue to pour in and contributor Zacks Equity Research takes a peek at (PYPL) whose earnings are due out on February 9, in PayPal To Post Q4 Earnings: What's In The Offing?

"The company projects fourth-quarter revenues of $7.375 billion, suggesting growth of 7% on a current spot rate basis and 9% on a currency-neutral basis from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for revenues is pegged at $7.39 billion, indicating an improvement of 6.9% from the prior-year quarter’s reported figure.

PayPal projects non-GAAP earnings of $1.18-$1.20 per share. The Zacks Consensus Estimate for earnings is pegged at $1.19 per share, suggesting growth of 7.2% from the year-ago reported figure...

The impacts of PayPal’s robust product portfolio, including Venmo, are anticipated to get reflected in its fourth-quarter results.

Strong monetization efforts of Venmo are likely to have aided its adoption rate in the to-be-reported quarter.

Robust PayPal Checkout experiences are expected to have sustained the company’s momentum in the to-be-reported quarter.

PayPal is expected to have gained from the growing proliferation of online payment transactions in the fourth quarter amid the pandemic...

Our proven model conclusively predicts an earnings beat for PayPal this time around...PayPal has an Earnings ESP of +1.61% and a Zacks Rank #3 (Hold)."

See the full article for more details.

As always, caveat emptor.

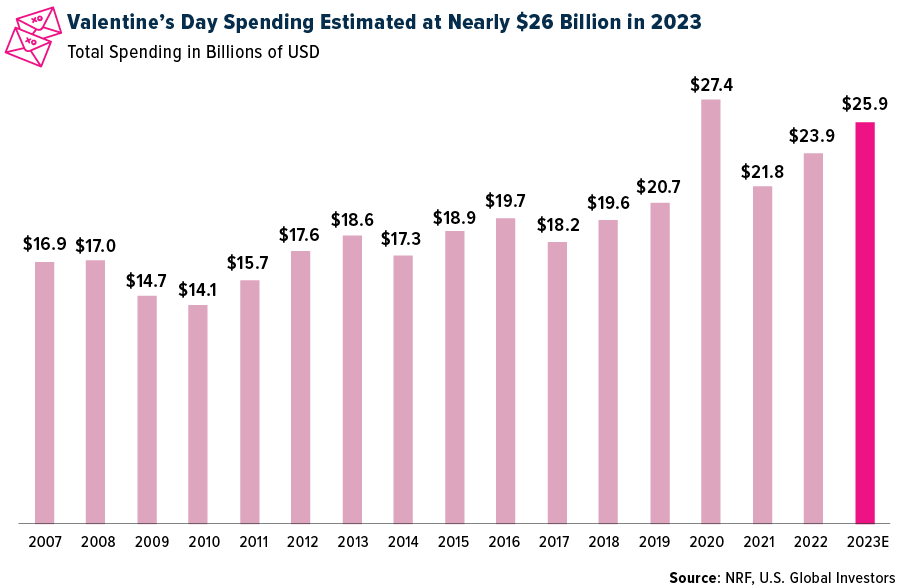

With Valentine's Day on deck for next week, TalkMarkets contributor Frank Holmes finds that Luxury Goods Retailers Bracing For A Strong Valentine’s Sales Season.

"Luxury goods retailers could be headed for a strong Valentine’s sales season if estimates prove accurate. According to the National Retail Federation (NRF), consumer spending in the U.S. may reach as high as $25.9 billion this year on Valentine’s Day gifts ranging from gold jewelry to clothes to fine chocolates.

That would make 2023 the second-best year for sales since the NRF began tracking this data."

"Of the nearly $26 billion, roughly 21% is forecast to be spent on jewelry, representing $5.5 billion. Clothing could fetch 19%, or around $5 billion."

See the article for Holmes' report on, and investments in, the luxury goods sector.

We're all hearts.

And speaking of hearts, do take time to contribute to relief efforts for the victims of yesterday's earthquakes in Turkey and Syria.

Have a good one.

More By This Author:

Tuesday Talk: Too Hot, Too Fast?

Thoughts For Thursday: Holding The Line