Tuesday Talk: Summer Stock

Summer is in full swing and as Q2 ends and its earning season begins it is time to take stock of 1H 2021 and see where things may be heading in 2H. So far pundits are predicting a higher ride for the stock market in July, though there are those that say gold is closing in. With the Nasdaq nudging toward 14,700 it should be good theater. Summer stock, indeed.

TalkMarkets contributor Victor Dergunov takes stock of Q2 21, providing a sector by sector analysis in his article All-Weather Portfolio: The Good, The Bad, And The Ugly.

Tech Related

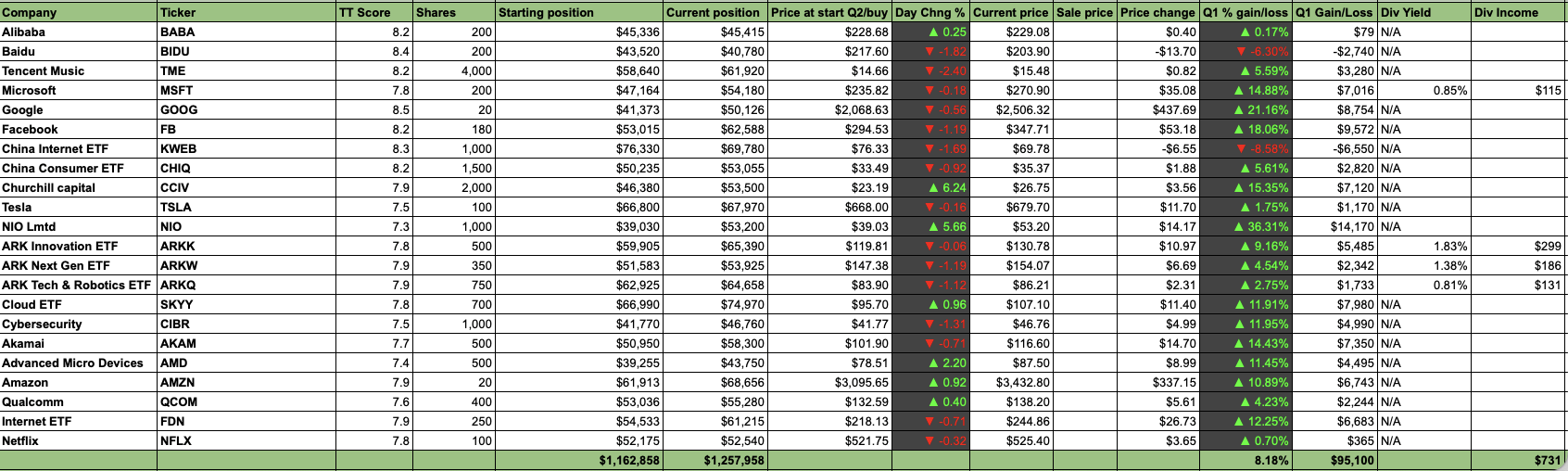

"Despite some volatility, the "Tech Plus" segment returned over 8% in Q2. Some noticeable outperformers were Alphabet (GOOGL) with a gain of 21%, Facebook (FB) with a return of 18%, Churchill Capital (CCIV) with an increase of 15%, and NIO Inc (NIO), which returned 36% in the quarter. Also, several names like Tesla (TSLA), Netflix (NFLX), and others, while up slightly on their own, worked exceptionally well with our covered call dividend strategy."

Here's his chart:

Healthcare Basket

"Better yet was the healthcare stock basket. I was anticipating a strong showing from this group, and we got it last quarter. This sector delivered 18.42% in Q2. Top performers were ETFMG Treatments, Testing and Advancements ETF (GERM), which gained 13.5%, AstraZeneca (AZN), which returned over 21%, and Moderna ( MRNA), which delivered close to 80% in the second quarter."

These are just two of the sectors Dergunov reviews. Check the full article for the others, including: Finance, Energy, Materials and Industrials, Gold and Silver, and Digital Assets and Bitcoin. Dergunov maintains his own "All Weather" portfolio and the article ends with his comments and some anticipated actions for Q3.

"Possibly the most significant difference in Q3 is that I cut down on the number of holdings. However, I continue to like the same areas. Technology, China, healthcare, oil/energy, materials, industrials, financials, GSMs, and digital assets still make up the lion's share of the all-weather portfolio. Technology, big tech especially, offers strong growth at a reasonable value...The all-weather portfolio looks more vital than ever, and I look forward to talking about more strong gains three months from now."

Durable Earnings Growth Expected is the headline of contributor Sheraz Mian's Editor's Choice column which takes a peek into Q2 earnings.

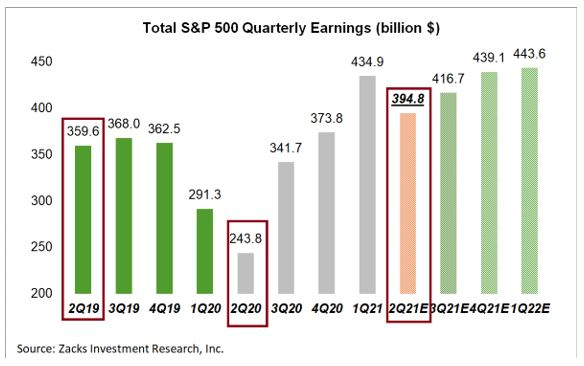

"Total Q2 S&P 500 earnings are currently expected to be up +61.9% from the same period last year on +18.2% higher revenues. Estimates have steadily gone up in recent months, with the current +61.9% growth rate up from +50.6% at the start of the quarter on April 1st and +41.6% at the start of January...The chart below shows the aggregate bottom-up quarterly earnings tallies, actual earnings for the reported periods, and estimates for 2021 Q2 and beyond, to give us a better sense of the easy-comps question."

"As you can see here, 2021 Q2 at $394.8 billion is +61.9% above the COVID-hit $243.8 billion tally achieved in 2020 Q2. You can also see here that 2021 Q2 is +9.8% above the comparable pre-COVID 2019 period."

Mian is optimistic, positing the following: "Please note the double-digit earnings growth expected in each of the next two years. This suggests that the market isn’t looking for a one-off rebound this year, but rather an enduring growth cycle that continues over the next couple of years."

The article concludes with predictions of Q2 results for the Banking sector.

In another TalkMarkets Editor's Choice column As Good As It Gets: Will Q2 Mark Peak Reporting?, contributor Lance Roberts thinks that Q2'21 will mark the peak of the post-Pandemic recovery. As usual his article is replete with graphs and myriad details. Here is some of what Roberts has to say:

"The bulls are indeed in charge of the markets currently, but the clock is ticking...Over the next couple of months, we will see the most significant numbers of the recovery cycle as we compare Q2-2021 to Q2-2020, which was the depth of the economic shutdown. As shown in the chart below, we will see a robust GDP report, but such will be the cycle’s peak."

Here is one of Roberts charts:

Roberts concludes by sounding some familiar alarm bells:

"As markets are rising, individuals believe that the current price trend will continue to last for an indefinite period. The longer the rising trend lasts, the more ingrained the belief becomes until the last of “holdouts” finally “buy-in” as the financial markets evolve into a “euphoric state.” Once the market begins to decline, there is a slow realization it is more than a “buy the dip” opportunity. As losses mount, the anxiety of loss begins to climb until individuals seek to “avert further loss” by selling. Such is the basis of the “Buy High / Sell Low” syndrome...It is likely, given there is “no fear” of a market correction, an overwhelming sense of “urgency” to get invested, and a continual drone of “bullish chatter,” that the markets are poised for an unexpected, unanticipated, and inevitable event. What will that be? No one knows until after the fact.

Such is why applying “risk management” before the event is critical to the eventual outcome. After all, you don’t carry an umbrella after it rains, do you?"

Contributor Paul Schatz's take is that the Stats Say It’s Still Onward & Upward For The Bulls . Here is the skinny as Schatz sees it:

"We also know that if July begins the month in an uptrend, like it did, it returns roughly +1.5% on average. The S&P 500 closed the first 6 months higher by more than 12.50%. When this happens, the rest of the year is usually up by roughly 10%, including the last 6 instances. Just keep in mind that 1987 and 1998 were in this category and both saw major declines in Q3."

"April, May and June all closed the month up. That has only happened 17 times since 1950. All 17 occurrences led to higher prices over the next 9 months. However, we did see some sharp declines in 2018, 2016, 1997 and 1980."

"The S&P 500 has made a higher low for 10 straight days, something that doesn’t happen very often and is yet another sign of strong upside momentum. Behavior like this has led to the S&P 500 being higher two months later almost every time according to Rennie Yang of Markettells.com."

Ever the prudent New Englander, Schatz concludes with another counterpoint: "However, once momentum starts to wane, it’s time to think more about defense and harvesting those acorns."

Still, it's summer, it's July and some of us are looking to party. Talk Markets contributor Kaustav Ghosh suggests three stocks for summer recreation in 3 Stocks To Watch Amid Robust Demand For Off-Road Vehicles.

"The off-road vehicle market seems ready to witness further growth as people continue to resort to adventure sports as the preferred way of fulfilling their entertainment needs. Therefore, it seems a good time to look at both off-road vehicle manufacturers as well as companies that manufacture parts for such off-road vehicles.

Polaris (PII) offers off-road vehicles, including all-terrain vehicles and side-by-side vehicles, among others. The company currently has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings increased 1.3% over the past 60 days. The company’s expected earnings growth rate for the current year is 19.8%.

Fox Factory Holding Corp. (FOXF) offers mid-end and high-end front fork and rear suspension products for off-road vehicles and trucks, all-terrain vehicles, and so on. The company currently has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings increased 10.8% over the past 60 days. The company’s expected earnings growth rate for the current year is 32.3%.

Honda Motor Co., Ltd.’s (HMC) Motorcycle Business segment produces motorcycles, including sports, business, and commuter models; and various off-road vehicles, such as all-terrain vehicles and side-by-sides. The company currently has a Zacks Rank #3. The Zacks Consensus Estimate for its next-year earnings increased 3.1% over the past 60 days. The company’s expected earnings growth rate for next year is 23.3%."

That's a wrap for this week. Here's to a hot July in the markets and a cool one under the trees.

Have a good week.

While citing history is educational and probably encouraging, we are constantly reminded,(at least I am!), that past performance is no guarantee of future results. So while the future claims to be positive, things may be different.