The Debt-Service Ratio And Estimated Recession Probability

Or, why I still think a recession is possible at 2024H1.

The BIS has just released debt-service ratios for 2023Q1. Using this variable, and term spread and foreign term spread, the estimated probability of a recession in 2024Q1 has risen substantially, although still far below the corresponding figure using only a term spread/short rate.

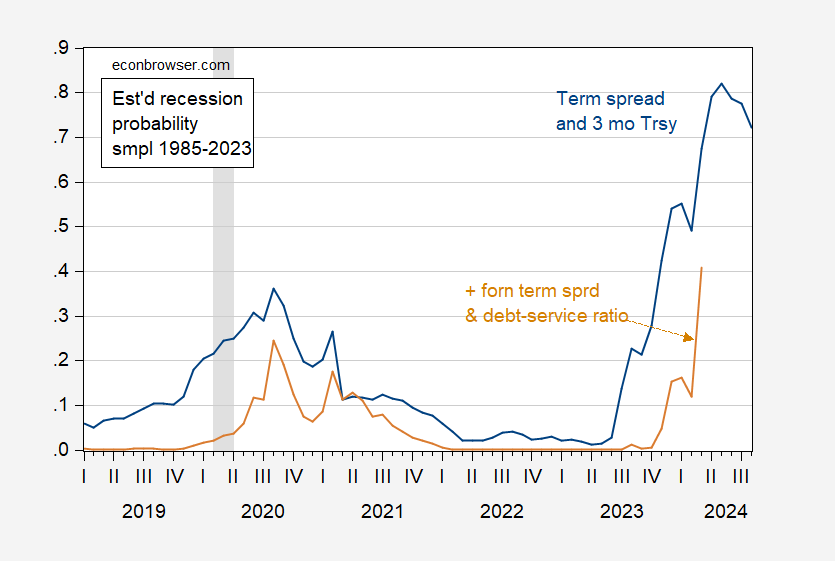

Figure 1: Estimated probability of NBER-defined recession using 10yr-3mo term spread plus 3 month Treasury rate (blue), and specification augmented with foreign term spread and debt-service ratio (tan). Debt-service ratio is for private nonfinancial sector. NBER defined peak-to-trough recession dates shaded gray. Source: Author’s calculations and NBER.

The increase in estimated probability for being in a recession month in rose from 12% in 2024M02 to 41% in 2024M03. This highlights the fact that the probit regression involves estimating a nonlinear relationship between the dependent and independent variables. The increase in debt-service ratio looks pretty modest.

That being said, the augmented specification implies a probability far below that from the term-spread and short rate only specification (in March 2024, it’s 68%, compared to 41% from the augmented specification). For motivation for use of debt-service ratio as a proxy for the financial cycle a la Borio-Drehmann-Xia, and the foreign term spread a la Ahmed-Chinn, see this post. Additional cross-country analysis in work with Laurent Ferrara in slide deck here.

Figure 2 depicts the evolution of the term spread and the debt-service ratio for the private nonfinancial sector.

Figure 2: 10yr-3mo Treasury spread, % (blue, left scale), and debt-service ratio, % (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, BIS, NBER, and author’s calculations.

Note that the term spread went more negative in 2023Q1 as the debt-service ratio rose. The increase in estimated probability in the un-augmented specification was 18 percentage points, and 29 percentage points for the augmented.

One might ask why one should prefer the augmented specification over the the unaugmented. The pseudo-R2 for the term spread plus short rate specification (1985-2023M08) is 0.28, while that for the debt-service and foreign term spread is 0.60. (Debt-service alone has a pseudo-R2 of 0.32, but implies essentially zero probability of recession in 2024M03).

In addition, the augmented specification captures 3 out of 4 recessions during the sample period, using a 50% threshold (missing the 2020 recession). A term spread plus short rate catches only the 2001 recession, while a debt-service ratio alone specification misses all four (coming close for the 2007-09 recession). Using a 40% threshold reduces the discrimination between the models, with both the term spread plus short rate and the augmented catching 3 out of 4 recessions (debt-service ratio only catches the 1990-91 and 2007-09 recessions). All specifications miss the 2020 recession.

An interesting aside: Even if you think the term spread is no longer a reliable predictor (e.g., Putnam), that doesn’t mean you can relax.

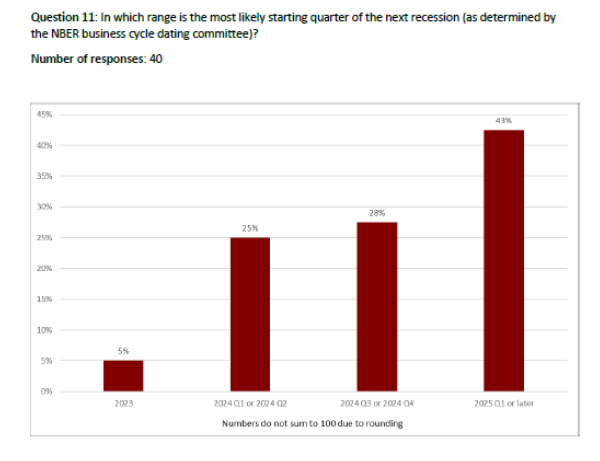

So, while the “soft landing” view is gaining dominance, the above results are consistent with the view of a downturn in 2024H1, which garners about 53% in the FT-Booth School macroeconomists survey:

Source: Booth School (September 2023).

Note that some analysts are forecasting a downturn while acknowledging such a downturn might not meet NBER criteria — e.g. Oxford Economics.

More By This Author:

FT-Booth September Survey

Nowcasts and Forecasts – Mid-September

Inflation In July

It was nice reading your post. Very informative indeed.PlayCaesar3