All-Weather Portfolio: The Good, The Bad, And The Ugly

It's that time of the year again. While Q2 was a challenging quarter for some segments, several areas of the all-weather portfolio performed remarkably well. I want to go over Q2 assets by sector to see what worked, what didn't, what could have worked better, and what will likely do well in the future.

What Worked

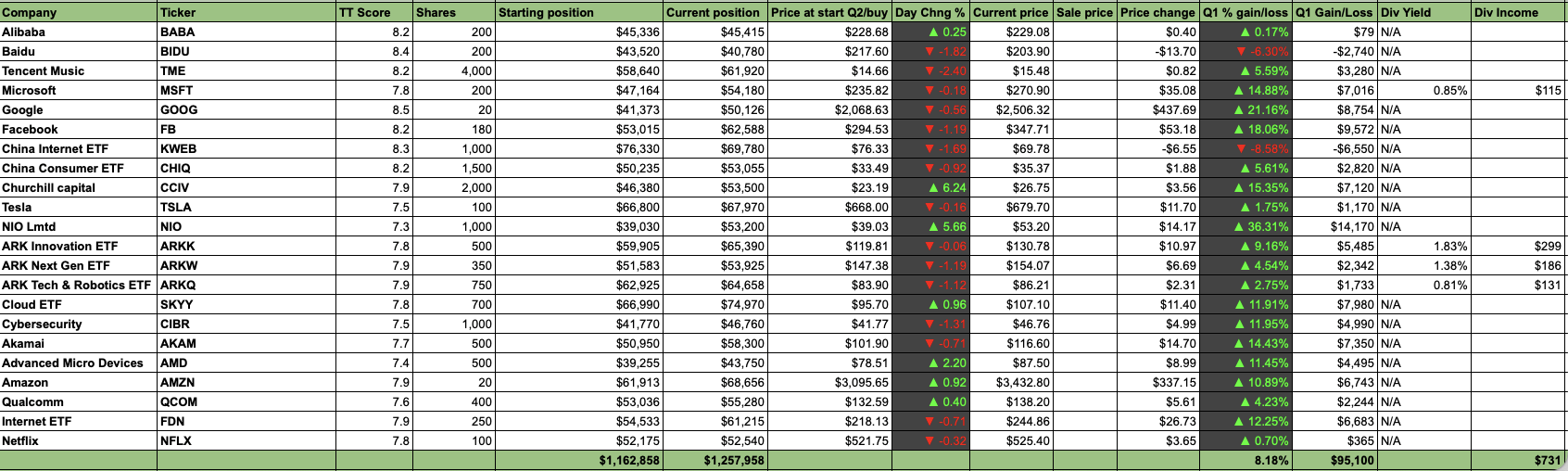

Tech Plus Segment

(Click on image to enlarge)

Source: seekingalpha.com

Despite some volatility, the "Tech Plus" segment returned over 8% in Q2. Some noticeable outperformers were Alphabet (Nasdaq: GOOG) (Nasdaq: GOOGL) with a gain of 21%, Facebook (Nasdaq: FB) with a return of 18%, Churchill Capital (NYSE: CCIV) with an increase of 15%, and NIO Inc (NYSE: NIO), which returned 36% in the quarter. Also, several names like Tesla (Nasdaq: TSLA), Netflix (Nasdaq: NFLX), and others, while up slightly on their own, worked exceptionally well with our covered call dividend strategy.

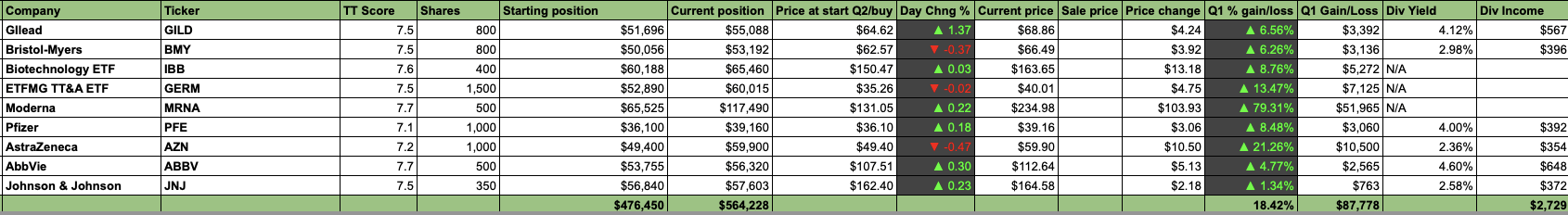

Healthcare Basket

(Click on image to enlarge)

Source: seekingalpha.com

Better yet was the healthcare stock basket. I was anticipating a strong showing from this group, and we got it last quarter. This sector delivered 18.42% in Q2. Top performers were ETFMG Treatments, Testing and Advancements ETF (NYSEARCA: GERM), which gained 13.5%, AstraZeneca (Nasdaq: AZN), which returned over 21%, and Moderna (Nasdaq: MRNA), which delivered close to 80% in the second quarter.

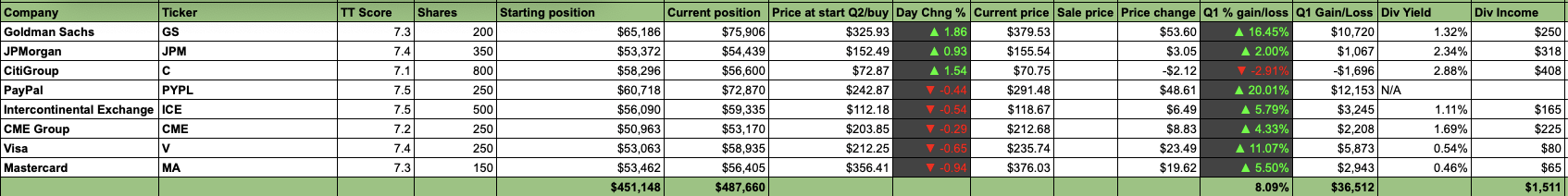

Financial Sector

(Click on image to enlarge)

Source: seekingalpha.com

The financial segment was another solid performer, as it returned over 8% last quarter. Top performs included PayPal (Nasdaq: PYPL), with a 20% gain, Goldman Sachs (NYSE: GS), with a return of 16.45%, and Visa (NYSE: V), with a return of over 11%. The only position with a negative showing was Citigroup (NYSE: C), which declined by around 3%.

Could Have Done Better

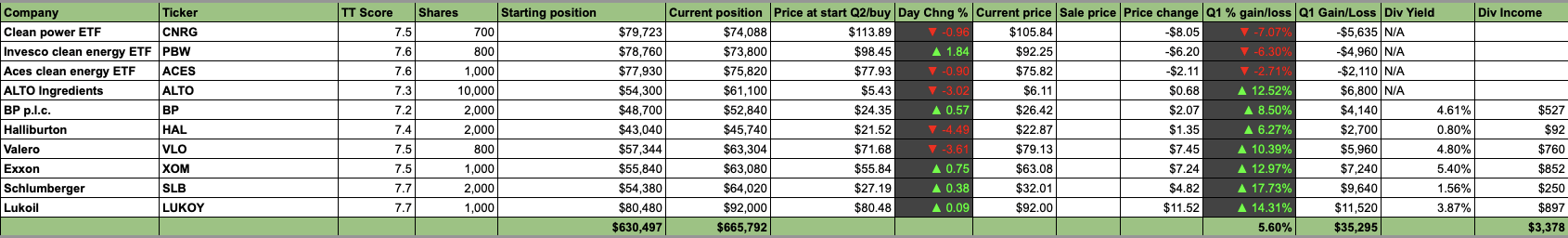

Energy Sector

(Click on image to enlarge)

Source: seekingalpha.com

The energy sector was a story of two tales. On the one hand, traditional oil and oil services names did well, as most achieved double-digit gains in Q2. However, the alternative energy side underperformed. Top performers in this segment included Exxon (NYSE: XOM) with a 13% gain, Lukoil (OTCPK: LUKOY) with a 14.3% appreciation, and Schlumberger (NYSE: SLB), which grew by about 18%. Due to underperformance on the alternative energy side, this segment returned just 5.6% in the quarter.

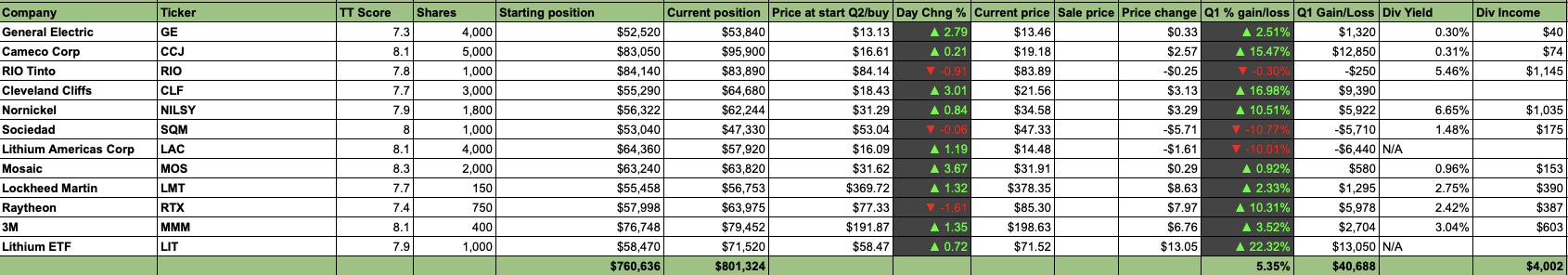

Materials & Industrials

(Click on image to enlarge)

Source: seekingalpha.com

The materials and industrials sector is another asset class that I feel should have performed better. The big letdown here was that the lithium producers, Lithium Americas Corp. (NYSE: LAC) and Sociedad Química y Minera de Chile S.A. (NYSE: SQM), both declined by roughly 10% in the quarter. Solid gains were observed in Cleveland-Cliffs (NYSE: CLF), up by 17%, Norilsk Nickel (OTCPK: NILSY) up by 10.5%, Cameco Corp (NYSE: CCJ), up by 15.5%, and Global X Lithium & Battery Tech ETF (NYSEARCA: LIT), up by more than 22%.

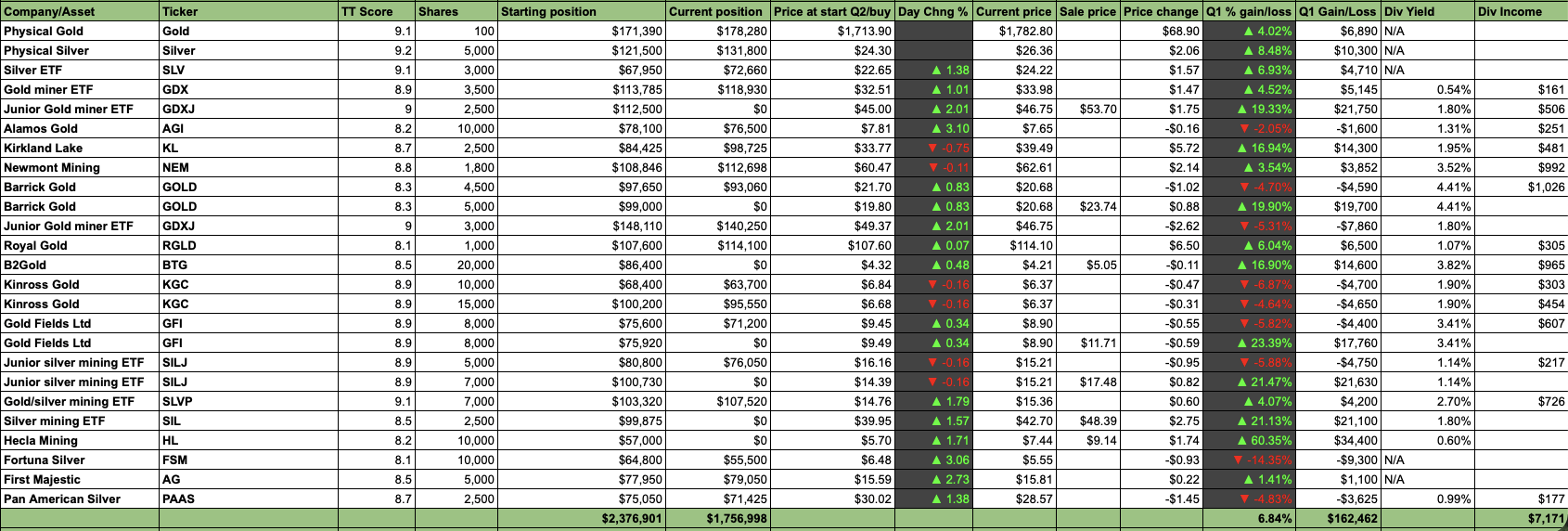

Gold & Silver

(Click on image to enlarge)

Source: seekingalpha.com

The gold, silver, gold/silver mining ("GSM") segment returned about 7% in Q2. However, it could have done much better. Despite realizing some profits near the top of the gold and silver move, some positions I left on gave back much of their gains. However, only one holding, Fortuna Silver (NYSE: FSM), showed a double-digit decline in the quarter. Several stocks and ETFs illustrated solid double-digit returns, with the top performer Hecla Mining (NYSE: HL) gaining 60% in the quarter.

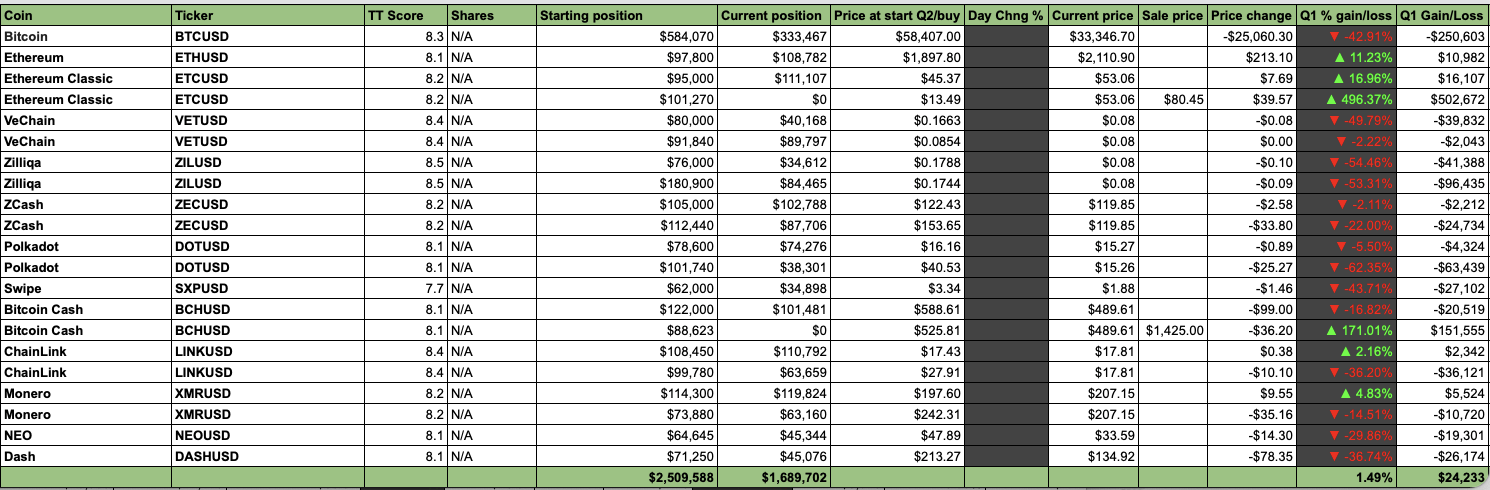

Digital Assets & Bitcoin

(Click on image to enlarge)

Source: seekingalpha.com

With about a 1.5% gain, the digital asset/Bitcoin segment was the worst performer in Q2. I took a 500% gain in Ethereum Classic (ETC-USD) and a 170% gain in Bitcoin Cash (BCH-USD) near the top. However, as the results indicate, I should have taken more profits. Several positions in this space gave up double-digit gains, despite being up notably around the highs in the crypto wave. My big mistake of the quarter was not taking more profits near the top here.

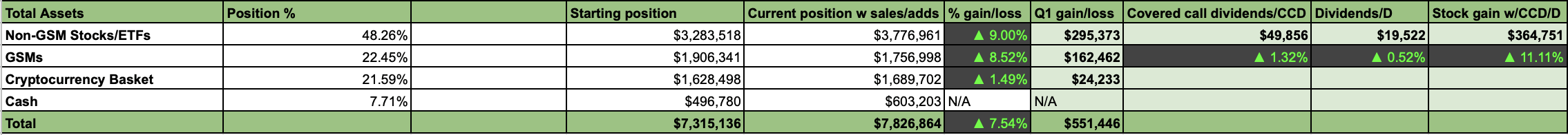

Overall Picture

(Click on image to enlarge)

Source: seekingalpha.com

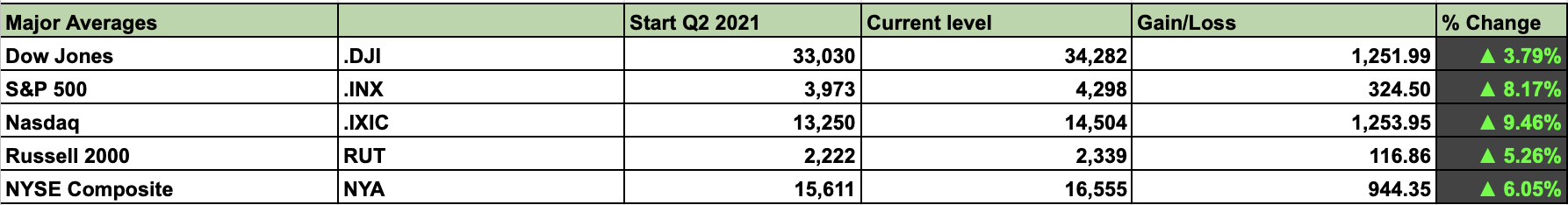

The all-weather portfolio returned 7.54% in Q2, slightly less than the S&P 500's return of 8.17% for the same time frame. However, combined with covered call premiums and dividends, the non-GSM stock/ETF segment produced a gain of 11.11%, bettering all major stock averages. In general, it was another strong quarter, but Q2 could have been much better, especially if I took more timely profits in the digital asset/Bitcoin segment around the highs. Through H1 2021, the all-weather portfolio appreciated by 22%, vs. the S&P 500's gain of 15%.

The Takeaway

I see several takeaways here, but the main one is in the digital asset/Bitcoin space. Wise people say that the bulls make money, the bears make money, but the greedy pigs get slaughtered. Well, with consistent double or even triple-digit gains in recent quarters, I got used to making easy money in the digital asset space. I got greedy, and instead of booking more profits near the top, I let some positions ride in anticipation of more profits. Unfortunately, Bitcoin and the broader segment took a sharp downturn, and most of the gains from the stellar returns in April evaporated. Also, while I took profits in around 30% of the gold names near the recent top, I should have realized more profits here. Well, we live, and we learn from our mistakes. The next time I see parabolic moves in Bitcoin, altcoins, or any other asset class for that matter, I will take more profits instead of expecting unsustainable gains to continue.

Looking Forward

Possibly the most significant difference in Q3 is that I cut down on the number of holdings. However, I continue to like the same areas. Technology, China, healthcare, oil/energy, materials, industrials, financials, GSMs, and digital assets still make up the lion's share of the all-weather portfolio. Technology, big tech especially, offers strong growth at a reasonable value. Quality China has not yet recovered from the Q2 meltdown and looks cheap right now. Healthcare names have a constructive fundamental backdrop along with favorable momentum. Inflation should persist and will likely reflect positively on oil, industrials, materials, GSMs, and other commodity-related segments. Bitcoin and the digital asset space went through a sharp correction. Yet, the sector appears to be stabilizing, should recover, and will likely proceed higher into year-end. The all-weather portfolio looks more vital than ever, and I look forward to talking about more strong gains three months from now.

Disclosure: I am/we are long ASSETS MENTIONED.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or ...

more