The Market Surge Continues

Image source: Pixabay

Friday delivered a small riposte to Thursday's big gains, but this rally from the December lows needs a larger consolidation to help digest those gains. There is some solid support established by breakouts and the moving averages, so if things stall out here, I wouldn't be too worried. Only if we were to lose all the moving averages (which would also take out breakout support), would a recovery take longer than just a few weeks.

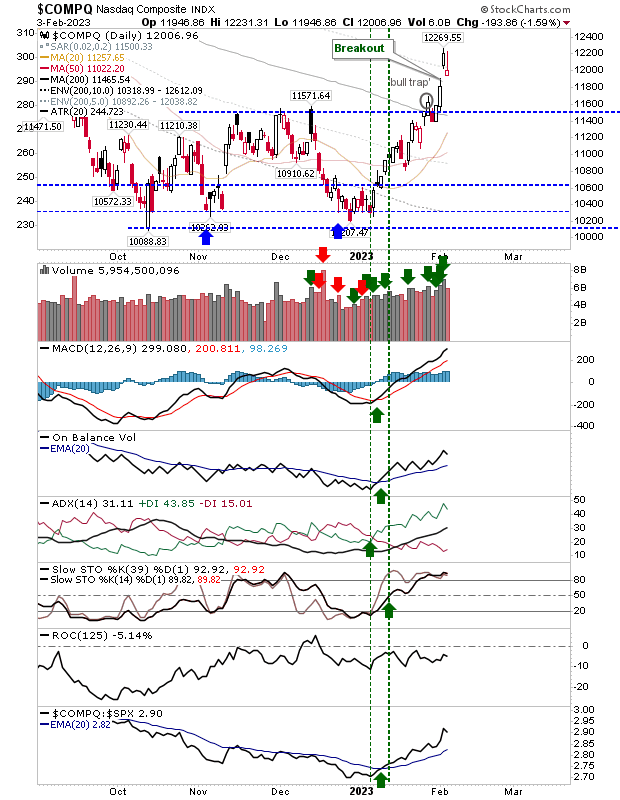

The Nasdaq is the market leader with net bullish technicals. If Friday's losses were the start of something more, then a retest of 11,500 would be very welcome, and a spike low below 11,500 would be even better. The 50-day MA would also offer a good test to wash out weak hands.

The S&P 500 has less wiggle room than the Nasdaq. The big win from last week was the 'golden cross' between the 50-day and 200-day MAs, and I would think a test of these moving averages is likely to occur in the weeks ahead. Key support lurks at 3,800, but if this rally was to get back there, I'm not certain that support would hold.

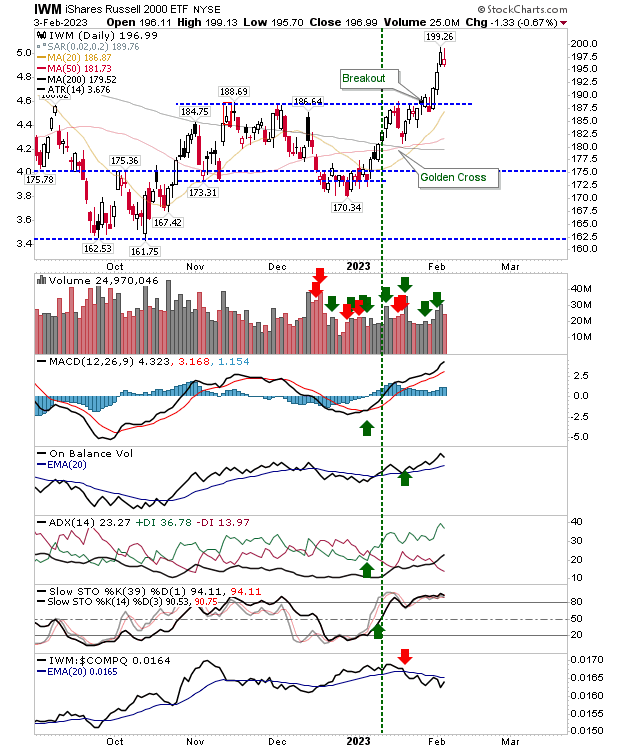

The Russell 2000 hasn't quite managed a "tweezer top" (the Thursday spike high is perhaps not long enough), but there is a strong reversal possibility for next week. Good support is to be found at $188.70 and what is a fast-approaching 20-day MA.

For next week, I would like to see some lateral action to consolidate the December-February gains. I would not be concerned with losses as long as volume remains below distribution levels.

Current action reflects a move into forming right-hand-bases -- bases that date back to 2021 for the S&P 500, Nasdaq, and Russell 2000. Investors should have been buying from June lows, but the market is now giving an opportunity for momentum players to jump aboard.

More By This Author:

S&P Breakout Joins Nasdaq And Russell 2000

'Bull Traps' Threaten Nasdaq And Russell 2000

Nasdaq Breakout At The End Of Last Week

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more