Recession Six Months Away?

Following up on the proposition that the recession is seemingly always six months away (as noted in WSJ’s ‘Godot’ recession”), I thought it would be interesting to see if the market had been saying a similar thing.

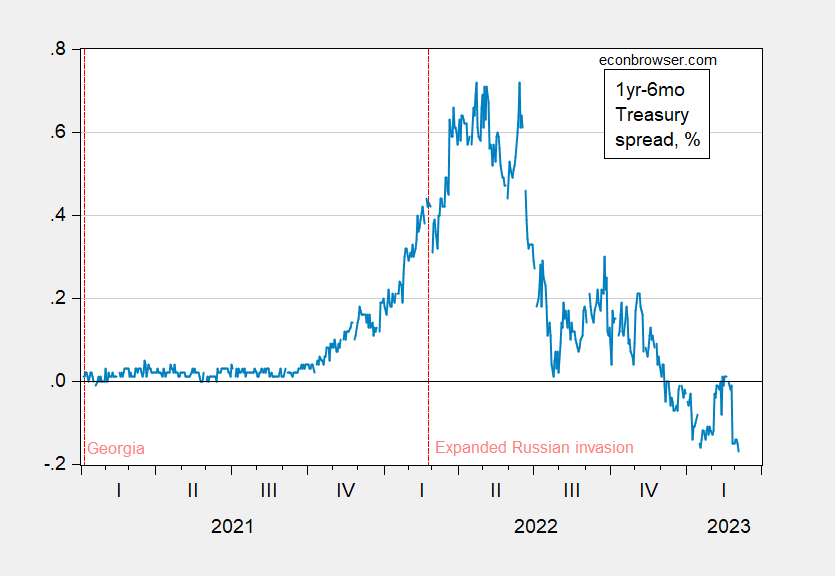

To wit, here’s the one year-6 month Treasury spread.

Figure 1: 1 year minus 6 months Treasury spread, % (light blue). Source: Treasury via FRED, and author’s calculations.

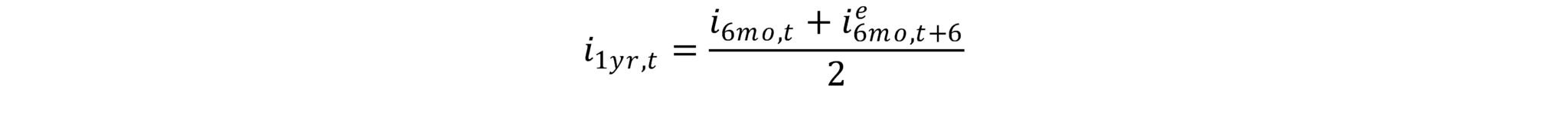

Inversion of this spread means the 1 year yield is lower than the 6 month. Assuming the pure expectations hypothesis of the term spread holds (the 1 year yield is the average of the current and expected 6 month yields):

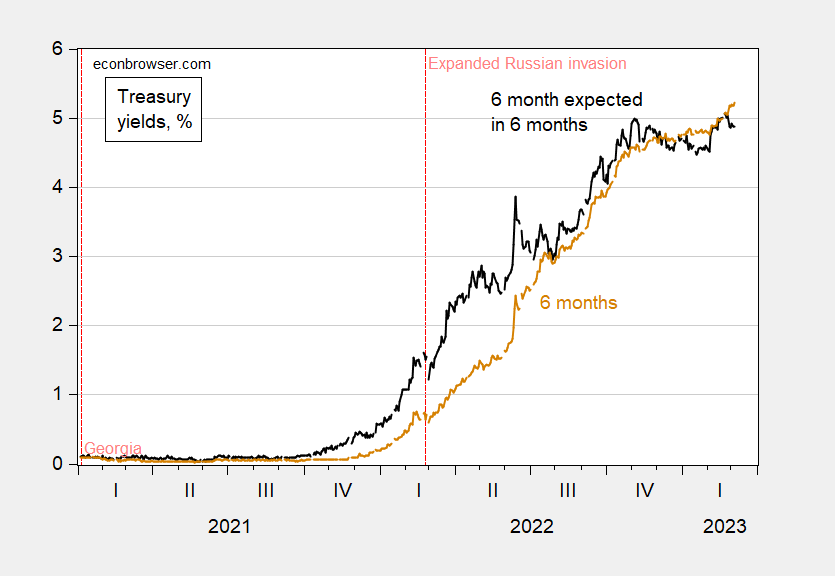

Then the 6 month interest rate expected in 6 months is:

The expected rate in 6 months is plotted in Figure 2 below in black, while the current 6 month rate is plotted in tan.

Figure 2: 6 month 6 month forward (black), and current 6 month rate (tan), both %. Source: Treasury via FRED, and author’s calculations.

The yield curve is pretty much flat at the 6 month-1 year part of the spectrum at end-July, and again in December of 2022. If one thinks rates are lower when the recession hits, then the recession has been six months ahead for the past six months, on and off for the last 7 months.

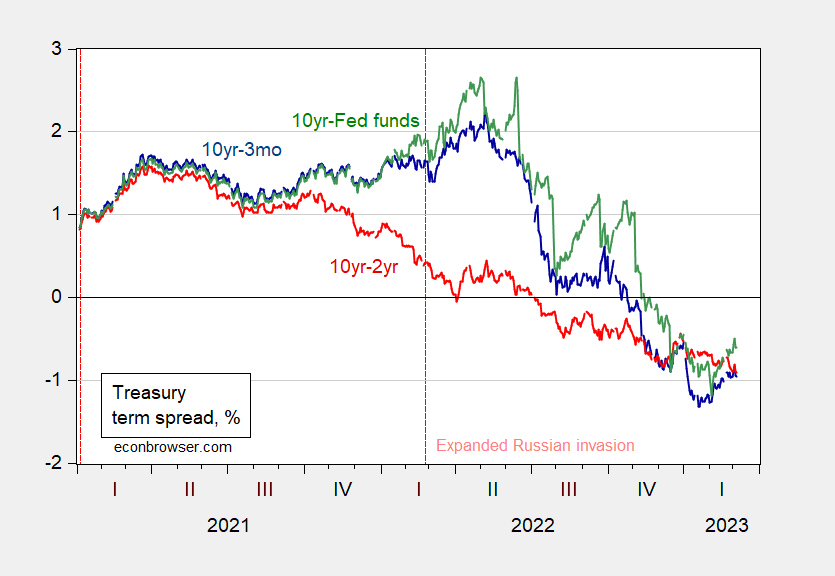

I will note that the 10yr-3mo and 10yr-2yr spreads are saying that the recession is coming.

Figure 3: 10 year-3 month Treasury spread (blue), 10 year-2 year spread (red), and 10 year – Fed funds spread (green), all in %. Source: Treasury via FRED.

Based on historical correlations, a recession would be expected around Q2/Q3.

More By This Author:

The “Godot” Recession?

Russia: Waiting For Inflation?

Output: Where We’ve Been And Where We Are Relative To Potential