Market Briefing For Monday, Apr. 24

Lack of 'any' conviction aptly describes the nominal Expiration just ended. I was hoping for more action; but the volume was generally light enough that the big option writers (who are often the largest institutional holders in stocks) were able to typically see nearest strike Puts & Calls expire worthless; thus of course the 'writers' retain their full positions.

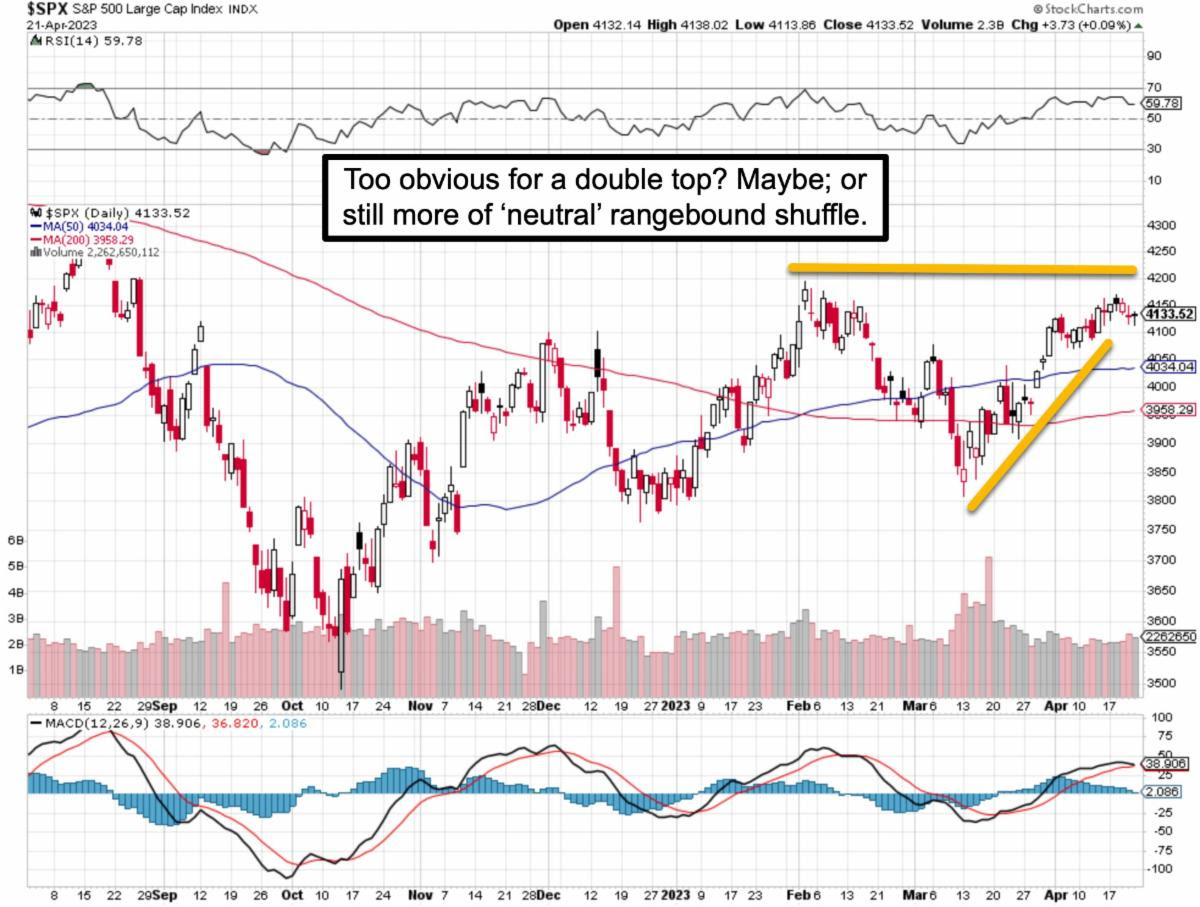

Sometimes that sets-up a post-Expiration rally; and it might. But things are so neutral (as we've contended for weeks) that a mild breeze could blow this one way or the other. The 'ducks on the pond' aren't immune from disruption; and in-theory those big-caps are capable of a swan-dive shakeout; but probably it won't be more than that; but some of it depends on Banking or similar issues.

Part of a 'neutrality-embrace' relates to a majority of issues previously having had 'swan dives'; so it's hard to crash what's already crashed. Same story as well as same situation that in-general has prevailed in ebb-and-flow fashion.

Muted volatility has been primarily reflected by the short-term options trading; because VIX is calculated on a longer-term correlation. Notice that the CBOE is rolling-out a one-day version of the Volatility Index and that's interesting, as it means the casino (the CBOE) is opening up a table for day-traders or those looking for more of a finessing of the VIX in terms of generating signals.

So I'll opine it will take awhile to grasp; but probably is borne out of frustration by the over-eager options crowd, and I get that, but suspect it's mostly just the market neutrality we've discussed; and when the shakeout comes; the regular VIX will reflect it. In other words, I dispute those saying VIX is broken. Not yet.

In sum: the bears are out in full-force talking about many dire consequences and many risks. There's a touch of validity in all the concerns; but nowhere do they acknowledge the crowded short-side and lag-effect into recession double dip, which also can set up anticipation of emerging from that.

It's all tricky but unexciting for now. I would not be surprised to see shakeout activity in the big-stocks; minor churning in the smaller stocks; and then rally into July from a low point to be seen... but again let's give this time to unfold.

This can be a false sense of neutral stability; given all that's looming ahead. However the monster week of earnings reports ahead can also swing stocks, though many seem already stretched, as far as the mega-cap stocks.

It's a benign condition for the majority of stocks; and makes discussion this in any extensive way an exercise in futility. We are seeing some composition or dispersion of interest (broadening) that allow the 'neutrality' to persist. I don't think most small-cap stocks that bounced earlier in the year won't challenge the highs then; but it will depend on business progress more individually too.

Well, neutrality has been our bias for weeks now; so while there is 'fragility' in mega-cap stocks that ran up to near prior highs; there is potential value likely in many newer growth stocks, especially in innovative and disruptive areas. It is ill-defined and the characterization really crosses into many equity sectors.

It's a 'hang-in-there' time for such stock sectors; especially the 'bets' on AI and 'space' that are indeed future-oriented; but sometimes need business models as advanced as their algorithms. We believe a couple we hold have business plans that promise 'actual revenues' at bare minimum; and likely profitability in the eyes of their CEO's, by the end of this year.

Bottom line: Nothing changed; PCI comes next week so that likely influences how analysts will assess what the Fed does at the May FOMC meeting. But it remains that the majority of the market timers and money managers are really negative; which often means the next thing that happens is they buy so as to enhance almost everyone's generally benign performance this year thus far.

Paradoxically if we're in a recession (I suspected we are; call it 'double-dip') it also diminishes the 'sell in May and go away' perception. Might well get a hit; the VIX argues that's coming. But the hit ideally would be to 'buy during' not so much to worry about. I think that applies more to smaller stocks than S&P, as the S&P has most all the stocks that have excess valuation levels.

No sense speculating more about this 'neutral market'; as it is still just that.

I do wish you all a fine weekend, and we'll assess this newly next week.

More By This Author:

Market Briefing For Friday, Apr. 21

Market Briefing For Thursday, Apr. 20

Market Briefing For Monday, Apr. 17