Recession Probabilities Based On Multiple Financial Measures

Assume no recession in US through February 2023. What do term and credit spreads, financial conditions index, debt-service ratios predict?

First, probit regression estimates, 1985-2023M02:

Notes: Bold face denotes significance at 10% msl.

Term spread is the 10yr-3mo Treasury spread, short rate is the 3 month Treasury yield, credit spread is the Gilchrist & Zakrajsek (AER, 2012) excess bond premium (EBP), NFCI is the Chicago Fed National Financial Conditions Index, DSR is the debt service ratio.

Note that augmenting the standard term spread and short rate with EBP raises the proportion of variance explained, and EBP enters with expected, and significant, sign. Alternatively financial stress as measured by the NFCI enters in with expected sign, and yet better explains recessions. Finally, as argued by Borio, Drehmann and Fan (J.Macro, 2020), debt service ratio adds measurably to the explanatory power of the term spread.

Interestingly, only the DSR survives as having statistical significance when all three additional financial indicators are added. EBP and NFCI are fairly highly correlated, while DSR is not particularly correlated with EBP and NFCI, so this outcome is not altogether surprising.

While DSR adds substantially to in sample fit, it is interesting to consider what this specification implies for the prediction of recessions.

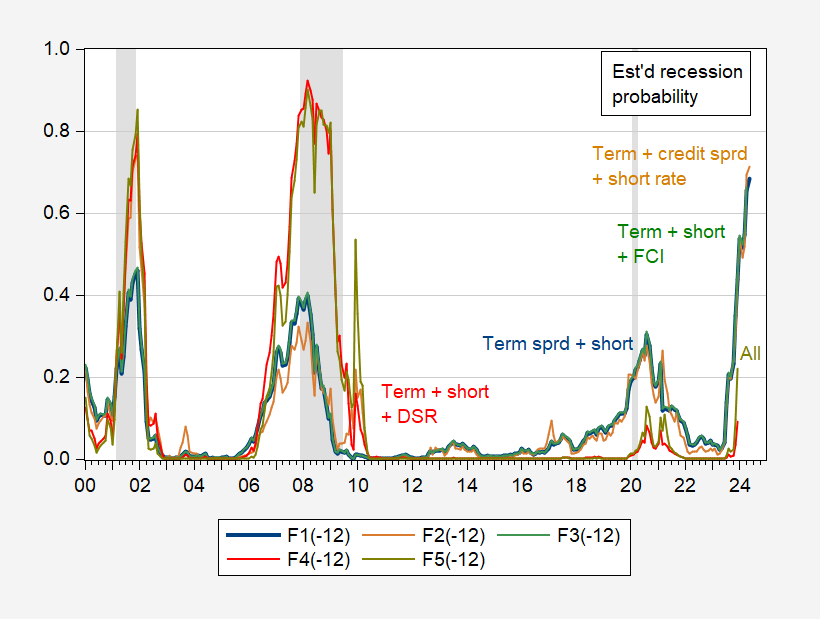

Figure 1: Estimated recession probability from term spread plus short rate (bold blue), from term and credit spreads plus short rate (tan), from term spread plus short rate and NFCI (green), term spread plus short rate and DSR (red), and from term and credit spreads plus short rate, NFCI, and DSR (chartreuse). NBER defined peak-to-trough recession dates shaded gray. Source: Author’s calculations.

Note that DSR data ends at 2022M12, so forecasts based on the DSR end at 2023M12.

Interestingly, any specification incorporating DSR imputes a substantially lower probability of recession than the corresponding specifications excluding DSR. For instance, at end-2023, a term spread plus short rate model indicates a 44% probabality, while a model incorporating all the measures including DSR stands at 22% probability.

More By This Author:

The Term Spread, 1970-2023M06

Fix the National Debt Without a Magic Wand

US-Euro Area Price Level And Inflation Differentials: I(0), I(1), Segmented Trends?