FT-Booth September Survey

The recession’s start is further delayed as forecasted growth continues. FT article and survey results: q4/q4 growth at 2% [1.3%, 2.5% 90%ile range].

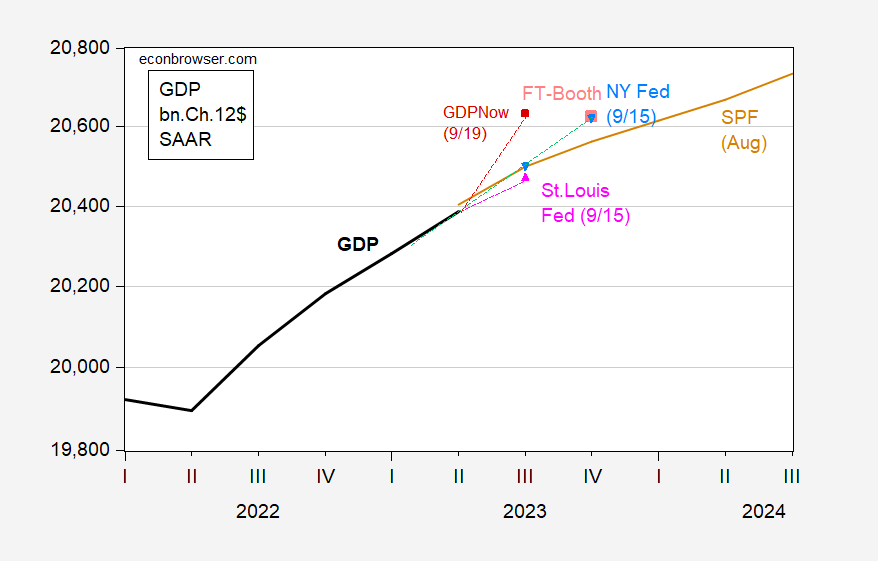

Figure 1: GDP (bold black), Survey of Professional Forecasters median (tan), FT-Booth median survey (light red square), GDPNow 9/15 (red square), St. Louis Fed Economic News Index 9/15 (pink triangle), NY Fed nowcast 9/815(light blue triangle), all in billions Ch.2012$ SAAR. Source: BEA 2023Q2 second release, Philadelphia Fed, Booth/U.Chicago, Atlanta Fed, St. Louis Fed via FRED, NY Fed.

The FT-Booth survey (responses submitted 9/13-9/15) is more optimistic than the August Survey of Professional Forecasters median, through end-2023. (My median forecast was 2.2%.) The increasingly optimistic outlook is in line with the evolution of nowcasts.

While the NY Fed and Atlanta Fed nowcasts remained largely (or completely) unchanged relative to the prior week (9/8), the St. Louis Fed news index has moved from zero growth to 1.71% (SAAR). GDPNow growth for Q3 (4.9%) remains substantially more optimistic than the other nowcasts and tracking forecasts.

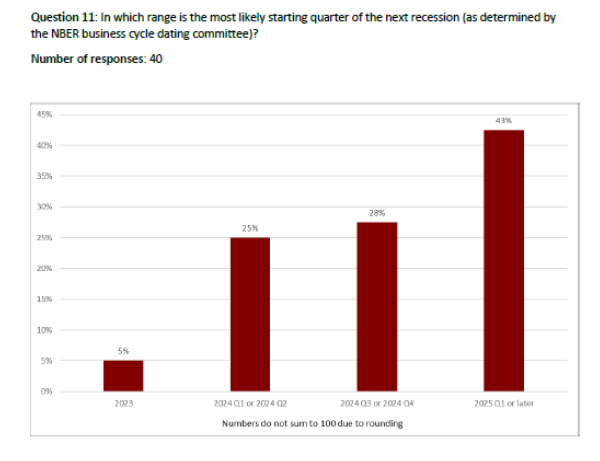

When do economists believe the next recession (as determined by the NBER BCDC) will begin, given the prospective growth path?

Source: Booth School (September 2023).

Once again, the recession start date is pushed back. The modal response (41%) is for 2025Q1 or later (is this the equivalent of “soft landing”?). Only 25% peg the recession start date in 2024H1 (which was my response).

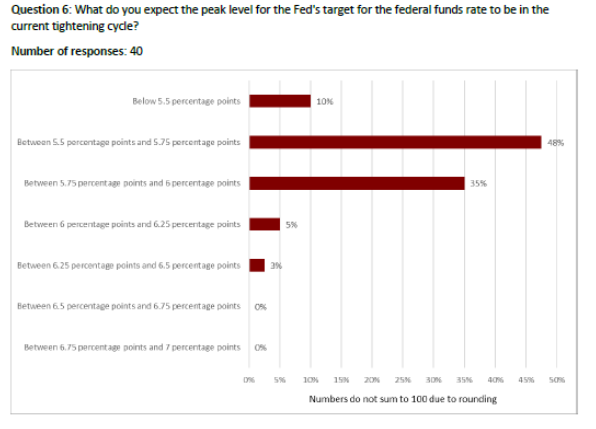

What does the survey indicate about the Fed funds trajectory?

Source: Booth School (September 2023).

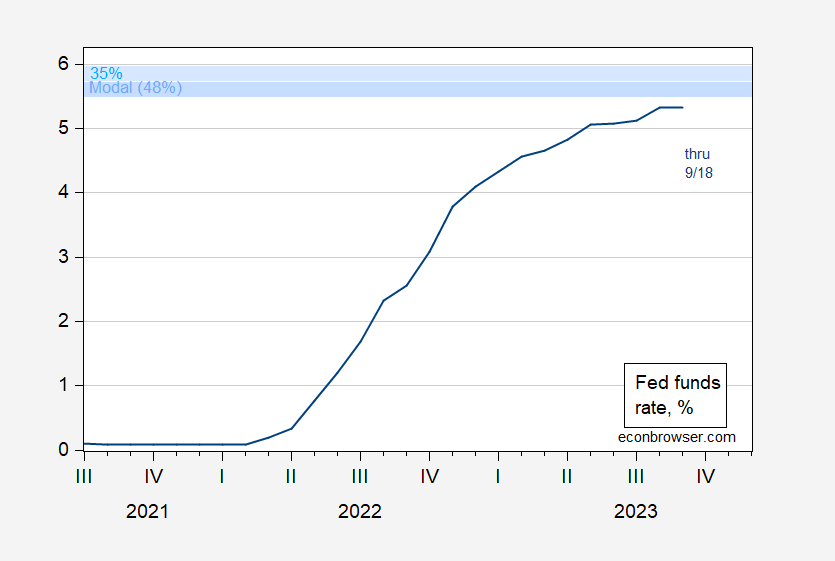

The modal response is for a peak Fed funds rate at 5.5-5.75%. For context, here’s the modal response and 2nd highest response (5.75%-6%) shown with the path of the Fed funds thus far.

Figure 2: Fed funds rate, % (blue). September observation for data through 9/18. Modal response for peak Fed funds shaded light blue, second highest response bin lighter blue. Source: Fed via FRED, Booth School.

More By This Author:

Nowcasts and Forecasts – Mid-September

Inflation In July

Calling Graduate Students Of The 1980’s…