What Performance Reversals Suggest

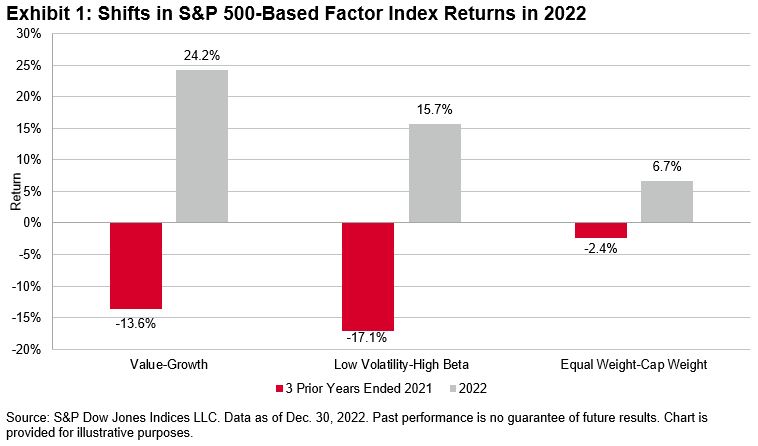

Investment results in 2022 were distinctly different from those of the recent past. The S&P 500®, which had doubled in the three years between 2019 and 2021, fell by more than 18% last year, and Exhibit 1 shows that there were regime shifts among factor indices as well.

The dominance of Value over Growth in 2022 was especially remarkable. The one-year Value-Growth spread stands at the 97th percentile overall 12-month intervals since mid-1996. Equally interesting is that six years had passed since Value’s last “win” in 2016.

What can we infer from these factor shifts? Here are three important things:

First, they suggest considering passive management to be the default position for any asset owner—regardless of whether he’s seeking broad equity market exposure from the S&P 500, or more targeted factor exposure from one of the indices in Exhibit 1 (or their many cousins). Readers familiar with our SPIVA® Scorecards (and I hope that means all of you) will realize that most active managers underperform most of the time. That result holds true across capitalization and style segments: the same causes that make it hard for a core equity manager to beat the S&P 500 make it hard for a value manager to outperform the S&P 500 Value. An asset owner who opts for indicated factor exposure is likely to outperform an active manager operating in the same market segment.

Second, Exhibit 1 reminds us of the importance of patience. There are good theoretical arguments for why value should outperform growth, why low volatility should outperform high beta and why equal weight should outperform cap weight—but even if completely correct, those are arguments about long-run performance. Many low-volatility or value investors spent the years between 2019 and 2021 wondering if something important had changed. 2022’s reversal was welcome, but it was a long time coming. In investment management, as in life generally, gratification must sometimes be deferred.

Finally, Exhibit 1 raises an important philosophical question: what is the point of factor indices in the first place? A value-driven factor index tracks relatively cheap stocks. A low-volatility index tracks stocks with below-average volatility. A quality index tracks stocks with strong balance sheets and profitability. Are these characteristics, or others like them, desirable in themselves, or are they means to a different end? Low volatility indices, for example, are almost always less volatile than the benchmark from which their constituents are drawn, but as we saw above, they sometimes underperform. An asset owner who chooses Low Volatility because he wants less volatility is likely to be satisfied most of the time; his counterpart who chooses Low Volatility because he thinks it will outperform has much more potential for buyer’s remorse.

An investor who undertakes factor exposure as a means of outperforming should understand that no factor index outperforms all the time and that his ability to tolerate periodic underperformance may have a major bearing on his success. The investor should strive to understand the conditions that will facilitate a factor’s success. At least as importantly, he should be clear about his own goals and motivations.

More By This Author:

Building A Passive Bridge Across The PondThe S&P China 500 Rebounded 7.1% In Q4 2022, Recovering A Portion Of Its 2022 Losses

Indexing Income: How Are Insurers Diversifying With Dividends?

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.