Pundits 'Hunting' For 'Signs Of A Bear'

Pundits 'hunting' for 'Signs of a Bear' are almost in a frenzy debating how many days a bearish trend lasts over, and whether it's absent or in-anticipation of, a 'recession' starting. Of course history is quite replete with examples and a slew of variations; so the exercise in mapping-out expectations seems futile.

That's so, in particular, as none of the alternatives generally offered, presume a recession 'already' underway in the United States. Yes you have to have two or more consecutive negative Quarters; but in our view you can track that from the economic higher in July, which coincided with an S&P rebound peak we called for, and suggested since, because earnings estimates and GDP forecasts were beyond realistic ones, that you'd probably look back and track it to July.

If so, what does that mean for the market. It merely confirms that a distribution of nearly-historic range should have taken place through the late Winter, Spring and no later than early-mid July of 2015; and for some (like insiders using their buyback plans to boost shares to enhance executive compensation; proven by the insider sales that SEC filings reported many made during the 'enthusiasm') it was a form of harvesting funds while they could.

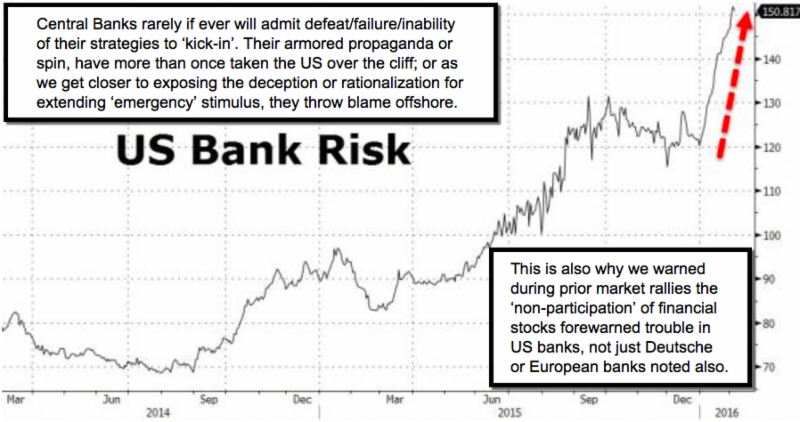

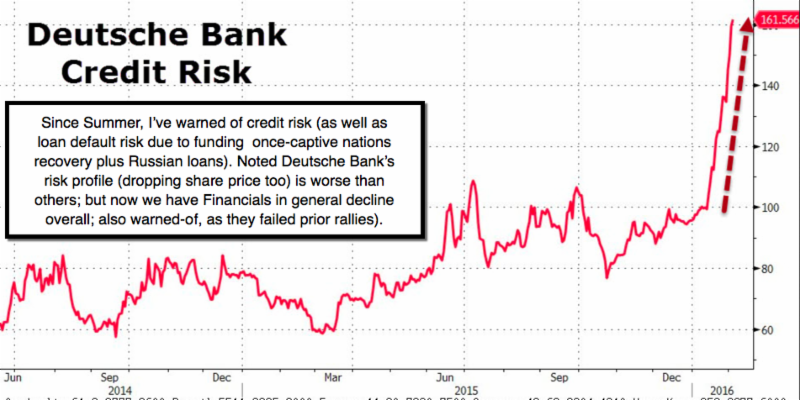

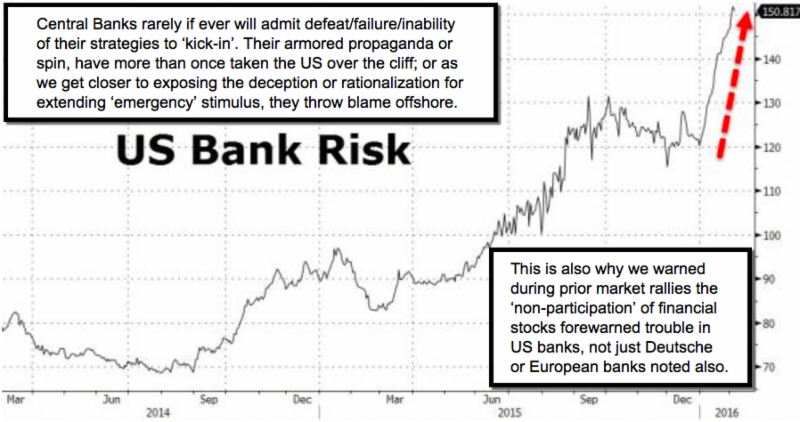

It's important that we identified that activity last year; because besides an 'edge' on what so many are talking about now, it means their speculation about 'if' we even have a recession (or sufficient growth to justify prices) isn't just academic or futile, it's inaccurate, because the activity they are speculating forthcoming or not, is ongoing. That includes the overall market downtrend, which would have duration varying according to whether we're in recession.

Since the market top was last year's Spring, and not late December, November or any other rebound 'save the day Hail Mary' rebound (such as they're trying a reflexive rebound from the interim low identified over two weeks ago); it means there's some good news: just by counting days for the average longevity on the downside, it could mean that the Bear Market ends in the 3rd or 4th Quarter of this year (much depends on how quickly the pattern evolves).

It's dicey because we live in an age of 'central bank (perceived) omnipotence'. Once they 'announce' a confirmed Recession; and everybody freaks well after the fact of its birth, the reality will be that it's the time to start looking at the long side of equities, especially if we get a base (whether after a 'crash' or not one of those 'as such'); or we have a celebration (such as after the major campaign to smash ISIS so-call capital of Raqqa rumored to be in preparation, including the updated airfield not far from Mosul the U.S. Army is preparing for the USAF just now; or perhaps after the ejection of ISIS from Libya which the US and several NATO members are said to be preparing now; all of which presumably would occur after the ISIS leaders had fled to some other territory such as in Africa, as this is too-broadly discussed now for an enemy not to disperse or try to).

(I won't delve into it, but none of the major media noted that our President's big meeting at a Baltimore mosque preaching tolerance and sympathy for them, is at a mosque monitored by the FBI counter-terrorism teams of history of people and donations to radical groups coming from there. Oh well, is this surprising? Most Democrats believe this President hasn't taken radical Islam seriously to a sufficient degree; and clearly most Republicans would concur. Perhaps going to battle belatedly during the April-May period, after winter but before sand storms later in summer make even aerial activities risky, makes some sense ahead.)

In-sum: not much was gleaned from Thursday's move; but note that the early high faded right at the time (and high of the day) desired on our morning video, while the rest of the pattern retraced 'most' but we avoided skirmishes and for the most part it was as outlined last night.

The 'battle' we're focused on right now is not the Middle East; but whether the 'reflex' rally is ending or just chopping around awaiting China reserve news.

Thursday (final) MarketCast

Pre-close (intraday + China risk) MarketCast

Disclosure: None.

excellent article - a very good source of "real" data that major media hubs are absent of showing.

Thank you kindly Adem; my bearishness for the last six months was based on 'facts' evident in the buyback-sustained S&P range during distribution. Even the OMB and IMF saw global GDP deteriorating, yet so many acted 'as if' things were growing. For our subscribers, we're still short from March S&P 2065; came out of half over 2 weeks ago now; and layered a bit back on during this past Monday's rally. A bit antsy about China's Currency Reserves coming Sunday, during a week their FX trading desks will be closed. Cheers!