Thoughts For Thursday: Holding The Line

The market closed nearly unchanged on Wednesday, which if you read some of the pundits may be akin to keeping one's balance on a tightrope. Tomorrow's release of December PCE data will be key in maintaining same.

The S&P 500 closed at 4,016, down less than 1 point, the Dow closed at 33,744, up 10 points and the Nasdaq Composite closed at 11,313, down 21 points.

Most actives didn't move much either except for AT&T and Warner Bros. Discovery, up 6.6% and 8.6%, respectively.

Chart: The New York Times

Currently in morning trading, S&P 500 market futures are up 7 points, Dow market futures are down 20 points and Nasdaq 100 market futures are up 67 points.

TalkMarkets contributor Jesse Felder discusses the market's tightrope in his article Something’s Gotta Give.

"We’re at a fascinating juncture here in the markets. Stocks have sold off hard for a little over a year now but have rallied once again in the short run. The result is that the S&P 500 Index has formed a fairly tight coil or pennant pattern over the past several months. And, as my friend Peter Atwater points out, this coil is merely a visual representation of a fierce battle going on in the markets."

"This tug-of-war between bulls and bears is centered on the trends in inflation, monetary policy and the economy. The recent rally in stocks has been driven by the idea that inflation will rapidly come down back to the Fed’s 2% target, without an economic recession as catalyst, allowing the Fed to end and even reverse its rate hike campaign later this year. As to inflation, CPI swaps are now pricing in a rapid decline in inflation over the course of this year."

"The stock market clearly sees this as good news. However, as the article above notes, a decline in inflation that rapid has only ever happened during steep economic recessions like that seen in the wake of the Great Financial Crisis just over a decade ago. Still, the market appears to be content to ignore the possibility of recession and discount strong earnings gains this year and next... "

"But if earnings are going to soar in a way that would preclude recession, then it would likely mean that inflation won’t come down back to 2%, as my friend Julian Brigden suggests. Markups have been a significant factor in both the strength of earnings and inflation over the past couple of years. And if inflation remains elevated, then the Fed may find itself coming under a great deal of pressure to keep interest rates elevated longer than the market expects if not raise them even higher than they have already indicated..."

"Of course, if the Fed is forced to raise interest rates even higher, the currently elevated probability of recession will grow even greater. A number of indicators, such as the Conference Board’s Leading Economic Index, suggest recession is not only likely but may have already begun. This perhaps helps to explain why many markets are so sanguine regarding inflation and also why they expect the Fed to be cutting rates later this year, rather than hiking..."

Which end of the rope will give first? See the full article for additional insights.

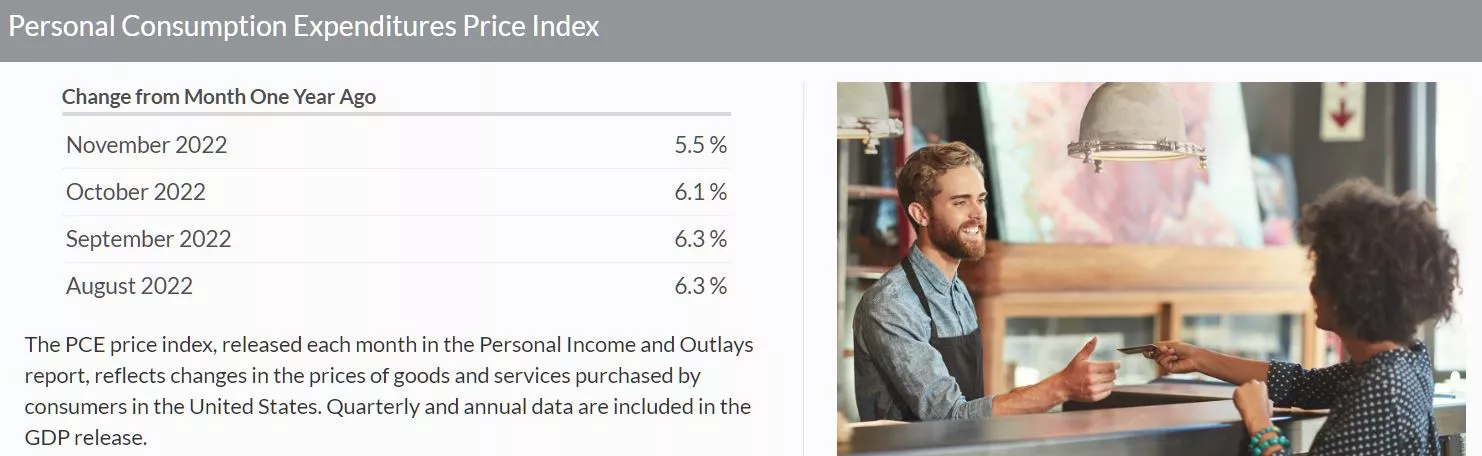

Contributor Joe Perry takes a stab at What Does It Mean For The Fed If Core PCE Comes Out Weaker Than Expected?

"The United States Core Personal Consumption Expenditure Price Index (Core PCE) is said to be the Fed’s favorite measure of inflation, as it captures the most meaningful data for the Fed, without food and energy...Expectations are for the index to rise by only 4.4% YoY. Note that the Fed targets 2% inflation. If the print is “as expected”, will this be enough of a drop for the Fed to leave rates unchanged at its February meeting? Perhaps, at the very least, it would lead the Fed to signal a pause in March. But if its stronger than expected, as was Australia’s CPI earlier today, watch for the Fed to increase 25bps and maintain its 25bps rate hikes “as needed”."

Economist and contributor Scott Sumner also takes up the question of what should the Fed do If Things Are Going Well.

"There are an increasing number of pundits suggesting that we may be on track for a soft landing. I don’t have strong views either way, but let’s assume that is the case; the US is increasingly likely to achieve a soft landing. What then? What should the Fed do next?

One answer is, “Keep doing what it’s doing, as that seems to be working”. But it’s not clear what it means to maintain a steady monetary policy, as the economics profession has never provided a satisfactory definition of “monetary policy”.

Karl Smith likes what he sees, and suggests that the economy is doing so well (in terms of achieving a soft landing) that the Fed should hold off on further rate increases.

Someone else might look at the same evidence, and agree that policy should stay the course. But for them, staying the course might be implementing the interest rate increases that the Fed has been predicting in recent meetings...

A third pundit might argue that the Fed “dot plot” is not fully credible. The market expects a slightly lower path for interest rates than the path predicted by the Fed. And it’s the market expectation of the future path of rates that the economy is reacting to. So perhaps the Fed should not keep rates where they are, nor should they raise them at the pace they have predicted. Instead, if the economy is doing well then perhaps the Fed should raise rates at the pace that the market is predicting.

I don’t much like any of these views, as they all rely on interest rate targeting. And I don’t believe the Fed should be targeting interest rates—let the financial markets set rates. But if the Fed insists on setting rates, and if the economy is indeed on track for a soft landing, then the least bad policy would be to have rates follow a path equivalent to the current market prediction.

Once again, I am not advocating that policy; I’m saying that policy would be appropriate if we are now on track for a soft landing. My own view is that the risks are still slightly to the upside, toward overheating."

Advocate or not, sounds like a vote for lower rates, if...

Over in commodities, James Harte notes that Oil Traders Increase Longs.

"The latest CFTC COT institutional positioning report shows that oil traders increased their net long positions last week from 205k contracts to 239k contracts. Oil prices have been relatively muted this week though are still up on the year so far having rallied more than 13% off initial 2023 lows...For now, crude prices remain very much constrained by the global economic outlook. Fresh concerns over recession risks in the US and globally...(and the) ongoing severity of the COVID situation (in China)...for now at least, means that demand is yet to pick up at the expected pace...

Looking further out across the quarter, however, there are some upside risks for oil. The first is the prospect of USD weakness should the Fed pivot on rates next week. If CPI continues to fall in the coming months, USD should head lower as traders begin to move forward with expectations for an end to Fed tightening. Furthermore, as the COVID situation in China balances out ( herd immunity developing) demand should start to pick up and the economy should start to reap the benefits of reopening which in turn should bolster demand for oil."

.webp)

Tesla (TSLA) was barely up yesterday after reporting good earnings.

Contributor Tyler Durden runs through the numbers and gives his take on the company in Tesla Beats On Top And Bottom Line As Margins Slump.

"...here is what Tesla reported moments ago (pdf link):

- Revenue was a record $24.318BN, up 37% Y/Y, beating the consensus estimate of $24.1BN

- Adj EPS $1.19, up 40% Y/Y, and also beating the consensus estimate of $1.12

- Free cash flow $1.42BN, down 49% Y/Y, and missing estimates of $3.13BN

- Capital expenditure $1.86 billion, up 3%, missing estimates of $1.9 billion

Bottom line: Tesla reported better-than expected profits amid growing skepticism about the auto industry, and signaled strength as it faces growing questions about demand for its all-electric vehicle lineup.

And while the top and bottom lines both beat, it came at a cost to margins: in Q4, Tesla's Automotive Gross Margin was +25.9%, down a whopping 466bps from 30.6%,and missing the estimate of +28.4%. The reason for this sharp drop in margins most likely has to do with the company's creeping price cuts and still rising commodity costs. The drop in the automotive gross margin also hit the total gross margin, which dropped to 23.8% vs. 27.4% y/y, and also missed the estimate of 25.4%.

This is how the company spun the shrinkage in margins: "our ASPs have generally been on a downward trajectory for many years. Improving affordability is necessary to become a multi-million vehicle producer.""

See the full article for a more in depth look.

Elsewhere in the market, TM contributor Sweta Killa puts Semiconductor ETFs In Focus Ahead Of Q4 Earnings.

"The semiconductor space has been surging over the past three months on improving demand...The Philadelphia Semiconductor Index gained more than 30% from a two-year low in mid-October, outperforming the tech-heavy Nasdaq 100 Index, which added about 10% in the same period."

"As such, Invesco PHLX Semiconductor ETF (SOXQ - Free Report), iShares Semiconductor ETF (SOXX - Free Report), VanEck Vectors Semiconductor ETF (SMH - Free Report), and First Trust NASDAQ Semiconductor ETF (FTXL - Free Report) have gained 25.7%, 26.3%, 29.2%, and 23.3%, respectively, over the past three months. The strong trend is likely to continue in the weeks ahead as the Q4 earnings season picks up pace. Texas Instruments (TXN - Free Report) came up with robust results, beating revenue and earnings estimates for the fourth quarter. The result is expected to add fuel to the sector...

Though (some individual) stocks have an unfavorable Zacks Rank, semiconductor ETFs might see smooth trading in the weeks ahead as SOXX, SMH and FTXL have a Zacks ETF Rank #1 or #2. This suggests outperformance in the weeks ahead."

Caveat Emptor.

That's a wrap for today.

Have a good one.

More By This Author:

Tuesday Talk: To The Moon With QT!

Tuesday Talk: Short Week - Up or Down?