Tentative Steps Lower For Markets

It could have been worse, the potential for losses was quite high but markets were reluctant to give in to sellers, many markets finished where they started.

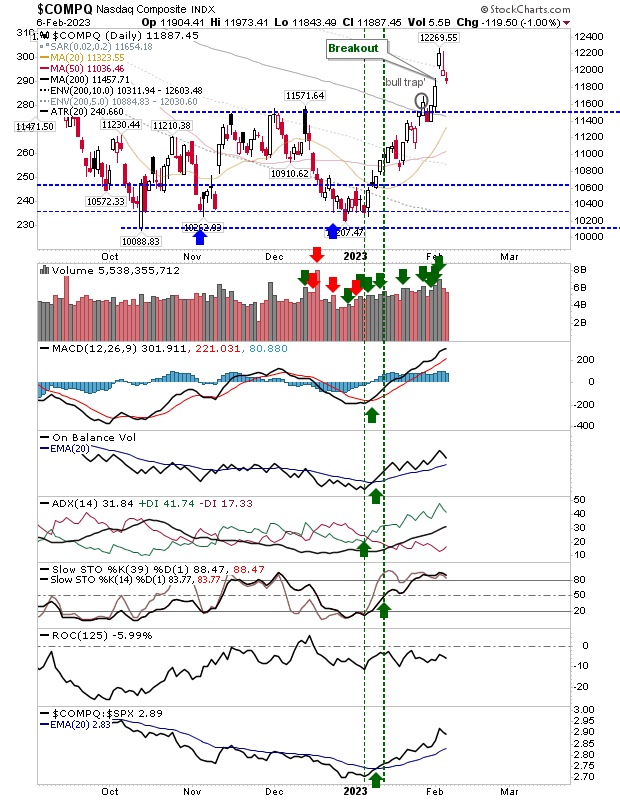

The Nasdaq was a case in point. Selling volume was lighter than Friday's as the index closed the breakout gap from last Wednesday (an intraday chart will show this better). This should give swing traders an opportunity to trade the next move - using the high/lows of today to determine the entry point and risk (buy break of high - stop on loss of low/short loss of low - stop on break of high). Technicals favor bulls, so the long trade is more likely to succeed.

The S&P was trading closer to breakout support, but today's loss wasn't big enough to break this support - so all good here. Technicals, aside from relative performance to the Russell 2000, remain bullish.

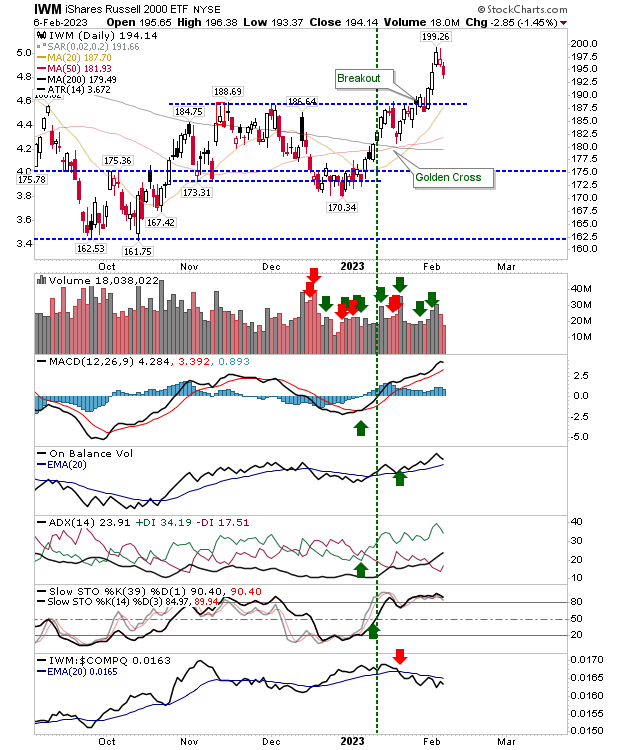

The Russell 2000 ($IWM) experienced a greater loss but also has the most room to run to support. Technicals remain in good shape - although relative performance is still a concern.

Today was healthy action across indices. Losses were small and were banked at the open (following the weekend) and not over the course of the day. There was not a whole lot to add aside from this.

More By This Author:

The Market Surge Continues

S&P Breakout Joins Nasdaq And Russell 2000

'Bull Traps' Threaten Nasdaq And Russell 2000

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more