Net-Zero Targets And Temperature Alignment: Two Sides Of The Same Coin?

For many people, a new year represents a chance to set new objectives and tick (or scrap) the previous year’s list of resolutions. Whether this objective-setting exercise works is debatable. A similar phenomenon might be observed within companies. Scientific consensus maintains that net-zero emissions should be reached by 2050 if the world is to keep warming levels below 1.5°C, aligned with the goals of the Paris Agreement. As such, an increasing number of companies, countries, and investment actors have been setting climate-related targets, which comprise one of the four pillars of the recommendations put forward by the Task Force on Climate-related Financial Disclosures (TCFD).1

Net-Zero Targets: From Commitment to Action

The Science-Based Targets Initiative (SBTI) is one of the leading organizations when it comes to supporting companies in setting and validating credible targets. To be validated by SBTI, targets must cover relevant emissions’ scopes, as well as be time-bounded and specific.2

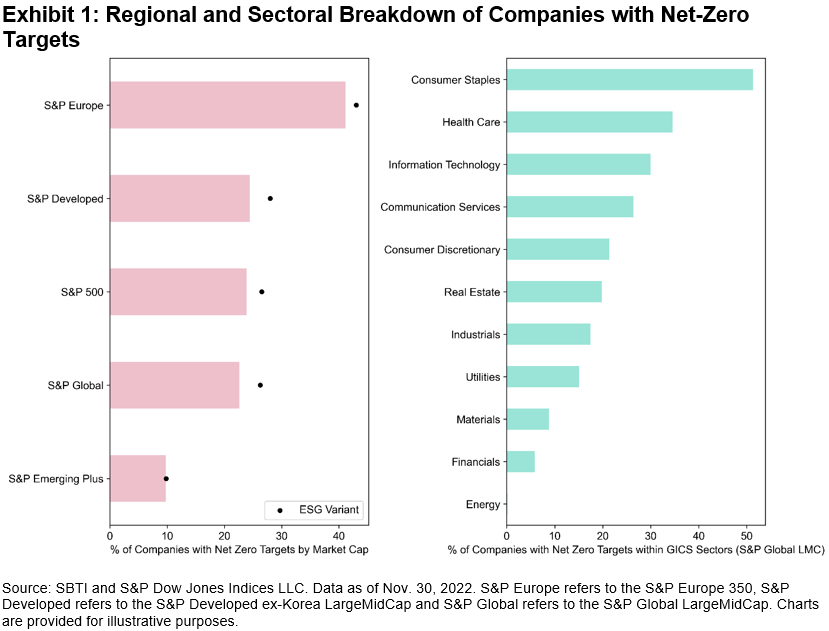

From a regional standpoint, Europe is leading the way when it comes to corporate net-zero target setting, with more than 40% of companies by a market cap having set a target within the S&P Europe 350®, while around a quarter of S&P 500® companies have done so (see Exhibit 1). All S&P ESG Index counterparts to the assessed universes have a higher percentage of companies with net-zero targets (see left-hand chart). From a sectoral lens, more than half of Consumer Staples’ companies have a verified target, with almost none in Energy being able to do so, due to fossil fuel involvement (see right-hand chart).3

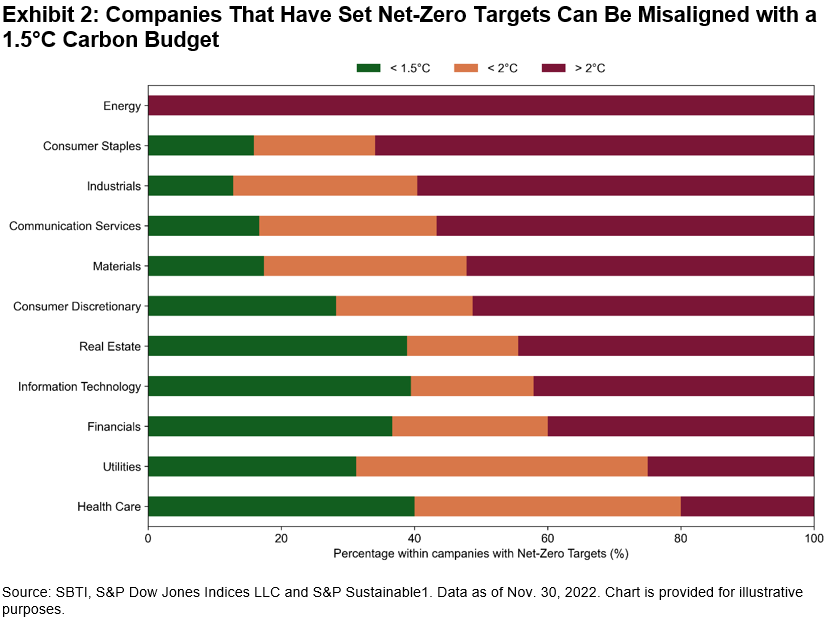

But is corporate target setting indicative of alignment with the goals of the Paris Agreement? Intuitively, one could expect that companies that have set net-zero targets are more likely to be on a 1.5°C trajectory through relative or absolute decarbonization efforts. However, these might just be two sides of the same coin. While targets indicate commitment (or even ambition), S&P Global temperature alignment models compare historical and forward-looking projected emissions to a specified carbon budget.4 Thus, even companies with net-zero targets might be aligned with a >2°C pathway by the end of the century (see Exhibit 2).

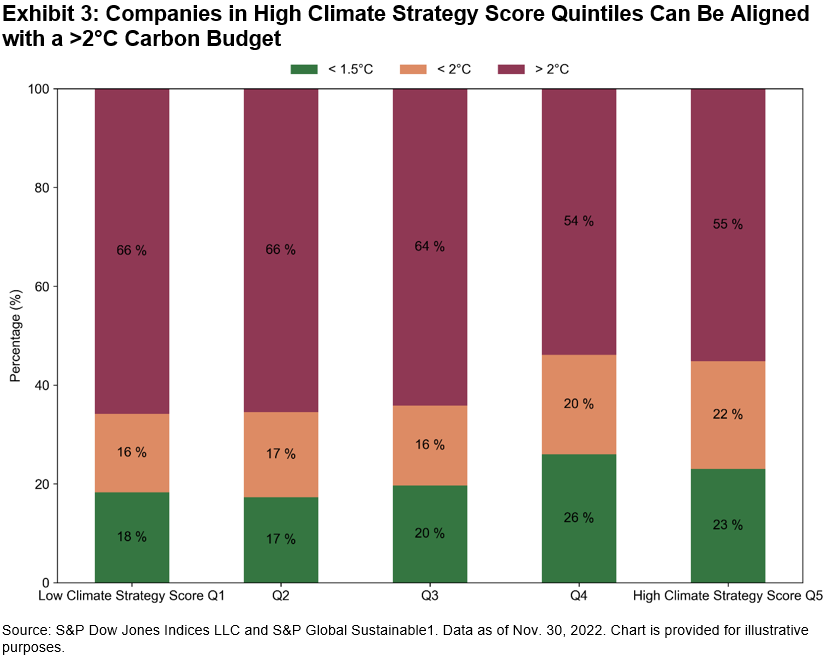

Another way to explore the relationship between net-zero targets and temperature alignment is to look at the S&P Climate Strategy Score. This is sourced from the S&P Global Corporate Sustainability Assessment (CSA)5 under the environmental dimension and comprises questions related to climate targets, carbon pricing, and TCFD disclosure, among others. A similar phenomenon occurs, where companies within low climate strategy quintiles can still be 1.5°C aligned, and vice-versa (see Exhibit 3).

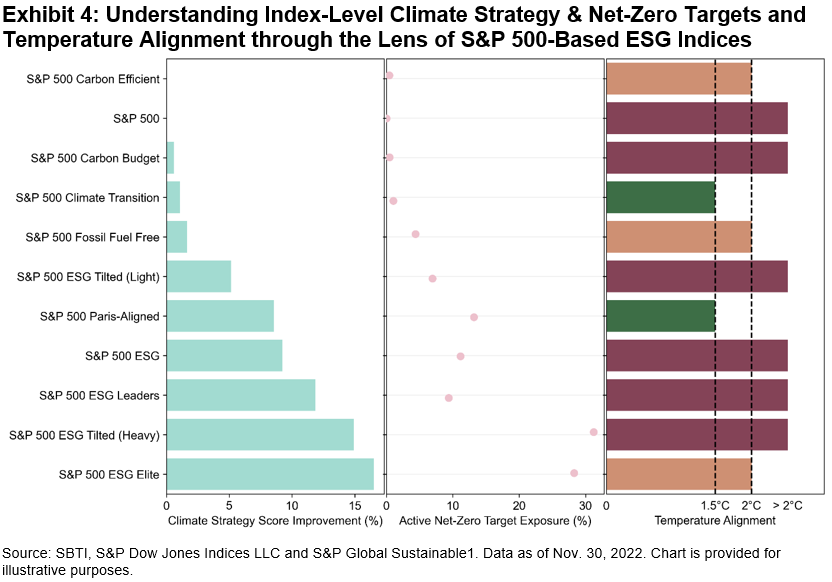

How do different S&P 500-based indices fare when considering all these aspects? Most of S&P DJI’s sustainability indices show a Climate Strategy Score improvement relative to the underlying S&P 500, except the S&P Carbon Efficient Index (see Exhibit 4). There seems to be a positive relationship between the Climate Strategy Score and active net-zero target exposure, which might be expected, as one of the metrics assessed under the score is climate targets commitment. Yet, when it comes to temperature alignment, what was observed at the company level also seems to prove true at the index level: higher exposure to companies with net-zero targets and enhanced climate strategies does not necessarily translate into a 1.5°C outcome, according to S&P Global Trucost models.

Bridging the gap between climate ambition and action has been the focus of many organizations, investor-led groups and policymakers alike. While corporate target setting might be the first step in the right direction, continued decarbonization action needs to be sustained to stay within a 1.5°C budget. Net-zero indices that incorporate forward-looking metrics, such as the S&P PACT™ Indices (S&P Paris-Aligned & Climate Transition Indices) might help market participants align with a 1.5°C pathway while increasing allocation to companies with climate-oriented targets and strategies.

1 Task Force on Climate-related Financial Disclosures (TCFD) recommends “Metrics & Targets” as one of the pillars for climate disclosures.

2 Companies are required to report annually on targets’ progress.

3 Companies involved in oil, natural gas and coal business activities are not currently able to set up SBTI targets.

4 Analysis performed using S&P Global Trucost’s Paris Alignment dataset.

5 For more information on the CSA, please see here.

More By This Author:

What Performance Reversals Suggest

Building A Passive Bridge Across The Pond

The S&P China 500 Rebounded 7.1% In Q4 2022, Recovering A Portion Of Its 2022 Losses

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.