Market Briefing For Wednesday, June 14

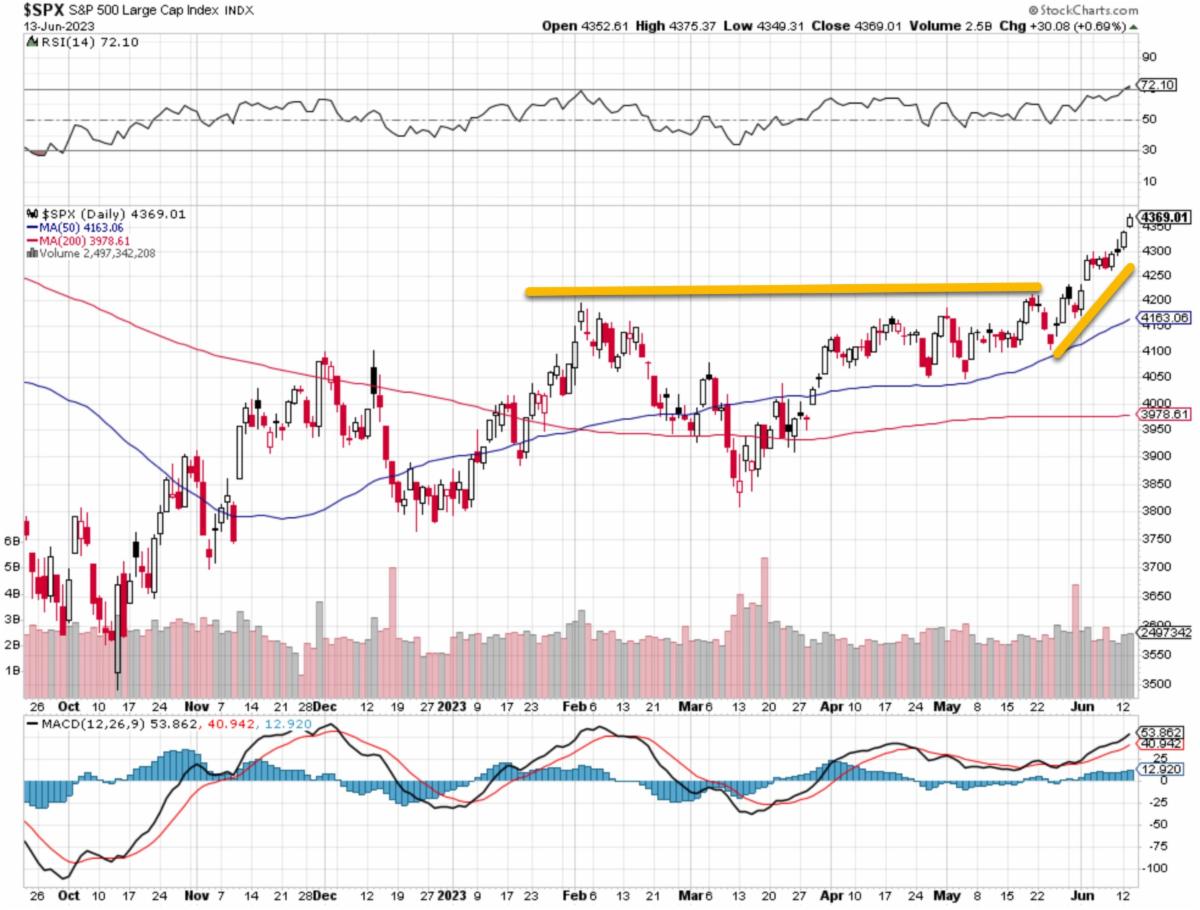

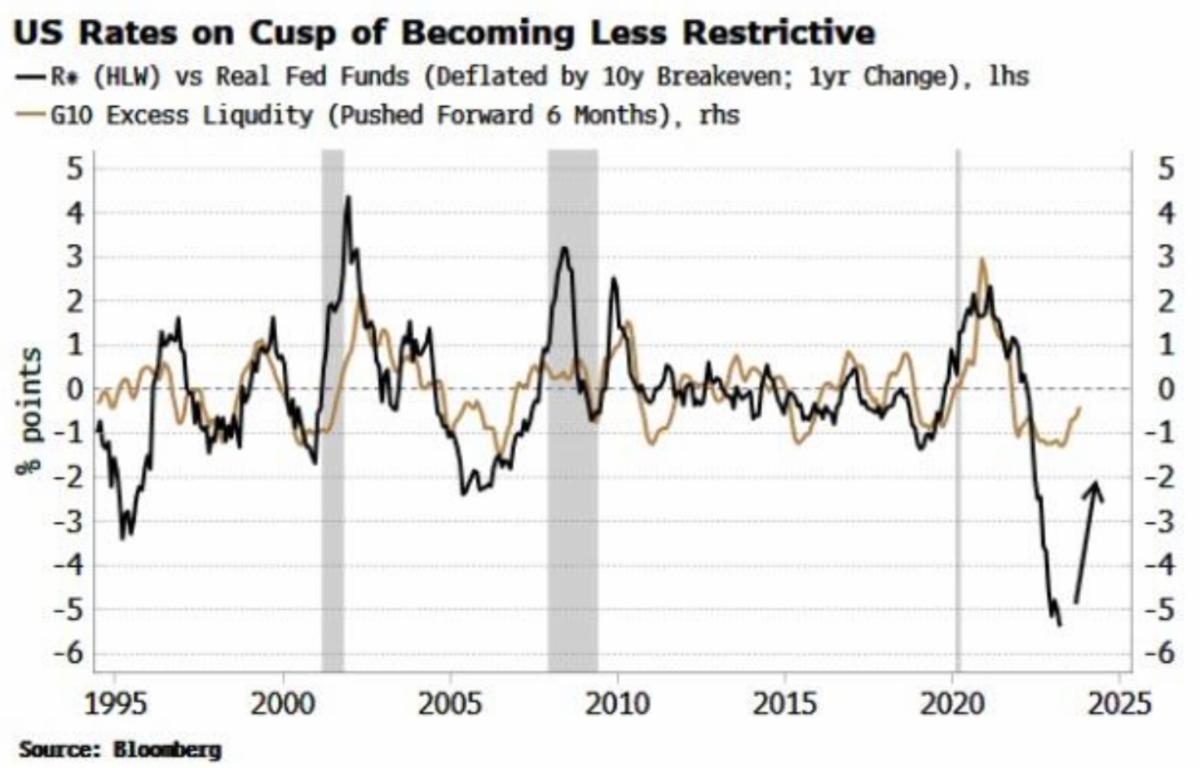

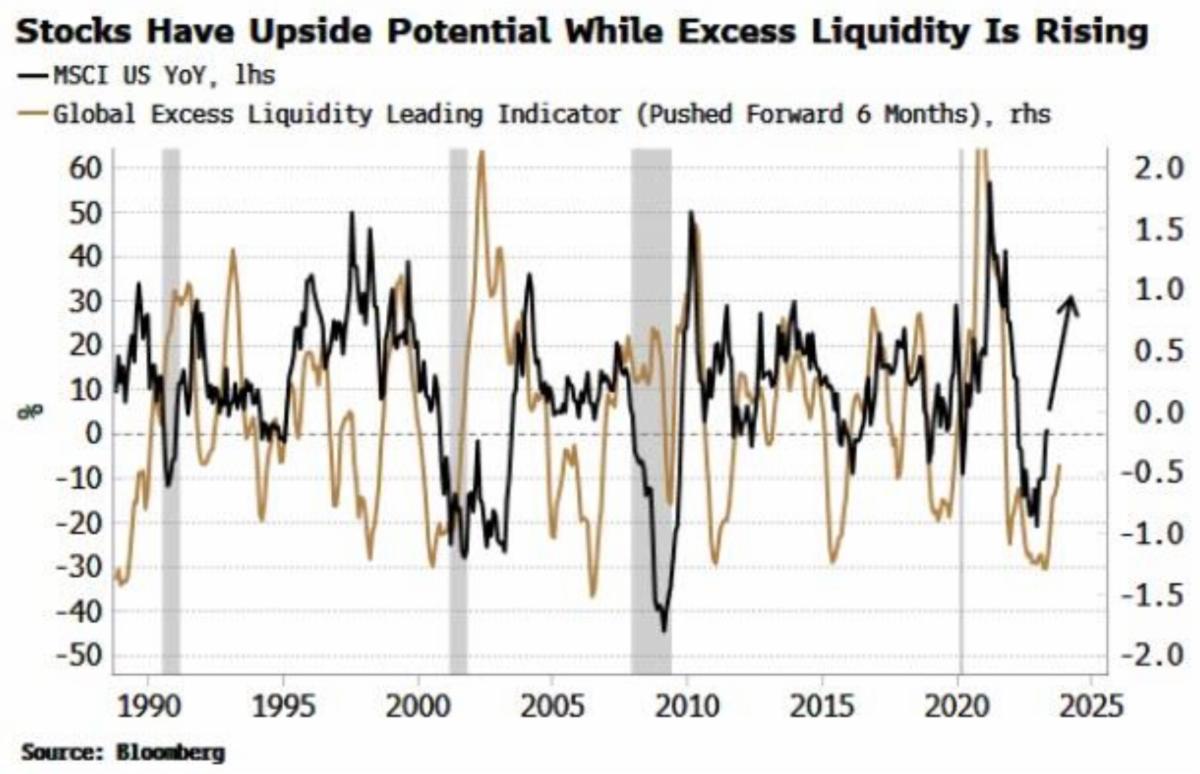

Stocks continue catching a bid - ahead of the FOMC decision on rates. As I noted. Liquidity actually is improving a bit, so is psychology. While sustaining a move like this is hard to estimate, it's the FOMO that encourages me most.

To wit: there's no assurance S&P (or stocks more broadly) will perform just as I ideally have orchestrated possible, but if they do you get something like 'fade on the Fed' news (even if they pause... you rally and get good new selling), to then surprise the newbie bears by rallying into Quarterly Expiration.

It's that sequence that has me allowing for an atypical series immediately after the Fed and given the encroaching Quadruple Witching Expiration. Now that's not to say we won't get a 2nd half of June shakeout thereafter, but that might be dependent on how things go with (stealth-like) negotiations with China, or if it's true that whole regiments of Russian forces are now being decimated at the cost a few (any are too many) Ukrainian troops and Western weaponry.

I might mention there are now two new distinct small armies or militias fighting Russia 'inside Russia'. One is comprised of deserting Russian soldiers and a contingent of Belarusian troops, all of who are upset with their dictators. That might be why Minsk has threatened Ukraine with nuclear attack even though Putin had said nuclear weapons put into Belarus would be Russian controlled.

All of it sounds dangerous, as did the appearance of Putin the other day. This is a factor, and how it goes (preferably to Russia going home and dealing with Putin on their own terms, with Ukraine out of the political picture in that).. well it will matter. The other issue that can impact is 'weather', which creates more rain, higher heat, and sets-up a stagflation situation for much of the world.

In-sum:

What's coming tomorrow has been over-discussed everywhere and so I won't. However the odds of the Fed pausing, while scaring us about July is logical in a reasonable sense, since they're not about to state inflation 'goals' reached. I suspect they will acknowledge progress, including lower Oil prices, but floods, heat and other issues is doing much to help food costs or for that matter rents in most areas of the Country. Then there's the story of Nordstrom's (JWN) pulling out of San Francisco, and I thought they already had. Poor San Francisco, all that tech talent and mediocre governance that can't get the situation resolved.

But 'retail' will have little to nothing to do with the Fed's decision or Expiration, it's just a pattern I suspect. Then we can correct somewhat and likely smaller stocks (proportionately) ought to do better in a down-the-line rally into July. It is too soon to tell, and there are many variables to contend with.

Meanwhile . . . I'm going to start monitoring another small 'sprinkle' stock that I've looked at preliminarily, and really didn't intend covering yet. I don't (yet) own even a single share. However BKSY is making institutional presentations twice later this week, got a new contract of significance, and is an alternative (competitor?) to another, in a way. It's a 'spooky' company, as visual spies. If you ask if it involves AI it does, and Peter Thiel and even Palantir.. some of these companies are partners on different Defense Dept. programs.

It's BlackSky. I mentioned it once or twice, it will be a 'light' (back burner but never know) holding. This is speculative low-priced, and is NYSE listed.

BlackSky is a provider of real-time geospatial intelligence. BlackSky delivers on-demand, high frequency imagery, monitoring and analytics of most critical and strategic locations, economic assets, and geopolitical events as ongoing.

BlackSky designs, owns and operates one significant 'low earth orbit' small satellite constellations, optimized to capture imagery cost-efficiently where or when customers need it. BlackSky’s Spectra AI software platform processes data from their constellation and from other third-party sensors to develop the critical insights and analytics customers require.

It seems like a cross between BigBear.ai (also popping) and Terran Orbital (BBAI, LLAP), and there may or may not be cross-ownership. I haven't had time to assess it that much, so of course one wonders about dilution, overhead supply and all the considerations. I only add it now without more study because of news and upcoming institutional presentations. If buying -as a spec- I suggest under 2, and preferably in the 1.70-1.90 range, with a goal of higher considered later.

Bottom-line:

we look for the Fed to have justification to 'pause' hiking, and to nevertheless stick to their guns about fighting inflation, and watching data as they head to the July FOMC... hence this 'might' be the end of the hiking.

Of course that's what the market likes, plus there is FOMO by the intensive as well as blindsided negativity that for months failed to assess bifurcation as the manifestation of 'fear' of catastrophe which was avoided and likely won't occur either. Now there should be an erratic process of advance due to FOMO.

More By This Author:

Market Briefing For Tuesday, June 13Market Briefing For Monday, Jun 12

Market Briefing For Thursday, June 8

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more