The S&P China 500 Rebounded 7.1% In Q4 2022, Recovering A Portion Of Its 2022 Losses

The S&P China 500 gained 7.1% in Q4 2022, gaining back some of the losses exhibited earlier in 2022. Despite the strong quarter, Chinese equities underperformed global and emerging markets in Q4, as these segments broadly bounced back from the heavy losses of Q3. The S&P China 500 declined 24.4% in 2022, likewise underperforming global and emerging market indices. For the final quarter of 2022, Communication Services, Health Care and Financials sectors led the gains, all up over 10%.

The S&P China 500 underperformed other Asian markets, which in some cases posted strong gains during Q4. Notable outperforming benchmarks were the S&P Hong Kong BMI, S&P Korea BMI and S&P Japan BMI, which returned 18.8%, 18.2% and 12.9%, respectively. Meanwhile, the S&P Indonesia BMI dropped nearly 9% during Q4 after being the sole positive performer in the region during Q3.

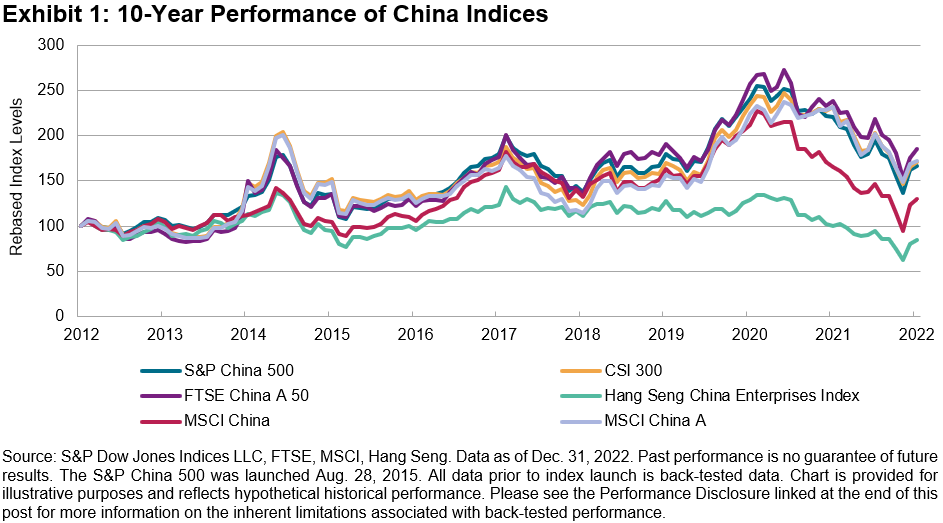

The S&P China 500 continues to maintain positive performance over the long term. With an annualized gain of 5.2% in USD over the past 10 years, the index has easily outperformed the S&P Emerging BMI, which had an annualized gain of only 2.6% over the same period.

Offshore Stocks Outperformed Onshore

Both domestic and offshore listed China equities delivered positive returns during the quarter. The global downturn in equities this year has resulted in higher correlation in China equity share types, however, Q4 2022 saw offshore China listings significantly outperform their onshore counterparts. Given its diversified composition across Chinese share classes, the S&P China 500 outperformed the indices that had more weight in China A-shares and underperformed those with more exposure to Hong Kong-listed Chinese companies (see Exhibit 1).

(Click on image to enlarge)

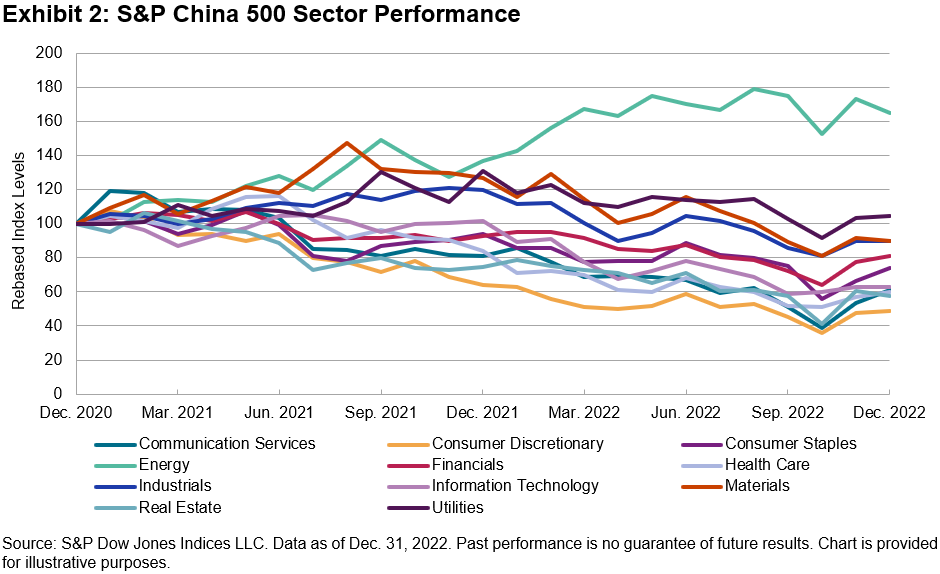

Communication Services and Health Care Led the Gains

Communication Services and Health Care outperformed in Q4, gaining 19.5% and 16.2%, respectively. Financials also had a strong quarter, up 12.4%. Consumer Staples was the largest drag on the S&P China 500’s performance, as it declined 1.6%. The Energy sector also saw negative returns during the quarter.

At the company level, the major contributors to the index’s performance during the quarter were Tencent, which clawed back all its previous quarters losses to post 26.1%; Alibaba, which was up over 10%; and Pinduoduo, which also had a strong quarter. In terms of outright performers, Shanghai Junshi Biosciences gained 95.5% on the back of a positive result from a clinical trial of a lung cancer treatment, while Country Garden Services regained Q3 losses and more—rising 69.1%—and Sinotruk, a heavy-duty vehicle manufacturer, also gained 66.6%.

NIO Inc (down 38.2%), Kweichow Moutai (down 5.9%) and LONGi Green Energy Technology (whose share price declined just over 10%) were among the few noteworthy detractors to the index’s performance during the quarter.

(Click on image to enlarge)

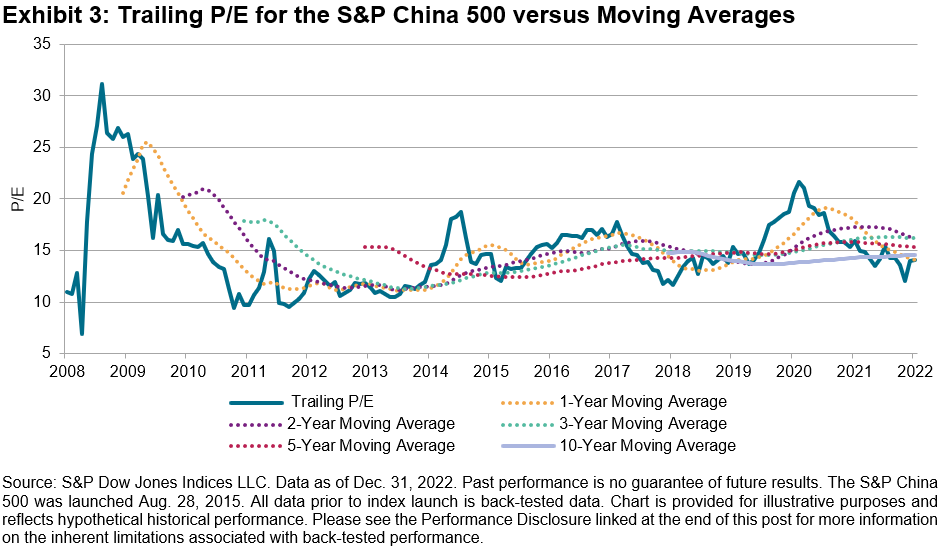

Valuation Metrics Remain Attractive

The S&P China 500 trailing P/E increased to 14.1x in Q4 (13.6x the prior quarter), however, it remained below the 3-, 5- and 10-year averages. The rolling 1-, 3-, and 5-year P/E ratios remained slightly above the long-term average.

(Click on image to enlarge)

The trailing P/E for the S&P Emerging BMI also increased to 13.2x, as security price gains were broad across ex-China emerging regions. The S&P China 500 index dividend yield, meanwhile, decreased from 2.58% to 2.44% on a quarterly basis.

More By This Author:

Indexing Income: How Are Insurers Diversifying With Dividends?

The Dow Jones Dividend 100 Indices Part 1: A Focus On Dividend Sustainability And Quality

Latin American Equities Outperformed Global Regions In 2022

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.