Recession Forecasts With And Without Debt-Service Ratio

Image Source: Pexels

In a previous post, I presented forecasts of recession based on probit models using term spread plus short rate, and term spread plus short rate, foreign term spread, and debt service ratio. The latter only went off to 2024M03 since BIS only published debt service ratio data up to March. I have extrapolated the ratio to June, so as to obtain the following forecasts.

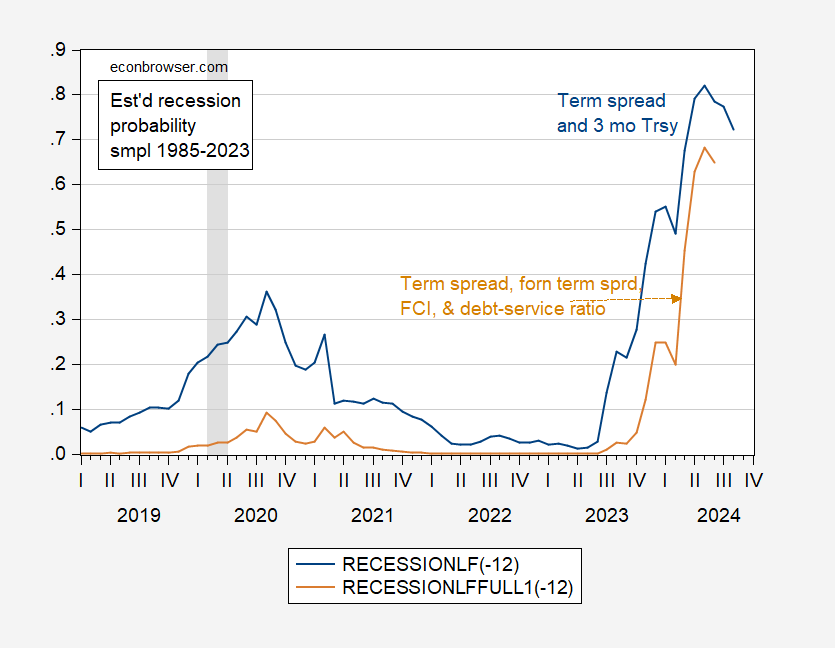

Figure 1: Probability of recession from 10yr-3mo term spread plus 3 mo rate (blue), and from spread, foreign spread, national financial conditions index, and debt service ratio (tan). Models estimated 1985-2023 (assuming no recession to 2023M08). Source: Treasury via FRED, Dallas Fed DGEI, Chicago Fed via FRED, BIS, and author’s calculations.

The full model has a pseudo-R2 of 0.52, vs. that for the term spread model of 0.28. The full model has no false negatives and missed positives for the 1989-2022 period.

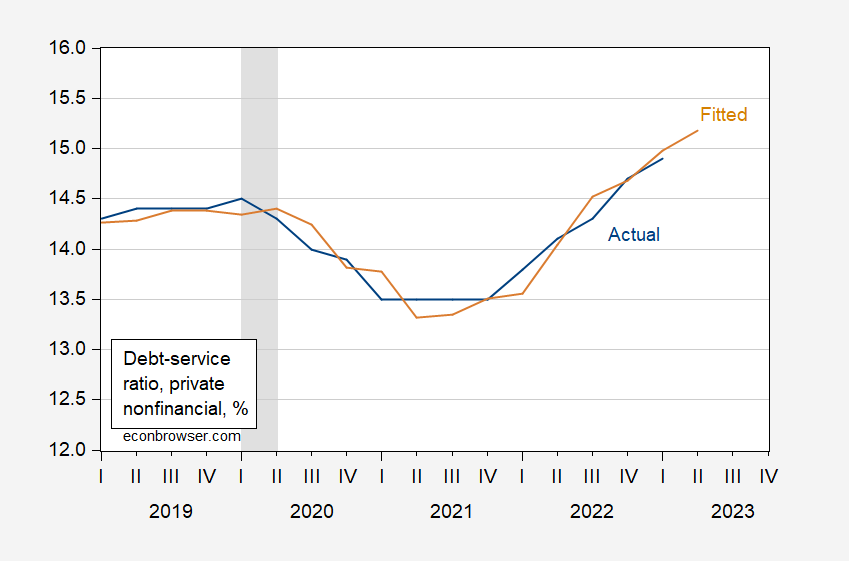

To extrapolate the debt service ratio to 2023Q2, I use the corporate AAA rate, the three-month T-bill yield, and two lags of the debt service ratio to predict the debt service ratio (all in first differences). The adj-R2 is 0.69. The fit (for 2019-23) is shown in Figure 2.

Figure 2: Debt service ratio (blue), and fitted value (tan), both in %. Model in first differences estimated 1985-2023. Source: BIS, and author’s calculations.

The (estimated) increase in the debt service ratio from 14.9 to 15.2 pushes up the probability of recession, from 45% to 65% (the term spread model has the probability rising from 68% to 79%).

More By This Author:

The Comprehensive Revisions: Little Change In TrajectoryMusings On Economic Policies In A Trump Second Term

Some Forecasts Of Industrial Production Growth