Market Briefing For Thursday, Apr. 27

Defensive hesitancy - makes sense in this market. Besides the convoluted bifurcation we've regularly referred to, there are global influences beyond the media's common reporting, such as Putin's latest threat to 'nuke' Ukraine, that is not sourced by us domestically, but just adds to the S&P's trepidation.

Now you have a very divided market, recession fears persisting, and GDP which at the same time might repel a Fed from hiking further. All those ripples= mixed.

That shift to 'defensive' posturing was suspected in the wake of better earning reports yesterday triggering another rally that would be unsustainable. Then, you had the UK knock-down a Microsoft / Activision deal, but maybe that's a plus for Microsoft (MSFT) just now. Besides, their new focus is increasingly 'AI'.

Of course late today you had more 'solid' earnings reports (beating estimates that were allowing for limited progress or contraction), ahead of a soft GDP. It might set the stage for something like Wednesday to repeat again Thursday.

Contributing factors to the 'negative sentiment' are well-known and need little expansion here. However, the threat by Putin is another reminder of instability such as existed before World War 1, the expansionary brutality shown during the occupation of parts of China by Japan and of course Hitler's Germany as the scourge of Europe (while the Soviets weren't innocent either) during those fabled Depression era, along with U.S. and U.K. late 30's military preparations as the stench of war was already palpable, long before it actually broadened.

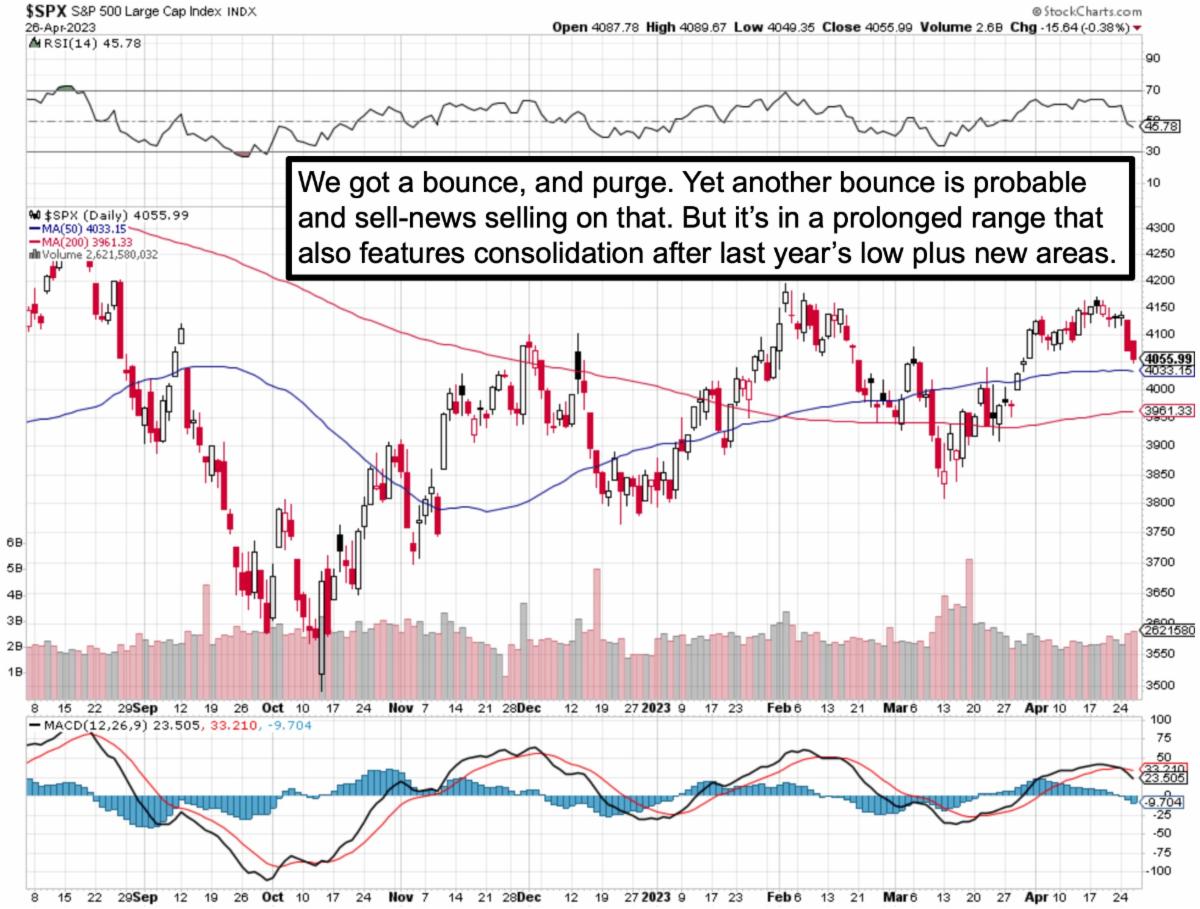

I suspect that although we thought the rally would falter (sell the news) and be hard-pressed to make a higher high (after all we had a double-top evident) for S&P, we would not plunge, and we actually did not. Now you'll get Facebook (or I mean META) soaring, perhaps Amazon (AMZN) popping too, and setting-up the Thursday session for a possible 'rinse & repeat' kind of action.

In-sum:

There's 'drama' around GDP, but shouldn't be. And China's overture to Ukraine is being leveraged by Putin's nuclear threat, likely not coincidental. Plus we're getting most of the big-cap techs exceeding estimates, but those in most cases were purposely very conservative, making it easier to achieve.

We are in a transition, but not to catastrophe or Armageddon. Actually a slight GDP disappointment would help dissuade excess Fed rate-hiking zealotry. At the same time remember that most of the market crashed in the prior year, so after the 'inverse head & shoulders' bottom we identified months ago, all this has the possibility of constructing a fatiguing base for market progress.

Even at the same time it's primarily stocks and sectors, not so much for the Index, it nevertheless can ultimately elevate S&P 'if' the movement is broad enough. That suggests 'if wider war is averted' any 'crack' in the market next month might be primarily for buying in beaten down areas that are actually in a money-making position (or innovative enough that it's forthcoming), not for an embrace of 'run for the hills' evacuations. That happened more last year.

(And speaking of 'threats', there are reports that China's hypersonic missiles flying at 6000 mph and that we have nothing 'finished yet' with capabilities of intercepting. There is also talk of the impossibility of defending Taiwan, which is not an accepted position, but was the outcome of another 'exercise' just in theory..in which bipartisan members of Congress had to ponder possibilities.)

Estimates for GDP emerge tomorrow, the economic positioning varies, just as the Atlanta Fed 'Now' report has settled-back to under 2% growth, so that's a rough estimate of what might be in the 'official' report Thursday morning. For the macro we held the ~4000 area, rebounded, faltered, and now defensive.

There is no shift in our view, just realization that if things are sluggish enough it could become 'bad news is good news' and retard the Fed from hiking rates again... or at least hinting more overtly at a pause if they do go forward.

More By This Author:

Market Briefing For Tuesday, Apr. 25Market Briefing For Monday, Apr. 24

Market Briefing For Friday, Apr. 21