'Bull Traps' Threaten Nasdaq And Russell 2000

What goes up may come down, or at least, the nascent breakouts in the Nasdaq and Russell 2000 now find themselves on the wrong side of support. It hasn't been a total collapse, selling volume was down on Friday's buying, and the potential for a recovery is quite high. But for this to happen, sellers can't be allowed to build up any momentum. As things stand, the Nasdaq and Russell 2000 now find themselves back inside the prior consolidation.

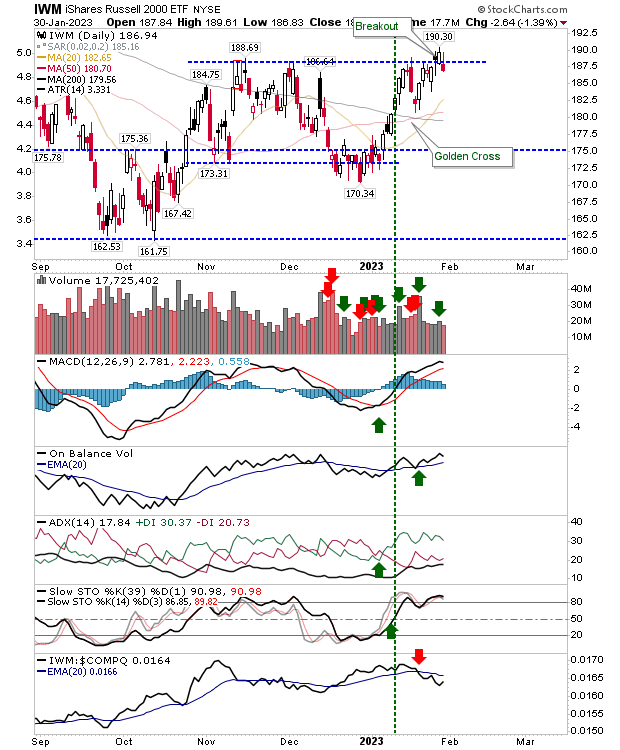

The Russell 2000 is underpeforming the Nasdaq, so it's the most vulnerable to further selling. Even if the 'bull trap' is confirmed, I would still look for the potential of the 20-day MA to play as support.

The loss of the breakout in the Nasdaq didn't do too much damage to the supporting technical picture, but I wouldn't want to see too much of a move away from its 200-day MA. The index doesn't have the benefit of the 'golden cross' between 50-day and 200-day MAs, so it might take a second wave of down-and-up before there is a confirmed breakout.

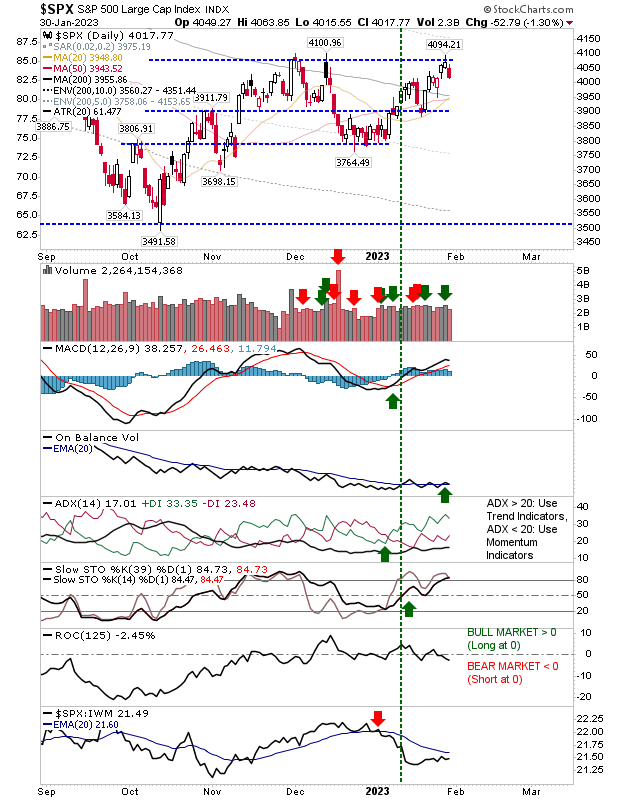

The S&P didn't have a breakout to lose, so there would have been no technical alert for this index to reverse. It's as you were for the index, but one thing I like is the pending 'golden cross' between the 50-day and 200-day MAs which might be the driver for a breakout. In such a scenario, I would be looking for the Russell 2000 to lead out and the S&P to follow.

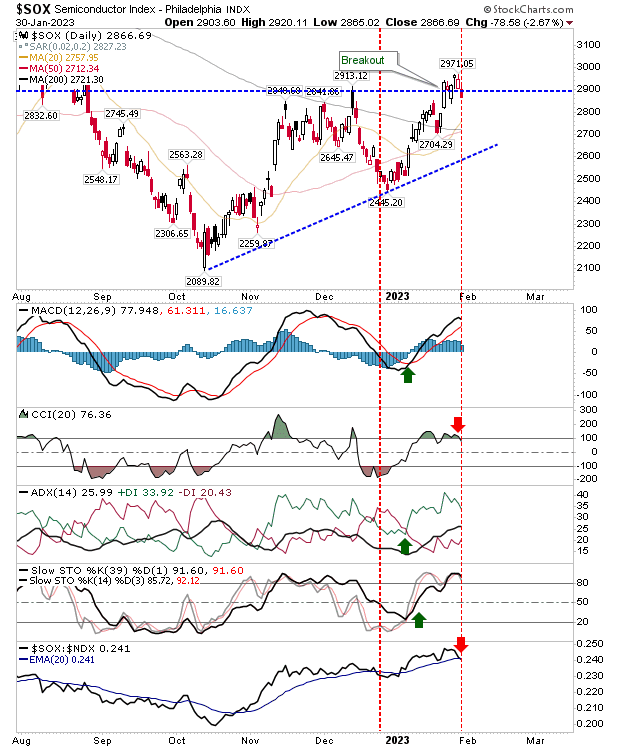

As a final note, the Semiconductor Index has also drifted below its breakout level but there is also a pending bullish cross between 50-day and 200-day MAs.

For the rest of the week, if ex-breakout indices are able to hold on to moving average support - and this could be any of 20-day, 50-day or 200-day MAs - then I wouldn't be too worried about today's breakout losses.

More By This Author:

Nasdaq Breakout At The End Of Last Week

Russell 2000 breakout?

Buyers Build Momentum Towards Resistance Challenges

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more